by Calculated Risk on 11/17/2009 10:46:00 AM

Tuesday, November 17, 2009

Fed's Lacker: Fed Can't be "paralyzed by patches of lingering weakness"

From Richmond Fed President Jeffrey Lacker The Economic Outlook:

Earlier this year some economists were highlighting the risk that the low level of economic activity could push the rate of inflation down, perhaps even below zero. I think the risk of a substantial further reduction in inflation has diminished substantially since then. The historical record suggests that the early years of a recovery is when the risk is greatest that confidence in the stability of inflation erodes and we see an upward drift in inflation and inflation expectations. This risk could be particularly pertinent to the current recovery, given the massive and unprecedented expansion in bank reserves that has occurred, and the widespread market commentary expressing uncertainty over whether the Federal Reserve is willing and able to promptly reverse that expansion.Lacker is one of the inflation hawks on the FOMC.

As a technical matter, I do not see any problem – we do have the tools to remove as much monetary stimulus as necessary to keep inflation low and stable. The harder problem is the same one that we face after every recession, which is choosing when and how rapidly to remove monetary stimulus. There is no doubt that we must be aware of the danger of aborting a weak, uneven recovery if we tighten too soon. But if we hope to keep inflation in check, we cannot be paralyzed by patches of lingering weakness, which could persist well into the recovery. In assessing when we will need to begin taking monetary stimulus out, I will be looking for the time at which economic growth is strong enough and well-enough established, even if it is not yet especially vigorous.

First, I think we could see further declines in inflation in 2010; even the possibility of core PCI deflation. I don't think the risk of further declines has "diminished substantially".

Second, I think Q3 GDP will be revised down based on subsequent data (like the trade report), and GDP growth will be lower than Lacker expects in early 2010. I think Lacker is overly optimistic on the economy.

Also - historically the Fed hasn't raised rates until well after unemployment peaks, and I doubt they will raise rates until late in 2010 at the earliest (and probably later). Here is a graph from a previous post in September (the unemployment rate is now 10.2%):

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the effective Fed Funds rate (Source: Federal Reserve) and the unemployment rate (source: BLS)

In the early '90s, the Fed waited more than a 1 1/2 years after the unemployment rate peaked before raising rates. The unemployment rate had fallen from 7.8% to 6.6% before the Fed raised rates.

Following the peak unemployment rate in 2003 of 6.3%, the Fed waited a year to raise rates. The unemployment rate had fallen to 5.6% in June 2004 before the Fed raised rates.

Industrial Production, Capacity Utilization Increase Slightly in October

by Calculated Risk on 11/17/2009 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.1 percent in October ... Manufacturing production moved down 0.1 percent and the output of mines decreased 0.2 percent, but the index for utilities rose 1.6 percent. At 98.6 percent of its 2002 average, total industrial production was 7.1 percent below its level of a year earlier. Capacity utilization for total industry moved up 0.2 percentage point to 70.7 percent, a rate 10.2 percentage points below its average for 1972 through 2008, and capacity utilization for manufacturing was unchanged at 67.6 percent.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series has increased for four straight months, and is up from the record low set in June (the series starts in 1967).

Note: y-axis doesn't start at zero to better show the change.

This is just one month, but the recovery in industrial production slowed in October.

Report: Record Mortgage Loan Delinquency Rates in Q3

by Calculated Risk on 11/17/2009 08:29:00 AM

TransUnion reports that the 60 day mortgage delinquency rate increased to a record 6.25% in Q3, from 5.81% in Q2.

From TransUnion: Mortgage Loan Delinquency Rates on Course to Hit Record in 2009

Mortgage loan delinquency (the ratio of borrowers 60 or more days past due) increased for the 11th straight quarter, hitting an all-time national average high of 6.25 percent for the third quarter of 2009. This statistic is traditionally seen as a precursor to foreclosure and increased 7.57 percent from the previous quarter's 5.81 percent average. While still increasing, this quarter marks the third consecutive period the delinquency rate increase has decelerated. For comparison purposes, the delinquency rate from the fourth quarter 2008 to first quarter 2009 saw an increase of almost 14 percent, and the percent change from first quarter to second quarter 2009 increased by 11.3 percent. Year-over-year, mortgage borrower delinquency is up approximately 58 percent (from 3.96 percent).The MBA will release delinquency data on Thursday.

Mortgage borrower delinquency rates in the third quarter of 2009 continued to be highest in Nevada (14.5 percent) and Florida (13.3 percent), while the lowest mortgage delinquency rates were found in North Dakota (1.7 percent), South Dakota (2.3 percent) and Vermont (2.6 percent). Areas showing the greatest percentage growth in delinquency from the previous quarter were Wyoming (+17.9 percent), Kansas (+17.4 percent) and North Dakota (+16 percent). Bright spots for the quarter included the District of Columbia, showing a decline in mortgage delinquency rates, down 0.19 percent from the previous quarter.

Monday, November 16, 2009

Merle Hazard: Give me that Old Time Recession

by Calculated Risk on 11/16/2009 11:55:00 PM

Some late night entertainment from Merle Hazard (other hits include Inflation or Deflation?, Mark to Market and H-E-D-G-E)

Note: Merle will be performing live at the annual convention of the American Economic Association, Sunday, January 3, 2010, 8 p.m. in Atlanta.

Update on Las Vegas Cosmopolitan Resort & Casino

by Calculated Risk on 11/16/2009 10:54:00 PM

In June 2008, reader Brian sent me an email that started:

"When the bankers are selecting color schemes, you know a project isn't going well"He was referring to Deutsche Bank foreclosing on the $3.5 billion Cosmopolitan Resort & Casino in Las Vegas.

Bloomberg has an update: Deutsche Bank Drowning in Vegas on Costliest Bank-Owned Casino

Deutsche Bank AG’s Cosmopolitan Resort & Casino complex in Las Vegas, already the most expensive debacle in the city for a single lender, is now two years behind schedule, $2 billion over budget and under water -- literally.From bad to worse ...

...

So far, Deutsche Bank has had to write down 500 million euros ($748 million) on Cosmopolitan. ... Further north on the Las Vegas Strip, work halted on the Fontainebleau in June with a bankruptcy filing after its lenders, including Deutsche Bank, refused further funding. The 63-story casino resort is about 70 percent complete.

TARP Watchdog: AIG Bailout Transferred Billions from Government to Counterparties

by Calculated Risk on 11/16/2009 09:47:00 PM

In a report (pdf) titled "Factors Affecting Efforts to Limit Payments to AIG Counterparties", Neil Barofsky, special inspector for TARP, wrote that the "negotiating strategy to pursue concessions from [AIG] counterparties offered little opportunity for success, even in the light of the willingness of one of the counterparty to agree to concessions".

He also concluded that the "structure and effect of the FRBNY's assistance to AIG ... effectively transferred tens of billions of dollars of cash from the government to AIG's counterparties".

Here is a story from Bloomberg: Fed’s Strategy ‘Severely Limited’ AIG Bailout, Watchdog Says

Meredith Whitney Expects Double-Dip Recession, FDIC dumps "Cease & Desist"

by Calculated Risk on 11/16/2009 03:51:00 PM

From CNBC (added): Stocks Overvalued, Recession Will Return: Meredith Whitney

From American Banker: FDIC Speaks More Softly, Retains Stick

The FDIC changed the name of its cease-and-desist order to the less ominous-sounding "consent order" (a term already used by other regulators) ... David Barr, an FDIC spokesman, said that the traditional cease-and-desist order will be issued to any banks that refuse to stipulate and instead seek an administrative hearing.A kinder softer name ...

...

The FDIC has not made any of the new orders public so far.

LA Area Port Traffic in October

by Calculated Risk on 11/16/2009 02:24:00 PM

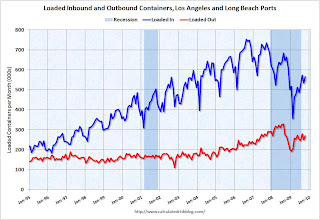

Note: this is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Loaded inbound traffic was 14.7% below October 2008.

Loaded outbound traffic was 1.0% above October 2008.

There was a clear recovery in U.S. exports earlier this year; however exports have been mostly flat since May. This year will be the 3rd best year for export traffic at LA area ports, behind 2007 and 2008.

For imports, traffic is below the October 2003 level, and 2009 will be the weakest year for import traffic since 2002.

Note: Imports usually peak in the August through October period (as retailers import goods for the holidays) and then decline in November.

The lack of further export growth to Asia is discouraging ...

On imports - last year retailers were stuck with too much inventory (the supply chain is long and imports didn't adjust as quickly as exports). It appears retailers will have much less inventory this year for the holidays.

Fed Chairman Ben Bernanke at Economic Club of NY

by Calculated Risk on 11/16/2009 12:15:00 PM

Here is a live video of Bernanke at the Economic Club of NY

Here is the CNBC feed.

Prepared Speech: On the Outlook for the Economy and Policy

How the economy will evolve in 2010 and beyond is less certain. On the one hand, those who see further weakness or even a relapse into recession next year point out that some of the sources of the recent pickup--including a reduced pace of inventory liquidation and limited-time policies such as the "cash for clunkers" program--are likely to provide only temporary support to the economy. On the other hand, those who are more optimistic point to indications of more fundamental improvements, including strengthening consumer spending outside of autos, a nascent recovery in home construction, continued stabilization in financial conditions, and stronger growth abroad.On CRE (added):

My own view is that the recent pickup reflects more than purely temporary factors and that continued growth next year is likely. However, some important headwinds--in particular, constrained bank lending and a weak job market--likely will prevent the expansion from being as robust as we would hope.

Demand for commercial property has dropped as the economy has weakened, leading to significant declines in property values, increased vacancy rates, and falling rents. These poor fundamentals have caused a sharp deterioration in the credit quality of CRE loans on banks' books and of the loans that back commercial mortgage-backed securities (CMBS). Pressures may be particularly acute at smaller regional and community banks that entered the crisis with high concentrations of CRE loans. In response, banks have been reducing their exposure to these loans quite rapidly in recent months. Meanwhile, the market for securitizations backed by these loans remains all but closed. With nearly $500 billion of CRE loans scheduled to mature annually over the next few years, the performance of this sector depends critically on the ability of borrowers to refinance many of those loans. Especially if CMBS financing remains unavailable, banks will face the tough decision of whether to roll over maturing debt or to foreclose.More:

I expect moderate economic growth to continue next year. Final demand shows signs of strengthening, supported by the broad improvement in financial conditions. Additionally, the beneficial influence of the inventory cycle on production should continue for somewhat longer. Housing faces important problems, including continuing high foreclosure rates, but residential investment should become a small positive for growth next year rather than a significant drag, as has been the case for the past several years. Prospects for nonresidential construction are poor, however, given weak fundamentals and tight financing conditions.

...

Jobs are likely to remain scarce for some time, keeping households cautious about spending. As the recovery becomes established, however, payrolls should begin to grow again, at a pace that increases over time. Nevertheless, as net gains of roughly 100,000 jobs per month are needed just to absorb new entrants to the labor force, the unemployment rate likely will decline only slowly if economic growth remains moderate, as I expect.

Business Inventories Decline in September

by Calculated Risk on 11/16/2009 10:00:00 AM

The Manufacturing and Trade Inventories and Sales report from the Census Bureau today showed inventories are still declining. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Census Bureau reported:

Manufacturers’ and trade inventories, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $1,303.4 billion, down 0.4 percent (±0.1%) from August 2009 and down 13.4 percent (±0.3%) from September 2008.Inventory levels are still a little high compared to lower sales levels, and further inventory reductions are probably coming. Although changes in private inventories made a positive contribution to Q3 GDP in the preliminary report, the usual inventory restocking cycle at the beginning of a recovery will probably be muted without a pickup in final demand.

The total business inventories/sales ratio based on seasonally adjusted data at the end of September was 1.32. The September 2008 ratio was 1.32.