by Calculated Risk on 11/11/2009 04:30:00 PM

Wednesday, November 11, 2009

WSJ on Permanent Modifications

Ruth Simon at the WSJ has some details on permanent modifications: Mortgage Program Gathers Steam After Slow Start

The administration won't release figures on completed modifications until December, but so far it appears that very few trial modifications are becoming permanent, often because of a lack of documentation.Diani Olick at CNBC wrote yesterday:

...

J.P. Morgan Chase & Co. said last week that more than 92,000 of its customers have made at least three trial payments under the program, but just 26% of them had submitted all the required documents for a permanent fix.

...

At Morgan Stanley's Saxon Mortgage Services, about 26,000 of the 39,000 borrowers in the program have made more than three trial payments. Roughly 500 have received completed modifications.

emphasis added

Insiders however tell me that a lot of that paperwork has to do with those so-called "stated-income" loans ...In my list of possible upside surprises / downside risks for the economy, the percent of permanent modifications is related to the #1 downside risk. If few of these modifications are successful, there could be a flood of foreclosures on the market next year.

Unsolicited Principal Reduction Offer from BofA

by Calculated Risk on 11/11/2009 03:01:00 PM

Here is an unsolicited Principal Reduction Loan Modification (pdf) offer from BofA. (ht Dwight)

A few background details:

The offer from BofA:

If the homeowner accepts the offer, he would still owe more on the 1st than the house is worth (the 2nd mortgage would have to be resolved). The personal issue still exists, and reducing the monthly payments by a couple of hundred dollars probably will not help. My understanding is the homeowner is considering trying for a short sale, but it is interesting that BofA is sending out unsolicited principal reduction offers - probably to NegAm borrowers.

UPDATE: The number is answered by a recording that announces they are a "debt collector", and then says they are now closed (probably for Veterans Day)

Economic Outlook: Possible Upside Surprises, Downside Risks

by Calculated Risk on 11/11/2009 01:15:00 PM

As I've noted several times, my general outlook is for GDP growth to be decent in Q4 (similar to Q3) and for sluggish and choppy GDP growth in 2010. I've been asked to list some possible upside surprises, and downside risks, to this forecast.

Possible Upside Surprises:

Click on graph for larger image in new window.

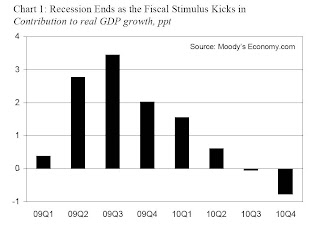

Click on graph for larger image in new window.This suggests that all the growth in Q3 was due to the stimulus package, and the impact will now wane - only 2% in Q4, and 1.5% in Q1 2010 - and then the package will be a drag on the economy (impact on GDP growth will be negative) in the 2nd half of 2010.

With unemployment above 10%, there will be significant political pressure for another stimulus package - especially if the economy starts to slow in the first half of 2010. This next package could be several hundred billion (maybe $500 billion) and could increase GDP growth in 2010 above my forecast.

Possible Downside Risks:

I expect another wave of foreclosures in early 2010, and the impact of the housing tax credit to wane, and eventually lower house prices especially in higher priced bubble areas (although I think we've seen the bottom in many other areas). My expectation is prices will fall in real terms for several years. But if prices fall further than I expect that could have a serious impact on banks (more losses) and consumer confidence (less spending).

These are just some possible upside surprises and downside risks. I'm sure there are plenty more ...

FHA Temporarily Relaxes Condo Rules

by Calculated Risk on 11/11/2009 11:23:00 AM

Last week the FHA released a temporary guidance that relaxed some of the rules for condominiums. From the FHA: Temporary Guidance for Condominium Policy

The Miami Herald has the key points: FHA moves to boost condo market

• Increase from 30 percent to 50 percent the number of units in a project that can be financed with FHA loans. FHA, however, will make exceptions, even allowing up to 100 percent, when buildings meet an additional set of more stringent criteria.This temporary guidance is in effect from December 7, 2009 through December 31, 2010.

• Require at least 50 percent of units in a complex to be owner-occupied or sold to owners who plan to live in the units. Bank-owned units may be disqualified from the percentage calculation.

• Reduce a presale requirement in new construction to 30 percent, compared with 70 percent for loans from conventional lenders.

Orange County: Foreclosure Notices Hit Record High

by Calculated Risk on 11/11/2009 08:47:00 AM

Matt Padilla at the O.C. Register writes: Foreclosure notices hit record 8,800 Click on graph for larger image in new window.

Graph from O.C. Register.

ForeclosureRadar.com reports that outstanding foreclosure auction notices in Orange County rose to 8,895 at the end of September, the highest in this housing downturn and probably the highest ever.Padilla provides a second graph (see his article) of 90 day delinquencies, foreclosures and REOs. He writes:

September’s total was up 5% from August and 90% from a year ago.

[The second] chart shows that the ratio of borrowers having missed at least three monthly payments is at nearly 7% and has risen every month for more than three years.Loans in the trial modification period are still considered delinquent, so that might explain some of the increase in 90+ day delinquencies. But that doesn't explain the continuing surge in foreclosure notices.

It’s incredible that while so many mortgages are delinquent, banks are only holding 0.26% of first mortgages as REOs.

Tuesday, November 10, 2009

California Controller: Overview of the Commercial Property Markets

by Calculated Risk on 11/10/2009 10:23:00 PM

Buried in the California Controller's November analysis is a guest article: Overview of the Commercial Property and Capital Markets with Implications for the State of California by Dr. Randall Zisler. (ht picosec)

Here are some excerpts:

Whereas excessive and imprudent leverage fed the bubble, deleveraging not only popped the bubble, but, in the process, destroyed record amounts of equity and debt. Most deals financed with high leverage from 2005 to the present are under water. The equity is gone and the debt, if it trades at all, trades at a deep discount to face value. Most leveraged equity invested in real estate has evaporated since property prices, if marked to market, have fallen 30% to 50%.

Click on graph for larger image in new window.

Click on graph for larger image in new window. The chart [right] shows overall U.S. property total returns, quarterly (at annual rates) and lagging four quarters. This appraisal-based, lagging index shows sharp negative returns exceeding the deterioration of the RTC (Resolution Trust Corp.)The author points out that many local and regional banks will fail because of CRE loans.

period of the early 1990s. (See Chart 1.) Second quarter 2009 returns indicate the possibility that total returns, while still negative, may have hit a point of inflection. We expect that property values in many sectors, especially office, retail, and industrial, will likely deteriorate further in 2010 with improvement beginning sometime in 2011.

...

A crisis of unprecedented proportions is approaching. Of the $3 trillion of outstanding mortgage debt, $1.4 trillion is scheduled to mature in four years. We estimate another $500 billion to $750 billion of unscheduled maturities (i.e., defaults). Unfortunately, traditional lenders of consequence are practically out of the market and massive amounts of maturing debt will not easily find refinancing. Marking-to-market outstanding debt will render many banks, especially regional and community banks, insolvent, especially as much of the debt is likely worth about 50% of par, or less.

The inability of many banks and other capital sources to lend not just to real estate firms but to other businesses in the State as well presents a real challenge to the private sector and state and local governments.

FDIC Chairwoman Sheila Bair said today: "We do obviously have a lot more banks that will close this year and next," Bair said, adding the failures "will peak next year and then subside."

These bad loans are also limiting lending to small businesses. Atlanta Fed President Dennis Lockhart made the same argument this morning:

I am concerned about the potential impact of CRE on the broader economy ... there could be an impact resulting from small banks' impaired ability to support the small business sector—a sector I expect will be critically important to job creation.

...

Many small businesses rely on these smaller banks for credit. Small banks account for almost half of all small business loans (loans under $1 million). Moreover, small firms' reliance on banks with heavy CRE exposure is substantial. Banks with the highest CRE exposure (CRE loan books that are more than three times their tier 1 capital) account for almost 40 percent of all small business loans.

Fed's Fisher: Suboptimal Growth in 2010, "Perhaps" 2011

by Calculated Risk on 11/10/2009 07:39:00 PM

"[L]ooking into 2010 and perhaps to 2011, the most likely outcome is for growth to be suboptimal, unemployment to remain a vexing problem and inflation to remain subdued."And a little more Fed Speak ... (note: Fisher's speeches are always colorful).

Dallas Fed President Richard Fisher

From Dallas Fed President Richard Fisher: The Current State of the Economy and a Look to the Future

Now, I’ve often thought that economic forecasters seem to be cursed—or maybe blessed, I suppose, dependent upon your point-of-view—with a short-term memory: They tend to extrapolate only the most recent trends into the future. As if goosed by the more optimistic tone of the latest GDP release, many now believe that solid output growth will extend into the first half of next year. The latest Blue Chip survey, for example, shows that professional forecasters expect GDP growth averaging 2.8 percent in the first half of 2010.And Fisher is usually one of the more optimistic Fed presidents.

I am wary of the consensus view. For a good while now, I’ve suggested that we are more likely to see a more uneven recovery—not a “V”-shaped recovery but something more akin to a check mark, where the elongated arm of that check mark inclines at a slope that is less than desirable and might possibly be repressed by an occasional pause or several quarters of weak growth.

Why a check mark?

Several recent sources of strength are likely to wane as we head into next year. Cash-for-clunkers and the first-time-homebuyer tax credit have both shifted demand forward, increasing sales today at the expense of sales tomorrow. Neither of these programs can be repeated with any real hope of achieving anywhere near the same effect: The more demand you steal from the future, the less future demand there is for you to steal. The general tax cuts and government spending increases included in this year’s fiscal stimulus package won’t have their peak impact on the level of GDP until sometime in 2010, but their peak impact on the growth of GDP has come and gone; the fiscal stimulus continues to drive GDP upward, compared with what it would otherwise have been, but the increments to GDP are beginning to shrink. And, as we all know, the shot in the arm that our economy is receiving from inventory adjustments is, while welcome, inherently transitory.

What about growth in the longer term—the second half of 2010 and beyond? American households have finally come to realize that they’ve been playing the part of the grasshopper in Aesop’s fable: They see that our previous spending boom was financed by somewhat reckless disregard for tomorrow by over-eager creditors feeding their desire for unsustainable leveraging of their income and balance sheets and, for the nation as a whole, by increases in overseas borrowing. That reality has been largely absorbed, and consumer spending is growing again—albeit from a lower base and at a slower pace. I doubt it will recover its previous vigor for some time to come. I expect that the strong bounce-back in consumer demand that we’ve come to expect in recoveries past will be absent this time around as Americans recalibrate the proportion of their income and wealth that they need to save versus what they need to consume. We need not become a nation as parsimonious as William Miles, but we are going to have to be more ant- than grasshopper-like in our behavior.[4]

...

It may be some time before significant job growth occurs and even longer before we see meaningful declines in the unemployment rate.

emphasis added

Loan Modifications: Key Numbers not Released

by Calculated Risk on 11/10/2009 03:17:00 PM

From Reuters: Treasury says 650,000 in trial home loan workouts

[The Treasury Department] said there were 650,994 active trial modifications through October under President Barack Obama's plan to help the housing market. That was up from 487,081 ... participating through September.The key number - permanent modifications - was not released. As of Sept 1st, the Obama plan had produced only 1,711 permanent loan modifications.

The Treasury did not release figures for trial modifications that have been made permanent.

Why doesn't Treasury release the number of trial modifications started, the redefault rates for trial modifications (by month started) and the number of permanent modifications?

Diani Olick at CNBC has more: Shadow Inventory Dwarfs Loan Mods

[W]e have no idea how successful those mods are now five months after the program really got cooking.The size of the next wave of foreclosures depends on the success of the modification programs. And right now Treasury is leaving us in the dark ...

It's coming, that's what the folks at Treasury say.

They also say that a lot of borrowers got extensions on the trial period in order to get paperwork together to move on to permanent modifications. Insiders however tell me that a lot of that paperwork has to do with those so-called "stated-income" loans, where you just had to tell the lender what you make for a living, not actually prove it. In order to move to a permanent mod, you have to prove it, so now we get to find out how many of those "liar loans" were just that.

emphasis added

Counterparty Risk: The Mortgage Insurers

by Calculated Risk on 11/10/2009 01:35:00 PM

From the Ambac 10-Q:

While management believes that Ambac will have sufficient liquidity to satisfy its needs through the second quarter of 2011, no guarantee can be given that it will be able to pay all of its operating expenses and debt service obligations thereafter, including maturing principal in the amount of $143,000 in August 2011. In addition, it is possible its liquidity may run out prior to the second quarter of 2011. Ambac is developing strategies to address its liquidity needs; such strategies may include a negotiated restructuring of its debt through a prepackaged bankruptcy proceeding. No assurances can be given that Ambac will be successful in executing any or all of its strategies. If Ambac is unable to execute these strategies, it will consider seeking bankruptcy protection without agreement concerning a plan of reorganization with major creditor groups.Apparently the Wisconsin Commissioner of Insurance will rule on Ambac’s statutory capital by November 16th. (ht JA)

emphasis added

And from Freddie Mac's 10-Q:

We have institutional credit risk relating to the potential insolvency or non-performance of mortgage insurers that insure single-family mortgages we purchase or guarantee. As a guarantor, we remain responsible for the payment of principal and interest if a mortgage insurer fails to meet its obligations to reimburse us for claims. If any of our mortgage insurers that provides credit enhancement fails to fulfill its obligation, we could experience increased credit-related costs and a possible reduction in the fair values associated with our PCs or Structured Securities.More from MarketWatch: MBIA loses $728 million as slowdown hits bond insurer

...

Based upon currently available information, we expect that all of our mortgage insurance counterparties will continue to pay all claims as due in the normal course for the near term except for claims obligations of Triad that are partially deferred after June 1, 2009, under order of Triad’s state regulator. We believe that several of our mortgage insurance counterparties are at risk of falling out of compliance with regulatory capital requirements, which may result in regulatory actions that could threaten our ability to receive future claims payments, and negatively impact our access to mortgage insurance for high LTV loans. Further, one or more of these mortgage insurers, over the remainder of 2009 or in the first half of 2010, could lack sufficient capital to pay claims and face suspension under Freddie Mac’s eligibility requirements for mortgage insurers.

The zombie watch continues ...

Fed's Yellen on the Economic Outlook

by Calculated Risk on 11/10/2009 10:53:00 AM

Lately I’ve been leaning against the view of a “V shaped” recovery. I think that growth will be decent in the second half of 2009, but growth will be sluggish in 2010.

San Francisco Fed President Dr. Yellen has a similar view – from her speech this morning: The Outlook for the Economy and Real Estate

The big issue is how strong the upturn will be. With such enormous reservoirs of slack in the form of high unemployment and idle productive capacity, we need a strong rebound to put unemployed people back to work and get underutilized factories, offices, and stores humming again. Unfortunately, my own forecast envisions a less-than-robust recovery for several reasons. As the impetus from government programs and inventories diminishes in the quarters ahead, private final demand will have to fill the breach. The danger is that demand may grow at too anemic a pace to support vigorous expansion.

First, it may take quite a while for financial institutions to heal to the point that normal credit flows are restored. The credit crunch hasn’t entirely gone away. In the face of massive loan losses, banks have clamped down on underwriting and credit terms for both businesses and consumers. Smaller businesses without direct access to capital markets are particularly feeling the pinch. Lenders have had to run hard just to stay in place: Rising unemployment, business failures, and delinquencies in real estate markets have fed additional credit losses and made it more difficult for financial institutions to get their balance sheets in good order.

Second, households have been pummeled and prospects for consumer spending are cloudy. Consumers have surprised us in the past with their free-spending ways and it’s not out of the question that they will do so again. But I wouldn’t count on them leading a strong recovery. They face high and rising unemployment, stagnant wages, and heavy debt burdens. Their nest eggs have shrunk dramatically as house and stock prices have fallen, and their access to credit has been squeezed.

It may be that we are witnessing the start of a new era for consumers following the harsh financial blows they have endured. ...

Weakness in the labor market is another factor that may keep the recovery sluggish for quite some time. Payroll employment has been plummeting for more than a year and a half, and, even though the pace of the decline has slowed, unemployment now stands at its highest level since 1983. In addition, many workers have seen their hours cut or are experiencing involuntary furloughs. ... my business contacts say they will be reluctant to hire again until they see clear evidence of a sustained recovery. High unemployment, weak job growth, and paltry wage increases are a recipe for sluggish consumer spending growth and a tepid recovery.

... the outlook for housing has turned up in response to favorable mortgage rates, lower house prices, and a lower overhang of unsold houses. And growth in this sector should contribute to the overall economic recovery. These developments represent real gains, but it’s important not to get carried away. Some of the advance reflects temporary government support in the form of tax credits for first-time home buyers, and the impact of loan modification programs and foreclosure moratoriums that reduced the pace of distressed sales. Moreover, foreclosure notices surged earlier this year and distressed property sales may rise once again in the months ahead. If so, we could see renewed pressure on house prices. Of course, continuing high unemployment will also fuel additional foreclosures. And the supply of credit for nonconforming mortgages remains extremely tight. Financial institutions are reluctant to place them on their books when they are trying to reduce leverage and we have yet to see any revival of the market for private mortgage-backed securities.

When we turn to commercial real estate, the prospects are worrisome. ...

When the weakness of the commercial property market is combined with the muted outlook for housing and consumer spending, you can see why I believe that the overall economic recovery is likely to be gradual and remain vulnerable to shocks. It’s popular to pick a letter of the alphabet to describe the likely course of the economy. The letter I would choose doesn’t exist in our alphabet, but if I were to describe it, it would look something like an “L” with a gradual upward tilt of the base. With such a slow rebound, unemployment could well stay high for several years to come. In other words, our recovery is likely to feel like something well short of good times.

emphasis added