by Calculated Risk on 10/13/2009 01:23:00 PM

Tuesday, October 13, 2009

DataQuick: SoCal home sales "inch up"

From DataQuick: Southern California home sales inch up; median price steady

Last month 21,539 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties. That was up 0.2 percent from 21,502 in August and up 5.1 percent from 20,497 a year earlier, according to MDA DataQuick of San Diego.Although DataQuick doesn't track short sales, we can estimate from the Sacramento data that another 15% or so of sales in SoCal were short sales - so probably over half the sales are distressed.

September marked the 15th month in a row with a year-over-year sales gain, although last month’s was the smallest of those increases. ... The small uptick in September sales from August was atypical. On average, sales have fallen 9.5 percent between those two months.

...

“There were more than just normal, seasonal forces at work in these September sales numbers. More attempts at short sales, which typically take longer, and new appraisal rules no doubt delayed some deals this summer, causing them to close in September rather than August. September probably also got a boost from people opting to buy sooner rather than later to take advantage of the federal tax credit for first-time buyers, which is set to expire next month,” said John Walsh, MDA DataQuick president.

...

Foreclosure resales – houses and condos sold in September that had been foreclosed on at some point in the prior 12 months – made up 40.4 percent of all Southland homes resold last month. That was down slightly from a revised 41.7 percent foreclosure resales in August and down from a high of 56.7 percent in February this year.

...

A common form of financing used by first-time buyers in more affordable neighborhoods remained near record levels. Government-insured FHA mortgages made up 36.4 percent of all home purchase loans last month ...

Foreclosure activity remains high by historical standards.

emphasis added

This report suggests sales were strong in September - similar to other regional reports.

We will probably see a decrease in year-over-year sales soon, as the first-time homebuyer tax credit buying frenzy subsides later this year.

CRE in San Diego, Orange County and Las Vegas: Higher Vacancy Rates, Lower Rents

by Calculated Risk on 10/13/2009 11:18:00 AM

Voit released Q3 quarterly reports today for CRE in Las Vegas, San Diego and Orange County.

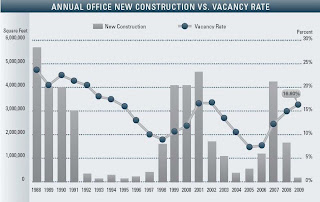

The reports show the vacancy rates are up and lease rates falling. It also shows new construction has slowed sharply. Here are a couple of graphs for Orange County and San Diego. We are seeing a similar pattern nationwide ...

Click on graph for larger image in new window.

This graph shows the annual Orange County office vacancy rate and new construction since 1988. See Voit report for more.

Note that in the previous slumps, office construction didn't pick up until the vacancy rate dropped below 10%.

From the Voit report:

Net absorption for the county posted a negative 438,803 square feet for the third quarter of 2009, giving the office market a total of 1.92 million square feet of negative absorption for the year.

...

The average asking Full Service Gross (FSG) lease rate per month per foot in Orange County is currently $2.24, which is a 16.73% decrease over last year’s rate of $2.69 and five cents lower than last quarter’s rate.

...

Total space under construction checked in at 166,455 square feet at the end of the third quarter, which is less than half the amount that was under construction this same time last year.

emphasis added

The second graph is for San Diego. The dynamics are similar, but absorption is slighly positive in San Diego. From Voit:

The second graph is for San Diego. The dynamics are similar, but absorption is slighly positive in San Diego. From Voit: Net absorption for the county posted a positive 346,030 square feet for the third quarter of 2009, giving the office market a total of 653,537 square feet of positive absorption for the year.Once again, investment in new office space will probably not increase until the vacancy rate is below 10%.

...

The average asking Full Service Gross (FSG) lease rate per month per foot in San Diego County is currently $2.39, which is a 12.8% decrease over last year’s rate of $2.74 and eight cents lower than last quarter’s rate. The record high rate of $2.76 was established in the first and second quarter of 2008.

Although Voit didn't provide a similar graph for Las Vegas, the situation is clearly worse:

The amount of occupied space valley-wide fell to 38.2 million, a level not witnessed since the second quarter of 2007. The average vacancy rate reached 22.7 percent, which represented a 0.7-point increase from the preceding quarter (Q2 2009). Compared to the prior year (Q3 2008), vacancies were up 5.7 points from 17.0 percent.New office construction has slowed significantly in these markets, and will not pick up until vacancy rates drop sharply.

...

On an annualized basis, new supply has dwindled and less than one million square feet of new supply is expected to enter the market during 2009, a figure not seen since 2003. We expect even less development in 2010 with a plug on the development pipe until the supply-demand imbalance corrects itself.

Report: CIT Nears Bankruptcy, CEO to Resign

by Calculated Risk on 10/13/2009 08:23:00 AM

From Reuters: CIT debt swap struggles, bankruptcy looms. Reuters is reporting that "sources familiar with the matter" say bondholders are showing little interest in the debt exchange offer and a bankruptcy is now more likely.

Also this morning CIT announced that CEO Jeffrey Peek is resigning effective Dec 31st.

The possible bankruptcy of CIT is a major concern because CIT provides financing for about one million small businesses. And small businesses are already having trouble obtaining credit.

From Peter Goodman in the NY Times: Credit Tightens for Small Businesses

Many small and midsize American businesses are still struggling to secure bank loans, impeding their expansion plans and constraining overall economic growth ...Also see: Small Business and Employment

Most banks expect their lending standards to remain tighter than the levels of the last decade until at least the middle of 2010, according to a survey of senior loan officers conducted by the Federal Reserve Board. ... Bankers worry about the extent of losses on credit card businesses ...[and] are also reckoning with anticipated failures in commercial real estate. Until the scope of these losses is known, many lenders are inclined to hang on to their dollars rather than risk them on loans to businesses in a weak economy ...

A CIT bankruptcy will probably lead to even tighter credit for many small businesses exacerbating the current credit situation.

Monday, October 12, 2009

Fed's Bullard: Falling Unemployment Rate "Prerequisite" for Rate Increase

by Calculated Risk on 10/12/2009 10:07:00 PM

Usually this would be a "duh", but with some of the Fed talk recently, this is worth noting ...

From Bloomberg: Bullard Says Lower Unemployment Condition to Tighten

...“You want some jobs growth and unemployment coming down. That is a prerequisite” for an increase in interest rates, Bullard said. “It doesn’t mean you need unemployment all the way down to more normal levels.”As Paul Krugman noted this weekend, we are a long way from when the Fed will raise rates.

...

Bullard, referring to a prior jobless rate of 10.8 percent, said “I don’t think we will quite hit the peak we hit in 1982, but things have surprised us before.”

...

“I’m the north pole of inflation hawks,” Bullard said. “But we are trying to describe optimal policy, some optimal outcomes in an environment where inflation is below target -- we have an implicit target of 1.5 to 2 percent -- and you have the specter of a Japanese-style outcome, which I have worried about and some other members of the FOMC have worried about.”

...

“It is a little disappointing that private-sector economists are thinking so much about when we are going to move our fed funds rate up,” he said. “We are at zero. We are going to be there awhile. The focus should be more on” the Fed’s asset purchase program.

CBRE: Retail Cap Rates Increase Sharply in Q3

by Calculated Risk on 10/12/2009 06:42:00 PM

From CB Richard Ellis: U.S. Retail Cap Rates

Ending at 8.71%, cap rates were up again. The 59 basis point gain is the largest quarterly increase we have ever measured, even trumping last quarter's previous record.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph from CBRE shows the retail cap rate since 2003. Note that 2009 is an average of Q1 through Q3, and the cap rate in Q3 was at 8.71% - above the 2003 annual level.

Sharply higher vacancy rates, lower rents, reduced leverage and much higher cap rates - this is what Brian calls the "neutron bomb for RE equity"; destroys CRE investors (and lenders), but leaves the buildings still standing.

Cap Rate: the net operating income divided by the current value (or purchase price). Net operating income excludes depreciation and interest expenses. Say an investor paid $100 thousand in cash for a retail property, the investor would expect to clear $8,710 in cash per year after expenses with an 8.71% cap rate (the $8,710 is before paying income taxes that depend on financing and depreciation).

The History of the World wouldn't be complete without ...

by Calculated Risk on 10/12/2009 04:45:00 PM

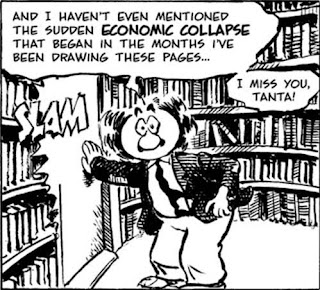

From Larry Gonick's The Cartoon History of the Modern World, Part 2, on page 248 ... (ht TDM)

Click on cartoon for larger image in new window.

Posted with permission from Larry Gonick. Thanks!

For more on Tanta, see the menu bar above ...

Mortgage Modifications and BofA

by Calculated Risk on 10/12/2009 02:10:00 PM

Renae Merle at the WaPo writes about Bank of America's struggles to ramp-up their mortgage modification department: Racing the Clock to Avoid Foreclosures

The following section probably requires more explanation:

The company was also slow out of the box because it initially took a more conservative approach than some other banks, requiring that borrowers document their income and complete other paperwork before granting preliminary approval for a modification. In August, Bank of America softened the requirement and began authorizing some modifications without getting all the documents first.Read mort_fin notes:

"What the article doesn't make clear is that what was changed was the timing of the income documentation, not the level. It used to be the case that bofa required full documentation of income before they would even run the numbers to tell a borrower that they qualified. Now they will give an answer over the phone and start a trial mod, giving the borrower a month or 2 to provide the docs. No docs, no permanent mod. A borrower who can't document their claims gets a month or two of reduced payments before getting kicked out."This is why it will be important to watch the number of permanent modifications over the next few months. The Treasury announced last week that 500,000 modifications have been started, but the Obama plan had produced only 1,711 permanent loan modifications as of Sept. 1. That number should increase sharply soon.

Hotel Industry Pulse Index Declines in September

by Calculated Risk on 10/12/2009 12:17:00 PM

From HotelNewsNow.com: Hotel Industry Pulse stalls

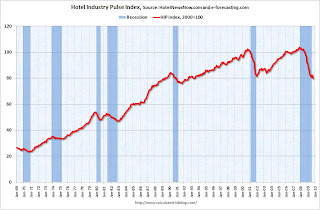

Economic research firm e-forecasting.com in conjunction with Smith Travel Research announced the HIP hit a snag in its recovery. After going up two months in a row, HIP declined 2.1 percent in September. HIP, the Hotel Industry's Pulse index, is a composite indicator that gauges business activity in the U.S. hotel industry in real-time. The latest decline brought the index to a reading of 79.7. The index was set to equal 100 in 2000.

...

“The HIP had shown improvements over the previous two months, but we’ve tried to approach those gains with cautious optimism,” said Chad Church, industry research manager at STR. “Over the past months, we saw leisure demand continue to make strides in recovery while business travel maintained its downward trend. Now that the summer travel season has come to an end, we’re waiting to see any signs of life from the business segment.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This index is now at the lowest point since 1992.

Over the last couple of years the hotel industry has been crushed. RevPAR (Revenue per available room) is off about 14% compared to the same period in 2008. And at the current occupancy and room rate levels, many hotels are losing money.

HIP historical data provided by HotelNewsNow.com and e-forecasting.com.

More from Chad Church at STR: STR's October forecast holds steady

As we come to conference season again, our outlook for 2010 and 2011 will depend heavily on the performance data we see during the next two months. ... As of now, we stand at a RevPAR projection of -4.2 percent in 2010.Chad provides this graph comparing weekend (leisure) vs. business travel:

"[D]emand in the weekend segment (which we use as a gauge for leisure travel) has stabilized, while demand in the weekday segment has yet to hit a definitive bottom. If the unemployment rate remains close to 10 percent throughout 2010, sustained demand growth in the leisure segment will be difficult. The corporate travel segment will then be the barometer for recovery, and as of August, there have been no discernable trends in our monthly data to indicate a turning point."I'll have more on Thursday, but the hotel industry is still searching for a bottom for the occupancy rate, and at the current low occupancy rates, the Average Daily Rate and RevPAR will continue to decline in 2010.

Distressed Sales: Sacramento as Example

by Calculated Risk on 10/12/2009 10:12:00 AM

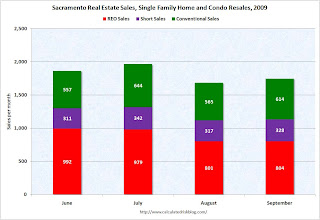

Note: The Sacramento Association of REALTORS® is now breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales). I'm following this series (as an example) to see changes in the mix.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the September data.

They started breaking out REO sales last year, but this is only the fourth monthly report with short sales. About 63 percent of all resales (single family homes and condos) were distressed sales in September. The second graph shows the mix for the last four months. Conventional and short sales have held steady, but foreclosure resales were lower in August and September. There are many reports of more foreclosures coming, and the number of foreclosure resales should pick up later this year.

The second graph shows the mix for the last four months. Conventional and short sales have held steady, but foreclosure resales were lower in August and September. There are many reports of more foreclosures coming, and the number of foreclosure resales should pick up later this year.

Total sales in September were off 18% compared to September 2008; the fourth month in a row with declining YoY sales.

On financing, over half the sales were either all cash (25.2%) or FHA loans (27.6%), suggesting most of the activity in distressed bubble areas like Sacramento is first-time home buyers using government-insured FHA loans (and taking advantage of the tax credits), and investors paying cash.

Rosenberg on Economy: "String of lowercase Ws for the next five years"

by Calculated Risk on 10/12/2009 08:43:00 AM

We are starting to exhaust the keyboard for the shape of the recovery ... and reuse letters!

Two different views:

From Bloomberg: Rosenberg Sees Low-To-No-Growth as Kantor Vows Vigorous Economy (ht jb)

“Right now the economy is being held together by very strong tape and glue provided by the Fed, Treasury and Congress,” [said David Rosenberg, Gluskin Sheff + Associates Inc.] ... The current economy won’t resemble previous V-shaped recoveries, he says. “It’s going to look like this whole string of lowercase Ws for the next five years,” with periods of growth followed by periods of contraction.And from Larry Kantor, head of research at Barclays Capital Inc. and former Fed economist:

“We think the recovery will be sustained,” ... “People talk about double-dips, the economy’s on life support and once it’s withdrawn everything is going to fall apart again. Business cycles typically don’t work that way.” ... Kantor ... says the parallel is closer to 1992, when the economy expanded 3.4 percent coming out of recession, or 1983, when it grew 4.5 percent.Of course Rosenberg tends to be bearish, and I can't remember when Kantor wasn't bullish. He was worried about inflation in 2005 and bullish in June 2008.

But this does show the range of forecasts. My view is the recovery will be sluggish for some time.