by Calculated Risk on 10/12/2009 12:17:00 PM

Monday, October 12, 2009

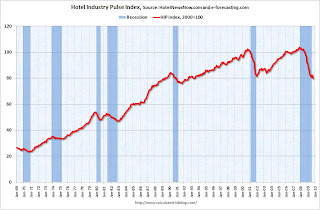

Hotel Industry Pulse Index Declines in September

From HotelNewsNow.com: Hotel Industry Pulse stalls

Economic research firm e-forecasting.com in conjunction with Smith Travel Research announced the HIP hit a snag in its recovery. After going up two months in a row, HIP declined 2.1 percent in September. HIP, the Hotel Industry's Pulse index, is a composite indicator that gauges business activity in the U.S. hotel industry in real-time. The latest decline brought the index to a reading of 79.7. The index was set to equal 100 in 2000.

...

“The HIP had shown improvements over the previous two months, but we’ve tried to approach those gains with cautious optimism,” said Chad Church, industry research manager at STR. “Over the past months, we saw leisure demand continue to make strides in recovery while business travel maintained its downward trend. Now that the summer travel season has come to an end, we’re waiting to see any signs of life from the business segment.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This index is now at the lowest point since 1992.

Over the last couple of years the hotel industry has been crushed. RevPAR (Revenue per available room) is off about 14% compared to the same period in 2008. And at the current occupancy and room rate levels, many hotels are losing money.

HIP historical data provided by HotelNewsNow.com and e-forecasting.com.

More from Chad Church at STR: STR's October forecast holds steady

As we come to conference season again, our outlook for 2010 and 2011 will depend heavily on the performance data we see during the next two months. ... As of now, we stand at a RevPAR projection of -4.2 percent in 2010.Chad provides this graph comparing weekend (leisure) vs. business travel:

"[D]emand in the weekend segment (which we use as a gauge for leisure travel) has stabilized, while demand in the weekday segment has yet to hit a definitive bottom. If the unemployment rate remains close to 10 percent throughout 2010, sustained demand growth in the leisure segment will be difficult. The corporate travel segment will then be the barometer for recovery, and as of August, there have been no discernable trends in our monthly data to indicate a turning point."I'll have more on Thursday, but the hotel industry is still searching for a bottom for the occupancy rate, and at the current low occupancy rates, the Average Daily Rate and RevPAR will continue to decline in 2010.