by Calculated Risk on 10/12/2009 02:10:00 PM

Monday, October 12, 2009

Mortgage Modifications and BofA

Renae Merle at the WaPo writes about Bank of America's struggles to ramp-up their mortgage modification department: Racing the Clock to Avoid Foreclosures

The following section probably requires more explanation:

The company was also slow out of the box because it initially took a more conservative approach than some other banks, requiring that borrowers document their income and complete other paperwork before granting preliminary approval for a modification. In August, Bank of America softened the requirement and began authorizing some modifications without getting all the documents first.Read mort_fin notes:

"What the article doesn't make clear is that what was changed was the timing of the income documentation, not the level. It used to be the case that bofa required full documentation of income before they would even run the numbers to tell a borrower that they qualified. Now they will give an answer over the phone and start a trial mod, giving the borrower a month or 2 to provide the docs. No docs, no permanent mod. A borrower who can't document their claims gets a month or two of reduced payments before getting kicked out."This is why it will be important to watch the number of permanent modifications over the next few months. The Treasury announced last week that 500,000 modifications have been started, but the Obama plan had produced only 1,711 permanent loan modifications as of Sept. 1. That number should increase sharply soon.

Hotel Industry Pulse Index Declines in September

by Calculated Risk on 10/12/2009 12:17:00 PM

From HotelNewsNow.com: Hotel Industry Pulse stalls

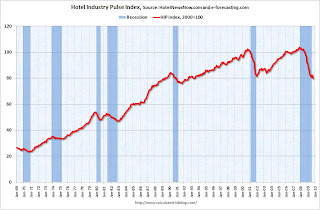

Economic research firm e-forecasting.com in conjunction with Smith Travel Research announced the HIP hit a snag in its recovery. After going up two months in a row, HIP declined 2.1 percent in September. HIP, the Hotel Industry's Pulse index, is a composite indicator that gauges business activity in the U.S. hotel industry in real-time. The latest decline brought the index to a reading of 79.7. The index was set to equal 100 in 2000.

...

“The HIP had shown improvements over the previous two months, but we’ve tried to approach those gains with cautious optimism,” said Chad Church, industry research manager at STR. “Over the past months, we saw leisure demand continue to make strides in recovery while business travel maintained its downward trend. Now that the summer travel season has come to an end, we’re waiting to see any signs of life from the business segment.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This index is now at the lowest point since 1992.

Over the last couple of years the hotel industry has been crushed. RevPAR (Revenue per available room) is off about 14% compared to the same period in 2008. And at the current occupancy and room rate levels, many hotels are losing money.

HIP historical data provided by HotelNewsNow.com and e-forecasting.com.

More from Chad Church at STR: STR's October forecast holds steady

As we come to conference season again, our outlook for 2010 and 2011 will depend heavily on the performance data we see during the next two months. ... As of now, we stand at a RevPAR projection of -4.2 percent in 2010.Chad provides this graph comparing weekend (leisure) vs. business travel:

"[D]emand in the weekend segment (which we use as a gauge for leisure travel) has stabilized, while demand in the weekday segment has yet to hit a definitive bottom. If the unemployment rate remains close to 10 percent throughout 2010, sustained demand growth in the leisure segment will be difficult. The corporate travel segment will then be the barometer for recovery, and as of August, there have been no discernable trends in our monthly data to indicate a turning point."I'll have more on Thursday, but the hotel industry is still searching for a bottom for the occupancy rate, and at the current low occupancy rates, the Average Daily Rate and RevPAR will continue to decline in 2010.

Distressed Sales: Sacramento as Example

by Calculated Risk on 10/12/2009 10:12:00 AM

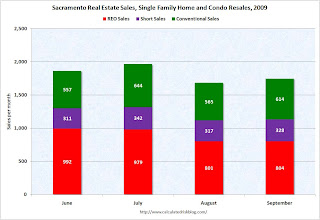

Note: The Sacramento Association of REALTORS® is now breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales). I'm following this series (as an example) to see changes in the mix.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the September data.

They started breaking out REO sales last year, but this is only the fourth monthly report with short sales. About 63 percent of all resales (single family homes and condos) were distressed sales in September. The second graph shows the mix for the last four months. Conventional and short sales have held steady, but foreclosure resales were lower in August and September. There are many reports of more foreclosures coming, and the number of foreclosure resales should pick up later this year.

The second graph shows the mix for the last four months. Conventional and short sales have held steady, but foreclosure resales were lower in August and September. There are many reports of more foreclosures coming, and the number of foreclosure resales should pick up later this year.

Total sales in September were off 18% compared to September 2008; the fourth month in a row with declining YoY sales.

On financing, over half the sales were either all cash (25.2%) or FHA loans (27.6%), suggesting most of the activity in distressed bubble areas like Sacramento is first-time home buyers using government-insured FHA loans (and taking advantage of the tax credits), and investors paying cash.

Rosenberg on Economy: "String of lowercase Ws for the next five years"

by Calculated Risk on 10/12/2009 08:43:00 AM

We are starting to exhaust the keyboard for the shape of the recovery ... and reuse letters!

Two different views:

From Bloomberg: Rosenberg Sees Low-To-No-Growth as Kantor Vows Vigorous Economy (ht jb)

“Right now the economy is being held together by very strong tape and glue provided by the Fed, Treasury and Congress,” [said David Rosenberg, Gluskin Sheff + Associates Inc.] ... The current economy won’t resemble previous V-shaped recoveries, he says. “It’s going to look like this whole string of lowercase Ws for the next five years,” with periods of growth followed by periods of contraction.And from Larry Kantor, head of research at Barclays Capital Inc. and former Fed economist:

“We think the recovery will be sustained,” ... “People talk about double-dips, the economy’s on life support and once it’s withdrawn everything is going to fall apart again. Business cycles typically don’t work that way.” ... Kantor ... says the parallel is closer to 1992, when the economy expanded 3.4 percent coming out of recession, or 1983, when it grew 4.5 percent.Of course Rosenberg tends to be bearish, and I can't remember when Kantor wasn't bullish. He was worried about inflation in 2005 and bullish in June 2008.

But this does show the range of forecasts. My view is the recovery will be sluggish for some time.

Sunday, October 11, 2009

Foreclosures Movin' on Up or Euphoria Express?

by Calculated Risk on 10/11/2009 10:37:00 PM

Kind of a weird juxtaposition ...

From the WSJ: Foreclosures Grow in Housing Market's Top Tiers

About 30% of foreclosures in June involved homes in the top third of local housing values, up from 16% when the foreclosure crisis began three years ago, according to new data from real-estate Web site Zillow.com.Meanwhile Jim the Realtor rides the Euphoria Express (mostly at the high end):

More on When the Fed might Raise Rates

by Calculated Risk on 10/11/2009 04:45:00 PM

From Paul Krugman: When should the Fed raise rates? (even more wonkish)

Let me start with a rounded version of the Rudebusch version of the Taylor rule:This is all back-of-the-envelope stuff - and maybe NAIRU or core inflation will be a little higher (although I think core inflation might be lower next year because of declining owners' equivalent rent).

Fed funds target = 2 + 1.5 x inflation - 2 x excess unemployment

where inflation is measured by the change in the core PCE deflator over the past four quarters (currently 1.6), and excess unemployment is the different between the CBO estimate of the NAIRU (currently 4.8) and the actual unemployment rate (currently 9.8).

Right now, this rule says that the Fed funds rate should be -5.6%. So we’re hard up against the zero bound.

Suppose that core inflation stays at 1.6% (although in fact it’s almost sure to go lower.) Then we can back out the unemployment rate at which the target would cross zero, suggesting that tightening should begin: it’s an excess unemployment rate of 2.2, implying an actual rate of 7 percent. That’s a long way from here. ...

If we use Krugman's analysis, and the recent CBO projections for the average annual unemployment rate (10.2% in 2010, 9.1% in 2011, and 7.2% in 2012), the Fed would not raise rates until some time in 2012.

Last month I wrote:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the effective Fed Funds rate (Source: Federal Reserve) and the unemployment rate (source: BLS)Maybe 2011. Or maybe 2012. But talk of a rate hike in early 2010 seems crazy ...

In the early '90s, the Fed waited more than a 1 1/2 years after the unemployment rate peaked before raising rates. The unemployment rate had fallen from 7.8% to 6.6% before the Fed raised rates.

Following the peak unemployment rate in 2003 of 6.3%, the Fed waited a year to raise rates. The unemployment rate had fallen to 5.6% in June 2004 before the Fed raised rates.

Although there are other considerations, since the unemployment rate will probably continue to increase into 2010, I don't expect the Fed to raise rates until late in 2010 at the earliest - and more likely sometime in 2011.

Ivy Zelman on Housing

by Calculated Risk on 10/11/2009 12:41:00 PM

Edward Robinson wrote a recent article for Bloomberg on the rise of independent research: ‘Sell’ for Research Renegades Becomes Business Off Wall Street (ht Eyal)

One of the analysts featured in the article is Ivy Zelman, formerly at Credit Suisse, and now at Zelman & Associates. Ms. Zelman became an internet favorite when she asked Toll Brothers CEO Bob Toll "Which Kool-aid are you drinking?" on the Q4 2006 Toll Brothers conference call.

On Zelman's current view:

Many of her clients are clamoring to know whether the market has hit bottom. In terms of prices, she says probably not: One out of three owners has a mortgage worth more than the value of the home, and mounting foreclosures and distressed properties are slated to account for 53 percent of home sales in 2010 compared with 40 percent in 2008, according to Moody’s.Although I think prices might have bottomed in some low end bubble areas at the end of 2008, or early 2009 - because of the flood of foreclosures at that time - some of these areas have seen prices increase 10% to 15% since then (according to local reports). This is because of a combination of a buying frenzy associated with the first time home buyer tax credit, and the lack of inventory because of foreclosure delays associated with the trial modifications. It is not unusual for homes in these areas to receive 20, 30 or 50 bids.

“When that inventory hits the market, it’s going to undermine prices,” she says.

Even if the first time home buyer tax credit is extended, I think the interest will wane. Meanwhile the banks are preparing to start foreclosing again. The WSJ recently quoted a Bank of America Corp. spokeswoman: "We are going to see a spike from now to the end of the year in foreclosures as we take people out of the running" [for a loan modification].

So I expect prices in the low end areas to decline again (even if the bottom is in). I also expect further price declines in the mid-to-high end bubble areas. Note: this isn't like in 2005 when I thought large price declines were inevitable. House prices are much closer to the bottom now, and the U.S. government is trying to support house prices, or at least slow the rate of price declines.

A Policy: Supporting House Prices

by Calculated Risk on 10/11/2009 09:45:00 AM

“I don’t think it’s a bad thing that the bad loans occurred. It was an effort to keep prices from falling too fast. That’s a policy.”

Barney Frank, chairman of the House Financial Services Committee on recent FHA lending, quoted Oct 9th, 2009 in the NY Times.

"I believe the intent of the FTHB [first time home buyer] credit (and any extensions) is to raise the floor on home prices to delay (and sometimes prevent) defaults, reducing the shock to the financial system."

reader picosec in email, Oct 2nd, 2009

And a couple more quotes from an article by Alan Heavens in Philadelphia Inquirer: Skeptics question housing recovery :

"Government intervention to date has been extremely helpful in preventing an even more dramatic decline in home prices."

John Burns, real estate industry consultant

The housing market "is showing improvement only because it is on government life support."

Mark Zandi, Economy.com

As Representative Frank notes, the policy of the U.S. appears to be to support asset prices at almost any cost. This includes:

We could probably include the Fed buying GSE MBS to lower mortgage rates, and other policies like increasing the "conforming loan" limit to $729,750 in high cost states.

Intentionally encouraging loans with high default rates (insured at taxpayer expense), and the FTHB tax credit (especially allowing buyers to use the credit as a down payment) have stimulated demand. And delaying foreclosures has restricted supply.

This has had the desired effect of pushing up asset prices, especially at the low end.

It is "a policy", but is it a good policy?

Saturday, October 10, 2009

The Pension Crisis

by Calculated Risk on 10/10/2009 10:35:00 PM

From David Cho at the WaPo: Steep Losses Pose Crisis for Pensions

The financial crisis has blown a hole in the rosy forecasts of pension funds that cover teachers, police officers and other government employees, casting into doubt as never before whether these public systems will be able to keep their promises to future generations of retirees.Infinity!

...

Within 15 years, public systems on average will have less half the money they need to pay pension benefits, according to an analysis by Pricewaterhouse Coopers. Other analysts say funding levels could hit that low within a decade.

After losing about $1 trillion in the markets, state and local governments are facing a devil's choice: Either slash retirement benefits or pursue high-return investments that come with high risk.

...

Some pension experts say the funding gap has become so great that no investment strategy can close it and that taxpayers will have to cover the massive bill.

The problem isn't limited to public pension funds; many corporate pension funds have lost so much ground that they are also pursuing riskier investments. And they, too, could end up a taxpayer burden if they cannot meet their obligations and are taken over by the federal Pension Benefit Guarantee Corp.

...

In Ohio, for instance, the teachers pension system reported that it would take 41 years for its investments to catch up with the costs of meeting its obligations to retirees. That was before the worst of the financial crisis.

During the last fiscal year, Ohio's fund lost 31 percent. Its most recent annual report detailed how long it would now take for its investments to put the fund back on track. Officials simply said: "Infinity."

Also check out the Time magazine cover story: Why It's Time to Retire the 401(k).

... at the end of 2007, the average 401(k) of a near retiree [55-to-64-year-old] held just $78,000 — and that was before the market meltdown.

The coming CRE losses for Local and Regional Banks

by Calculated Risk on 10/10/2009 05:45:00 PM

From Eric Dash at the NY Times: Small Banks Failure Rate Grows, Straining F.D.I.C.

A few numbers from the article:

... About $870 billion, or roughly half of the industry’s $1.8 trillion of commercial real estate loans, now sit on the balance sheets of small and medium-size banks like these, according to an analysis by Foresight Analytics, a research firm. ... And as a group, small banks have written off only a tiny percentage of the losses that analysts expect them to incur.This gives us a ballpark feel for the coming CRE losses. Local and regional banks are exposed to about $870 billion in CRE loans. Not all of the loans will go bad, and the loss severity will be far less than 100%. So the losses may be in the $100 to $200 billion range; small compared to the residential mortgage losses, but still very significant.

In fact, applying only the commercial real estate loss assumptions that federal regulators used during the stress tests for the big banks last spring, Foresight analysts estimated that as many as 581 small banks were at risk of collapse by 2011.

By contrast, commercial real estate losses put none of the nation’s 19 biggest banks, and only about 5 of the next 100 largest lenders, in jeopardy.

....

[Gerard Cassidy, a veteran banking analyst] projects that as many as 1,000 small banks will close over the next few years and that their losses will be more severe. “It’s a repeat [of savings and loan crisis] on steroids,” he said.