by Calculated Risk on 10/07/2009 11:52:00 AM

Wednesday, October 07, 2009

Hotel Defaults and Foreclosures Increase Sharply in California

Hotel investment has always been boom and bust, but the most recent boom was off the charts ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

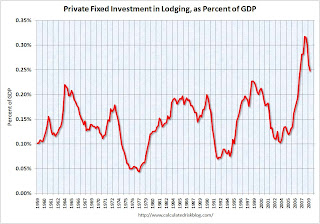

This graph shows lodging investment as a percent of GDP since 1959 through Q2 2009.

Lodging investment peaked in mid-2008, but because of the length of time for hotel construction, there are many new hotels still coming online - at just the wrong time.

From the LA Times: Hotel defaults, foreclosures rise in California (ht Ann)

... Statewide, more than 300 hotels were in foreclosure or default on their loans as of Sept. 30 -- a nearly fivefold increase since the start of the year, according to an industry report released Tuesday.Not only is the recession impacting business and leisure travel, but there are just too many hotel rooms, and many more on the way.

...

Most struggling hotels remain open, but industry experts believe many properties are likely to be closed down in the months ahead, even if they are not in foreclosure, because they are losing so much money. ...

"I have never seen so many lenders contemplating mothballing properties," said Jim Butler, a hotel lawyer and chairman of the global hospitality group for Jeffer, Mangels, Butler & Marmaro. "It can and it will get worse for the hotel industry."

...

Statewide, 260 hotels were in default on their loans and 47 had been taken over by their lenders in foreclosure, the Atlas report said.

... a leading hotel consulting firm, Smith Travel Research, recently issued a report that predicted no significant improvement for the hotel industry until 2011 at the earliest.

"It's going to be a lot worse than it is now," said Bobby Bowers, senior vice president of Smith Travel Research.

... an increasing number of hotels have so little revenue that they can't even afford to pay their operating bills and payroll, not to mention servicing debt.

Owners of such hotels are increasingly handing the keys back to the lenders, and the problem is likely to get worse: As many as 1 in 5 U.S. hotel loans may default through 2010, UC Berkeley economist Kenneth Rosen said.

In some cases the lenders are simply locking up the properties...

emphasis added

Office Vacancy Rate and Unemployment

by Calculated Risk on 10/07/2009 10:31:00 AM

Last night Reis reported that the U.S. office vacancy rate hits 16.5 percent in Q3. (See Reis: U.S. Office Vacancy Rate Hits 16.5% in Q3 for a graph). Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the office vacancy rate vs. the quarterly unemployment rate and recessions.

The unemployment rate and the office vacancy rate tend to move in the same direction - and the peaks and troughs mostly line up.

As the unemployment rate continues to rise over the next year or more, the office vacancy rate will probably rise too. Reis' forecast is for the office vacancy rate to peak at 18.2 percent in 2010, and for rents to continue to decline through 2011.

One of the questions is why - with a 9.8% unemployment rate in September - the office vacancy rate isn't even higher? This is probably because of less overbuilding, as compared to the S&L related overbuilding in the '80s, and the tech bubble overbuilding a few years ago. Also a number of non-office workers (construction and retail workers) have lost their jobs in the current employment recession. The second graph shows office investment as a percent of GDP since 1959 through Q2 2009.

The second graph shows office investment as a percent of GDP since 1959 through Q2 2009.

Office investment peaked in Q3 2008, and with the office vacancy rate rising sharply, office investment will probably decline at least through 2010.

Of course many existing office buildings were purchased in recent years at very low cap rates, with excessive leverage, and optimistic income projections. Now that prices have fallen sharply, many of these building owners are far underwater - and that will lead to more losses for lenders. See the WSJ: Fed Frets About Commercial Real Estate

NY Times: Employment Tax Credit Gains Support

by Calculated Risk on 10/07/2009 09:21:00 AM

From Catherine Rampell at the NY Times: Support Builds for Tax Credit to Help Hiring

... a tax credit for companies that create new jobs ... is gaining support among economists and Washington officials ...The timing is probably better than in 1977 when employment was already recovering. If the 1970s estimate is accurate (about 2/3 of the jobs would have been created anyway), this proposal is already much better targeted than the housing tax credit, and better for the economy and the housing market too.

Timothy J. Bartik, a senior economist at the Upjohn Institute for Employment Research who is working on the draft with John H. Bishop of Cornell, estimates that it would cost about $20,000 for each job created.

...

Under the proposal from Mr. Bartik and Mr. Bishop, the credit in the first year would equal 15.3 percent of the cost of adding an employee. In the second year, it would fall to about 10.2 percent.

...

The authors estimate their proposal could create more than two million jobs in the first year.

...

Of course, even in recessionary times, some companies are hiring without tax breaks. So a subsidy could merely benefit those businesses that already would have added new workers.

An American Economic Review study has suggested that the 1970s policy was responsible for adding about 700,000 of the 2.1 million jobs that were awarded the credit.

...

Advocates argue that such incentives would be more effective this time around not only because of design, but also because of timing. In 1977, hiring was already on the upswing, whereas economists expect today’s job market to decline a bit more and then stagnate for months.

A key problem for housing and the economy is that there are too many housing units compared to the number of households. This proposal will indirectly stimulate more household formation - more jobs will create more households - and more households is the key to the housing market and the economy.

Reis: U.S. Office Vacancy Rate Hits 16.5% in Q3

by Calculated Risk on 10/07/2009 01:11:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the office vacancy rate starting 1991.

Reis is reporting the vacancy rate rose to 16.5% in Q3 from 15.9% in Q2. The peak following the previous recession was 17%.

From Bloomberg: U.S. Office Vacancies Reach Five-Year High of 16.5%, Reis Says

U.S. office vacancies ... climbed to 16.5 percent ... New York-based Reis said in a report. Effective rents ... fell 8.5 percent, the biggest year-over-year drop since 1995.Earlier this year Reis forecast that the U.S. office vacancy rate will top out at 18.2 percent in 2010, and that rents will continue to decline through 2011.

“The decline in effective rents really accelerated after the fall of Lehman Brothers,” Victor Calanog, director of research at Reis, said in a statement. “Tenants will continue shedding occupied space as jobs are lost.”

...

“Weakness in rents is not concentrated in just a few” cities, Calanog said.

No wonder the Fed is so worried (previous post).

Tuesday, October 06, 2009

Fed Worries about CRE Grow

by Calculated Risk on 10/06/2009 10:07:00 PM

From the WSJ: Fed Frets About Commercial Real Estate

Banks in the U.S. "are slow" to take losses on their commercial real-estate loans being battered by slumping property values and rental payments, according to a Federal Reserve presentation to banking regulators last month.There is much more in the article, including a discussion on interest reserves masking bad loans (something we've been discussing for a few years) and "extend and pretend". Hey, hoocoodanode!

.... "Banks will be slow to recognize the severity of the loss -- just as they were in residential," according to the Fed presentation, which was reviewed by The Wall Street Journal.

A Fed official confirmed the authenticity of the document, prepared by an Atlanta Fed real-estate expert who is part of the central bank's Rapid Response program to spread information about emerging problem areas to federal and state banking examiners throughout the U.S.

While the Sept. 29 presentation by K.C. Conway doesn't represent the central bank's formal opinion, worries about the banking industry's commercial real-estate exposure have been building inside the Fed for months. ...

Mr. Conway's presentation painted a bleak picture of the sliding real-estate values and enormous debt that will need to be refinanced in the next few years. Vacancy rates in the apartment, retail and warehouse sectors already have exceeded those seen during the real-estate collapse of the early 1990s, Mr. Conway noted. His report also predicted that commercial real-estate losses would reach roughly 45% next year. Valuing real estate has always been tricky for banks, and the problem is particularly acute now because sales activity is practically nonexistent.

...

More than half of the $3.4 trillion in outstanding commercial real-estate debt is held by banks.

Note: REIS reported today that the apartment vacancy rate in cities hit a 23 year high: From Reuters: US apartment vacancy rate hits 23-year high-report and other CRE categories are also seeing rapidly rising vacancies and falling rents.

Small Business and Employment

by Calculated Risk on 10/06/2009 07:00:00 PM

Atlanta Fed research economist Melinda Pitts writes at Macroblog: Prospects for a small business-fueled employment recovery

In a speech yesterday, William Dudley, the president of the Federal Reserve Bank of New York, identified financial constraints for small businesses as a restraint on the pace of economic recovery.Dr. Pitts excerpt from William Dudley's speech, and then notes:

President Dudley's comments are even more relevant in the current recession if one considers the disproportionate effect the recession has had on very small businesses.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Graph Credit: Melinda Pitts, Atlanta Fed research economist and associate policy adviser

This graph breaks down net job gains and losses by firm size since 1992. During the current employment recession, small firms have accounted for about 45% of the job losses - much higher than during the 2001 recession.

Dr. Pitts cautions:

Looking ahead, it's not clear whether small businesses will continue to play their traditional role in hiring staff and helping to fuel an employment recovery. However, if the above-mentioned financial constraints are a major contributor to the disproportionately large employment contractions for very small firms, then the post-recession employment boost these firms typically provide may be less robust than in previous recoveries.

Starwood to Buy Corus Assets

by Calculated Risk on 10/06/2009 04:00:00 PM

From Zachery Kouwe and Eric Dash at the NY Times DealBook: Sternlicht, Ross Strike Deal for Corus Assets

The Federal Deposit Insurance Corporation plans to announce on Tuesday that it will sell about $4.5 billion of troubled real estate loans that it recently seized from Corus Bancshares to a group of private investment firms led by the Starwood Capital Group ...The details are not available yet.

Under the terms of the complex deal, Starwood and its business partners agreed to pay $554 million for a 40 percent equity stake in the loan pool while the F.D.I.C. keeps a 60 percent stake ... By providing guaranteed financing to the buyers, the government hopes that they will be able finish developing the condo projects or turn them into apartments or hotels.

...

The sale reflects an estimated price of about 50 cents on the dollar for the batch of troubled loans ...

Inland Empire Retail Vacancy Rate Increases

by Calculated Risk on 10/06/2009 02:45:00 PM

Just to complete the CRE circle: rising vacancy rates for apartments, offices, and retail ...

From the Press Enterprise: Vacancy rates among Inland retailers mounts

... Inland retail vacancy rates in the third quarter [were] 11.2 percent ...The REIS national Q3 retail vacancy rates will be released soon, but here is a preview based on the Q2 numbers:

That marked a rise from 10.6 percent in the prior quarter, and was well up from 7.6 percent in the third quarter of 2008, according to new data from commercial real estate broker CB Richard Ellis.

...

"I think we're going to be seeing these trends for the rest of this year and for much of 2010," said Matt Burnett, senior associate in the Ontario office of CB Richard Ellis.

Click on graph for larger image in new window.

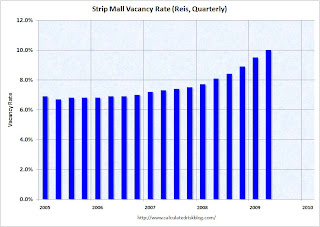

Click on graph for larger image in new window.In Q2, the U.S. strip mall vacancy rate hit 10%, the highest level since 1992.

"Until we see stabilization and recovery take root in both consumer spending and business spending and hiring, we do not foresee a recovery in the retail sector until late 2012 at the earliest."

Victor Calanog, director of research for Reis Inc, July 2009

Report: Manhattan Office Vacancy Rate Increases, Rents Decline

by Calculated Risk on 10/06/2009 11:43:00 AM

From Bloomberg: Manhattan Office Vacancies Reach Five Year High, Cushman Says

Manhattan’s third-quarter office vacancy rate hit a five-year high ... The rate rose to 11.1 percent, the highest since the third quarter of 2004, New York-based broker Cushman & Wakefield said in a statement today. Rents fell 5.2 percent from the second quarter to $57.08 a square foot and were down 22 percent from a year earlier.Yesterday, NY Fed President commented about falling commercial real estate prices:

emphasis added

First, the capitalization rate—the ratio of income to valuation—has climbed sharply. At the peak, capitalization rates for prime properties were in the range of 5 percent. That means that investors were willing to pay $20 for a $1 of income. Today, the capitalization rate appears to have risen to about 8 percent. That means that the same dollar of income is now capitalized as worth only $12.50. In other words, if income were stable, the value of the properties would have fallen by 37.5 percent. Second, the income generated by commercial real estate has generally been falling.According to Cushman, rents are off 22% over the last year (probably more since the peak), and combined with the higher cap rate, Dudley's estimate suggests office building prices have fallen by half or more in New York.

There was a little good news in the Cushman report:

Sublease space declined to 11.1 million square feet from 11.4 million at mid-year, the first drop since the end of 2007, Cushman said.However the vacancy rate is still expect to rise further, perhaps to 14% in New York according to Cushman.

“A decline in sublease space is indicative of the market beginning to move towards stabilization,” said Joseph Harbert, chief operating officer for Cushman’s New York metropolitan region.

The national office vacancy data from REIS will be released soon.

NRF Forecasts One Percent Decline in Holiday Retail Sales

by Calculated Risk on 10/06/2009 08:50:00 AM

From the National Retail Federation: NRF Forecasts One Percent Decline in Holiday Sales

The National Retail Federation today released its 2009 holiday forecast, projecting holiday retail industry sales to decline one percent this year to $437.6 billion.* While this number falls significantly below the ten-year average of 3.39 percent holiday season growth, the decline is not expected to be as dramatic as last year’s 3.4 percent drop in holiday retail sales ...Notice the focus on cost controls, and that suggests retail hiring for the holiday season will be weak.

“The expectation of another challenging holiday season does not come as news to retailers, who have been experiencing a pullback in consumer spending for over a year,” said NRF President and CEO Tracy Mullin. “To compensate, retailers’ focus on the holiday season has been razor-sharp with companies cutting back as much as possible on operating costs in order to pass along aggressive savings and promotions to customers.”

* NRF defines “holiday sales” as retail industry sales in the months of November and December. Retail industry sales include most traditional retail categories including discounters, department stores, grocery stores, and specialty stores, and exclude sales at automotive dealers, gas stations, and restaurants.

Here is a repeat of a graph from a post a couple weeks ago: Retail Hiring Outlook "Jobs Scarce"

Click on graph for larger image in new window.

Click on graph for larger image in new window.Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. This graph shows the historical net retail jobs added for October, November and December by year.

Based on the NRF forecast, seasonal retail hiring might be around 400 thousand again in 2009.

More from Ylan Mui at the WaPo: Retailers Hope for Holiday Cheer

The retail federation's forecast "is a good number in that it shows stabilizing in sales," NRF spokesman Scott Krugman said. "However, it also acknowledges that the recovery is not going to be consumer-led."Typically recoveries are consumer led, and then the increase in end demand eventually leads to more business investment. Not this time. Just another reminder that the typical engines of recovery are still misfiring.