by Calculated Risk on 9/30/2009 09:54:00 AM

Wednesday, September 30, 2009

Chicago Purchasing Managers Index Declines in September

From MarketWatch: Business activity declines in Chicago area

The Chicago purchasing managers index fell to 46.1% in September from 50.0% in August ... The new orders index backtracked to 46.3% from 52.5% in August. The employment index was essentially unchanged at 38.8% ...Readings below 50% indicate contraction.

This index is for both manufacturing and service activity in the Chicago region. In general the Chicago area is considered representative of the mix of manufacturing and non-manufacturing business activity in the nation, so a decline in the Chicago PMI is significant.

The national ISM manufacturing index will be released tomorrow, and the ISM non-manufacturing index on Monday.

MBA: 30 Year Mortgage Rate Falls to 4.94 Percent

by Calculated Risk on 9/30/2009 08:42:00 AM

The MBA reports: Mortgage Applications Decrease

The Market Composite Index, a measure of mortgage loan application volume, decreased 2.8 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index decreased 0.8 percent from the previous week and the seasonally adjusted Purchase Index decreased 6.2 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.94 percent from 4.97 percent ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

The Purchase index declined to 270.4, and the 4-week moving average declined to 283.9.

Note: The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007, even though activity was actually declining.

Tuesday, September 29, 2009

Survey: Home Purchase Market by Homebuyer Category

by Calculated Risk on 9/29/2009 11:20:00 PM

Here is some national data on the types of homebuyers in August. This is from a survey by Campbell Communications (excerpted with permission).

Source: Tracking Real Estate Market Conditions, a whitepaper regarding the Campbell/Inside Mortgage Finance Monthly Survey on Real Estate Market Conditions. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Campbell survey breaks out sales by buyer type.

According to the Campbell survey about 64% of sales in August were to first-time buyers and investors.

Survey results show that first-time homebuyers, motivated by first-time homebuyer tax credit, made up the largest component of demand in August 2009. In the summer months, current homeowners also make up a significant component of demand. (Note: rounding on graph figures precludes totaling to 100%.)

For comparison, here is the same breakdown for Q2.

For comparison, here is the same breakdown for Q2.According to the Campbell survey over 70% of sales in Q2 were to first-time buyers and investors.

Whenever the tax credit expires (whether or not is extended), the percent of first time buyers will decline.

Report: CIT Preparing Plan to Hand Control to Bondholders

by Calculated Risk on 9/29/2009 07:46:00 PM

From the WSJ: CIT in Last-Ditch Rescue Bid

CIT is preparing a sweeping exchange offer that would eliminate 30% to 40% of its more than $30 billion in outstanding debt ... The plan would offer bondholders new debt secured by CIT assets, as well as nearly all of the equity in a restructured company. ... If not enough bondholders agreed to the plan, the company could seek to execute the restructuring in bankruptcy court, the person said. The result could potentially be one of the largest Chapter 11 bankruptcy-court filings in U.S. history.The writing was on the wall in July when CIT obtained a $3 billion emergency loan secured by all of their assets. As I noted in July, the emergency loan just kicked the can down the road.

Now it appears CIT is at the end of the road ...

Citi Still Using FDIC TLGP

by Calculated Risk on 9/29/2009 07:26:00 PM

From Dow Jones: Citi Prices $5B Four-Part FDIC-Backed Deal-Source

Citigroup Inc. priced a $5 billion government-backed bond Tuesday, its second benchmark-sized bond offering this month under the U.S. Federal Deposit Insurance Corp.'s Temporary Liquidity Guarantee Program ... Since November of last year, when the FDIC program was launched, Citi has issued $49.6 billion of these deals ...If the TLGP is extended, Citi might be the only user.

Also, the FDIC earlier today announced a plan to "require insured institutions to prepay their estimated quarterly risk-based assessments" for the next three years. This plan would raise approximately $45 billion.

Bloomberg has a story on the costs: Bank of America, 3 Other Banks’ FDIC Fees May Top $10 Billion

Bank of America, the biggest U.S. lender by deposits, may owe $3.5 billion under the FDIC proposal for banks to prepay three years of premiums, based on the lowest assessment rate multiplied by the bank’s $900 billion in second-quarter U.S. deposits.Ouch.

...

U.S. bank premiums range from 12 cents per $100 in deposits for the safest lenders to 45 cents for banks the U.S. considers risky, said Chris Cole, senior regulatory counsel for the Independent Community Bankers of America.

...

Based on the current assessment and each bank’s deposits, Wells Fargo & Co.’s fee may be $3.2 billion based on its $814 billion in deposits, JPMorgan Chase & Co. may pay $2.4 billion and Citigroup Inc. $1.2 billion.

Market Update

by Calculated Risk on 9/29/2009 04:12:00 PM

Note: Looking ahead, Thursday and Friday will be heavy economic news days with vehicle sales (how bad will the post-clunker slump be?), construction spending, personal income and outlays for August, the employment report on Friday and more.

A couple of market graphs ... the S&P 500 was first at this level in March 1998; about 11 1/2 years ago.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

The S&P 500 is up 57% from the bottom (384 points), and still off 32% from the peak (505 points below the max). The second graph is from Doug Short - Instead of comparing the markets from the peak (See: the Four Bad Bears), Doug Short matched up the market bottoms for four crashes (with an interim bottom for the Great Depression).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

House Prices: Stress Test and Price-to-Rent

by Calculated Risk on 9/29/2009 12:56:00 PM

This following graph compares the Case-Shiller Composite 10 SA index with the Stress Test scenarios from the Treasury (stress test data is estimated from quarterly forecasts). The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

Case-Shiller Composite 10 Index (SA), July: 154.69

Stress Test Baseline Scenario, July: 147.23

Stress Test More Adverse Scenario, July: 138.14

Unlike with the unemployment rate (worse than both scenarios), house prices are performing better than the the stress test scenarios.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through July 2009 using the Case-Shiller Composite Indices (SA): Click on image for larger graph in new window.

Click on image for larger graph in new window.

This graph shows the price to rent ratio (January 2000 = 1.0) for the Case-Shiller composite indices. For rents, the national Owners' Equivalent Rent from the BLS is used.

Back in 2004 or 2005, it was obvious that prices were out of line with fundamentals. This was clear in the price-to-income and price-to-rent ratios - and there was also widespread speculation (the definition of a bubble).

Now, looking at the price-to-rent ratio based on the Case-Shiller indices, the adjustment in the price-to-rent ratio is mostly behind us. Although the ratio is still a little high. Note: some would argue the ratio being a little too high is reasonable based on mortgage rates and "affordability".

With rents now falling almost everywhere, a further downward adjustment in house prices seems likely.

FDIC Seeks $45 Billion in Prepayments from Banks

by Calculated Risk on 9/29/2009 11:03:00 AM

The Board of Directors of the Federal Deposit Insurance Corporation today adopted a Notice of Proposed Rulemaking (NPR) that would require insured institutions to prepay their estimated quarterly risk-based assessments for the fourth quarter of 2009 and for all of 2010, 2011 and 2012. The FDIC estimates that the total prepaid assessments collected would be approximately $45 billion.MarketWatch has more details: Fund to protect deposits has shrunk to low levels

Absent the prepaid premiums, the FDIC said that the agency's Deposit Insurance Fund ... would face a liquidity crunch early next year, and that it will be operating in the red by the end of this month.

The FDIC said that the prepayments would raise $45 billion for the fund. The board said it estimates that total bank failure losses could reach $100 billion by 2013.

emphasis added

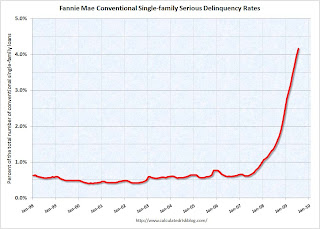

Fannie Mae Serious Delinquency Rate increases Sharply

by Calculated Risk on 9/29/2009 10:33:00 AM

Here is a hockey stick graph ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

Fannie Mae reported that the serious delinquency rate for conventional loans in its single-family guarantee business increased to 4.17 percent in July, up from 3.94 percent in June - and up from 1.45% in July 2008.

"Includes seriously delinquent conventional single-family loans as a percent of the total number of conventional single-family loans. These rates are based on conventional single-family mortgage loans and exclude reverse mortgages and non-Fannie Mae mortgage securities held in our portfolio."

Just more evidence of some shadow inventory and the next wave of foreclosures.

Update: These stats include Home Affordable Modification Program (HAMP) loans in trial modifications.

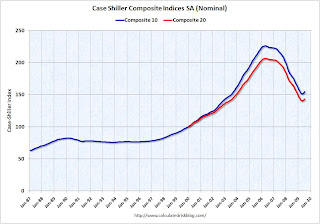

Case-Shiller House Prices increase in July

by Calculated Risk on 9/29/2009 09:00:00 AM

S&P/Case-Shiller released their monthly Home Price Indices for July this morning.

This monthly data includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). This is the Seasonally Adjusted data - others report the NSA data.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.6% from the peak, and up about 1.3% in July.

The Composite 20 index is off 30.6% from the peak, and up 1.2% in July. The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 12.8% from July 2008.

The Composite 20 is off 11.5% from last year.

This is still a very strong YoY decline.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. Prices increased (SA) in 17 of the 20 Case-Shiller cities in July.

Prices increased (SA) in 17 of the 20 Case-Shiller cities in July.

In Las Vegas, house prices have declined 55.2% from the peak. At the other end of the spectrum, prices in Dallas are only off about 4.9% from the peak - and up in 2009. Prices have declined by double digits almost everywhere.

The debate continues - is the price increase because of the seasonal mix (distressed sales vs. non-distressed sales), the impact of the first-time home buyer frenzy on prices, and the slowdown in the foreclosure process (with a huge shadow inventory), or have prices actually bottomed? I think we will see further house price declines in many areas.

I'll compare house prices to the stress test scenarios soon.