by Calculated Risk on 9/26/2009 09:25:00 PM

Saturday, September 26, 2009

Banks: Troubled Asset Ratio

The American University School and MSNBC have created a tool for tracking the "troubled asset ratio" for banks. This tool allows you to search for individual banks.

Here is the description:

[The] “troubled asset ratio” ... compares the sum of troubled assets with the sum of Tier 1 Capital plus Loan Loss Reserves. Generally speaking, higher values in this ratio indicate that a bank is under more stress caused by loans that are not paying as scheduled.According to BankTracker, the national median troubled-asset ratio is 13 (a percentage of Tier 1 Capital plus Loan Loss Reserves). The most recent bank failure, Georgian Bank in Altanta Georgia had a ratio of 198.3.

Wendell Cochran, senior editor of the Investigative Reporting Workshop, and a former business reporter for the Kansas City Star, the Des Moines Register and Gannett News Service, was likely the first journalist to create this measure of bank health. He did that while covering banking for the Des Moines Register in the early 1980s. Later, at Gannett News Service, he was involved in projects published at USA TODAY and elsewhere that calculated this ratio for every bank and savings and loan in the nation.

Others do similar calculations. The most widely used is the so-called Texas Ratio, created during the 1980s by a banking consultant. You can find various formulas for calculating this ratio, but they generally are in line with the method used by the Investigative Reporting Workshop. There is no attempt here to value the non-loan assets that may also be causing bank problems, such as mortgage-backed securities, collateralized debt obligations, etc.

I looked up a few banks from the Unofficial Problem Bank List with Prompt Corrective Actions:

| Name | City | State | PCA | Troubled Asset Ratio |

|---|---|---|---|---|

| Peoples First Community Bank | Panama City | FL | 6/11/2009 | 362.8 |

| Warren Bank | Warren | MI | 8/3/2009 | 351.1 |

| Home Federal Savings Bank | Detroit | MI | 3/5/2009 | 193.2 |

| Bank of Elmwood | Racine | WI | 7/23/2009 | 182.5 |

| American United Bank | Lawrenceville | GA | 8/13/2009 | 155.3 |

| Heritage Bank | Topeka | KS | 3/31/2009 | 149.1 |

| Bank 1st | Albuquerque | NM | 8/31/2009 | 146.1 |

WaPo: An Interview with Barney Frank

by Calculated Risk on 9/26/2009 04:06:00 PM

From the WaPo: Barney Frank Talks Back A couple of excerpts:

Klein: What's the most important part of financial regulation?This is an interesting answer. About two years ago, I was asked to sum up the causes of the crisis in a few words, and I responded "Securitization and the lack of regulatory oversight". I then explained how rapid innovation in lending resulted in a disconnect between the borrower and the eventual debt holder.

Frank: Limiting securitization. I believe the single biggest issue here is that people invented ways to lend money without worrying if they got paid back or not by securitizing the loan. When I was younger, the theory was if you had a high risk tolerance, you went into stocks. If you were safe and stodgy, you bought debt. But debt became the volatile aspect here.

...

Klein: One theory of the crisis is that the problem wasn't traders and their high tolerance for risk. It was people fooling themselves into thinking this stuff was safe by slapping a triple-A rating on everything.

Frank: I agree; the theory has always been that people bought debt because it was safer. The basic problem was that 30 years ago when people lent other people money, they expected to be paid back by the people they lent money to. So they were very careful. Two years ago, most loans were being made by people who were going to sell those loans to other people and didn't expect to be paid back.

The mortgage lenders and Wall Street firms were disconnected from the performance of the actual loan (the "Originate-to-sell" model). At the same time, the rating agencies were evaluating the debt based on the historical performance of the old style lender-borrower relationship. The eventual debt holders relied on the rating agencies, without realizing the entire model had changed.

Meanwhile the regulators were not following this advice:

“Instruct regulators to look for the newest fad in the industry and examine it with great care. The next mistake will be a new way to make a loan that will not be repaid.”

William Seidman, "Full Faith and Credit", 1993.

There is nothing inherently wrong with securitization or financial innovation. But the regulators should always be on the lookout for "a new way to make a loan that will not be repaid".

IMF Managing Director: "Too early to claim victory"

by Calculated Risk on 9/26/2009 01:28:00 PM

A quote from Bloomberg: Strauss-Kahn Says Crisis Consequences Will Last Long Time

“We will still have rising unemployment at least for a year,” [International Monetary Fund Managing Director Dominique] Strauss-Kahn said via videolink in an address to the Yalta European Strategy Conference from Washington. “From this point of view, the crisis isn’t over. It is too early to claim victory, even that we have avoided the worst situation. The consequences will be there for a long time.”Strauss-Kahn makes several key points:

Earlier this week, Strauss-Kahn expressed concern about the social consquences of the crisis (via Reuters):

"In many areas of the world, what is at stake is not only higher unemployment or lower purchasing power, but life and death itself," Strauss-Kahn said.

"We don't just care about growth for growth's sake, we also want to safeguard peace and prevent war," he said, adding: "Indeed, when low-income countries were doing well over the past decade or so, the incidence of war declined significantly. The great fear is that this trend could be reversed."

L.A. Times: A House is a Home

by Calculated Risk on 9/26/2009 08:33:00 AM

From Peter Hong at the LA Times: Don't bank on your home as an ATM (ht Ann). A few excerpts:

For generations of Americans, a home was seen not simply as a dwelling, but as an engine of personal wealth. That view was promoted by the home-building and real estate sales industries as well as the U.S. government, which subsidized home loans and provided tax deductions for mortgage interest.It makes sense for people to buy houses as a place to live, not as an investment.

...

Now, however, the worst housing crash since the Great Depression may mean that a home purchase ought to be considered with the same warning issued to investors in securities: Past performance is not indicative of future results.

...

Leslie Appleton-Young, chief economist for the California Assn. of Realtors, said that the state's median home price used to rise and fall roughly in line with the national median. ... "It didn't really get out of whack until about four or five years ago," she said. "It was tied into financing."

With lax mortgage standards a thing of the past, at least for now, Appleton-Young said, home price increases will be more moderate in the future, which should lead people to "a much more realistic assessment of why they're buying a home. They'll do so more for the consumption value; it's a place to raise your family, not your nest egg."

...

"In the period post-World War II, you bought a home, gave your family a great place to live relative to the alternatives, and if all went well, in 20 years you didn't have a mortgage," said [Thomas Lawler, influential housing consultant and a former Fannie Mae official]. "That's what people ought to go back to."

Perhaps Leslie Appleton-Young has lost track of time, but four years ago was 2005 - the peak of the housing insanity. She probably meant four or five years before 2006 (when prices peaked) as to when house prices in California started to detach from fundamentals.

G-20 Agreements

by Calculated Risk on 9/26/2009 01:47:00 AM

From the NY Times: Group of 20 Agrees on Far-Reaching Economic Plan

The leaders pledged to rethink their economic policies in a coordinated effort to reduce the immense imbalances between export-dominated countries like China and Japan and debt-laden countries like the United States, which has long been the world’s most willing consumer.Imagine an export led recovery in the U.S. (as opposed to the typical recovery with consumer spending and housing leading the way). I'll believe it when I see it.

The United States will be expected to increase its savings rate, reduce its trade deficit and address its huge budget deficit. Countries like China, Japan and Germany will be expected to reduce their dependence on exports by promoting more consumer spending and investment at home.

... for the first time ever, each country agreed to submit its policies to a “peer review” from the other governments as well as to monitoring by the International Monetary Fund.

Friday, September 25, 2009

Problem Bank List (Unofficial) Sept 25, 2009

by Calculated Risk on 9/25/2009 07:36:00 PM

This is an unofficial list of Problem Banks.

Changes and comments from surferdude808:

Another week with significant changes to the Unofficial Problem Bank List as the FDIC released its enforcement actions for August. We will not get another release from the FDIC until the end of October.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

The Unofficial Problem Bank List grew by 23 institutions to 459 and aggregate assets total $297.2 billion, up from $294 billion last week. During the week, we added 25 institutions to the list while we removed 2 because of failure. The failures were Irwin Union Bank and Trust Company ($2.8 billion) and Irwin Union Bank, F.S.B. ($518 million).

The largest asset additions include First Mariner Bank ($1.3 billion), Baltimore, MD; Anchor Mutual Savings Bank ($657 million), Aberdeen, WA; and NexBank ($560 million), Dallas, TX.

For the other 23 additions, the average asset size is $178 million. The additions are concentrated in handful of states including Minnesota (5), California (4), Washington (4), and Georgia (3), which all continue to see banks with large CRE or C&D lending concentrations come under enforcement action.

The list includes 2 new Prompt Corrective Action orders the FDIC issued against American United Bank ($112 million), Lawrenceville, GA; and Bank 1st ($109 million), Albuquerque, NM. It is long overdue for the agencies to start issuing more PCA orders.

One other interesting item this week is that the FDIC issued a Cease & Desist order on August 31st against Georgian Bank ($2.2 billion), Atlanta, GA, which was closed today. We typically remove failures from the subsequent week’s list but, in this case, we did not add Georgian Bank otherwise aggregate assets would have been $299.4 billion.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failure #95: Georgian Bank, Atlanta, GA

by Calculated Risk on 9/25/2009 04:36:00 PM

Just five simple syllables

Foreclosure central

by Rob Dawg (SGIP out today)

From the FDIC: First Citizens Bank and Trust Company, Incorporated, Columbia, South Carolina, Assumes All of the Deposits of Georgian Bank, Atlanta, Georgia

Georgian Bank, Atlanta, Georgia, was closed today by the Georgia Department of Banking and Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Friday starts early ...

As of July 24, 2009, Georgian Bank had total assets of $2 billion and total deposits of approximately $2 billion. In addition to assuming all of the deposits of the failed bank, First Citizens Bank agreed to purchase essentially all of the assets.

The FDIC and First Citizens Bank entered into a loss-share transaction on approximately $2 billion of Georgian Bank's assets. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $892 million. ... Georgian Bank is the 95th FDIC-insured institution to fail in the nation this year, and the nineteenth in Georgia. The last FDIC-insured institution closed in the state was First Coweta, Newnan, on August 21, 2009.

Freddie Exec Compensation, Bandos, Market and more

by Calculated Risk on 9/25/2009 04:00:00 PM

Michelle at Footnoted.org digs up the employment contract for Freddie Mac's new CFO: Taxpayer funded signing bonus at Freddie Mac?

• annual compensation of $3.5 million (this includes $675K in salary, $1.6 million in something called “additional annual salary” and $1.1 million in a target incentiveWhy is Freddie paying more than the private sector? And I bet Geithner is jealous about the house deal!

• a $1.95 million signing bonus

• immediate buyout of Kari’s house

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

And the Bandos are moving on up in Miami! From nbcphiladelphia.com: After Miami's Ritzy Bubble Bursts, Squatters Move on Up

Miami's squatter problem has garnered national media attention over the past year and a half, as the foreclosure crisis threatened to transform the Magic City into something resembling a lawless, "Mad Max"-esque landscape.Maybe the lenders should sell the foreclosed homes?

The squatters mostly kept a low profile, moving in ... to neighborhoods where they could take over unnoticed.

But now come reports that squatters are seeking out more ritzy neighborhoods, including the pricey, tree-lined streets of Coral Gables.

...

A check of county records found that the home went into foreclosure over a year ago, just about the time residents said the alleged squatters showed up.

The bank which owns the property hired a realtor to sell it last month ...

And from the LA Times: Calls to renew home buyer tax credit get louder in Washington. Yeah, an expensive, poorly targeted tax credit for those not suffering during the recession. This isn't as dumb as allowing the FHA DAP to continue (Downpayment Assistance Program - the poster child for bad housing policy), but close. Why not a "first-time renters" tax credit for anyone who hasn't rented for 3 years? That makes as much economic sense.

Truck Tonnage Index Increased in August

by Calculated Risk on 9/25/2009 02:23:00 PM

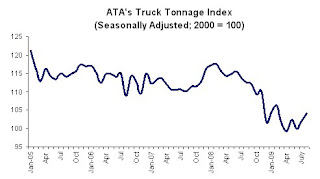

From the American Trucking Association: ATA Truck Tonnage Index Rose 2.1 Percent in August Click on graph for slightly larger image in new window.

Click on graph for slightly larger image in new window.

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 2.1 percent in August, matching July’s increase of the same magnitude. The latest gain raised the SA index to 104.1 (2000=100), which was the best reading since February 2009. ... Compared with August 2008, SA tonnage fell 7.5 percent, which was the best year-over-year showing since November 2008. ...The Rail Freight Traffic shows some recent pickup too, but the level is still way below 2008 and 2007. (ht Bob_in_MA) Note: Trucking accounts for about 70% of tonnage carried by all modes of domestic freight transportation, and about 83% of total revenue.

“The gains in tonnage during July and August reflect a growing economy and less of an overhang in inventories,” [ATA Chief Economist Bob Costello] noted. “While I am optimistic that the worst is behind us, most economic indicators, including industrial output and household spending, suggest freight tonnage will exhibit moderate, and probably inconsistent, growth in the months ahead."

It appears the economy has reset to a new lower level, and growth will probably be sluggish. Trucking is probably benefiting from inventory restocking, and exports - the key positive areas for the economy.

Existing Home Turnover Ratio, and Distressing Gap

by Calculated Risk on 9/25/2009 12:16:00 PM

For graphs based on the new home sales report this morning, please see: New Home Sales Flat in August

The following graph is a turnover ratio for existing home sales. This is annual sales and year end inventory divided by the total number of owner occupied units. For 2009, sales were estimated at 4.8 million units, and inventory at the August level. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Although the turnover ratio has fallen from the bubble years, the level is still above the median for the last 40 years. This suggests 2009 is about a normal year for existing home turnover.

That might seem shocking based on all the reports of weak existing home sales. But the problem isn't the number of sales (except as compared to the bubble years), but the type and price of sales.

The reason turnover hasn't fallen further is because of all the distressed sales (foreclosures and short sales) primarily in the low priced areas. Distressed sales declined in August, and this is a major reason existing home sales declined.

There is another wave of foreclosures coming, so existing home sales might stay elevated for some time. Plus, the "first-time" homebuyers tax credit might be extended (a poorly targeted an inefficient credit).

Note: there is a substantial shadow inventory too.

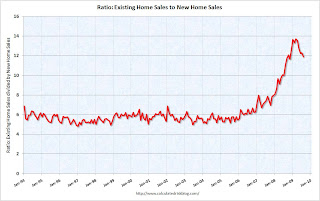

All this distressed sales activity has created a gap between new and existing sales as shown in the following graph that I've jokingly labeled the "Distressing" gap. This graph shows existing home sales (left axis) and new home sales (right axis) through August.

This graph shows existing home sales (left axis) and new home sales (right axis) through August.

As I've noted before, I believe this gap was caused primarily by distressed sales. Even with the recent rebound in new and existing home sales, the gap is still very wide.

The third graph shows the same information, but as a ratio for existing home sales divided by new home sales. Although distressed sales will stay elevated for some time, eventually I expect this ratio to decline back to the previous ratio.

Although distressed sales will stay elevated for some time, eventually I expect this ratio to decline back to the previous ratio.

The ratio could decline because of a further increase in new home sales, or a decrease in existing home sales - or a combination of both. I expect the ratio will decline mostly from a decline in existing home sales as the first-time home buyer frenzy subsides, and as the foreclosure crisis moves into mid-to-high priced areas (with fewer cash flow investors).