by Calculated Risk on 9/16/2009 05:25:00 PM

Wednesday, September 16, 2009

Jobs, Jobs, Jobs

From the UCLA News today:

Sluggish overall growth is predicted [in a report titled "The Long Goodbye," by UCLA Anderson Forecast], as the [national] unemployment rate will be above 10 percent well into next year.And in the UK from The Times: Record one in five young people out of work

The number of young people out of work hit a record 947,000 in July as total unemployment in Britain hit 2.47 million.And from the NY Times: High Jobless Rates Could Last Years, O.E.C.D. Warns

Official data today showed that the number of jobless 16 to 24-year-olds jumped by nearly 60,000 in the three months to July to the highest level since 1992, when records began.

That figure translates to a record 19.7 per cent - also the highest since records began - meaning that one in five people in that age bracket is looking for work.

...

Total unemployment hit a 13-year high of 2.47 million as more than 210,000 people lost their jobs, sending the jobless rate back to 1996 levels of 7.9 per cent.

Unless government programs for the unemployed are refined, there is a danger that high jobless rates will persist beyond 2010 in advanced economies, the Organization for Economic Cooperation and Development warned on Wednesday.In the U.S., Rep. Jim McDermott, D-Wash and Sen. Jack Reed, D-R.I. have offered bills in the House and Senate to extend unemployment benefits again. However this proposed extension would only be for any additional 13 weeks for people in high-unemployment states, and many workers will exhaust those claims early in the new year.

“A recovery may be in sight,” the group said in its annual employment outlook, referring to economic output. “But the short-term employment outlook is grim.”

The international organization said that unemployment among its 30 member nations would rise to nearly 10 percent by the end of 2010, above its previous post-1970 peak of 7.5 percent during the second quarter of 1993.

I expect to see a double digit unemployment rate within the next few months, and with below trend GDP growth, I expect double digit unemployment rates through most of 2010.

Report: Fed Reviews Banks CRE Exposure

by Calculated Risk on 9/16/2009 02:41:00 PM

Better late than never ...

From Steve Liesman at CNBC: Fed Reviewing Banks' Commercial Real Estate Exposure (ht Bill)

The Federal Reserve is involved a broad review of commercial real estate exposures at the nation's largest regional banks, which Fed sources say is both the result of concern in that area but part of the "new normal" for how they will be supervising banks.Clearly the Fed has room for improvement. A review of bank failures (see: Federal Reserve Oversight and the Failure of Riverside Bank of the Gulf Coast) shows that the Fed recognized problems of excessive concentration and risk taking as early as 2003 - and the Fed did nothing.

...

People familiar with the examinations say the fed is "getting granular" looking, for example, at the differences in banks' concentration of construction loans vs. multifamily vs. motels and retail.

I think the Fed needs to explain how the new approach would have caught the problems at Riverside (as an example) in 2004 or so. Hopefully that is the point of this "new normal".

NAHB: Builder Confidence increases Slightly in September

by Calculated Risk on 9/16/2009 01:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

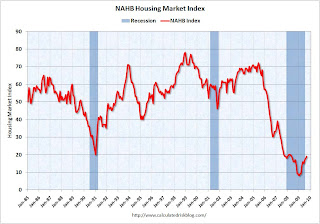

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) increased to 19 in September from 18 in August. The record low was 8 set in January.

This is still very low - and this is what I've expected - a long period of builder depression.

Note: any number under 50 indicates that more builders view sales conditions as poor than good. This second graph compares the NAHB HMI (left scale) with new home sales and single family housing starts (right scale). This is the September release for the HMI compared to the July data for starts and sales.

This second graph compares the NAHB HMI (left scale) with new home sales and single family housing starts (right scale). This is the September release for the HMI compared to the July data for starts and sales.

This shows that the HMI, single family starts and new home sales mostly move in the same direction - although there is plenty of noise month-to-month.

NOTE: For purposes of determining if starts are above or below sales, you have to use the quarterly data by intent. You can't compare the monthly total single family starts directly to new home sales, because single family starts include several categories not included in sales (like owner built units and high rise condos).

Press release from the NAHB (added): Builder Confidence Edges Up Again In September

Builder confidence in the market for newly built, single-family homes edged higher for a third consecutive month in September, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI rose one point to 19 this month, its highest level since May of 2008.

“Builders are seeing some improvement in buyer demand as a result of the first-time home buyer tax credit, and low mortgage rates and strong housing affordability have also helped to revive some optimism,” noted Joe Robson, chairman of the National Association of Home Builders (NAHB) and a home builder from Tulsa, Okla. “However, the window is now basically closed for being able to start a new home that can be completed in time for buyers to take advantage of the tax credit before it expires at the end of November, and builders are concerned about what will keep the market moving once the credit is gone. ....”

“Today’s report indicates that builders are starting to see some glimmers of light at the end of the tunnel in terms of improving sales activity,” said NAHB Chief Economist David Crowe. “However, the fact that the HMI component gauging sales expectations for the next six months slipped backward this month is a sign of their awareness that this is a very fragile recovery period and several major hurdles remain that could stifle the positive momentum. Those hurdles include the impending expiration of the $8,000 tax credit as well as the critical lack of credit for housing production loans and continuing problems with low appraisals that are sinking one quarter of all new-home sales. These concerns need to be addressed if we are to embark on a sustained housing recovery that will help bolster economic growth.”

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view sales conditions as good than poor.

Two out of three of the HMI’s component indexes recorded gains in September. The index gauging current sales conditions rose two points to 18, while the index gauging traffic of prospective buyers rose one point, to 17. Meanwhile, the index gauging sales expectations for the next six months declined one point, to 29.

All four regions posted gains in their HMI readings for September. The biggest improvement was registered in the Midwest, where a three-point gain brought its HMI to 19, the highest level since July of 2007. The Northeast posted a two-point gain to 24, the South posted a two-point gain to 19, and the West posted a one-point gain to 18, respectively.

emphasis added

Roubini: "Desperately seeking an exit strategy"

by Calculated Risk on 9/16/2009 11:48:00 AM

Nouriel Roubini writes: Desperately seeking an exit strategy

[T]he key issue for policy-makers is to decide when to mop up the excess liquidity and normalize policy rates – and when to raise taxes and cut government spending, and in which combination.In the short term - probably through most or all of 2010 - with the sluggish recovery, high unemployment and overcapacity, the major concern of policymakers will continue to be deflation.

The biggest policy risk is that the exit strategy from monetary and fiscal easing is somehow botched, because policy-makers are damned if they do and damned if they don't. If they have built up large, monetized fiscal deficits, they should raise taxes, reduce spending and mop up excess liquidity sooner rather than later.

The problem is that most economies are now barely bottoming out, so reversing the fiscal and monetary stimulus too soon – before private demand has recovered more robustly – could tip these economies back into deflation and recession. Japan made that mistake between 1998 and 2000, just as the United States did between 1937 and 1939.

But if governments maintain large budget deficits and continue to monetize them as they have been doing, at some point – after the current deflationary forces become more subdued – bond markets will revolt. When that happens, inflationary expectations will mount, long-term government bond yields will rise, mortgage rates and private market rates will increase, and one would end up with stagflation (inflation and recession).

...

Getting the exit strategy right is crucial: Serious policy mistakes would significantly heighten the threat of a double-dip recession.

Industrial Production, Capacity Utilization Increase in August

by Calculated Risk on 9/16/2009 09:15:00 AM

The Federal Reserve reported:

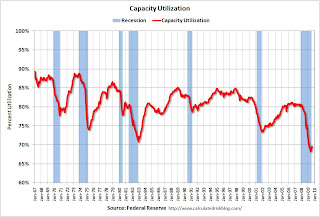

Industrial output rose 0.8 percent in August, following an upwardly revised increase of 1.0 percent in July. Production in manufacturing expanded 0.6 percent in August, and the index excluding motor vehicles and parts increased 0.4 percent. The gain in July for manufacturing was revised up 0.4 percentage point, to 1.4 percent; in addition, factory output for April through June is now somewhat less weak than reported previously. Production at mines moved up 0.5 percent in August. The output of utilities gained 1.9 percent, as temperatures swung from an unseasonably mild July to a slightly warmer-than-usual August. At 97.4 percent of its 2002 average, total industrial production was 10.7 percent below its level of a year earlier. In August, the capacity utilization rate for total industry advanced to 69.6 percent, a level 11.3 percentage points below its average for the period 1972 through 2008.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series has increased for two straight months, and is up slightly from the record low set in June (the series starts in 1967). Capacity Utilization had decreased in 17 of the previous 18 months.

Note: y-axis doesn't start at zero to better show the change.

Even excluding motor vehicles and parts, industrial production increased 0.4% in August. This suggests that the official recession ended sometime this Summer.

CPI Increases 0.4% in August, BLS Rent Measures Increase Slightly

by Calculated Risk on 9/16/2009 08:33:00 AM

From the BLS: Consumer Price Index Summary

On a seasonally adjusted basis, the Consumer Price Index for all Urban Consumers (CPI-U) rose 0.4 percent in August, the Bureau ofThe BLS measure for rent increased slightly (rounded to flat). And owners' equivalent rent (OER), the largest component of CPI, increased slightly even though rents have been falling in most areas.

Labor Statistics reported today. The index has decreased 1.5 percent over the last 12 months on a not seasonally adjusted basis.

...

The index for all items less food and energy also rose 0.1 percent in August, the second consecutive such increase.

...

the shelter index ... rose 0.1 percent in August after a 0.2 percent decline in July. The rent index was unchanged and the index for owners' equivalent rent increased 0.1 percent.

CPI has declined 1.5% compared to one year ago.

Tuesday, September 15, 2009

Streitfeld: The Housing Tax Credit Debate

by Calculated Risk on 9/15/2009 10:19:00 PM

From David Streitfeld at the NY Times: Fight Looming on Tax Break to Buy Houses

When Congress passed an $8,000 tax credit for first-time home buyers last winter, it was intended as a dose of shock therapy during a crisis. Now the question is becoming whether the housing market can function without it.Streitfeld discusses some of the proponents of extending and expanding the tax credit (like the NAR), and some of the opponents (most economists on the right and left).

As many as 40 percent of all home buyers this year will qualify for the credit. It is on track to cost the government $15 billion, more than twice the amount that was projected when Congress passed the stimulus bill in February.

Dean Baker of the Center for Economic and Policy Research called the credit “a questionable redistributive policy” from renters to home buyers, but said that he used it himself when he bought a house.Mark Zandi at Economy.com supports extending and expanding the tax credit because he believes the housing market is still in serious trouble:

He wrote on his blog: “Thank you very much, suckers!”

"The risks of not doing something like this are too great,” [Zandi] said. “I don’t think the coast is clear.”But if we actually look at the numbers, this is a poor choice for a second stimulus package. The NAR recently reported:

NAR estimates that about 1.8 to 2.0 million first-time buyers will take advantage of the $8,000 tax credit this year, with approximately 350,000 additional sales that would not have taken place without the credit.You can calculate the new $15 billion projection; 1.9 million times $8,000.

But this only resulted in 350,000 additional sales. Divide $15 billion by 350 thousand, and the program cost is about $43,000 per additional buyer. Very expensive.

Now the National Association of Home Builders estimates that expanding and extending the credit through 2010 would generate 500,000 additional sales at a cost of about $30 billion. So this is approximately $60,000 per additional house sold. And I think the cost will be much higher.

REMEMBER: Many homes will be sold to buyers who would have bought anyway without the credit. These buyers will still receive the credit. This year almost 2 million home buyers will claim the tax credit, but only 350,000 were additional buyers. That means this was a poorly targeted tax credit since so many people receive it who would have bought anyway. Targeting is the problem with any tax credit.

Mark Zandi is arguing to expand the credit all home buyers, including investors. Then the cost would be much higher than the $30 billion estimate - maybe $75 billion based on 5 million homes sold. Maybe closer to $90 billion if we include new home sales. But that would be a huge gift to a majority of buyers.

Here is a more effective tax credit:

The real problem is the number of households, not home sales. Many people have doubled up during the recession with friends and family, and will probably be looking to rent or buy once they get back on their feet. An incentive for new household formation (for people that were part of another household for the last year or two) would be much less expensive, would be more targeted (recipients would have to show they were part of another household) and would reduce the excess inventory of all housing units.

Credit Cards: Most Institutions Report higher Write-Offs in August

by Calculated Risk on 9/15/2009 07:42:00 PM

From Bloomberg: U.S. Credit-Card Defaults Resume Ascent as Unemployment Worsens (ht Bob_in_MA)

Bank of America said write-offs rose to 14.54 percent ... That compares with 13.81 percent in July ...As a reminder, the bank stress tests assumed a cumulative two year credit card loss rate of 18% to 20% for the more adverse scenario (only 12% to 17% for the baseline scenario). Right now losses are running worse than the more adverse scenario.

Citigroup’s soured loans rose to 12.14 percent last month, from 10.03 percent, while JPMorgan said write-offs advanced to 8.73 percent from 7.92 percent in July ...

Discover Financial Services ... said charge-offs rose to 9.16 percent from 8.43 percent in July. ...

Capital One Financial Corp. ... said charge-offs improved to 9.32 percent in August, from 9.83 percent.

...

Moody’s Investors Service has said it expects average U.S. charge-offs to peak at 12 percent to 13 percent in 2010.

Also credit card loss rates tend to the track unemployment - so, as the unemployment rate rises into 2010, the credit card charge-offs will probably increase some more.

LA Area Port Traffic in August

by Calculated Risk on 9/15/2009 05:15:00 PM

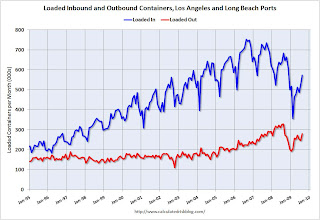

Note: this is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Inbound traffic was 14.5% below August 2008.

Outbound traffic was 16.2% below August 2008.

There has been a clear recovery in U.S. exports (the year-over-year comparison was off 30% from December through February). And export traffic, at the LA area ports, is at the August 2007 level.

However, for imports, traffic is at the August 2003 level, and 2009 will probably be the weakest year for import traffic since 2002.

Note: Imports usually peak in the August through October period (as retailers import goods for the holidays) and then decline in November.

The End of the Official Recession?

by Calculated Risk on 9/15/2009 02:32:00 PM

First, a nice mention in Newsweek (thank you): The Financial Meltdown in Words (see slide 4 for a quote from Feb 2005, ht Matthew, Eric)

On the end of the recession, from Bloomberg: Bernanke Says U.S. Recession ‘Very Likely’ Has Ended

“Even though from a technical perspective the recession is very likely over at this point, it’s still going to feel like a very weak economy for some time,” Bernanke said today at the Brookings Institution in Washington, responding to questions after a speech.Although I think the official recession has probably ended, it is worth remembering that one or two quarters of GDP growth doesn't necessarily mean the recession is over. Right in the middle of the '81/'82 recession, there was one quarter when GDP increase 4.9% (annualized).

On recession dating: 1The National Bureau of Economic Research (NBER) Business Cycle Dating Committee is the recognized group for calling dating recessions in the U.S. It is always difficult to tell when a recession has ended, especially with a jobless recovery (something I expect again). As an example, it took NBER over a year and half after the 2001 recession ended to call the trough of the cycle. And it took 21 months after the 1990-1991 recession ended for NBER to date the end of the recession.

From the 2003 announcement of the end of the 2001 recession:

The committee waited to make the determination of the trough date until it was confident that any future downturn in the economy would be considered a new recession and not a continuation of the recession that began in March 2001.The economy was still struggling in 2003 - especially employment - but the NBER committee members felt that any subsequent downturn would be considered a separate recession:

The committee noted that the most recent data indicate that the broadest measure of economic activity-gross domestic product in constant dollars-has risen 4.0 percent from its low in the third quarter of 2001, and is 3.3 percent above its pre-recession peak in the fourth quarter of 2000. Two other indicators of economic activity that play an important role in the committee's decisions-personal income excluding transfer payments and the volume of sales of the manufacturing and wholesale-retail sectors, both in real terms-have also surpassed their pre-recession peaks. Two other indicators the committee focuses on-payroll employment and industrial production-remain well below their pre-recession peaks. Indeed, the most recent data indicate that employment has not begun to recover at all. The committee determined, however, that the fact that the broadest, most comprehensive measure of economic activity is well above its pre-recession levels implied that any subsequent downturn in the economy would be a separate recession.This is relevant to today. It is very likely that any recovery will be very sluggish, and if the economy turns down within the next 6 to 12 months, the NBER would probably consider that a continuation of the Great Recession.

Yesterday San Francisco Fed President Janet Yellen argued the recovery would be "tepid". She pointed out that there will probably be a boost from an inventory correction in the 2nd half of 2009, but that that boost will be transitory:

I expect the biggest source of expansion in the second half of this year to come from a diminished pace of inventory liquidation by manufacturers, wholesalers, and retailers. Such a pattern is typical of business cycles. Inventory investment often is the catalyst for economic recoveries. True, the boost is usually fairly short-lived, but it can be quite important in getting things going. ...But then what happens in a couple of quarters? Where are the engines of growth? As Yellen noted:

The chances are slim for a robust rebound in consumer spending, which represents around 70 percent of economic activity. Of course, consumers are getting a boost from the fiscal stimulus package. But this program is temporary. Over the long term, consumers face daunting issues of their own.As I noted in March (see Business Cycle: Temporal Order), the usual engines for growth coming out of a recession are Personal Consumption expenditures (PCE), and Residential Investment (RI). If PCE is weak, we are left with residential investment. Although it appears RI has bottomed, I doubt we will see much of a rebound until the overhang of existing home inventory is reduced. That is one of the reason the DataQuick SoCal report this morning was so important - it might signal another downturn for sales in the existing home market (and possibly new home market).

Although I started the year looking for the sun, I remain concerned about the possibilities of a double dip recession - or at least a prolonged period of sluggish growth. And this means the unemployment rate will continue to rise well into 2010; I expect the unemployment rate to hit 10% in November (or so). See: When Will the Unemployment Rate hit 10%? .

There is an old saying: "A recession is when your neighbor loses his job, a depression is when you lose your job." Unfortunately 2010 will probably feel like a depression to a large number workers.

More on NBER and double dip recessions:

Here is the NBER dating procedure.

Note that the trough of the 1980 recession was only 12 months before the beginning of the 1981 recession, but the short recovery was fairly robust with real GDP up 4.4%. Those two recessions are frequently called a "double dip" recession, but the NBER considers them as two separate recessions.

1 Some of this post was excerpted from a previous post.