by Calculated Risk on 9/15/2009 10:19:00 PM

Tuesday, September 15, 2009

Streitfeld: The Housing Tax Credit Debate

From David Streitfeld at the NY Times: Fight Looming on Tax Break to Buy Houses

When Congress passed an $8,000 tax credit for first-time home buyers last winter, it was intended as a dose of shock therapy during a crisis. Now the question is becoming whether the housing market can function without it.Streitfeld discusses some of the proponents of extending and expanding the tax credit (like the NAR), and some of the opponents (most economists on the right and left).

As many as 40 percent of all home buyers this year will qualify for the credit. It is on track to cost the government $15 billion, more than twice the amount that was projected when Congress passed the stimulus bill in February.

Dean Baker of the Center for Economic and Policy Research called the credit “a questionable redistributive policy” from renters to home buyers, but said that he used it himself when he bought a house.Mark Zandi at Economy.com supports extending and expanding the tax credit because he believes the housing market is still in serious trouble:

He wrote on his blog: “Thank you very much, suckers!”

"The risks of not doing something like this are too great,” [Zandi] said. “I don’t think the coast is clear.”But if we actually look at the numbers, this is a poor choice for a second stimulus package. The NAR recently reported:

NAR estimates that about 1.8 to 2.0 million first-time buyers will take advantage of the $8,000 tax credit this year, with approximately 350,000 additional sales that would not have taken place without the credit.You can calculate the new $15 billion projection; 1.9 million times $8,000.

But this only resulted in 350,000 additional sales. Divide $15 billion by 350 thousand, and the program cost is about $43,000 per additional buyer. Very expensive.

Now the National Association of Home Builders estimates that expanding and extending the credit through 2010 would generate 500,000 additional sales at a cost of about $30 billion. So this is approximately $60,000 per additional house sold. And I think the cost will be much higher.

REMEMBER: Many homes will be sold to buyers who would have bought anyway without the credit. These buyers will still receive the credit. This year almost 2 million home buyers will claim the tax credit, but only 350,000 were additional buyers. That means this was a poorly targeted tax credit since so many people receive it who would have bought anyway. Targeting is the problem with any tax credit.

Mark Zandi is arguing to expand the credit all home buyers, including investors. Then the cost would be much higher than the $30 billion estimate - maybe $75 billion based on 5 million homes sold. Maybe closer to $90 billion if we include new home sales. But that would be a huge gift to a majority of buyers.

Here is a more effective tax credit:

The real problem is the number of households, not home sales. Many people have doubled up during the recession with friends and family, and will probably be looking to rent or buy once they get back on their feet. An incentive for new household formation (for people that were part of another household for the last year or two) would be much less expensive, would be more targeted (recipients would have to show they were part of another household) and would reduce the excess inventory of all housing units.

Credit Cards: Most Institutions Report higher Write-Offs in August

by Calculated Risk on 9/15/2009 07:42:00 PM

From Bloomberg: U.S. Credit-Card Defaults Resume Ascent as Unemployment Worsens (ht Bob_in_MA)

Bank of America said write-offs rose to 14.54 percent ... That compares with 13.81 percent in July ...As a reminder, the bank stress tests assumed a cumulative two year credit card loss rate of 18% to 20% for the more adverse scenario (only 12% to 17% for the baseline scenario). Right now losses are running worse than the more adverse scenario.

Citigroup’s soured loans rose to 12.14 percent last month, from 10.03 percent, while JPMorgan said write-offs advanced to 8.73 percent from 7.92 percent in July ...

Discover Financial Services ... said charge-offs rose to 9.16 percent from 8.43 percent in July. ...

Capital One Financial Corp. ... said charge-offs improved to 9.32 percent in August, from 9.83 percent.

...

Moody’s Investors Service has said it expects average U.S. charge-offs to peak at 12 percent to 13 percent in 2010.

Also credit card loss rates tend to the track unemployment - so, as the unemployment rate rises into 2010, the credit card charge-offs will probably increase some more.

LA Area Port Traffic in August

by Calculated Risk on 9/15/2009 05:15:00 PM

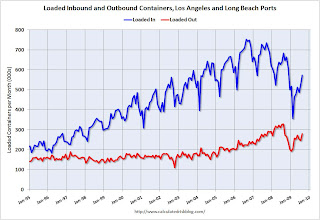

Note: this is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Inbound traffic was 14.5% below August 2008.

Outbound traffic was 16.2% below August 2008.

There has been a clear recovery in U.S. exports (the year-over-year comparison was off 30% from December through February). And export traffic, at the LA area ports, is at the August 2007 level.

However, for imports, traffic is at the August 2003 level, and 2009 will probably be the weakest year for import traffic since 2002.

Note: Imports usually peak in the August through October period (as retailers import goods for the holidays) and then decline in November.

The End of the Official Recession?

by Calculated Risk on 9/15/2009 02:32:00 PM

First, a nice mention in Newsweek (thank you): The Financial Meltdown in Words (see slide 4 for a quote from Feb 2005, ht Matthew, Eric)

On the end of the recession, from Bloomberg: Bernanke Says U.S. Recession ‘Very Likely’ Has Ended

“Even though from a technical perspective the recession is very likely over at this point, it’s still going to feel like a very weak economy for some time,” Bernanke said today at the Brookings Institution in Washington, responding to questions after a speech.Although I think the official recession has probably ended, it is worth remembering that one or two quarters of GDP growth doesn't necessarily mean the recession is over. Right in the middle of the '81/'82 recession, there was one quarter when GDP increase 4.9% (annualized).

On recession dating: 1The National Bureau of Economic Research (NBER) Business Cycle Dating Committee is the recognized group for calling dating recessions in the U.S. It is always difficult to tell when a recession has ended, especially with a jobless recovery (something I expect again). As an example, it took NBER over a year and half after the 2001 recession ended to call the trough of the cycle. And it took 21 months after the 1990-1991 recession ended for NBER to date the end of the recession.

From the 2003 announcement of the end of the 2001 recession:

The committee waited to make the determination of the trough date until it was confident that any future downturn in the economy would be considered a new recession and not a continuation of the recession that began in March 2001.The economy was still struggling in 2003 - especially employment - but the NBER committee members felt that any subsequent downturn would be considered a separate recession:

The committee noted that the most recent data indicate that the broadest measure of economic activity-gross domestic product in constant dollars-has risen 4.0 percent from its low in the third quarter of 2001, and is 3.3 percent above its pre-recession peak in the fourth quarter of 2000. Two other indicators of economic activity that play an important role in the committee's decisions-personal income excluding transfer payments and the volume of sales of the manufacturing and wholesale-retail sectors, both in real terms-have also surpassed their pre-recession peaks. Two other indicators the committee focuses on-payroll employment and industrial production-remain well below their pre-recession peaks. Indeed, the most recent data indicate that employment has not begun to recover at all. The committee determined, however, that the fact that the broadest, most comprehensive measure of economic activity is well above its pre-recession levels implied that any subsequent downturn in the economy would be a separate recession.This is relevant to today. It is very likely that any recovery will be very sluggish, and if the economy turns down within the next 6 to 12 months, the NBER would probably consider that a continuation of the Great Recession.

Yesterday San Francisco Fed President Janet Yellen argued the recovery would be "tepid". She pointed out that there will probably be a boost from an inventory correction in the 2nd half of 2009, but that that boost will be transitory:

I expect the biggest source of expansion in the second half of this year to come from a diminished pace of inventory liquidation by manufacturers, wholesalers, and retailers. Such a pattern is typical of business cycles. Inventory investment often is the catalyst for economic recoveries. True, the boost is usually fairly short-lived, but it can be quite important in getting things going. ...But then what happens in a couple of quarters? Where are the engines of growth? As Yellen noted:

The chances are slim for a robust rebound in consumer spending, which represents around 70 percent of economic activity. Of course, consumers are getting a boost from the fiscal stimulus package. But this program is temporary. Over the long term, consumers face daunting issues of their own.As I noted in March (see Business Cycle: Temporal Order), the usual engines for growth coming out of a recession are Personal Consumption expenditures (PCE), and Residential Investment (RI). If PCE is weak, we are left with residential investment. Although it appears RI has bottomed, I doubt we will see much of a rebound until the overhang of existing home inventory is reduced. That is one of the reason the DataQuick SoCal report this morning was so important - it might signal another downturn for sales in the existing home market (and possibly new home market).

Although I started the year looking for the sun, I remain concerned about the possibilities of a double dip recession - or at least a prolonged period of sluggish growth. And this means the unemployment rate will continue to rise well into 2010; I expect the unemployment rate to hit 10% in November (or so). See: When Will the Unemployment Rate hit 10%? .

There is an old saying: "A recession is when your neighbor loses his job, a depression is when you lose your job." Unfortunately 2010 will probably feel like a depression to a large number workers.

More on NBER and double dip recessions:

Here is the NBER dating procedure.

Note that the trough of the 1980 recession was only 12 months before the beginning of the 1981 recession, but the short recovery was fairly robust with real GDP up 4.4%. Those two recessions are frequently called a "double dip" recession, but the NBER considers them as two separate recessions.

1 Some of this post was excerpted from a previous post.

DataQuick: SoCal Home Sales Decline

by Calculated Risk on 9/15/2009 12:44:00 PM

From DataQuick: Southland home sales fall; median price edges up again

Home sales dipped in Southern California last month, the result of a thinning inventory of foreclosure properties and financial uncertainty among potential home buyers. ...Here are a few key points:

A total of 21,502 new and resale homes sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in August. That was down 10.8 percent from 24,104 in July, and up 11.0 percent from 19,366 in August 2008, according to MDA DataQuick of San Diego.

Last month was the 14th in a row with a year-over-year sales increase. The decline from July to August was unusual, given an increase is normal for the season. August sales in DataQuick’s statistics, which go back to 1988, range from a low of 16,379 in 1992 to a high of 39,562 in 2003. The average is 27,458.

“There’s still a lot of uncertainty out there about prices, interest rates and the availability of mortgage money. Additionally, we don’t know if this drop in foreclosure resales is temporary. We’re hearing from public agencies and the banking industry that there’s still a lot of financial distress in the pipeline,” said John Walsh, MDA DataQuick president.

Foreclosure resales accounted for 38.8 percent of August’s resales activity, down from 40.7 percent in July and down from 45.5 percent in August 2008. In February this year it peaked at 56.7 percent. Most of the relative decline is due to an increase in non-foreclosure resales.

...

Changes in the median do not necessarily correspond to changes in home values in the current, atypical sales environment. Adjusting for shifts in market mix, it now appears that over the past two years homes in older, more costly neighborhoods have come down in value by about half as much as homes in newer, more affordable neighborhoods. Prices also fell sharply in some lower-cost, older communities where the use of risky subprime loans was high, triggering relatively high foreclosure rates.

... a common form of financing used by first-time home buyers in more affordable neighborhoods remains near record levels. Government-insured, FHA mortgages made up 37.4 percent of all purchase loans in August, up from 37.0 percent in July and 27.1 percent in August last year.

... Foreclosure activity remains near record levels. Financing with multiple mortgages is low, down payment sizes are stable, and non-owner occupied buying is above-average in some markets

Ghost Towns in Ireland

by Calculated Risk on 9/15/2009 10:26:00 AM

From Bloomberg: Ghost Towns May Haunt Ireland in Property Loan Gamble (ht Mike In Long Island)

Finance Minister Brian Lenihan will detail tomorrow how much Ireland will pay for about 90 billion euros ($131 billion) of real estate loans now crippling what as recently as 2006 was one of Europe’s most dynamic economies.The government is taking over most of the non-residential property loans in Ireland. It is amazing that these loans total about half of Ireland's GDP (not including residential).

...

The National Asset Management Agency, known as NAMA, will buy 18,000 loans at a discount from lenders led by Allied Irish Banks Plc and Bank of Ireland Plc. The agency will manage the loans, which amount to about half of Ireland’s gross domestic product. ... Most of the property-related loans of the biggest Irish banks are being taken over by the agency, excluding residential mortgages.

...

The office vacancy rate at the end of the second quarter was 21 percent in Dublin, compared with 8 percent in London and 10 percent in Berlin, according to CB Richard Ellis Group Inc. As many as 35,000 new homes are now vacant, estimates Davy, the country’s largest securities firm, up from 20,000 18 months ago.

emphasis added

Bernanke on Financial Crisis of 2008

by Calculated Risk on 9/15/2009 10:02:00 AM

Fed Chairman Ben Bernanke speaking on the financial crisis of 2008.

A live feed from C-SPAN.

From the Fed: Reflections on a Year of Crisis

NOTE: This is the same speech he gave last month. A history review ...

Retail Sales increase in August

by Calculated Risk on 9/15/2009 08:30:00 AM

On a monthly basis, retail sales increased 2.7% from July to August (seasonally adjusted), and sales are off 5.3% from August 2008 (retail ex food services decreased 6.3%).

Excluding motor vehicles, retail sales were up 1.1%.

The following graph shows the year-over-year change in nominal and real retail sales since 1993. Click on graph for larger image in new window.

Click on graph for larger image in new window.

To calculate the real change, the core PCI price index from the BLS was used (August prices were estimated as the average increase over the previous 3 months).

Real retail sales (ex food services) declined by 6.3% on a YoY basis. The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

NOTE: The graph doesn't start at zero to better show the change.

This shows that retail sales fell off a cliff in late 2008, and appear to have bottomed, but at a much lower level.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for August, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $351.4 billion, an increase of 2.7 percent (±0.5%) from the previous month, but 5.3 percent (±0.7%) below August 2008. Total sales for the June through August 2009 period were down 7.6 percent (±0.3%) from the same period a year ago. The June to July 2009 percent change was revised from -0.1 percent (±0.5%)* to -0.2 percent (±0.2%)*.It appears the cliff diving is over and the official recession probably ended in July. But retail sales are still far below the pre-recession level, and the recovery will probably be sluggish.

Monday, September 14, 2009

More on U.S. Possibly Selling Citi Stake

by Calculated Risk on 9/14/2009 11:04:00 PM

From the WSJ: Citigroup Explores Bid to Pare U.S. Stake

The tentative aim is for a joint stock sale. Under this scenario, Citigroup would issue as much as $5 billion in new shares, while the government would simultaneously sell an undetermined amount of the stock it is holding ... Citigroup could use proceeds from a stock sale to redeem some of the preferred stock the Treasury is holding ...If I have the numbers correct, the total U.S. bailout of Citi was $45 billion (not including guarantees). Then $25 billion of preferred stock was converted to common at $3.25 per share in February - and that is the 7.69 billion common shares we all own (through the Treasury).

The government converted its preferred shares into common stock at $3.25 a share. Citigroup's shares closed Monday at $4.52. That means the government's 7.7 billion shares have gained about $9.8 billion.

So the U.S. still holds $20 billion in preferred stock. This would be a start, although it might be premature considering all the toxic assets Citi probably still holds.

Report: U.S. Discussing Selling Citi Shares

by Calculated Risk on 9/14/2009 07:35:00 PM

From Bloomberg: U.S. Said to Explore Selling Stock Acquired in Citigroup Rescue (ht jb)

Bloomberg is reporting that the Treasury and Citigroup are discussing how the U.S. can sell the 34 percent stake (7.7 billion shares) that the U.S. acquired as part of the bailout. At $4.50 per share, the U.S. stake is worth almost $35 billion.

In the February bailout, the U.S. increased it's common stake in Citi by converting $25 billion in preferred shares into common. And the U.S. is still also guaranteeing about $306 billion in assets (per the bailout agreement last November).

But selling some common would be a good first step ...