by Calculated Risk on 9/14/2009 08:44:00 AM

Monday, September 14, 2009

Fed's Duke on Accounting Changes

Fed Governor Elizabeth Duke presented some thoughts today on possible accounting changes: Regulatory Perspectives on the Changing Accounting Landscape

... I feel it is crucial that an accounting regime directly link reported financial condition and performance with the business model and economic purpose of the firm. It is difficult for me to comprehend the value of an accounting regime that doesn't make that link.Take a mortgage loan. If the business model is to hold the loan to maturity, Duke believes the loan should be valued based on future cash flow (considering the creditworthiness and capacity of the borrower). However if the business model is based on trading mortgage loans, then she believes the loan should be valued based on fair market prices.

As a regulator, I focus on the viability of individual financial institutions and the financial system as a whole. To be frank, it has been frustrating to try to assess that viability when the value of an asset is based on the nature of its acquisition rather than the way in which it is managed or the way in which its economic value is likely to be realized.

...

If the business model is predicated on the trading of financial instruments for the realization of value, or other strategies that essentially focus on short-term price movements, then fair value has relevance. In the trading business model, reporting fair value focuses risk management on short-term price movements and in most cases incentivizes management to define the organization's risk appetite and to mitigate risk through hedging or other means. Fair value also incentivizes the entity to raise and maintain capital at a level sufficient to cover the price volatility of its assets. For example, if the business model is an originate-to-distribute model, then fair value has relevance.

In contrast, if the business model is predicated on the realization of value through the return of principal and yield over the life of the financial instrument, then fair value is less relevant. Consider, for example, a bank that finances the operations of a commercial enterprise. The realization of value will come from the repayment of cash flows. Risk management is based on an assessment of the borrower's creditworthiness and the entity's ability to fund the loan to maturity. In this case, the accounting should incentivize the entity to maintain sufficient funding to hold the instrument to maturity and to hold a sufficient amount of capital to cover potential credit losses through the credit cycle, preferably in a designated reserve. Indeed, the use of fair value could create disincentives for lending to smaller businesses whose credit characteristics are not easily evaluated by the marketplace.

Admittedly, some have used the business model argument to manipulate accounting results. But the actions of those entities do not diminish the relevance of the business model to the measurement principle. Indeed, over time if the valuation model is not relevant to the business model, the business model itself is likely to change. Rather, the lesson to be learned from such manipulation is that we--preparers, users and auditors of financial statements--need to be vigilant in evaluating actual business practice, and restrict the use of particular measurement principles to the relevant business models.

To this end, safeguards should be implemented to eliminate a firm's ability to overstate gains or understate losses by switching back and forth between business models or by reclassifying assets from one business segment to another. For example, from a regulatory perspective, assets in a financial institution's liquidity reserve, by their nature, imply utility through sale and, therefore, should be valued at market price.

Duke goes on an discusses the Stress Test accounting and current FASB and IASB discussions.

Sunday, September 13, 2009

A Moment with Minsky

by Calculated Risk on 9/13/2009 11:22:00 PM

Stephen Mihm at the Boston Globe looks at Hyman Minsky: Why capitalism fails

Amid the hand-wringing ... a few ... commentators started to speak about the arrival of a “Minsky moment,” ... shorthand for Hyman Minsky, a hitherto obscure macroeconomist who died over a decade ago.An interesting overview of Minsky. And this sure sounds like the recent credit bubble:

...

In recent months Minsky’s star has only risen. Nobel Prize-winning economists talk about incorporating his insights, and copies of his books are back in print and selling well. He’s gone from being a nearly forgotten figure to a key player in the debate over how to fix the financial system.

But if Minsky was as right as he seems to have been, the news is not exactly encouraging. He believed in capitalism, but also believed it had almost a genetic weakness. Modern finance, he argued, was far from the stabilizing force that mainstream economics portrayed: rather, it was a system that created the illusion of stability while simultaneously creating the conditions for an inevitable and dramatic collapse.

In other words, the one person who foresaw the crisis also believed that our whole financial system contains the seeds of its own destruction. “Instability,” he wrote, “is an inherent and inescapable flaw of capitalism.”

Minsky’s vision might have been dark, but he was not a fatalist; he believed it was possible to craft policies that could blunt the collateral damage caused by financial crises. But with a growing number of economists eager to declare the recession over, and the crisis itself apparently behind us, these policies may prove as discomforting as the theories that prompted them in the first place. Indeed, as economists re-embrace Minsky’s prophetic insights, it is far from clear that they’re ready to reckon with the full implications of what he saw.

As people forget that failure is a possibility, a “euphoric economy” eventually develops, fueled by the rise of far riskier borrowers - what [Minsky] called speculative borrowers, those whose income would cover interest payments but not the principal; and those he called “Ponzi borrowers,” those whose income could cover neither, and could only pay their bills by borrowing still further. As these latter categories grew, the overall economy would shift from a conservative but profitable environment to a much more freewheeling system dominated by players whose survival depended not on sound business plans, but on borrowed money and freely available credit.And since the failure of many economists to see the coming crisis is being widely discussed, here is a quote from Minsky on macroeconomics:

“There is nothing wrong with macroeconomics that another depression [won’t] cure."

Stiglitz: Banking Problems Worse than in 2007

by Calculated Risk on 9/13/2009 06:49:00 PM

From Bloomberg: Stiglitz Says Banking Problems Are Now Bigger Than Pre-Lehman (ht Ron Wallstreetpit)

... “In the U.S. and many other countries, the too-big-to-fail banks have become even bigger,” [Joseph] Stiglitz said in an interview today in Paris. “The problems are worse than they were in 2007 before the crisis.”And on the economy:

...

“It’s an outrage,” especially “in the U.S. where we poured so much money into the banks,” Stiglitz said. “The administration seems very reluctant to do what is necessary. Yes they’ll do something, the question is: Will they do as much as required?”

"We’re going into an extended period of weak economy, of economic malaise,” Stiglitz said. The U.S. will “grow but not enough to offset the increase in the population,” he said, adding that “if workers do not have income, it’s very hard to see how the U.S. will generate the demand that the world economy needs.”Stiglitz also wrote a comment in the Financial Times: Towards a better measure of well-being and I think this comment is very important:

The Federal Reserve faces a “quandary” in ending its monetary stimulus programs because doing so may drive up the cost of borrowing for the U.S. government, he said.

“The question then is who is going to finance the U.S. government,” Stiglitz said.

Too often, we confuse ends with means. ... a financial sector is a means to a more productive economy, not an end in itself.

excerpted with permission

The Credit Score Impact of Mortgage Choices

by Calculated Risk on 9/13/2009 01:11:00 PM

Kenneth Harney discusses the credit impact of various mortgage choices: Mortgage problems are walloping Americans' credit scores

For example, loan modifications that roll late payments and penalties into the principal debt owed on the house can actually increase borrowers' scores modestly. Refinancings of underwater, negative-equity mortgages ... may have little or no negative effect on scores ...However:

... short sales can trigger big drops in credit scores. ... strategic defaults [lead to even larger credit hits] "plus negative marks on their credit bureau files for as long as seven years." ... People who file for bankruptcy protection covering all their debts (mortgage, credit cards, auto loans, etc.) will get hit [the hardest]. Bankruptcies remain on borrowers' credit bureau files for 10 years.Harney has some data on the sharp overall decline in credit scores.

Most of these changes -- fewer people with excellent credit, more people in the lowest brackets -- have been caused by late payments on home mortgages, serious delinquencies, short sales and foreclosures ...One of the tragedies of the housing / credit bubble was that many people bought homes before they were financially ready - or bought homes they could not afford. Now many of these people will be soured on the home buying experience, and their credit scarred for years.

And there will also be another group of people who make their payments, and keep their "excellent" credit scores, but will be stuck with their underwater homes for years.

Foxwood Casino Debt Problems

by Calculated Risk on 9/13/2009 10:30:00 AM

The "everyone was doing it" excuse ...

“Yes, we spent too much money. Of course we made mistakes. We made the same mistakes that everyone else has made across the country,’’From the Boston Globe: The wonder, and the fall (ht Lisa)

Roland Fahnbulleh Jr., [a Pequot tribal member].

... casinos rode the wave of easy credit to success in the years leading up to the recession, and Foxwoods was no exception. The Pequots, who had to go to Malaysia to fund the initial $60 million casino because no one else would lend to them, soon had banks lining up with loan offers as Foxwoods raked in customers - and their cash. The tribe quickly expanded the resort, adding hotels, restaurants, and shops to the complex, which now stands at 4.7 million square feet, nearly 20 times its original size. The Pequots also spent big to acquire nearby businesses and invest in other industries, such as shipbuilding -an expensive effort that later flopped.This has some interesting twists because many of the employees are members of the tribe and have lost their jobs. Plus there are payouts to the tribe members ... but the rapid expansion, with too much debt, are common stories.

...

But by the time the MGM Grand at Foxwoods debuted in May 2008, the recession was well underway, and gambling receipts were dipping sharply nationwide. ... Now, the shimmering tower stands as a symbol of excess, with unbooked rooms, empty stores, and a sparsely populated gaming floor.

Saturday, September 12, 2009

Federal Reserve Oversight and the Failure of Riverside Bank of the Gulf Coast

by Calculated Risk on 9/12/2009 10:56:00 PM

From Bloomberg: Fed Failed to Curb Flawed Bank Lending, Inspector General Says (ht Stephen, others)

Federal Reserve examiners failed to rein in practices that led to losses from excessive real estate lending at two banks in California and Florida that later closed, the central bank’s inspector general said.Riverside Bank was closed in February 2009 by the Florida Office of Financial Regulation. The FDIC DIF is estimated to have lost $201.5 million from the failure of Riverside, or about 38.5% of assets (not an unusually high loss percentage in this cycle, see this sortable table).

Riverside Bank of the Gulf Coast in Cape Coral, Florida, “warranted more immediate supervisory attention” by the Atlanta district bank, Fed Inspector General Elizabeth Coleman said in a report to the central bank’s board. In overseeing County Bank in Merced, California, the San Francisco Fed should have taken a “more aggressive supervisory” approach, Coleman said in another report, also dated Sept. 9.

Here is the report from the Inspector General: Material Loss Review of Riverside Bank of the Gulf Coast

Inspector General Coleman suggested that there should have been "more immediate supervisory attention" in 2007.

Based on our analysis of Riverside-Gulf Coast’s supervision, we believe that emerging problems observed during a 2007 visitation provided FRB Atlanta with an opportunity for a more aggressive supervisory response. Specifically, FRB Atlanta noted a significant decline in the local residential housing market and observed that new appraisals indicated that the value of certain collateral, particularly developed lots ready for construction, declined by as much as 70 percent. In addition, examiners observed that Riverside-Gulf Coast could no longer sell mortgages in the secondary market and, therefore, would be required to hold and service these loans."Emerging problems" in 2007? I strongly believe that action should have been taken much sooner - at least by 2005 - because of 1) concerns about the housing market, and 2) the concentration of loans in residential real estate. From the report:

Historically, Riverside-Gulf Coast focused on growth through real estate lending in its local service area, a business strategy that created concentrations in both the type of loans and the geographic location. In general, local real estate concentrations increase a financial institution’s vulnerability to cyclical changes in the local market place and may elevate a bank’s safety and soundness risk. Examiners noted that Riverside-Gulf Coast experienced rapid growth during its first six years when the bank’s total assets grew approximately 40 percent annually, to $275 million as of December 31, 2003.The signs of excessive risk were apparent in 2003 to 2005. The Fed is aware of the risks, especially of a high growth strategy with a high loan type concentration. If the regulator was unable to step in sooner and evaluate the risk, then the regulatory process is flawed - and the regulator has already failed. It was too late by 2007.

...

Riverside-Gulf Coast’s concentration in real estate loans ranged between 92 and 98 percent of total loans during 2003 to 2008. The bank’s real estate portfolio included traditional one-to-four family mortgages and home equity lines of credit. In addition, a substantial number of Riverside-Gulf Coast’s real estate loans, such as those for residential construction, were categorized as CRE because repayment was dependent on the rental income, sale, or refinancing of the underlying collateral.

emphasis added

The inability of the Federal Reserve and the Inspector General to recognize the need for tighter supervision in 2005 or earlier is a serious oversight failure.

Failed Banks and the Deposit Insurance Fund

by Calculated Risk on 9/12/2009 05:59:00 PM

As a companion to the September 11 Problem Bank List (unofficial), below is a list of failed banks since Jan 2007.

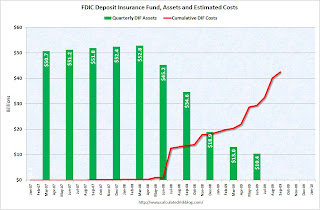

The recently released FDIC Q2 Quarterly Banking Profile showed that the Deposit Insurance Fund (DIF) balance had fallen to $10.4 billion or 0.22% of insured deposits as of June 30th. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The graph shows the cumulative estimated losses to the FDIC Deposit Insurance Fund (DIF) and the quarterly assets of the DIF (as reported by the FDIC). Note that the FDIC takes reserves against future losses in the DIF, and collects fees and special assessments - so you can't just subtract estimated losses from assets to determine the assets remaining in the DIF.

The cumulative estimated losses for the DIF, since early 2007, are now over $42.5 billion.

Regulators closed three more banks on Friday, and that brings the total FDIC insured bank failures to 92 in 2009. At the recent pace, regulators will probably close around 150 banks this year - the most since 1992.

Failed Bank List

Deposits, assets and estimated losses are all in thousands of dollars.

Losses for failed banks in 2009 are the initial FDIC estimates. The percent losses are as a percent of assets.

See description below table for Class and Cert (and a link to FDIC ID system).

The table is wide - use scroll bars to see all information!

Click here for a full screen version.

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. You can click on the number and see "the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

OECD: Global Recession Over

by Calculated Risk on 9/12/2009 03:48:00 PM

Just thought everyone would want to know ...

From The Independent: OECD calls an end to the global recession

The global downturn was effectively declared over yesterday, with the Organisation for Economic Co-operation and Development (OECD) revealing that "clear signs of recovery are now visible" in all seven of the leading Western economies, as well as in each of the key "Bric" nations.From the OECD: Composite Leading Indicators point to broad economic recovery

The OECD's composite leading indicators suggest that activity is now improving in all of the world's most significant 11 economies – the leading seven, consisting of the US, UK, Germany, Italy, France, Canada and Japan, and the Bric nations of Brazil, Russia, India and China – and in almost every case at a faster pace than previously.

OECD composite leading indicators (CLIs) for July 2009 show stronger signs of recovery in most of the OECD economies. Clear signals of recovery are now visible in all major seven economies, in particular in France and Italy, as well as in China, India and Russia. The signs from Brazil, where a trough is emerging, are also more encouraging than in last month’s assessment.Although there is clear improvement in many countries, the recovery will probably be very choppy and sluggish. And the OECD agrees that unemployment will continue to rise into 2010:

Despite early signs that an economic recovery may be in sight, unemployment is likely to continue rising into 2010.

Jim the Realtor: On the REO Trail

by Calculated Risk on 9/12/2009 11:49:00 AM

REO activity is starting to pickup again, and Jim breaks the news to a tenant:

Distressed Sales: Sacramento as Example

by Calculated Risk on 9/12/2009 08:38:00 AM

Just using Sacramento as an example ...  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Sacramento Association of REALTORS® is now breaking out monthly resales by equity sales (normal resales), and distressed sales (Short sales and REO sales). Here is the August data.

They started breaking out REO sales last year, but this is only the third monthly report with short sales. Almost two thirds of all resales (single family homes and condos) were distressed sales in August.

Total sales in August were off 10% compared to August 2008; the third month in a row with declining YoY sales.

On financing, over half the sales were either all cash (24.7%) or FHA loans (26.9%), suggesting most of the activity in distressed bubble areas like Sacramento is first-time home buyers using government-insured FHA loans (and taking advantage of the tax credits), and investors paying cash.