by Calculated Risk on 9/13/2009 01:11:00 PM

Sunday, September 13, 2009

The Credit Score Impact of Mortgage Choices

Kenneth Harney discusses the credit impact of various mortgage choices: Mortgage problems are walloping Americans' credit scores

For example, loan modifications that roll late payments and penalties into the principal debt owed on the house can actually increase borrowers' scores modestly. Refinancings of underwater, negative-equity mortgages ... may have little or no negative effect on scores ...However:

... short sales can trigger big drops in credit scores. ... strategic defaults [lead to even larger credit hits] "plus negative marks on their credit bureau files for as long as seven years." ... People who file for bankruptcy protection covering all their debts (mortgage, credit cards, auto loans, etc.) will get hit [the hardest]. Bankruptcies remain on borrowers' credit bureau files for 10 years.Harney has some data on the sharp overall decline in credit scores.

Most of these changes -- fewer people with excellent credit, more people in the lowest brackets -- have been caused by late payments on home mortgages, serious delinquencies, short sales and foreclosures ...One of the tragedies of the housing / credit bubble was that many people bought homes before they were financially ready - or bought homes they could not afford. Now many of these people will be soured on the home buying experience, and their credit scarred for years.

And there will also be another group of people who make their payments, and keep their "excellent" credit scores, but will be stuck with their underwater homes for years.

Foxwood Casino Debt Problems

by Calculated Risk on 9/13/2009 10:30:00 AM

The "everyone was doing it" excuse ...

“Yes, we spent too much money. Of course we made mistakes. We made the same mistakes that everyone else has made across the country,’’From the Boston Globe: The wonder, and the fall (ht Lisa)

Roland Fahnbulleh Jr., [a Pequot tribal member].

... casinos rode the wave of easy credit to success in the years leading up to the recession, and Foxwoods was no exception. The Pequots, who had to go to Malaysia to fund the initial $60 million casino because no one else would lend to them, soon had banks lining up with loan offers as Foxwoods raked in customers - and their cash. The tribe quickly expanded the resort, adding hotels, restaurants, and shops to the complex, which now stands at 4.7 million square feet, nearly 20 times its original size. The Pequots also spent big to acquire nearby businesses and invest in other industries, such as shipbuilding -an expensive effort that later flopped.This has some interesting twists because many of the employees are members of the tribe and have lost their jobs. Plus there are payouts to the tribe members ... but the rapid expansion, with too much debt, are common stories.

...

But by the time the MGM Grand at Foxwoods debuted in May 2008, the recession was well underway, and gambling receipts were dipping sharply nationwide. ... Now, the shimmering tower stands as a symbol of excess, with unbooked rooms, empty stores, and a sparsely populated gaming floor.

Saturday, September 12, 2009

Federal Reserve Oversight and the Failure of Riverside Bank of the Gulf Coast

by Calculated Risk on 9/12/2009 10:56:00 PM

From Bloomberg: Fed Failed to Curb Flawed Bank Lending, Inspector General Says (ht Stephen, others)

Federal Reserve examiners failed to rein in practices that led to losses from excessive real estate lending at two banks in California and Florida that later closed, the central bank’s inspector general said.Riverside Bank was closed in February 2009 by the Florida Office of Financial Regulation. The FDIC DIF is estimated to have lost $201.5 million from the failure of Riverside, or about 38.5% of assets (not an unusually high loss percentage in this cycle, see this sortable table).

Riverside Bank of the Gulf Coast in Cape Coral, Florida, “warranted more immediate supervisory attention” by the Atlanta district bank, Fed Inspector General Elizabeth Coleman said in a report to the central bank’s board. In overseeing County Bank in Merced, California, the San Francisco Fed should have taken a “more aggressive supervisory” approach, Coleman said in another report, also dated Sept. 9.

Here is the report from the Inspector General: Material Loss Review of Riverside Bank of the Gulf Coast

Inspector General Coleman suggested that there should have been "more immediate supervisory attention" in 2007.

Based on our analysis of Riverside-Gulf Coast’s supervision, we believe that emerging problems observed during a 2007 visitation provided FRB Atlanta with an opportunity for a more aggressive supervisory response. Specifically, FRB Atlanta noted a significant decline in the local residential housing market and observed that new appraisals indicated that the value of certain collateral, particularly developed lots ready for construction, declined by as much as 70 percent. In addition, examiners observed that Riverside-Gulf Coast could no longer sell mortgages in the secondary market and, therefore, would be required to hold and service these loans."Emerging problems" in 2007? I strongly believe that action should have been taken much sooner - at least by 2005 - because of 1) concerns about the housing market, and 2) the concentration of loans in residential real estate. From the report:

Historically, Riverside-Gulf Coast focused on growth through real estate lending in its local service area, a business strategy that created concentrations in both the type of loans and the geographic location. In general, local real estate concentrations increase a financial institution’s vulnerability to cyclical changes in the local market place and may elevate a bank’s safety and soundness risk. Examiners noted that Riverside-Gulf Coast experienced rapid growth during its first six years when the bank’s total assets grew approximately 40 percent annually, to $275 million as of December 31, 2003.The signs of excessive risk were apparent in 2003 to 2005. The Fed is aware of the risks, especially of a high growth strategy with a high loan type concentration. If the regulator was unable to step in sooner and evaluate the risk, then the regulatory process is flawed - and the regulator has already failed. It was too late by 2007.

...

Riverside-Gulf Coast’s concentration in real estate loans ranged between 92 and 98 percent of total loans during 2003 to 2008. The bank’s real estate portfolio included traditional one-to-four family mortgages and home equity lines of credit. In addition, a substantial number of Riverside-Gulf Coast’s real estate loans, such as those for residential construction, were categorized as CRE because repayment was dependent on the rental income, sale, or refinancing of the underlying collateral.

emphasis added

The inability of the Federal Reserve and the Inspector General to recognize the need for tighter supervision in 2005 or earlier is a serious oversight failure.

Failed Banks and the Deposit Insurance Fund

by Calculated Risk on 9/12/2009 05:59:00 PM

As a companion to the September 11 Problem Bank List (unofficial), below is a list of failed banks since Jan 2007.

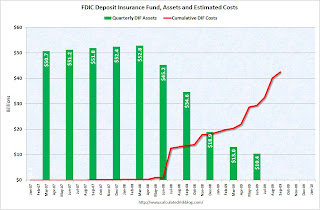

The recently released FDIC Q2 Quarterly Banking Profile showed that the Deposit Insurance Fund (DIF) balance had fallen to $10.4 billion or 0.22% of insured deposits as of June 30th. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The graph shows the cumulative estimated losses to the FDIC Deposit Insurance Fund (DIF) and the quarterly assets of the DIF (as reported by the FDIC). Note that the FDIC takes reserves against future losses in the DIF, and collects fees and special assessments - so you can't just subtract estimated losses from assets to determine the assets remaining in the DIF.

The cumulative estimated losses for the DIF, since early 2007, are now over $42.5 billion.

Regulators closed three more banks on Friday, and that brings the total FDIC insured bank failures to 92 in 2009. At the recent pace, regulators will probably close around 150 banks this year - the most since 1992.

Failed Bank List

Deposits, assets and estimated losses are all in thousands of dollars.

Losses for failed banks in 2009 are the initial FDIC estimates. The percent losses are as a percent of assets.

See description below table for Class and Cert (and a link to FDIC ID system).

The table is wide - use scroll bars to see all information!

Click here for a full screen version.

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. You can click on the number and see "the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

OECD: Global Recession Over

by Calculated Risk on 9/12/2009 03:48:00 PM

Just thought everyone would want to know ...

From The Independent: OECD calls an end to the global recession

The global downturn was effectively declared over yesterday, with the Organisation for Economic Co-operation and Development (OECD) revealing that "clear signs of recovery are now visible" in all seven of the leading Western economies, as well as in each of the key "Bric" nations.From the OECD: Composite Leading Indicators point to broad economic recovery

The OECD's composite leading indicators suggest that activity is now improving in all of the world's most significant 11 economies – the leading seven, consisting of the US, UK, Germany, Italy, France, Canada and Japan, and the Bric nations of Brazil, Russia, India and China – and in almost every case at a faster pace than previously.

OECD composite leading indicators (CLIs) for July 2009 show stronger signs of recovery in most of the OECD economies. Clear signals of recovery are now visible in all major seven economies, in particular in France and Italy, as well as in China, India and Russia. The signs from Brazil, where a trough is emerging, are also more encouraging than in last month’s assessment.Although there is clear improvement in many countries, the recovery will probably be very choppy and sluggish. And the OECD agrees that unemployment will continue to rise into 2010:

Despite early signs that an economic recovery may be in sight, unemployment is likely to continue rising into 2010.

Jim the Realtor: On the REO Trail

by Calculated Risk on 9/12/2009 11:49:00 AM

REO activity is starting to pickup again, and Jim breaks the news to a tenant:

Distressed Sales: Sacramento as Example

by Calculated Risk on 9/12/2009 08:38:00 AM

Just using Sacramento as an example ...  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Sacramento Association of REALTORS® is now breaking out monthly resales by equity sales (normal resales), and distressed sales (Short sales and REO sales). Here is the August data.

They started breaking out REO sales last year, but this is only the third monthly report with short sales. Almost two thirds of all resales (single family homes and condos) were distressed sales in August.

Total sales in August were off 10% compared to August 2008; the third month in a row with declining YoY sales.

On financing, over half the sales were either all cash (24.7%) or FHA loans (26.9%), suggesting most of the activity in distressed bubble areas like Sacramento is first-time home buyers using government-insured FHA loans (and taking advantage of the tax credits), and investors paying cash.

Friday, September 11, 2009

Problem Bank List (Unofficial) Sept 11, 2009

by Calculated Risk on 9/11/2009 09:43:00 PM

This is an unofficial list of Problem Banks.

Note: Bank failures today, Corus Bank, N.A., Chicago IL, Brickwell Community Bank, Woodbury, MN, and Venture Bank, Lacey, WA, were on this list.

Changes and comments from surferdude808:

The Unofficial Problem Bank List increased by 3 institutions to 424; however, assets jumped by $18.8 billion to $286.6 billion.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

We added seven institutions and removed four institutions from last week’s list. Most prominent among the additions are United Commercial Bank (ticker UCBH), San Francisco, CA with assets of $12.8 billion, La Jolla Bank, FSB, La Jolla, CA with assets of $3.9 billion, and Bank of Granite (ticker GRAN), Granite Falls, NC, with assets of $1.1 billion, which has the dubious distinction of being once praised by Warren Buffet as one of the best run banks in the country (http://www.charlotteobserver.com/breaking/story/927809.html).

The removals include three failures on September 4th and one action termination by the OCC. The other change to the list is a Prompt Corrective Action being issued by the FDIC against Rainier Pacific Bank, Tacoma, WA, which is reportedly already operating under a Cease & Desist Order.

Starting with its release of actions during July 2009, the FDIC is disclosing its notice of charges against institutions that are contesting enforcement actions. In an American Banker article some industry observers thought this new disclosure is very harsh as it includes specific details on why the agency is seeking an enforcement order. One banker quoted in the article thought the FDIC started disclosing the charges to limit dissent -- "This is just another way of putting additional pressure on community banks to consent to these orders, even if they think it is not in the best interest of the bank," said Jeffrey C.. Gerrish, a partner at the law firm Gerrish McCreary Smith PC in Memphis. "The inflammatory nature of these charges could certainly do damage to a community bank." The FDIC said it is only trying to make the “information accessible” and that most information becomes public if there is a hearing. While we applaud the FDIC in providing increased transparency around its actions, we would like the FDIC to improve the timeliness of their disclosures regarding new enforcement actions. Generally, the other agencies will release their actions as they occur while the FDIC only discloses its actions once a month on a lagged basis. For example, the FDIC will disclose its actions for August at the end of September.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failure #92: Venture Bank, Lacy, Washington

by Calculated Risk on 9/11/2009 09:11:00 PM

Rest easy now Venture Bank

Feds have made you safe.

by Soylent Green is People

Note: Mostly Haiku will be by SGIP, but here is an extra ...

But very little gained, now

the whole bank transfered

by seajane

From the FDIC: First-Citizens Bank & Trust Company, Raleigh, North Carolina, Assumes All of the Deposits of Venture Bank, Lacy, Washington

Venture Bank, Lacy, Washington, was closed today by the Washington Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver....

As of July 28, 2009, Venture Bank had total assets of $970 million and total deposits of approximately $903 million. ...

The FDIC and First-Citizens Bank & Trust Company entered into a loss-share transaction on approximately $715 million of Venture Bank's assets....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $298 million. .... Venture Bank is the 92nd FDIC-insured institution to fail in the nation this year, and the third in Washington. The last FDIC-insured institution closed in the state was Westsound Bank, Bremerton, on May 8, 2009.

Bank Failure #91: Brickwell Community Bank, Woodbury, Minnesota

by Calculated Risk on 9/11/2009 07:27:00 PM

Failed bank numbers soar like crane

May top Mount Fuji

by Soylent Green is People

From the FDIC:

Brickwell Community Bank, Woodbury, Minnesota, was closed today by the Minnesota Department of Commerce, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with CorTrust Bank, N.A., Mitchell, South Dakota, to assume all of the deposits of Brickwell Community Bank.

...

As of July, 24, 2009, Brickwell Community Bank had total assets of $72 million and total deposits of approximately $63 million. CorTrust Bank will pay the FDIC a premium of 0.10 percent to assume all of the deposits of Brickwell Community Bank. In addition to assuming all of the deposits of the failed bank, CorTrust Bank agreed to purchase essentially all of the assets.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $22 million. ... Brickwell Community Bank is the 91st FDIC-insured institution to fail in the nation this year, and the third in Minnesota. The last FDIC-insured institution closed in the state was Mainstreet Bank, Forest Lake, on August 28, 2009.