by Calculated Risk on 9/05/2009 07:59:00 AM

Saturday, September 05, 2009

NY Times: One-sixth of Construction Loans in Trouble

From Floyd Norris at the NY Times: Construction Loans Falter, a Bad Omen for Banks

Reports filed by banks with the Federal Deposit Insurance Corporation indicate that at the end of June about one-sixth of all construction loans were in trouble. With more than half a trillion dollars in such loans outstanding, that represents a source of major losses for banks.See the great charts in the article.

...

It is in commercial real estate construction — be it stores or office buildings — that the pain seems likely to rise. At the end of June, $291 billion in such loans was outstanding, down only a few billion from the peak reached earlier this year.

“On the commercial side,” said Matthew Anderson, a partner in Foresight Analytics, a research firm based in Oakland, Calif., “I think we are fairly early in the down cycle.”

The article makes the point that the local and regional banks were unable to compete with the larger banks for credit card loans (and residential mortgages too). So the smaller banks ended up overweighted in Construction & Development (C&D) and CRE loans. That isn't look good now, and most of the bank failures during the next couple of years will probably be because of CRE and C&D defaults.

I was looking back at some old posts, and I started writing about how CRE typically follows residential real estate back in 2006, and also about the excessive C&D and CRE loans concentrations of local and regional banks. Here is an excerpt from a post in March 2007:

The housing crisis is now front page news, but there is little discussion about U.S. bank exposure to CRE loans. If a CRE slump follows the residential real estate bust (the typical historical pattern), then the U.S. commercial banks might have a serious problem.The pattern is always the same: residential leads, CRE follows. And some lenders (and developers) never learn.

Friday, September 04, 2009

SEC Chairman Madoff? Corus and More

by Calculated Risk on 9/04/2009 09:55:00 PM

A few posts earlier today:

From the SEC: Investigation of Failure of the SEC to Uncover Bernard Madoff’s Ponzi Scheme - Public Version - :

The other NERO examiner noted that “[a]ll throughout the examination, Bernard Madoff would drop the names of high-up people in the SEC.” Madoff told them that Christopher Cox was going to be the next Chairman of the SEC a few weeks prior to Cox being officially named. He also told them that Madoff himself “was on the short list” to be the next Chairman of the SEC.Note: first posted at the WSJ Washington Wire.

emphasis added

The Corus auditor resigned. From a SEC 8-K filing today (ht jb):

On August 31, 2009, Corus Bankshares, Inc. (the “Company”), received notification from Ernst & Young, LLP (“E&Y”) of their resignation as the Company’s independent registered public accounting firm.There was no disagreement with the auditor, but I guess E&Y isn't sticking around for the FDIC party.

And a Cease & Desist for Granite Bank in North Carolina, from The Charlotte Observer: Bank of Granite under “cease and desist” order (ht Surferdude808)

Regulators have placed Bank of Granite Corp. under a so-called “cease and desist” order, the bank announced this afternoon.But what makes this one a little unusual:

Known for being conservative and thrifty, it was once praised by Warren Buffett as one of the best-run banks in the country.And here is a puzzle for you all (via Surferdude808). On the FDIC cert site, Platinum Community Bank is listed as having $148 million in assets. However, when the bank was seized today, the FDIC noted:

Platinum Community Bank, as of August 29, 2009, had total assets of $345.6 million and total deposits of $305.0 million.Did this bank really more than double their assets in 60 days? (Update: probably is related to the bank holding company)

Bank Failure #89: First State Bank, Flagstaff, AZ

by Calculated Risk on 9/04/2009 09:13:00 PM

First State Bank falls forcefully

Feds funds are famished.

by Soylent Green is People

From the FDIC: Sunwest Bank, Tustin, California, Assumes All of the Deposits of First State Bank, Flagstaff, Arizona

First State Bank, Flagstaff, Arizona, was closed today by the Arizona Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Sunwest Bank, Tustin, California, to assume all of the deposits of First State Bank.Five more today ... so far.

...

As of July 24, 2009, First State Bank had total assets of $105 million and total deposits of approximately $95 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $47 million. .... First State Bank is the 89th FDIC-insured institution to fail in the nation this year, and the third in Arizona. The last FDIC-insured institution closed in the state was Union Bank, National Association, Gilbert, on August 14, 2009.

Bank Failure #88: Community Bank, Rolling Meadows, Illinois

by Calculated Risk on 9/04/2009 08:08:00 PM

Platinum Bank now fools gold

Shut by tin star Fed

by Soylent Green is People

From the FDIC: FDIC Approves the Payout of Insured Deposits of Platinum Community Bank, Rolling Meadows, Illinois

The Federal Deposit Insurance Corporation (FDIC) approved the payout of the insured deposits of Platinum Community Bank, Rolling Meadows, Illinois. The bank was closed today by the Office of Thrift Supervision, which appointed the FDIC as receiver.No one wanted this one. That makes four today.

The FDIC will mail customers checks for their insured funds on Tuesday, September 8. Platinum Community Bank, as of August 29, 2009, had total assets of $345.6 million and total deposits of $305.0 million.

...

Platinum Community Bank is the 88th FDIC-insured institution to fail this year and the 15th in Illinois. The last bank to be closed in the state was Inbank, Oak Forest, earlier today. The FDIC estimates the cost of the failure to its Deposit Insurance Fund to be approximately $114.3 million.

Bank Failures #86 & #87: InBank, Oak Forest, IL, Vantus Bank, Sioux City, IA

by Calculated Risk on 9/04/2009 07:13:00 PM

Small fries, not big potatos

Is a whopper next?

by Soylent Green is People

From the FDIC: MB Financial Bank, National Association, Chicago, Illinois, Assumes All of the Deposits of InBank, Oak Forest, Illinois

InBank, Oak Forest, Illinois, was closed today by the Illinois Department of Financial and Professional Regulation, Division of Banking, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...FDIC: Great Southern Bank, Springfield, Missouri, Assumes All of the Deposits of Vantus Bank, Sioux City, Iowa

As of August 3, 2009, InBank had total assets of $212 million and total deposits of approximately $199 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $66 million. ... InBank is the 86th FDIC-insured institution to fail in the nation this year, and the 14th in Illinois. The last FDIC-insured institution closed in the state was Mutual Bank, Harvey, on July 31, 2009.

Vantus Bank, Sioux City, Iowa, was closed today by the Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...

As of August 28, 2009, Vantus Bank had total assets of $458 million and total deposits of approximately $368 million. ...

The FDIC and Great Southern Bank entered into a loss-share transaction on approximately $338 million of Vantus Bank's assets. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $168 million. .... Vantus Bank is the 87th FDIC-insured institution to fail in the nation this year, and the first in Iowa. The last FDIC-insured institution closed in the state was Hartford-Carlisle Savings Bank, Carlisle, on January 14, 2000.

Bank Failure #85: First Bank of Kansas City, Kansas City, MO

by Calculated Risk on 9/04/2009 06:08:00 PM

A long weekend for resting

Also for failure

by Soylent Green is People

From the FDIC: Great American Bank, De Soto, Kansas, Assumes All of the Deposits of First Bank of Kansas City, Kansas City, Missouri

First Bank of Kansas City, Kansas City, Missouri, was closed today by the Missouri Division of Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Great American Bank, De Soto, Kansas, to assume all of the deposits of First Bank of Kansas City.A small one to start the day.

...

As of June 30, 2009, First Bank of Kansas City had total assets of $16 million and total deposits of approximately $15 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $6 million. ... First Bank of Kansas City is the 85th FDIC-insured institution to fail in the nation this year, and the second in Missouri. The last FDIC-insured institution closed in the state was American Sterling Bank, Sugar Creek, on April 17, 2009.

Tax Credit: Mercury News Advocates Taxpayers pay $60 Thousand per Additional Home Sold

by Calculated Risk on 9/04/2009 04:29:00 PM

From the Mercury News: Editorial: Congress should expand $8,000 home-buyer tax credit (ht ShortCourage)

[I]t's crucial that when Congress returns from recess next week, lawmakers extend the soon-to-expire credit through 2010. And if they want to bolster the fledgling recovery, they'll expand eligibility.Do the math. $30 billion for an additional 500,000 sales equals $60,000 per house. Ouch.

Though the credit has helped stabilize the housing market nationally, in the pricey Bay Area, it hasn't been as helpful. ... Lifting the income caps and expanding the credit to all buyers of primary residences would nudge existing homeowners to move up. That would open up more houses in the red-hot lower end of the market, where many first-time buyers have been outbid by investors paying cash.

...

The National Association of Home Builders estimates that expanding and extending the credit through 2010 would generate 500,000 additional sales ... estimated to cost $30 billion ...

And forget the 500 thousand additional sales. The evidence suggests that interest is already waning (although there will be a flurry of activity at the end just like Cash-for-clunkers). My estimate is the program will cost taxpayers $100,000 per additional home sold. Not very efficient or effective.

Naught for Naughts Update

by Calculated Risk on 9/04/2009 03:12:00 PM

From Rex Nutting at MarketWatch: Lost decade for job growth

[T]he private sector didn't just lose jobs over the last month or the last year -- it's lost jobs over the last decade.Here is a different way to look at it: net jobs in the Naughts (2000 through 2009).

[The private sector] ended up with a net loss of 223,000 jobs since August 1999, according to the latest figures from the Bureau of Labor Statistics. Meanwhile, the nation's population has grown by 33.5 million people.

That's the worst job-creating performance by the private sector since, you guessed it, the Great Depression.

Click on graph for larger image.

Click on graph for larger image.Note: scale doesn't start at zero to show the change. This is a followup to Naught for the Naughts?.

The dashed lines show the level of private and total jobs at the end of the '90s (December 1999).

As Nutting notes, the private sector has lost jobs over the last decade, and is down 1.256 million jobs in the Naughts (so the decade will finish with net negative private sector jobs).

Total jobs are up 691 thousand since Dec 1999, and with four months to go, the race is on! If the economy loses about 172 thousand jobs on average over the next four months, total jobs will finish negative too.

Naught for the Naughts. A lost decade for employment.

Problem Bank List (Unofficial) Sep 4, 2009

by Calculated Risk on 9/04/2009 01:45:00 PM

This is an unofficial list of Problem Banks.

The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

Changes and comments from surferdude808:

During the week, 12 institutions with aggregate assets of $17.7 billion were added to the Unofficial Problem Bank List.See description below table for Class and Cert (and a link to FDIC ID system).

The list stands at 421 institutions with assets of $267.8 billion.

Largest among the additions is Capmark Bank, a Utah-based industrial loan company with assets of $11.1 billion. Should the parent, Capmark Financial Group, not find a buyer this could be another costly failure. Other notable additions include the $2.4 billion Bank of the Cascades, Bend, Oregon; the $1.9 billion Citizens First Savings Bank, Port Huron, Michigan; and two bankers’ banks – Midwest Independent Bank in Missouri and Nebraska Bankers’ Bank.

All three deletions from the list were because of failure including Affinity Bank, Mainstreet Bank, and Bradford Bank. Lastly, the OTS issued a Prompt Corrective Action order against Vantus Bank, Sioux City, Iowa, which was already operating under a Cease & Desist order.

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Employment-Population Ratio, Part Time Workers, Average Workweek

by Calculated Risk on 9/04/2009 10:40:00 AM

A few more graphs based on the (un)employment report ...

Employment-Population Ratio Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph show the employment-population ratio; this is the ratio of employed Americans to the adult population.

Note: the graph doesn't start at zero to better show the change.

The general upward trend from the early '60s was mostly due to women entering the workforce. As an example, in 1964 women were about 32% of the workforce, today the percentage is closer to 50%.

This measure fell in August to 59.2%, the lowest level since the early '80s. This also shows the weak recovery following the 2001 recession - and the current cliff diving!

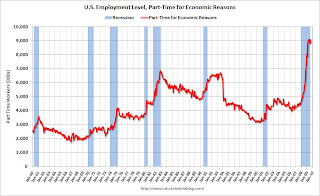

Part Time for Economic Reasons

From the BLS report:

In August, the number of persons working part time for economic reasons was little changed at 9.1 million. These individuals indicated that they were working part time because their hours had been cut back or because they were unable to find a full-time job. The number of such workers rose sharply in the fall and winter but has been little changed since March.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) is at 9.076 million. This is only slightly below the peak of 9.084 million in May.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) is at 9.076 million. This is only slightly below the peak of 9.084 million in May.Note: the U.S. population is significantly larger today (about 305 million) than in the early '80s (about 228 million) when the number of part time workers almost reached 7 million. That is the equivalent of about 9.3 million today, so population adjusted this is not quite a record.

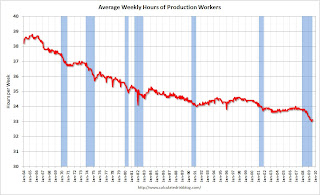

Average Weekly Hours

From the BLS report:

In August, the average workweek for production and nonsupervisory workers on private nonfarm payrolls was unchanged at 33.1 hours. The manufacturing workweek and factory overtime also showed no change over the month (at 39.8 hours and 2.9 hours, respectively).

The average weekly hours has been declining since the early '60s, but usually falls faster during a recession. Average weekly hours worked has essentially been flat since March.

The average weekly hours has been declining since the early '60s, but usually falls faster during a recession. Average weekly hours worked has essentially been flat since March.Some analyst look to an increase in this series as an indicator a recession is over. I guess they are still waiting.

Note: the graph doesn't start at zero to better show the change.

Earlier employment posts today: