by Calculated Risk on 8/30/2009 11:14:00 PM

Sunday, August 30, 2009

Shanghai Cliff Diving

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph is the Shanghai SSE composite index. I used to post this graph with the subtitle "Cliff Diving"!

Now the Shanghai composite is off more than 20% from the recent peak, and off close to 5% tonight. I guess this is 'mini-me' Cliff Diving ...

The U.S. futures are also off tonight, but not significantly:

CBOT mini-sized Dow

Futures from barchart.com

CME Globex Flash Quotes

And the other Asian markets are mostly red too.

Best to all.

FDIC risks $80 Billion in Loss Share Agreements

by Calculated Risk on 8/30/2009 06:46:00 PM

Every Friday, in just about every bank failure press release, the FDIC mentions a loss share agreement with the acquiring bank. As an example, in the press release regarding Mutual Bank of Harvey, Illinois on July 31st:

As of July 16, 2009, Mutual Bank had total assets of $1.6 billion and total deposits of approximately $1.6 billion. In addition to assuming all of the deposits of the failed bank, United Central Bank agreed to purchase essentially all of the assets.For those interested in every detail, here are the Single Family Loss Share Agreement (page 54) and Commercial Loss Share Agreement {page 89) between the FDIC and United Central Bank (the acquirer).

The FDIC and United Central Bank entered into a loss-share transaction on approximately $1.3 billion of Mutual Bank's assets.

emphasis added

From the WSJ: FDIC Shoulders Big Losses on Loans

[T]he Federal Deposit Insurance Corp. has agreed to assume most of the risk on $80 billion in loans and other assets. The agency expects it will eventually have to cover $14 billion in future losses on deals cut so far. ...These agreements definitely make the deals more attractive to potential buyers because the limit the downside.

So far, the FDIC has paid out $300 million to a handful of banks under the loss-share agreements. ... The agency estimates the loss-share deals cut will cost it $11 billion less than if the agency seized the assets and sold them at fair-market value.

...

In most cases, the FDIC agrees to cover 80% of future losses on a big portion of the assets, and 95% on the rest. The FDIC says it doesn't anticipate facing the 95% loss-coverage scenario on any deal. ... Many of the loss-share deals will be in place for up to 10 years.

The article notes that the FDIC "had just $10.4 billion in its deposit-insurance fund at the end of June", but that includes reserves for future losses. And since the FDIC expects losses of $14 billion from these loss share agreements, they should have already reserved for those losses.

Still many of these agreements will be in place for 10 years, and there is the potential for much higher losses.

Econbrowser Shifts to Neutral

by Calculated Risk on 8/30/2009 03:16:00 PM

Professor Hamilton has changed the emoticon on his site to neutral. Hamilton has been generally negative since early 2007 ...

| Date | Status |

|---|---|

| Sep 13, 2006 | |

| Feb 21, 2007 | |

| Apr 25, 2007 | |

| Jun 27, 2007 | |

| Oct 5, 2007 | |

| Jan 4, 2008 | |

| Aug 30, 2009 |

If you've only been following Econbrowser since 2008, you may have thought that the crabby countenance in the upper-right corner of our main page was a permanent fixture, conveying our general grumpiness about the state of the economy or perhaps life in general. Despite having been stuck in the pessimistic mode for quite some time now, the emoticon was in fact always intended to be a dynamic feature, adjusted from time to time to provide readers with our overall impression of incoming data. The table on the left provides links to each occasion that our Little Econ Watcher's countenance has changed in the past.See Hamilton's post for the reasons for the change. I think we are a long way from a smiley face.

Last week's data persuaded me to move the Econbrowser Emoticon back into neutral, signifying that I now judge overall output to be growing slowly rather than declining. Here are details on the evidence that prompted this change in assessment, and what it signifies.

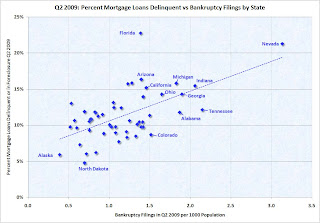

Bankruptcy Filings and Mortgage Delinquencies by State

by Calculated Risk on 8/30/2009 10:47:00 AM

Here is a graph of bankruptcy filings vs. mortgage delinquencies (including homes in foreclosure process) by state for Q2 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The bankruptcy filings data is from the American Bankruptcy Institute.

The mortgage delinquency data is from the Mortgage Bankers Association.

No surprise - there is a clear correlation, although each state has different bankruptcy laws that can impact the relationship (see Florida).

Here is a sortable table to find the data for each state (use scroll bar to see all data).

Saturday, August 29, 2009

Houses: Cash Buyer Percentages in Orlando, Tampa and Knoxville

by Calculated Risk on 8/29/2009 09:38:00 PM

Here is some data from the Atlanta Fed on cash buyers in the southeast. This is part of the economic and financial highlights the Atlanta Fed puts out weekly. Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the Economic Highlight:

Orlando and Tampa Realtor data [earlier] showed an increase in the share of cash buyers, but in recent months that share has weakened somewhat.The percentages for Orlanda and Tampa are similar to the percentages in the lower priced areas of the California Bay Area: see the table in Carolyn Said's recent article in the San Francisco Chronicle 'Cash is king' in market for foreclosed homes

In the Knoxville market, where home sales and prices did not accelerate as much as in Orlando and Tampa, the share of cash buyers had peaked earlier in the year but has tapered off since March.

I suspect many of these cash buyers are investors buying for cash flow (not the speculators we saw during the boom). Frequently these investors are buying in the same areas as first-time home buyers (some motivated by the $8K tax credit) - and the competition is pushing up prices and reducing supply. Now if we just had better first-time home buyer data ...

Article: "The HAMP Mirage"

by Calculated Risk on 8/29/2009 05:40:00 PM

Andy Kroll at Mother Jones discusses problems with the Home Affordable Modification Program (HAMP): The Foreclosure Rescue Mirage

Industry experts are now questioning how many of the program’s estimated 235,000 modifications will actually benefit homeowners in the long term, and say that homeowners clamoring to participate in HAMP have created an industrywide logjam for mortgage servicers, resulting in substantial delays and backed-up customer service support. The Treasury’s first servicer performance report (PDF), covering March to July 2009, found that servicers had offered modifications to just 15 percent of eligible delinquent homeowners, and initiated them for just 9 percent of that group.I've heard from servicers who've said they are just overwhelmed and are staffing up to meet the demand. And it appears the administration is trying to make improvements:

Despite its flaws, HAMP is a good-faith effort by the government to address the foreclosure crisis, and there are signs of improvement. In June, HAMP officials began conducting much more rigorous reviews of servicers, and have started a "second look" program, in which servicers’ decisions to approve or deny HAMP modifications are scrutinized. Compliance officials are also analyzing samples of HAMP-modified loans to track error rates with servicers. And government officials have on several occasions tried to light a fire under HAMP servicers to speed up the modification process.Some believe HAMP will fall far short of the goals:

The Treasury has set a target of modifying 4 million mortgages by 2012, but Moody's estimates HAMP will in fact modify only 1.5 to 2 million.The Treasury disagrees:

More than 400,000 modification offers have been extended and more than 230,000 trial modifications have begun. This pace of modifications puts the program on track to offer assistance to up to 3 to 4 million homeowners over the next three years, our target on February 18.Actually the original press release stated the program "will help up to 3 to 4 million at-risk homeowners avoid foreclosure" and the new press release says "offer assistance to up to 3 to 4 million homeowners". A few word changes makes a significant difference.

The Treasury's current target is 500,000 cumulative trial modifications started by November 1st, up from the 235,000 cumulative at the end of July. At that pace (about 90 thousand trials started per month), the cumulative trial modifications started will be close to 3.0 million by early 2012 - however many of those borrowers will probably redefault. Anyone who redefaults will have been "offered assistance", but probably will not "avoid foreclosure".

The article has a few interesting anecdotes of the struggles of borrowers in dealing with their servicers. My best wishes to Kristina Page. Thanks for mentioning CR!

Quarterly Housing Starts and New Home Sales

by Calculated Risk on 8/29/2009 01:02:00 PM

The Census Bureau has released the "Quarterly Starts and Completions by Purpose and Design" report for Q2 2009 a few days ago.

Monthly housing starts (even single family starts) cannot be compared directly to new home sales, because the monthly housing starts report from the Census Bureau includes apartments, owner built units and condos that are not included in the new home sales report.

However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis. The quarterly report shows that there were 82,000 single family starts, built for sale, in Q2 2009 and that is less than the 102,000 new homes sold for the same period. This data is Not Seasonally Adjusted (NSA). This suggests homebuilders are selling more homes than they are starting.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because homebuilders were stuck with “unintentional spec homes” during the housing bust because of the high cancellation rates, but cancellation rates are now much closer to normal. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph provides a quarterly comparison of housing starts and new home sales. In 2005, and most of 2006, starts were higher than sales, and inventories of new homes rose sharply. For the last seven quarters, starts have been below sales – and new home inventories have been falling. The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Condo starts in Q2 tied the all time record low for Condos built for sale set in Q1 (5,000); the previous record was 8,000 set in Q1 1991 (data started in 1975).

Owner built units are above the record low set last quarter (38,000 units compared to 24,000 units in Q1 2009), however the pickup in starts was probably mostly seasonal (this is NSA data).

And single family units built for sale were also above the record low set last quarter (82,000 compared to 53,000 in Q1 2009).

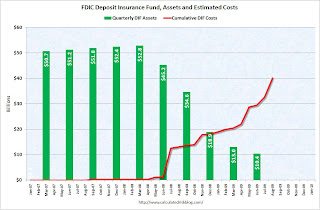

Failed Banks and the Deposit Insurance Fund

by Calculated Risk on 8/29/2009 10:11:00 AM

As a companion to the August 28 Problem Bank List (unofficial), below is a list of failed banks since Jan 2007.

The FDIC released the Q2 Quarterly Banking Profile this week. The report showed that the Deposit Insurance Fund (DIF) balance had fallen to $10.4 billion or 0.22% of insured deposits. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The graph shows the cumulative estimated losses to the FDIC Deposit Insurance Fund (DIF) and the quarterly assets of the DIF (as reported by the FDIC). Note that the FDIC takes reserves against future losses in the DIF, and collects fees and special assessments - so you can't just subtract estimated losses from assets to determine the assets remaining in the DIF.

The cumulative estimated losses for the DIF are now over $40 billion.

In this Dick Bove interview with CNNMoney, the interviewer Poppy Harlow said:

"When we look at that list though - we don't get the names from the FDIC obviously - only about 13% of the bank on that list actually end up failing".The 13% number is historically accurate, but that is over the entire cycle - and this down cycle will probably be worse than most. So during this down period, the percentage will probably be much higher. As far as the names of the banks on the "list", most of them are on the Unofficial Problem Bank list.

The FDIC closed three more banks on Friday, and that brings the total FDIC bank failures to 84 in 2009.

Failed Bank List

Deposits, assets and estimated losses are all in thousands of dollars.

Losses for failed banks in 2009 are the initial FDIC estimates. The percent losses are as a percent of assets.

See description below table for Class and Cert (and a link to FDIC ID system).

The table is wide - use scroll bars to see all information!

Click here for a full screen version.

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. You can click on the number and see "the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Friday, August 28, 2009

Judge Stays FOIA Fed Ruling Pending Appeal

by Calculated Risk on 8/28/2009 11:55:00 PM

From Rolfe Winkler at Reuters: Judge puts Fed's bailout revelations on hold

Chief Judge Loretta Preska of the U.S. District Court in Manhattan stayed her August 24 order in favor of Bloomberg News, which had sought [the names of the banks that have participated in the Federal Reserve's emergency lending programs] under the federal Freedom of Information Act, so that the central bank could appeal.This case might go on and on. Perhaps Barney Frank and Ron Paul will pass new legislation requiring auditing the Fed before this FOIA case makes it through the courts.

UPDATE: Mish says

"[W]e will subject [the Federal Reserve] to a complete audit. I have been working with Ron Paul, who is the main sponsor of that bill. He agrees that we don't want to have the audit appear as if it is influencing monetary policy, because that would be inflationary. And Ron and I agree on that.

One of the things the audit will show you is what the Federal Reserve buys and sells. And that will be made public, but not instantly, because if that was made instantly you would have a lot people trading off of that and you would have too much impact the market - and again Ron agrees with that. So we will publicly have that data released after a time period of several months, enough time so it wouldn't be market sensitive. That will be part of the overall Federal regulation that we are redacting.

The House will pass [the bill] probably in October."

Bank Failure #84: Affinity Bank, Ventura, California

by Calculated Risk on 8/28/2009 09:19:00 PM

Affinity burned brightly

Extinguished today

by Soylent Green is People

From the FDIC: Pacific Western Bank, San Diego, California, Assumes All of the Deposits of Affinity Bank, Ventura, California

Affinity Bank, Ventura, California, was closed today by the California Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...A quarter of billion here, a quarter of a billion there ...

As of July 10, 2009, Affinity Bank had total assets of $1 billion and total deposits of approximately $922 million. ...

The FDIC and Pacific Western Bank entered into a loss-share transaction on approximately $934 million of Affinity Bank's assets. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $254 million. ... Affinity Bank is the 84th FDIC-insured institution to fail in the nation this year, and the ninth in California. The last FDIC-insured institution closed in the state was Vineyard Bank, National Association, Rancho Cucamonga, on July 17, 2009.