by Calculated Risk on 8/17/2009 01:00:00 PM

Monday, August 17, 2009

NAHB: Builder Confidence Slightly Higher in August

Click on graph for larger image in new window.

Click on graph for larger image in new window.

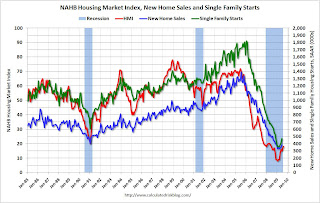

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) increased to 18 in August from 17 in July. The record low was 8 set in January.

This is still very low - and this is what I've expected - a long period of builder depression.

Note: any number under 50 indicates that more builders view sales conditions as poor than good. This second graph compares the NAHB HMI (left scale) with new home sales and single family housing starts (right scale). This is the August release for the HMI compared to the June data for starts and sales.

This second graph compares the NAHB HMI (left scale) with new home sales and single family housing starts (right scale). This is the August release for the HMI compared to the June data for starts and sales.

This shows that the HMI, single family starts and new home sales mostly move in the same direction - although there is plenty of noise month-to-month.

NOTE: For purposes of determining if starts are above or below sales, you have to use the quarterly data by intent. You can't compare the monthly total single family starts directly to new home sales, because single family starts include several categories not included in sales (like owner built units and high rise condos).

Press release from the NAHB (added):

Builder confidence in the market for newly built, single-family homes rose one point in August to its highest level in more than a year, according to the latest reading of the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. Building on a two-point gain in July, the HMI reached 18 this month, its highest point since June of 2008.

“Home builder expectations have been buoyed by the success of the first-time home buyer tax credit and its anticipated boost to buying activity leading up to the Nov. 30 expiration date,” said NAHB Chairman Joe Robson, a home builder from Tulsa, Okla. “The question is what happens after that ..."

...

“One very positive aspect of today’s report is the big gain registered in the component gauging home builders’ expectations for the next six months,” noted NAHB Chief Economist David Crowe. “This reflects anticipated sales stemming from the tax credit as well as recent signs that an economic recovery has begun. There is definitely a sense of hope among builders that the worst of the downturn is over and that a turning point is near at hand.”

...

NAHB is calling on Congress to extend the first-time home buyer tax credit for another year and to offer it to all income-eligible buyers.

Shanghai Cliff Diving

by Calculated Risk on 8/17/2009 11:03:00 AM

Just a note: The NAHB Housing Market Index will be released today at 1 PM ET, and the Fed Senior Loan Officer survey for July will probably be released today or tomorrow.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Shanghai SSE composite index is cliff diving again following the recent large increase. The index was off 5.8% on Friday today.

I've also added the S&P 500 for comparison (dashed blue line).

NY Fed: Empire State Manufacturing "Improved"

by Calculated Risk on 8/17/2009 08:33:00 AM

From the NY Fed: Empire State Manufacturing Survey

For the first time in considerably more than a year, the Empire State Manufacturing Survey indicates that conditions for New York manufacturers have improved. The general business conditions index increased 13 points, to 12.1, its highest level since November of 2007. Although the inventories index remained well below zero, the new orders and shipments indexes rose to their highest levels in many months. The prices paid index was positive, while the prices received index continued to be negative. Employment indexes were much improved from their recent low levels, although they remained below zero. Future indexes generally rose from last month and conveyed optimism about the six-month outlook; the capital expenditures index rose to its highest level in over a year.Here is the general business conditions index. Note that the data only goes back to July 2001 (chart to Jan 2002). Any reading above zero is expansion, so this index shows manufacturing is expanding in August.

Lowe's: 'Consumers Remain Cautious', Cuts Investment Plans

by Calculated Risk on 8/17/2009 08:17:00 AM

Press Release from Lowe's:

Lowe's Companies, Inc. ... the world's second largest home improvement retailer, today reported net earnings of $759 million for the quarter ended July 31, 2009, a 19.1 percent decline from the same period a year ago.According to the BEA data, home improvement has held up better than other areas of residential investment:

...

"Wavering consumer confidence, unseasonable weather in core markets, and restrained customer spending compared to last year's fiscal stimulus-aided results led to lower than expected sales in the second quarter," commented Robert A. Niblock, Lowe's chairman and CEO. "Cautious consumers remain reluctant to take on discretionary projects until signs of economic improvement are more evident."

...

In response to the challenging economic environment, which has resulted in declining demand for home improvement products, the company has re-evaluated its future store expansion plans. For 2010, expansion in North America will be below previously anticipated levels, and new store openings will likely be in the range of 35 to 45. Given this, the company has evaluated the pipeline of potential future store sites and made the decision to no longer pursue several projects.

emphasis added

Click on graph for updated image in new window.

Click on graph for updated image in new window.This graph shows home improvement investment as a percent of GDP.

Home improvement is at 1.08% of GDP, well off the high of 1.31% in Q4 2005 - but just back to the average of the last 50 years of 1.07%.

This would seem to suggest there remains downside risk to home improvement spending. Home Depot and Lowes are the largest home improvement retailers, and their results are something to watch.

NOTE: Home improvement is a rough estimate by the BEA - and could be lower. Also, there could be changes in spending patterns leading to a higher percentage of GDP on home improvement.

Sunday, August 16, 2009

Report: Guaranty Bank Bids Due Monday

by Calculated Risk on 8/16/2009 10:40:00 PM

The Financial Times is reporting that regulators have ask prospective buyers to submit bids for Guaranty Bank on Monday.

Guaranty Bank had $14.4 billion in assets at the end of Q1.

From Reuters: Regulators want Guaranty bids by Monday: report

Regulators are hoping that three banks that had bid for Colonial Bank -- Canada's Toronto Dominion, JPMorgan and Spain's BBVA -- will step in to bid for Guaranty ... private equity consortium, which includes Blackstone Group LP, Carlyle, Oak Hill Capital, TPG and the Texas banker Gerald Ford, is also considering a bid for GuarantySounds like another fairly large bank failure this week.

WSJ: Loss Rates for FDIC higher than during S&L Crisis

by Calculated Risk on 8/16/2009 09:25:00 PM

From the WSJ: Failed Banks Weighing on FDIC

For the 102 banks that have collapsed in the past two years, the FDIC's estimated cost averaged 34%. That is sharply higher than the 24% rate between 1989 and 1995, when 747 financial institutions were closed by regulators ... At three of the five banks that failed Friday, increasing the total to 77 so far this year, the financial hit to the agency's deposit-insurance fund is expected by the FDIC to be about 50% of their assets.The numbers for the Community Bank of Nevada, Las Vegas, Nevada are amazing. From the FDIC on Friday:

As of June 30, 2009, Community Bank of Nevada had total assets of $1.52 billion ... The cost to the FDIC's Deposit Insurance Fund is estimated to be $781.5 million.The question is: Why is the FDIC waiting so long on banks like Community Bank of Nevada?

Judge: WaMu's actions in Pushing for Foreclosure suggest "Bad Faith"

by Calculated Risk on 8/16/2009 03:54:00 PM

Jim Dwyer at the NY Times brings us the tale of WaMu pushing for foreclosure, even though the owner of the small multi-tenant building kept trying to pay in full after missing two payments in May and June 2008: Banks Help Small Debt Become a Big One (ht Edward)

Here is the order vacating the default from Judge Emily Jane Goodman:

"The facts in this case, in their simplicity, illustrate the state or property foreclosures in New York and the economic relationship and their borrowers, as well as the surrounding ironies."An interesting read.

WaMu actually had a strong incentive to push for foreclosure or payment in full (the entire amount of the note) or even to delay the proceedings. In the July 2008 Summons and Complaint, WaMu's attorney wrote:

As of the date hereof, (unless a different date is indicated) there is due the plaintiff upon said Note and Mortgage the following:So the note required 11.6% interest once the loan went into default (5% above the original rate). Since the building was worth more than the amount owed, by pushing for foreclosure, WaMu could collect this higher interest rate, legal fees, and other fees.

Principal balance : $460,283.26

Interest rate : 6.60%

Interest due from : April 1, 2008

Default interest : 11.60%

Default Interest due from : May 16, 2008

Late charges due as of : $150.09

May 1, 2008

Obligor shall also pay any prepayment, recapture and other fees as

set forth in the Note.

Since the default is vacated, the interest rate on late payments goes back to 6.6%, and I hope the Judge rules for WaMu's successor to pay the borrower's legal fees (usually a separate motion) - especially since she suggested WaMu had acted in bad faith.

A couple of excerpts from the Order:

"Even if the bank had no duty to alert defendant to the possible litigation, and even if their service methods are permissible, they clearly elected not to affect the most reliable available service - personal service - suggesting bad faith by Washington Mutual, especially when taken with their refusal to accept payment after only two months of lateness, as well as their decision to accelerate the entire loan."And from the footnotes:

The Court admonishes the Bank's counsel for submitting papers, referring to the oppositions papers of Owner's principal, a lawyer, as containing "fraud and deceit" and that his seeking to vacate the default and protect his property as "frivolous". These charges are not only disrespectful to another member of the bar, it is not supported by his or her papers.

Health Care Spending and PCE

by Calculated Risk on 8/16/2009 01:28:00 PM

By request ...  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The graph shows health care spending as a percent of GDP using three measures.

The first BEA measure, by major type of product, is of health care services as percent of GDP.

The larger BEA measure, by major function, includes health goods and services as a percent of GDP.

The Department of Health and Human Services includes investment in equipment and structures and is the broadest measure of health care spending. See here for a description of the HHS estimates:

These statistics, termed National Health Expenditure Accounts (NHEA), are compiled with the goal of measuring the total amount spent in the United States to purchase health care goods and services during the year. The amount invested in medical sector structures and equipment and in non-commercial research in the United States, to procure health services in the future, is also included.Here are the HHS estimates. (Note: 2008 in graph is based on HHS forecast).

The NHEA are generally compatible with the National Income and Product Accounts (NIPA), but bring a more complete picture of the health care sector of the nation’s economy together in one set of statistics.

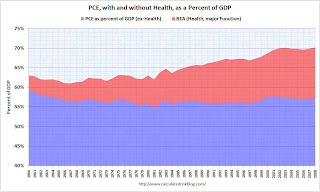

The second graph shows the broader BEA measure and Personal Consumption Expenditures (PCE) as a percent of GDP. (Note: we can't use the HHS measure because that includes investment, and investment is not included in PCE).

Important: y-axis doesn't start at zero to better show the change in PCE from health spending - Please do not use to compare health spending to overall PCE (starting from zero percent would be better).

Important: y-axis doesn't start at zero to better show the change in PCE from health spending - Please do not use to compare health spending to overall PCE (starting from zero percent would be better).This graph was inspired by an article in Business Week by Michael Mandel: Consumer Spending is *Not* 70% of GDP (ht jb).

Note that PCE ex-health has actually declined slightly over the last 50 years, but health care related spending has increased sharply (not exactly news!).

Mandel writes:

First, the category of “personal consumption expenditures” includes pretty much all of the $2.5 trillion healthcare spending, including the roughly half which comes via government.This isn't quite correct. Healthcare spending will be around $2.5 trillion this year (according to the HHS), but that includes investment (see first graph). The portion included in PCE is about $1.9 trillion (the blue line in the first graph and red shaded area in second graph).

But the more important point is what will happen in the future. From a demographic perspective, these are the best of times for healthcare expenses. The original baby busters (from 1925 to the early 1940s) are now at the peak medical expense years, but their medical care is being heavily supported by the baby boomers (now in their peak earning years).

Here is an animation I made several years ago to show this point. The shows the U.S. population distribution by age from 1920 to 2000 (plus 2005).

Watch for the original baby bust (shows up in 1930). Those are the people currently in retirement.

Animation updates every 2 seconds.

Just some food for thought ...

The Rentership Society

by Calculated Risk on 8/16/2009 10:11:00 AM

From the Boston Globe: President shifts focus to renting, not owning

The Obama administration, in a major shift on housing policy, is abandoning George W. Bush’s vision of creating an “ownership society’’ and instead plans to pump $4.25 billion of economic stimulus money into creating tens of thousands of federally subsidized rental units in American cities.This conversion of housing stock from ownership to rental units is already happening. Based on data from the Census Bureau, there have been over 4.3 million units added to the rental inventory since Q4 2004, far more than the 1.1 million new units completed as 'built for rent' since 2004. (see The Surge in Rental Units)

The idea is to pay for the construction of low-rise rental apartment buildings and town houses, as well as the purchase of foreclosed homes that can be refurbished and rented to low- and moderate-income families at affordable rates.

...

“People who were owners are going to be renting for a while,’’ said Margery Turner, vice president for research for The Urban Institute, a Washington think tank that studies social and economic policy.

“There is a housing stock that is sitting vacant. There is a real opportunity here’’ to use those homes as rental property and solve both problems, she said.

And this conversion is ongoing. According to the Campbell Survey, 29 percent of all existing home properties in Q2 were purchased by investors - probably mostly for use as rentals.

In addition, many of the modification programs are really turning homeowners into renters (or "debtowners"). Most mods just capitalize missed payments and fees, and reduce interest rates for a few years. Many of these "homeowners" will still have negative equity when the interest rate increases again, and this could be viewed as Single Family Public Housing.

The Rentership Society.

Saturday, August 15, 2009

Jim the Realtor: The $4 Million Gate

by Calculated Risk on 8/15/2009 10:59:00 PM

For a Saturday night - two stories from Jim - the 2nd one is a small high end development that was just foreclosed on by Wells Fargo.