by Calculated Risk on 8/08/2009 03:47:00 PM

Saturday, August 08, 2009

Another Apartment-to-Condo Conversion Disaster

From the Las Vegas Sun:

The worst investment over the past year was apartment conversions ... [Larry Murphy, president of SalesTraq] said.And the lender for the purchase and conversion of the Meridian? Corus Bank. From 2005:

The worst of the that segment was the Meridian at Hughes Center on Flamingo Road, east of the Strip that was converted from apartments to condominiums between 2005 and 2007, Murphy said.

The property, which had a failed attempt at trying to convert into a condo-hotel because of Clark County regulations, sold for $604 per square foot when it first entered the market. The average price was $539,000, Murphy said.

Through June, the average resale price has fallen to $87,611 or $121 a square foot, Murphy said. With that drop in price has come rising foreclosures. Murphy reports that 201 of the 680 units or 30 percent have been foreclosed upon, and that number is likely to rise. The foreclosures have been running as high as 25 a month so far in 2009, he said.

Murphy said he’s not surprised apartment conversions have fared the worst because in essence some are 20-year-old buildings that have a new granite countertop.

The Meridian consists of five four-story buildings containing 592,680 residential square feet.Not only has the average price fallen 84%, but the current average sales price of $121 per sq ft is significantly below the price of the loan amount from Corus in 2005 (of $188 per sq ft) - before the granite counter top improvements.

Corus ... felt comfortable with the market as this large conversion represents the Bank’s 8th transaction in the Las Vegas area within the last 13 months. “The Meridian appears to be a natural candidate for a condo conversion ...” said John Markowicz, Corus Bank Senior Vice President.

The Meridian appears to be a natural candidate for reconversion back to apartments.

U.K. Record 33 Thousand People Declared Insolvent in Q2

by Calculated Risk on 8/08/2009 11:38:00 AM

From the Independent: Banks take the blame as 33,000 are declared insolvent

More than 33,000 people were declared insolvent during the second quarter of the year, official statistics revealed yesterday, the highest number ever recorded. ...In the U.S., bankruptcy filings are rising sharply too, but are not are record levels because of the change to the bankruptcy law in 2005.

Almost 19,000 people were declared bankrupt during the second quarter of the year ... while a further 12,000 people entered into individual voluntary arrangements, agreements with creditors that fall short of full-scale bankruptcy. ... In addition, 2,000 people signed up to debt relief orders, a new type of insolvency agreement introduced in April for those with relatively small amounts of borrowing.

Insolvency experts warned that the combination of rising unemployment and the lack of stigma attached to options such as IVAs and debt relief orders meant the number of people affected would go on rising.

Mark Sands, director of personal insolvency at Tenon Recovery, predicted 140,000 people would be declared insolvent during 2009, 30 per cent more than in 2006 – the worst year on record so far – when the figure was 107,000.

"The overall record level of personal insolvencies, whilst at first shocking, hides the detail which suggests the worst is yet to come," Mr Sands warned.

For the U.S., see: Personal Bankruptcy Filings up 34.3 Percent compared to July 2008

When it comes to bankruptcy (or insolvency) apparently misery does love company.

NODs Increasing, Foreclosures Decreasing

by Calculated Risk on 8/08/2009 08:10:00 AM

This is a common story in many areas ... the following information is from San Diego.

San Diego real estate broker Edgewood121 attended a presentation this week by San Diego County Assessor / Recorder / County Clerk David Butler on NODs and foreclosures in the county. The following is a handout from the presentation: Click on document for larger image in new window.

Click on document for larger image in new window.

Acording to Edgewood121, Butler said that San Diego county is "expecting a wave of foreclosures in the near future and they are gearing up for it". (quoting Edgewood121 paraphrasing Butler). Butler thinks the banks are holding back, probably because of the various government programs.

Edgewood121 was left with the impression that "it is [only] a matter of time before more properties become available." And that the only reason prices appear to have stabilized "is because of the artificial choking-off of inventory, thereby creating urgency and multiple-offer scenarios."

Clearly the banks are hoping that the modification programs will reduce the number of foreclosures. However most mods just capitalize missed payments and fees (so the banks can pretend they are still whole), and reduce interest rates for a few years (so the homeowner can pretend they still own something of value). Extend and pretend.

Really these underwater "homeowners" are more renters than owners, and many will still have negative equity when the interest rate increases again. Perhaps we should call the modification programs Single Family Public Housing.

Friday, August 07, 2009

Problem Bank List (Unofficial)

by Calculated Risk on 8/07/2009 09:31:00 PM

This is an unofficial list of Problem Banks.

The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay - the most recent data is from June 30th. The Fed and OTC data is more timely, and the OCC a little lagged. Credit: surferdude808.

DISCLAIMER: This is an unofficial list, the information is from public sources and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

See description below table for Class and Cert (and a link to FDIC ID system).

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. You can enter the certificate number in the Institution Directory (ID) system "which will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failure #72: Community First Bank, Prineville, Oregon

by Calculated Risk on 8/07/2009 09:30:00 PM

Banks cash burn rate a firestorm

Smokey Bair on scene

by Soylent Green is People

From the FDIC: Home Federal Bank, Nampa, Idaho, Assumes All of the Deposits of Community First Bank, Prineville, Oregon

Community First Bank, Prineville, Oregon, was closed today ... As of July 5, 2009, Community First Bank had total assets of $209 million and total deposits of approximately $182 million.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $45 million. ... Community First Bank is the 72nd FDIC-insured institution to fail in the nation this year, and the third in Oregon. The last FDIC-insured institution to be closed in the state was Silver Falls Bank, Silverton, Oregon, on February 20, 2009.

Bank Failures 70 & 71: First State Bank and Community National Bank of Sarasota County, Florida

by Calculated Risk on 8/07/2009 06:15:00 PM

"A rising tide lifts all boats"

Not these submarines

by Soylent Green is People

From the FDIC: Stearns Bank, National Association, St. Cloud, Minnesota, Assumes All of the Deposits of First State Bank, Sarasota, Florida

First State Bank, Sarasota, Florida, was closed today by the Florida Office of Financial Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...

As of May 31, 2009, First State Bank had total assets of $463 million and total deposits of approximately $387 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $116 million. ... First State Bank is the 70th FDIC-insured institution to fail in the nation this year, and the fifth in Florida. The last FDIC-insured institution to be closed in the state was Integrity Bank, Jupiter, on July 31, 2009.

From the FDIC: Stearns Bank, National Association, St. Cloud, Minnesota, Assumes All of the Deposits of Community National Bank of Sarasota County, Venice, Florida

Community National Bank of Sarasota County, Venice, Florida, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...

As of June 30, 2009, Community National Bank of Sarasota County had total assets of $97 million and total deposits of approximately $93 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $24 million. ... Community National Bank of Sarasota County is the 71st FDIC-insured institution to fail in the nation this year, and the sixth in Florida. The last FDIC-insured institution to be closed in the state was First State Bank, Sarasota, earlier today.

Freddie Mac: House Price Improvement "Largely Seasonal"

by Calculated Risk on 8/07/2009 04:22:00 PM

Freddie Mac Press Release:

Freddie Mac had a positive net worth of $8.2 billion at June 30, 2009. As a result, no additional funding was required from Treasury under the terms of the Senior Preferred Stock Purchase Agreement (Purchase Agreement) for the second quarter.No mention of the amount of nonperforming loans.

...

Provision for credit losses was $5.2 billion for the second quarter of 2009, compared to $8.8 billion for the first quarter of 2009. The decrease was driven by a reduced rate of growth in the company's loan loss reserve due to the recent modest national home price improvements, which the company believes to be largely seasonal.

emphasis added

Consumer Credit Declines in June

by Calculated Risk on 8/07/2009 03:30:00 PM

From MarketWatch: June consumer credit down for 5th straight month

U.S. consumers reduced their debt in June for the fifth consecutive month, the Federal Reserve reported Friday. Total seasonally adjusted consumer debt fell $10.29 billion, or at a 4.9% annual rate, in June to $2.502 trillion. Consumer credit fell in eight of the past nine months.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the year-over-year (YoY) change in consumer credit. Consumer credit is off 2.8% over the last 12 months. The record YoY decline was 1.9% in 1991 - and that record has been shattered.

Note: Consumer credit does not include real estate debt.

Colonial BancGroup SEC Filing: Target of Criminal Investigation, Possible FDIC Seizure

by Calculated Risk on 8/07/2009 01:26:00 PM

From a SEC 8-K filed this morning:

On August 6, 2009, The Colonial BancGroup, Inc. (the Company or BancGroup) was informed by the U.S. Department of Justice that it is the target of a federal criminal investigation relating to the Company’s mortgage warehouse lending division and related alleged accounting irregularities. The Company has been informed that the alleged accounting irregularities relate to more than one year’s audited financial statements and regulatory financial reporting, and the Company’s Board of Directors and Audit Committee are making every effort to determine the impact of these alleged accounting irregularities on the Company’s financial statements and regulatory financial reporting. The Company intends to cooperate with the investigation.Here is the press release.

Earlier in 2009, BancGroup provided documents to the Special Inspector General for the Troubled Asset Relief Program (SIGTARP) in response to a subpoena issued by SIGTARP.

Also, the SEC has issued subpoenas to BancGroup seeking documents related to, among other things, BancGroup’s disclosures related to its participation in the U.S. Treasury Department’s Troubled Asset Relief Program and BancGroup’s disclosures respecting accounting for loan loss reserves. BancGroup has provided, and continues to provide, documents in response to these subpoenas.

On August 5, 2009, the Alabama State Banking Department provided notice to Colonial Bank that the Alabama State Banking Board will meet on August 12, 2009, at which time Colonial Bank will be asked to consent to the Superintendent’s exercise of his statutory authority to appoint the FDIC as receiver or conservator for the Bank if and when the Superintendent deems such appointment to be necessary. In the meantime, the Company continues to explore all possible capital-raising alternatives that would position it and Colonial Bank to comply with the requirements of the Orders to Cease and Desist to which they are subject.

emphasis added

Employment-Population Ratio, Part Time Workers, Average Workweek

by Calculated Risk on 8/07/2009 11:20:00 AM

Note: Several analysts follow the average workweek series to look for the end of a recession. The idea is that companies will increase the work week before they start hiring, so the average weekly hours might increase as a recession ends. The small increase in July will be viewed as a possible indicator. Other employment measures that are used to judge the end of a recession are the four-week moving average of initial unemployment claims (has fallen significantly) and the diffusion index (previous post).

A few more graphs based on the (un)employment report ...

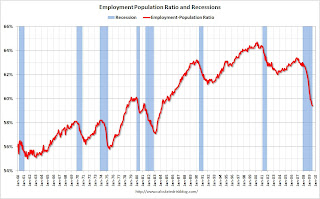

Employment-Population Ratio Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph show the employment-population ratio; this is the ratio of employed Americans to the adult population.

Note: the graph doesn't start at zero to better show the change.

The general upward trend from the early '60s was mostly due to women entering the workforce. As an example, in 1964 women were about 32% of the workforce, today the percentage is close to 50%.

This measure fell slightly in July to 59.4%, the lowest level since the early '80s. This also shows the weak recovery following the 2001 recession - and the current cliff diving!

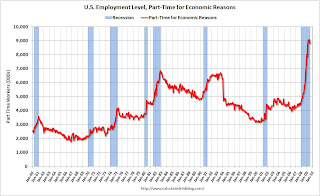

Part Time for Economic Reasons

From the BLS report:

The number of persons working part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in July at 8.8 million. The number of such workers rose sharply in the fall and winter but has been little changed for 4 consecutive months.Note: "This category includes persons who would like to work full time but were working part time because their hours had been cut back or because they were unable to find full-time jobs."

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) is at 8.8 million. This is slightly below the peak of 9.1 million in May.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) is at 8.8 million. This is slightly below the peak of 9.1 million in May.Note: the U.S. population is significantly larger today (about 305 million) than in the early '80s (about 228 million) when the number of part time workers almost reached 7 million. That is the equivalent of about 9.3 million today, so population adjusted this wasn't quite a record.

Average Weekly Hours

From the BLS report:

In July, the average workweek of production and nonsupervisory workers on private nonfarm payrolls edged up by 0.1 hour to 33.1 hours. The manufacturing workweek increased by 0.3 hour to 39.8 hours. Factory overtime was unchanged at 2.9 hours.

The average weekly hours has been declining since the early '60s, but usually falls faster during a recession. Average weekly hours in June was at the lowest level since the series began in 1964, and the uptick in July was very small.

The average weekly hours has been declining since the early '60s, but usually falls faster during a recession. Average weekly hours in June was at the lowest level since the series began in 1964, and the uptick in July was very small.Note: the graph doesn't start at zero to better show the change.

Earlier employment posts today: