by Calculated Risk on 8/07/2009 09:06:00 AM

Friday, August 07, 2009

Unemployment: Stress Tests, Unemployed over 26 Weeks, Diffusion Index

Note: earlier Employment post: Employment Report: 247K Jobs Lost, 9.4% Unemployment Rate . The earlier post includes a comparison to previous recessions.

Stress Test Scenarios Click on graph for larger image in new window.

Click on graph for larger image in new window.

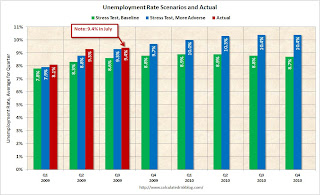

This graph shows the unemployment rate compared to the stress test economic scenarios on a quarterly basis as provided by the regulators to the banks (no link).

This is a quarterly forecast: the Unemployment Rate for Q3 just includes July, and will probably move higher. Once again, the unemployment rate is already higher than the "more adverse" scenario.

Note also that the unemployment rate has already exceeded the peak of the "baseline scenario".

Unemployed over 26 Weeks

The DOL report yesterday showed seasonally adjusted insured unemployment at 6.3 million, down from a peak of about 6.9 million. This raises the question of how many unemployed workers have exhausted their regular unemployment benefits (Note: most are still receiving extended benefits, although this is about to change).

The monthly BLS report provides data on workers unemployed for 27 or more weeks, and here is a graph ... The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

According to the BLS, there are almost 5.0 million workers who have been unemployed for more than 26 weeks (and still want a job). This is 3.2% of the civilian workforce.

Notice the peak happens after a recession ends, and the of long term unemployed peaked about 18 months after the end of the last two recessions (because of the jobless recovery). This suggests that even if the current recession officially ended this month, the number of long term unemployed would probably continue to rise through the end of 2010.

Diffusion Index

Here is a look at how "widespread" the job losses are using the employment diffusion index from the BLS.

In July, job losses continued in many of the major industry sectors.

BLS, July Employment Report

The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct.

The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct.From the BLS handbook:

The diffusion indexes for private nonfarm payroll employment are based on estimates for 278 industries, while the manufacturing indexes are based on estimates for 84 industries. Each component series is assigned a value of 0, 50, or 100 percent, depending on whether its employment showed a decrease, no change, or an increase over a given period. The average (mean) value is then calculated, and this percent is the diffusion index number.Think of this as a measure of how widespread the job losses are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS.

Before last Summer, the all industries employment diffusion index was in the 40s, suggesting that job losses were limited to a few industries. However starting in September the diffusion index plummeted. In March, the index hit 19.6, suggesting job losses were very widespread. The index has recovered since then to 30.1 in July, suggesting job losses are not as widespread across industries as in March - but losses continue in many industries.

The manufacturing diffusion index fell even further, from 40 in May 2008 to just 6 in January 2009. The manufacturing index has rebounded to 22.3 in July, indicating some improvement, but still widespread job losses across manufacturing industries.