by Calculated Risk on 8/07/2009 09:06:00 AM

Friday, August 07, 2009

Unemployment: Stress Tests, Unemployed over 26 Weeks, Diffusion Index

Note: earlier Employment post: Employment Report: 247K Jobs Lost, 9.4% Unemployment Rate . The earlier post includes a comparison to previous recessions.

Stress Test Scenarios Click on graph for larger image in new window.

Click on graph for larger image in new window.

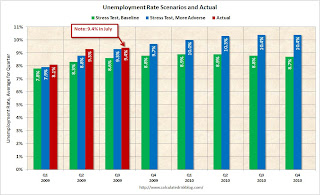

This graph shows the unemployment rate compared to the stress test economic scenarios on a quarterly basis as provided by the regulators to the banks (no link).

This is a quarterly forecast: the Unemployment Rate for Q3 just includes July, and will probably move higher. Once again, the unemployment rate is already higher than the "more adverse" scenario.

Note also that the unemployment rate has already exceeded the peak of the "baseline scenario".

Unemployed over 26 Weeks

The DOL report yesterday showed seasonally adjusted insured unemployment at 6.3 million, down from a peak of about 6.9 million. This raises the question of how many unemployed workers have exhausted their regular unemployment benefits (Note: most are still receiving extended benefits, although this is about to change).

The monthly BLS report provides data on workers unemployed for 27 or more weeks, and here is a graph ... The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

According to the BLS, there are almost 5.0 million workers who have been unemployed for more than 26 weeks (and still want a job). This is 3.2% of the civilian workforce.

Notice the peak happens after a recession ends, and the of long term unemployed peaked about 18 months after the end of the last two recessions (because of the jobless recovery). This suggests that even if the current recession officially ended this month, the number of long term unemployed would probably continue to rise through the end of 2010.

Diffusion Index

Here is a look at how "widespread" the job losses are using the employment diffusion index from the BLS.

In July, job losses continued in many of the major industry sectors.

BLS, July Employment Report

The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct.

The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct.From the BLS handbook:

The diffusion indexes for private nonfarm payroll employment are based on estimates for 278 industries, while the manufacturing indexes are based on estimates for 84 industries. Each component series is assigned a value of 0, 50, or 100 percent, depending on whether its employment showed a decrease, no change, or an increase over a given period. The average (mean) value is then calculated, and this percent is the diffusion index number.Think of this as a measure of how widespread the job losses are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS.

Before last Summer, the all industries employment diffusion index was in the 40s, suggesting that job losses were limited to a few industries. However starting in September the diffusion index plummeted. In March, the index hit 19.6, suggesting job losses were very widespread. The index has recovered since then to 30.1 in July, suggesting job losses are not as widespread across industries as in March - but losses continue in many industries.

The manufacturing diffusion index fell even further, from 40 in May 2008 to just 6 in January 2009. The manufacturing index has rebounded to 22.3 in July, indicating some improvement, but still widespread job losses across manufacturing industries.

Employment Report: 247K Jobs Lost, 9.4% Unemployment Rate

by Calculated Risk on 8/07/2009 08:30:00 AM

From the BLS:

Nonfarm payroll employment continued to decline in July (-247,000), and the unemployment rate was little changed at 9.4 percent, the U.S. Bureau of Labor Statistics reported today. The average monthly job loss for May through July (-331,000) was about half the average decline for November through April (-645,000). In July, job losses continued in many of the major industry sectors.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 247,000 in July. The economy has lost almost 5.7 million jobs over the last year, and 6.66 million jobs during the 19 consecutive months of job losses.

The unemployment rate declined slightly to 9.4 percent.

Year over year employment is strongly negative.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).For the current recession, employment peaked in December 2007, and this recession was a slow starter (in terms of job losses and declines in GDP).

However job losses have really picked up over the last year, and the current recession is now the 2nd worst recession since WWII in percentage terms (and the 1948 recession recovered very quickly) - and also in terms of the unemployment rate (only early '80s recession was worse).

With fewer job losses ("only" a rate of 3 million job losses per year), and the dip in unemployment rate, this will be consider an improvement. It is still a weak employment report. Much more to come ...

Thursday, August 06, 2009

Google Maps Shows Foreclosure Status

by Calculated Risk on 8/06/2009 08:58:00 PM

Note: some of the data appears out of date - but if the data was updated regularly this would be a useful tool.

Healdsburg Housing Bubble directs me to a Google maps feature that shows houses in various states of distress.

The distress ranges from delinquent payments, to homes that will be auctioned off, to REOs. It appears that Google uses several vendors for the data, and some of the vendors charge for more information.

Here is a look at a section of New York and New Jersey. Click on the red dots for more info (some data is free depending on the vendor). Use the map here, or click on View larger map and enter your own zip code.

View Larger Map

Fannie Mae: $14.8 Billion Loss, Requests $10.7 Billion from Treasury

by Calculated Risk on 8/06/2009 06:03:00 PM

Fannie Mae Press Release: Loss of $14.8 Billion Driven by Credit-Related Expenses

Fannie Mae (FNM/NYSE) reported a loss of $14.8 billion, ... in the second quarter of 2009, compared with a loss of $23.2 billion, ... in the first quarter of 2009. Second-quarter results were driven primarily by $18.8 billion of credit-related expenses, reflecting the ongoing impact of adverse conditions in the housing market, as well as the economic recession and rising unemployment. Credit-related expenses were partially offset by fair value gains. The company also reported a substantial decrease in impairment losses on investment securities, which was due in part to the adoption of new accounting guidance.Fannie Mae has reserved seating at the confessional. NPLs of $171.0 billion. Wow.

Taking into account unrealized gains on available-for-sale securities during the second quarter and an adjustment to our deferred tax assets due to the new accounting guidance, the loss resulted in a net worth deficit of $10.6 billion as of June 30, 2009. As a result, on August 6, 2009, the Director of the Federal Housing Finance Agency (FHFA), which has been acting as our conservator since September 6, 2008, submitted a request for $10.7 billion from the U.S. Department of the Treasury on our behalf under the terms of the senior preferred stock purchase agreement between Fannie Mae and the Treasury in order to eliminate our net worth deficit. FHFA has requested that Treasury provide the funds on or prior to September 30, 2009.

...

Credit-related expenses, which are the total provision for credit losses plus foreclosed property expense, were $18.8 billion, compared with $20.9 billion in the first quarter of 2009. Our provision for credit losses was $18.2 billion, compared with $20.3 billion in the first quarter of 2009. The reduction in the provision for credit losses in the second quarter was attributable to a slower rate of increase in both our estimated default rate and average loss severity, or average initial charge-off per default, as compared with the first quarter. Our provision exceeded net charge-offs of $4.8 billion by $13.4 billion, as we continued to build our combined loss reserves, which represent our current estimate of probable losses inherent in our guaranty book of business as of June 30, 2009.

Combined loss reserves were $55.1 billion on June 30, 2009, up from $41.7 billion on March 31, 2009, and $24.8 billion on December 31, 2008. ...

We are experiencing increases in delinquency and default rates for our entire guaranty book of business, including on loans with fewer risk layers. Risk layering is the combination of risk characteristics that could increase the likelihood of default, such as higher loan-to-value ratios, lower FICO credit scores, higher debt-to-income ratios and adjustable-rate mortgages. This general deterioration in our guaranty book of business is a result of the stress on a broader segment of borrowers due to the rise in unemployment and the decline in home prices. Certain states, higher risk loan categories and our 2006 and 2007 loan vintages continue to account for a disproportionate share of our foreclosures and chargeoffs.

Total nonperforming loans in our guaranty book of business were $171.0 billion on June 30, 2009, compared with $144.9 billion on March 31, 2009, and $119.2 billion on December 31, 2008. The carrying value of our foreclosed properties was $6.2 billion, compared with $6.4 billion on March 31, 2009, and $6.6 billion on December 31, 2008.

emphasis added

Residential Investment Components in Q2

by Calculated Risk on 8/06/2009 03:50:00 PM

More from the supplemental GDP tables released yesterday ...

Residential investment (RI), according to the Bureau of Economic Analysis (BEA), includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

Back in Q4 2008 - for the first time ever - investment in home improvements exceeded investment in new single family structures. This has continued through Q2 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

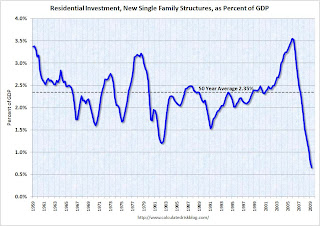

This graph shows the various components of RI as a percent of GDP for the last 50 years. The most important components are investment in single family structures followed by home improvement.

Investment in home improvement was at a $153.3 billion Seasonally Adjusted Annual Rate (SAAR) in Q2, significantly above investment in single family structures of $92.8 billion (SAAR).

Let's take a closer look at these two key components of RI: As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales.

As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales.

Currently investment in single family structures is at 0.66% of GDP, significantly below the average of the last 50 years of 2.35% - and almost half of the previous record low in 1982 of 1.20%.

And on home improvement: The third graph shows home improvement investment as a percent of GDP.

The third graph shows home improvement investment as a percent of GDP.

Home improvement is at 1.08% of GDP, well off the high of 1.31% in Q4 2005 - but just back to the average of the last 50 years of 1.07%.

This would seem to suggest there remains downside risk to home improvement spending. Home Depot and Lowes announce results in the middle of August, and this might be something to watch.

NOTE: Home improvement is a rough estimate by the BEA - and could be lower. Also, there could be changes in spending patterns leading to a higher percentage of GDP on home improvement.

Foreclosures: One Giant Wave, Still Building

by Calculated Risk on 8/06/2009 12:59:00 PM

Note: Graph is for Orange County only.

From Matt Padilla at the O.C. Register: Foreclosure wave gathers momentum

“To say there is a second wave implies the (current) wave has receded,” [Sam Khater, senior economist, First American CoreLogic] “I don’t see that the wave has receded.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph is from Matt based on data from American CoreLogic.

Khater said ... federal and state efforts have mostly delayed foreclosures, preventing few. ... So to tune out the noise, just look at the 90-day rate. In Khater’s view it shows “one giant wave.”UPDATE: Matt provided me with the definitions:

90 day delinquency rate: "everything 3 months late or more. Likely includes most all Foreclosures in Process. The categories are not separate."

Foreclosure Rate is actual foreclosures in process: "Everything with NOD and Trustee's Sale filing."

REO Rate: "Everything foreclosed but still held by bank or servicer. This category is separate from other two."

Hotel RevPAR off 15.5 Percent

by Calculated Risk on 8/06/2009 11:48:00 AM

From HotelNewsNow.com: STR reports US performance for week ending 1 August 2009

In year-over-year measurements, the industry’s occupancy fell 6.4 percent to end the week at 66.5 percent. Average daily rate dropped 9.6 percent to finish the week at US$97.48. Revenue per available room for the week decreased 15.5 percent to finish at US$64.86.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 7.6% from the same period in 2008.

The average daily rate is down 9.6%, and RevPAR is off 15.5% from the same week last year.

Comments: This is a multi-year slump. Although the occupancy rate was off 6.6 percent compared to last year, the occupancy rate is off about 10 percent compared to the same week in 2007.

Also, the end of July and beginning of August is the peak leisure travel period. The peak occupancy rate for the year was probably two weeks ago at 67%.

Also, the end of July and beginning of August is the peak leisure travel period. The peak occupancy rate for the year was probably two weeks ago at 67%.Note: Graph doesn't start at zero to better show the change.

Business travel is off much more than leisure travel, so the summer months are not as weak as other times of the year. September will be the real test for business travel.

Q2: Office, Mall and Lodging Investment

by Calculated Risk on 8/06/2009 09:31:00 AM

Here is a graph of office, mall and lodging investment through Q2 2009 based on the underlying detail data released yesterday by the BEA ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows investment in offices, lodging and malls as a percent of GDP.

The recent boom in lodging investment has been stunning. Lodging investment peaked at 0.32% of GDP in Q2 2008 and has started to decline (0.27% in Q2 2009). There was a small increase in Q2 2009 that is probably related to projects being completed. I expect lodging investment to continue to decline through at least 2010, to perhaps one-third of the peak.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and has fallen sharply. As projects are completed, mall investment will probably continue to decline through next year. As David Simon, Chief Executive Officer or Simon Property Group, the largest U.S. shopping mall owner said earlier this year:

"The new development business is dead for a decade. Maybe it’s eight years. Maybe it’s not completely dead. Maybe I’m over-dramatizing it for effect."Office investment as a percent of GDP peaked at 0.46% in Q3 2008 and has started to decline sharply. With the office vacancy rate rising sharply, office investment will also probably decline through at least 2010.

Notice that investment in all three categories typically falls for a year or two after the end of a recession, and then usually slowly recovers. Also - usually office investment is the most overbuilt in a boom, but this time the office market struggled for a few years after the stock market bubble burst and there was comparatively more investment in malls and hotels.

As projects are completed there will be little new investment in these categories probably at least through 2010. This will be a steady drag on GDP (nothing like the decline in residential investment though), and a steady drag on construction employment.

Weekly Unemployment Claims Fall to 550 Thousand

by Calculated Risk on 8/06/2009 08:31:00 AM

The DOL reports weekly unemployment insurance claims fell to 550,000 from 588,000 the week before.

In the week ending Aug. 1, the advance figure for seasonally adjusted initial claims was 550,000, a decrease of 38,000 from the previous week's revised figure of 588,000. The 4-week moving average was 555,250, a decrease of 4,750 from the previous week's revised average of 560,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending July 25 was 6,310,000, an increase of 69,000 from the preceding week's revised level of 6,241,000.

Click on graph for larger image in new window.

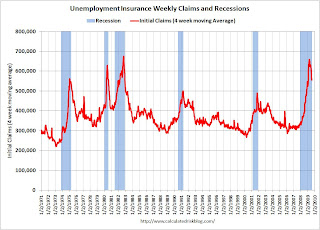

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 4,750 to 555,250, and is now 103,500 below the peak of 17 weeks ago. It appears that initial weekly claims have peaked for this cycle.

The level of initial claims has fallen fairly quickly - but the number is still very high (at 550,000), indicating significant weakness in the job market. The four-week average of initial weekly claims will probably have to fall below 400,000 before the total employment stops falling.

After earlier recessions (like '81), weekly claims fell quickly, but in the two most recent recessions, weekly claims declined a little and then stayed elevated for some time. A jobless recovery, with elevated weekly claims, seems likely this time too.

When the BLS reports tomorrow, I will graph the number of workers unemployed for 27 or more weeks. These workers have exhausted their regular benefits, although most are still on extended benefits.

Wednesday, August 05, 2009

More Cash for Clunkers

by Calculated Risk on 8/05/2009 11:26:00 PM

From CNBC: Senate Reaches Deal on $2 Billion 'Clunkers' Refill

The Senate reached a deal on saving the dwindling "cash for clunkers" program ... that would add $2 billion to the popular rebate program ...The deal is to allow some amendments to be offered that will be voted down, and then the bill will be passed exactly as it is.

... The Toyota Corolla is the top-selling vehicle on the list, followed by the Ford Focus, Honda Civic, Toyota Prius and the Toyota Camry. There is one SUV on the list, the Ford Escape, which also comes in a hybrid model. Six of the top-10 selling vehicles are built by foreign manufacturers, but most are built in North America.