by Calculated Risk on 8/01/2009 06:30:00 PM

Saturday, August 01, 2009

Tiered House Prices for Several Cities

The big question of the week was: "Are house prices near the bottom?"

My feeling has been that house prices are probably close to the bottom in the lower priced bubble areas with heavy foreclosure activity (Lawler's "de-stickification"). Inventories are very low in many of these areas, and activity has been fairly high as first time buyers and investors buy distressed properties.

However it appears there are more foreclosures coming, and the level of inventory will be the key to future price declines.

My view is that mid-to-high priced bubble areas - with far fewer distressed sales than the low-to-mid priced areas, and much higher inventory-to-sales levels, and few move-up buyers - will see continued real price declines, although the pace of price declines will probably slow.

That still seems reasonable, and it depends on location. Here is a look as tiered house price indices from Case-Shiller to see if the lower priced areas have fallen further than the high priced areas.

All graphs use the seasonally adjusted indices and nominal prices (not inflation adjusted).

The second graph is for Miami. Here is appears that all tiers are now at about the same level. |  |

This graph is for Washington, D.C. |  |

| This graph is for Boston. The pattern is slightly different - the low end is still above the mid and high tiers. |

Next up is San Diego. Although the low end tier has fallen the furthest, the high end tier pricing is pretty low for San Diego because of the mix. |  |

| The last graph is for San Francisco and show the the low end has increased more than the mid-to-high tiers, and has also fallen further. |

This was an interesting exercise (at least for me!), but I'm not completely comfortable with the tiered pricing because the buckets are impacted by the mix of homes sold.

Unemployment: 1.5 Million Workers will Exhaust Extended Benefits by end of 2009

by Calculated Risk on 8/01/2009 03:35:00 PM

From the NY Times: Prolonged Aid to Unemployed Is Running Out

Over the coming months, as many as 1.5 million jobless Americans will exhaust their unemployment insurance benefits, ending what for some has been a last bulwark against foreclosures and destitution.The National Employment Law Project report breaks down the extended benefit programs by state. The programs are triggered by the state unemployment rate. About half the states qualify for 53 weeks on top of the regular 26 weeks for unemployment benefits. Other states qualify for 46, 33 and 20 weeks of extended benefits.

... laid-off workers in nearly half the states can collect benefits for up to 79 weeks, the longest period since the unemployment insurance program was created in the 1930s. But unemployment in this recession has proved to be especially tenacious, and a wave of job-seekers is using up even this prolonged aid.

Tens of thousands of workers have already used up their benefits, and the numbers are expected to soar in the months to come, reaching half a million by the end of September and 1.5 million by the end of the year, according to new projections by the National Employment Law Project, a private research group.

From the report:

There are now an all-time high of 4.4 million Americans who have been out of work for more than six months, up dramatically from 2.6 million in February. That translates into 29% of jobless workers who have been out of work for six months, a record since data were first reported in 1948.Here is a graph I posted earlier this week of the number of workers who have exhausted their regular benefits:

Click on graph for larger image in new window.

Click on graph for larger image in new window.The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

According to the BLS, there are almost 4.4 million workers who have been unemployed for more than 26 weeks (and still want a job). This is 2.8% of the civilian workforce.

Right now very few workers have exhausted their unemployment benefits, but there is tidal wave coming. The Law Project estimates 0.5 million workers will have exhausted their extended benefits by the end of September, and close to 1.5 million by the end of 2009. Unless the unemployment rate starts to decline, the numbers will continue to grow rapidly in 2010.

CRE Report: U.S. Postal Service Might Consolidate up to 14 million Square Feet

by Calculated Risk on 8/01/2009 01:18:00 PM

From Costar: Post Office Looking at Consolidation of 3,243 of its 4,851 Largest Branches and Stations (ht John)

The Postal Service sent a notice to American Postal Workers Union executives this summer that it was considering consolidation options in every major metro market in the country and would consider closing 3,243 of its 4,851 largest branches and centers in the review process. ... The review process was to last most of the summer ... but they want the consolidation to occur by October 2010.Here is the GAO report:

...

According to USPS records, it owns 8,546 facilities totaling 219.6 million square feet and leases another 25,272 locations totaling 912.2 million square feet. ...

[T]he USPS could be studying the consolidation of more than 14 million square feet of retail/office/industrial space across the country. To put that in perspective, 14 million square feet would be the equivalent of about all of the vacant retail space in a market such as Boston or Cleveland or Denver or the Inland Empire or Tampa.

...

In May, the U.S. Government Accountability Office (GAO) issued a report en titled "U.S. Postal Service - Network Rightsizing Needed to Help Keep USPS Financially Viable." The GAO study criticized the USPS for failing to take the necessary steps to remain viable, such as "rightsizing its retail and mail processing networks by consolidating operations and closing unnecessary facilities," and "reducing the size of its workforce."

Network rightsizing by consolidating operations and closing unnecessary facilities is likely to be only one of many steps that USPS will need to take to remain financially viable in the long run. ... We recognize that USPS faces formidable resistance to closing and consolidating facilities because of concerns about the effects of such actions on service, employees, and local communities.

Click on chart for larger image in new window.

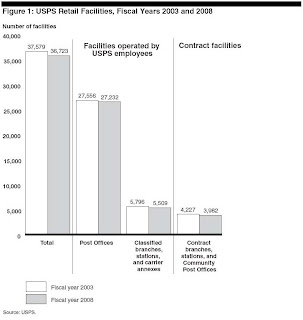

Click on chart for larger image in new window.The postal service has already reduced their footprint a little since 2003 as shown in the chart from the GAO.

But the GAO report suggests the next reductions may be much more significant. How about another 14 million square feet of vacant retail space on the market?

FDIC Bank Failure Update

by Calculated Risk on 8/01/2009 08:00:00 AM

The FDIC closed five more banks on Friday, and that brings the total FDIC bank failures to 69 in 2009. The following graph shows bank failures by week in 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Note: Week 1 on graph ends Jan 9th.

The pace has really picked up recently, with the FDIC seizing almost 5 banks per week in July, and with 5 months to go, it seems 125 to 150 bank failures this year is likely.

The current pace suggests there will be more failures in 2009 than in the early years of the S&L crisis. From 1982 thorough 1984 there were about 100 failures per year, and then the number of failures really increased as the 2nd graph shows. There were 28 weeks during the S&L crisis when regulators closed 10 or more banks, and the peak was April 20, 1989 with 60 bank closures (there were 7 separate weeks with more than 30 closures in the late '80s and early '90s).

There were 28 weeks during the S&L crisis when regulators closed 10 or more banks, and the peak was April 20, 1989 with 60 bank closures (there were 7 separate weeks with more than 30 closures in the late '80s and early '90s).

The 2nd graph covers the entire FDIC period (annually since 1934).

For a graph that includes the 1920s and early '30s (before the FDIC was enacted) see the 3rd graph here.

Of course the number of banks isn't the only measure. Many banks today have more branches, and far more assets and deposits.

With Colonial (about $25.5 billion in assets), Guaranty (Texas, with close to $15.4 billion in assets) and Corus ($7.7 billion) all on the ropes, the dollars could really add up later this year. Corus and Guaranty will probably be seized in the next few weeks.

The FDIC era source data is here - including by assets (in most cases) - under Failures and Assistance Transactions

The pre-FDIC data is here.

Friday, July 31, 2009

Colonial Deal Collapses, Expresses Substantial Doubt as Going Concern

by Calculated Risk on 7/31/2009 09:24:00 PM

From the WSJ: Colonial Financing Pact Collapses

Colonial BancGroup Inc.'s second-quarter loss widened on big charges and a key financing deal fell through, pushing the company out of compliance with Alabama capital requirements and causing doubts about the company's ability to remain a going concern.From the SEC 8-K filed today:

...

In June, the Colonial Bank unit agreed to oversight by the Federal Deposit Insurance Corp. and Alabama Banking Department and to other steps ... a $26 billion institution.

Going Concern AssessmentSomething for another BFF.

As a result of the above described regulatory actions and the current uncertainties associated with Colonial’s ability to increase its capital levels to meet regulatory requirements, management has concluded that there is substantial doubt about Colonial’s ability to continue as a going concern. The Company expects to update its 2008 financial statements contained in the Company’s Annual Report on Form 10-K, prior to filing its June 30, 2009 Form 10-Q. The Company is working to implement the Capital Action Plan described above which includes strategies to increase capital or to sell the Company in order to address the uncertainties giving rise to the going concern assessment.

Bank Failure #69 in 2009: Mutual Bank, Harvey, Illinois

by Calculated Risk on 7/31/2009 08:16:00 PM

Our oversight, their ethics

We should demand more

by Soylent Green is People

From the FDIC:

Mutual Bank, Harvey, Illinois, was closed today by the Illinois Department of Financial Professional Regulation - Division of Banking, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...That makes five today ...

As of July 16, 2009, Mutual Bank had total assets of $1.6 billion and total deposits of approximately $1.6 billion.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $696 million. ... Mutual Bank is the 69th FDIC-insured institution to fail in the nation this year, and the thirteenth in Illinois. The last FDIC-insured institution to be closed in the state was First National Bank of Danville, Danville, on July 2, 2009.

Bank Failures 65 through 68

by Calculated Risk on 7/31/2009 06:16:00 PM

Hasn't run out of money

Four traded so far.

by Soylent Green is People

From the FDIC: Herring Bank, Amarillo, Texas, Assumes All of the Deposits of First State Bank of Altus, Altus, Oklahoma

First State Bank of Altus, Altus, Oklahoma, was closed today by the Oklahoma State Banking Department, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: Stonegate Bank, Fort Lauderdale, Florida, Assumes All of the Deposits of Integrity Bank, Jupiter, Florida

As of June 19, 2009, First State Bank of Altus had total assets of $103.4 million and deposits of approximately $98.2 million. In addition assuming all of the deposits of the failed bank, Herring Bank will purchase approximately $64.4 million in assets. The FDIC will retain the remaining assets for later disposition.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $25.2 million.... First State Bank of Altus is the 65th FDIC-insured institution to fail in the nation this year, and the first in Oklahoma. The last FDIC-insured institution to be closed in the state was American Bank of Commerce, Oklahoma City, on March 26, 1992.

Integrity Bank, Jupiter, Florida, was closed today by the Florida Office of Financial Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver....From the FDIC: First Financial Bank, National Association, Hamilton, Ohio, Assumes All of the Deposits of Peoples Community Bank, West Chester, Ohio

As of June 5, 2009, Integrity Bank had total assets of $119 million and total deposits of approximately $102 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $46 million. ... Integrity Bank is the 66th FDIC-insured institution to fail in the nation this year, and the fourth in Florida. The last FDIC-insured institution to be closed in the state was BankUnited, FSB, Coral Gables, on May 21, 2009.

Peoples Community Bank, West Chester, Ohio, was closed today by the Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: Crown Bank, Brick, New Jersey, Assumes All of The Deposits of First Bankamericano, Elizabeth, New Jersey

As of March 31, 2009, Peoples Community Bank had total assets of $705.8 million and total deposits of approximately $598.2 million. ...

The FDIC and First Financial Bank, N.A. entered into a loss-share transaction on approximately $657.6 million of Peoples Community Bank's assets....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $129.5 million. ... Peoples Community Bank is the 67th FDIC-insured institution to fail in the nation this year, and the first in Ohio. The last FDIC-insured institution to be closed in the state was Miami Valley Bank, Lakeview, October 4, 2007.

First BankAmericano, Elizabeth, New Jersey, was closed today by the New Jersey Department of Banking and Insurance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...That is four so far ...

As of July 16, 2009, First BankAmericano had total assets of $166 million and total deposits of approximately $157 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $15 million. ... First BankAmericano is the 68th FDIC-insured institution to fail in the nation this year, and the second in New Jersey. The last FDIC-insured institution to be closed in the state was Citizens Community Bank, Ridgewood, May 1, 2009.

Market Mishmash

by Calculated Risk on 7/31/2009 03:55:00 PM

As we wait for the first bank failure today, let me start with a comment on house prices:

Tech Ticker has a story on house prices today: Housing Bottom? No, the Mother of All Head Fakes. The house price issue is worth some thought this weekend. Although the seasonal adjustment for Case-Shiller appears insufficient, I checked it with some models, and I think it is calculated correctly. I'll post some thoughts on house prices this weekend.

And on vacant CRE, it is hard to beat this, from the WSJ: Giant Warehouses Dot Phoenix Desert Awaiting Imports That Never Came

Along a 15-mile stretch of desert, amid strip malls and unfinished subdivisions, nearly a dozen giant warehouses sit silent and empty. They are relics of this city's dream of becoming a national warehouse hub ...And this is a corollary to bank failures, from the Seattle Times: Frontier Financial to be bought by takeover firm (ht Mark)

Today, an empty, half-mile-long warehouse lingers from that vision. The building's 1.2 million square feet could fit 193 full-size copies of the Statue of Liberty. Its parking lot has room for 292 tractor trailers. But on a recent morning the only signs of life were a security guard's trailer, golf cart and bicycle.

...

"It's not a pretty story," says developer Jonathan Tratt ... Mr. Tratt's warehouse is one of 11 storage complexes completed in southwest Phoenix in 2008, with two more set to be finished this year. Those 13 properties combined will have eight million square feet and are now 86% empty ...

Frontier Financial and SP Acquisition Holdings announced this morning a deal that will give Frontier shareholders 2.5 million SPAH shares ...Probably a number of weaker banks will be acquired this year. It is better than being seized by the FDIC.

In March, Everett-based Frontier Financial had agreed to submit to tighter supervision by regulators over the way it lends money and manages its operations.

On Wednesday, the company with $4 billion in assets reported a second-quarter loss of $50 million ... Nonperforming assets accounted for 20.5 percent of the company's total assets at the end of June, up from 3 percent a year ago ...

And finally from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

More Cash for More Clunkers

by Calculated Risk on 7/31/2009 02:57:00 PM

From NY Times: House Votes for $2 Billion Fund to Extend ‘Clunker’ Plan (ht Paul)

The House of Representatives voted to provide an emergency $2 billion for the “cash for clunkers” program on Friday, and the White House declared the program very much alive, even though car buyers appear to have already snapped up the $1 billion that Congress originally appropriated.

...

The Senate, which will be in session next week, will take up the program then.

...

“If you were planning on going to buy a car this weekend using this program, the program continues to run,” [Robert Gibbs, the chief White House spokesman] said. “If you meet the requirements of the program, the certificates will be honored.”