by Calculated Risk on 7/24/2009 06:10:00 PM

Friday, July 24, 2009

Bank Failures 59 through 64: Six Bank Subsidiaries of Security Bank Corporation, Macon, Georgia

Gwinnett, North Fulton, Houston,

A Cat. Six Fail Storm

by Soylent Green is People

From the FDIC: State Bank and Trust Company, Pinehurst, Georgia, Assumes All of the Deposits of the Six Bank Subsidiaries of Security Bank Corporation, Macon, Georgia

The six bank subsidiaries of Security Bank Corporation, Macon, Georgia, were closed today by the Georgia Department of Banking and Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with State Bank and Trust Company, Pinehurst, Georgia, to assume all of the deposits of the six bank subsidiaries of Security Bank Corporation.That makes seven today ...

The six banks involved in today's transaction are: Security Bank of Bibb County, Macon, GA, with $1.2 billion in total assets and $1 billion in deposits; Security Bank of Houston County, Perry, GA, with $383 million in assets and $320 million in deposits; Security Bank of Jones County, Gray, GA, with $453 million in assets and $387 million in deposits; Security Bank of Gwinnett County, Suwanee, GA, with $322 million in assets and $292 million in deposits; Security Bank of North Metro, Woodstock, GA, with $224 million in assets and $212 million in deposits; and Security Bank of North Fulton, Alpharetta, GA, with $209 million in assets and $191 million in deposits.

...

As of March 31, 2009, the six banks had total assets of $2.8 billion and total deposits of approximately $2.4 billion. In addition to assuming all of the deposits of the failed bank, State Bank and Trust Company will acquire $2.4 billion in assets.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $807 million. ... The failure of the six banks brings the nation's total number this year to 64, and the total for Georgia to 16. The last FDIC-insured institution to be closed in the state was First Piedmont Bank, Winder, on July 17, 2009.

Bank Failure #58: Waterford Village Bank, Clarence, New York

by Calculated Risk on 7/24/2009 05:47:00 PM

Bankers caught breaking their trust

"Acting stupidly"

by Soylent Green is People

From the FDIC: Evans Bank, National Association, Angola, New York, Assumes All of the Deposits of Waterford Village Bank, Clarence, New York

Waterford Village Bank, Clarence, New York, was closed today by the New York State Banking Department, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...It is Friday and New York is on the FDIC map (not counting Lehman, Bear Stearns, etc.)

As of March 31, 2009, Waterford Village Bank had total assets of $61.4 million and total deposits of approximately $58 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $5.6 million. ... Waterford Village Bank is the 58th FDIC-insured institution to fail in the nation this year, and the first in New York. The last FDIC-insured institution to be closed in the state was Reliance Bank, White Plains, March 19, 2004.

Market and Bank Watch

by Calculated Risk on 7/24/2009 04:00:00 PM

Both Corus and Guaranty Bank (Texas) are on the mat being counted out.

Financial Guaranty has even agreed to be seized.

Apparently Corus bidders have a couple more weeks. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

The S&P 500 is up 44.7% from the bottom (303 points), and still off 37.4% from the peak (586 points below the max).

This puts the recent rally into perspective. The S&P 500 first hit this level in Sept 1997; about 12 years ago. The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Double Up to Catch Up!

by Calculated Risk on 7/24/2009 01:50:00 PM

From the NY Times: California Pension Fund Hopes Riskier Bets Will Restore Its Health (ht several)

[Joseph A. Dear, the fund’s new head of investments] wants to embrace some potentially high-risk investments in hopes of higher returns. He aims to pour billions more into beaten-down private equity and hedge funds. Junk bonds and California real estate also ride high on his list. And then there are timber, commodities and infrastructure.The post title is an old gambling saying. Actually now is probably a better time to buy some of these assets than a few years ago.

That’s right, he wants to load up on many of the very assets that have been responsible for the fund’s recent plunge.

The Surge in Rental Units

by Calculated Risk on 7/24/2009 11:36:00 AM

Please see this earlier post for graphs of the homeownership rate, and homeowner and rental vacancy rates.

The supply of rental units has been surging: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).

The total number of rental units (red and blue) bottomed in Q2 2004, and started climbing again. Since Q2 2004, there have been over 4.3 million units added to the rental inventory.

Note: please see caution on using this data - this number might be a little too high, but the concepts are the same even with a lower increase.

This increase in units has more than offset the recent strong migration from ownership to renting, so the rental vacancy rate is now at a record 10.6%.

Where did these approximately 4.3 million rental units come from?

The Census Bureau's Housing Units Completed, by Intent and Design shows 1.1 million units completed as 'built for rent' since Q2 2004. This means that another 3.2 million or so rental units came mostly from conversions from ownership to rentals.

These could be investors buying REOs for cash flow, condo "reconversions", builders changing the intent of new construction (started as condos but became rentals), flippers becoming landlords, or homeowners renting their previous homes instead of selling.

This huge surge in rental supply has pushed down rents, and pushed the rental vacancy rate to record levels.

Yes, people are doubling up with friends and family during the recession, and some renters are now buying again, but the main reason for the record vacancy rate is the surge in supply.

Q2: Homeowner Vacancy Rate Declines, Rental Vacancy Rate at Record High

by Calculated Risk on 7/24/2009 10:36:00 AM

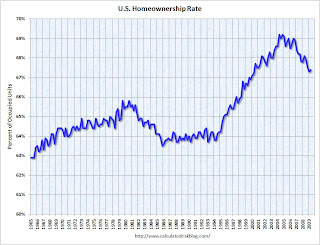

This morning the Census Bureau reported the homeownership and vacancy rates for Q2 2009. Here are a few graphs ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

The homeownership rate increased slightly to 67.4% and is now at the levels of Q2 2000.

Note: graph starts at 60% to better show the change.

The homeownership rate increased in the '90s and early '00s because of changes in demographics and "innovations" in mortgage lending. The increase due to demographics (older population) will probably stick, so I expect the rate to decline to the 66% to 67% range - and not all the way back to 64% to 65%.

The homeowner vacancy rate was 2.5% in Q2 2009. This is the lowest vacancy rate since mid-2006, but still very high. A normal rate for recent years appears to be about 1.7%.

This is the lowest vacancy rate since mid-2006, but still very high. A normal rate for recent years appears to be about 1.7%.

This leaves the homeowner vacancy rate about 0.8% above normal, and with approximately 75 million homeowner occupied homes; this gives about 600 thousand excess vacant homes.

The rental vacancy rate increased to a record 10.6% in Q2 2009.  It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 40 million rental units in the U.S. If the rental vacancy rate declined from 10.6% to 8%, there would be 2.6% X 40 million units or about 1.04 million units absorbed.

It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 40 million rental units in the U.S. If the rental vacancy rate declined from 10.6% to 8%, there would be 2.6% X 40 million units or about 1.04 million units absorbed.

These excess units will keep pressure on rents and house prices for some time.

Guaranty Financial: Probably "Not be able to continue as a going concern"

by Calculated Risk on 7/24/2009 08:02:00 AM

To start BFF off ...

Guaranty Financial Group filed an 8-K with the SEC last night (ht Russ). Here are a few excerpts:

[T]he Company no longer believes that it will be possible for the Company or the Bank to raise sufficient capital to comply with the Orders to Cease and Desist described in the Company’s Current Report on Form 8-K filed on April 8, 2009. In light of these developments, the Company believes that it is probable that it will not be able to continue as a going concern.That is more than your typical 'going concern' warning.

emphasis added

Current stockholders will get nothing:

The Company continues to cooperate with the OTS and the FDIC as they pursue potential alternatives for the business of the Bank. Any such transaction would not be expected to result in the receipt of any proceeds by the stockholders of the Company.The bank has consented to be seized:

[T]he OTS has directed that the Board of Directors of the Bank consent to the OTS exercising its statutory authority to appoint the FDIC as receiver or conservator for the Bank. ... The Board has complied with the OTS demand for such consent, but the appointment of a receiver or conservator has not yet occurred.Its subsidiary, Guaranty Bank, is deep in the hole:

[T]he Bank’s core capital ratio stood at negative 5.78% as of March 31, 2009. The Bank’s total risk based capital ratio as of March 31, 2009 stood at negative 5.52%. Both of these ratios result in the Bank being considered critically under-capitalized under regulatory prompt corrective action standards.It is just a matter of when. Guaranty Financial will be the largest bank failure this year with approximately $14 billion in assets.

Here is a story from Brendan Case at the Dallas Morning News: Guaranty Bank may face federal control

California Budget: Misery Loves Company

by Calculated Risk on 7/24/2009 12:51:00 AM

One of the key elements of the new California budget is to have the state use money that is normally allocated to cities. This is a crushing blow to the finances of many cities. Here is an example from the O.C. Register: State revenue raids could bankrupt city, officials say

Placentia city officials are howling in effort to keep state hands out of their coffers. The plan to seize millions could bankrupt the city, they say.

"We may have to declare bankruptcy – that's how serious this is," said City Administrator Troy Butzlaff. "This is something the system can't endure. We just avoided bankruptcy by doing all the right things; by cutting back, by getting concessions from staff, by cutting $4.5 million over last year's budget."

...

Butzlaff said earlier this week the state legislators' budget proposals could take roughly $900,000 from gas tax money, $800,000 from property tax money, and $400,000 from the Redevelopment Agency.

...

"Some of my cities are in good shape, some are teetering on the edge," [State Sen. Bob Huff, R- Diamond Bar] said. "It's not fair for the state to outsource its miseries to the local level."

Thursday, July 23, 2009

More on Foreclosure Modification Scams

by Calculated Risk on 7/23/2009 09:22:00 PM

From Matt Padilla at the O.C. Register: DA raids Ladera homes tied to alleged loan-aid scam

Investigators with the Orange County District Attorney early Thursday morning searched three Ladera Ranch homes tied to an alleged foreclosure rescue scam.Once again some of these scamsters are former subprime mortgage brokers. I bet many people hope Ms. Henderson is successful!

...

Attorney General Jerry Brown last week said he has filed suit against the men for allegedly charging homeowners $4,000 in upfront fees and then failing to get them cheaper payments on their home loans.

...

Earlier in the week District Attorney Tony Rackauckas told a group of community leaders his office is expanding investigations into real estate fraud.

Elizabeth Henderson, an assistant DA who spoke at the same event in Garden Grove, said 30% of the cases handled by the office’s major fraud unit are tied to real estate, up from an average 10% in past years ...

“We want to send people to jail,” she said.

Report: Corus Bank may be Seized by early August

by Calculated Risk on 7/23/2009 07:14:00 PM

Another preview for BFF ...

From Bloomberg: Lubert-Adler Said to Mull Bid for Chicago’s Corus Bankshares

Lubert-Adler Partners LP, the Philadelphia-based private-equity firm, is among at least four investors weighing bids for Corus Bankshares Inc. ... The Federal Deposit Insurance Corp. has indicated that the bank ... may be seized as soon as Aug. 6, the people said.It is just a matter of when ...