by Calculated Risk on 7/18/2009 12:07:00 AM

Saturday, July 18, 2009

"The Money Game"

Click on painting for larger image in new window.

Click on painting for larger image in new window.

"The Money Game"

Image posted with permission from Laguna Beach artist Scott Moore.

This images is of a five foot by seven and a half foot oil painting.

Scott posted a step-by-step outline here of how he designed and painted the image (with much more detail). In the detail you can see Fannie and Freddie, Madoff, Countrywide, and much more. Enjoy.

Friday, July 17, 2009

Bank Failures #56 & #57: Temecula Valley Bank, Temecula, CA and Vineyard Bank, Rancho Cucamonga, CA

by Calculated Risk on 7/17/2009 09:23:00 PM

This makes four today. We've discussed these two before ...

Failure swings.... to deep center

A double this time.

by Soylent Green is People

From the FDIC: California Bank & Trust, San Diego, California, Assumes All of the Deposits of Vineyard Bank, National Association, Rancho Cucamonga, California

Vineyard Bank, National Association, Rancho Cucamonga, California, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver.From the FDIC: First-Citizens Bank and Trust Company, Raleigh, North Carolina, Assumes All of the Deposits of Temecula Valley Bank, Temecula, California

...

As of March 31, 2009, Vineyard Bank, N.A. had total assets of $1.9 billion and total deposits of approximately $1.6 billion.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $579 million. ... Vineyard Bank, N.A. is the 56th FDIC-insured institution to fail in the nation this year, and the seventh in California. The last FDIC-insured institution to be closed in the state was Mirae Bank, Los Angeles, on June 26, 2009.

Temecula Valley Bank, Temecula, California, was closed today by the California Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver.

...

As of May 31, 2009, Temecula Valley Bank had total assets of $1.5 billion and total deposits of approximately $1.3 billion.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $391 million. ... Temecula Valley Bank is the 57thth FDIC-insured institution to fail in the nation this year, and the eighth in California. The last FDIC-insured institution to be closed in the state was Vineyard Bank, National Association, Rancho Cucamonga, also today.

Report: Record Drop in State Tax Revenues

by Calculated Risk on 7/17/2009 08:08:00 PM

No surprise ...

From the NY Times: State Tax Revenues at Record Low, Rockefeller Institute Finds (ht Ann)

The anemic economy decimated state tax collections during the first three months of the year ... The drop in revenues was the steepest in the 46 years that quarterly data has been available.Here is the report: State Tax Decline in Early 2009 Was the Sharpest on Record

Over all, the report found that state tax collections dropped 11.7 percent in the first three months of 2009, compared with the same period last year.

...

All the major sources of state tax revenue — sales taxes, personal income taxes and corporate income taxes — took serious blows ...

And it looks much worse in Q2:

Early figures for April and May of 2009 show an overall decline of nearly 20 percent for total taxes, a further dramatic worsening of fiscal conditions nationwide.Note: an earlier report was on state pesonal income taxes - this is all state taxes.

Bank Failure #55: BankFirst, Sioux Falls, South Dakota

by Calculated Risk on 7/17/2009 06:14:00 PM

Two down, many to follow

Quaff to banks gone bye.

by Soylent Green is People

From the FDIC:

BankFirst, Sioux Falls, South Dakota, was closed today by the South Dakota Division of Banking, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Alerus Financial, National Association, Grand Forks, North Dakota, to assume all of the deposits of BankFirst.That makes two today ...

...

As of April 30, 2009, BankFirst had total assets of $275 million and total deposits of approximately $254 million.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $91 million. ... BankFirst is the 55th FDIC-insured institution to fail in the nation this year, and the first in South Dakota. The last FDIC-insured institution to be closed in the state was First Federal Savings Bank of South Dakota, Rapid City, on April 24, 1992.

Bank Failure #54: First Piedmont Bank, Winder, Georgia

by Calculated Risk on 7/17/2009 05:47:00 PM

Does Taxpayers cool cash quench?

Not so for Piedmont.

by Soylent Green is People

From the FDIC:

First Piedmont Bank, Winder, Georgia, was closed today by the Georgia Department of Banking and Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with First American Bank and Trust Company, Athens, Georgia, to assume all of the deposits of First Piedmont Bank.

...

As of July 6, 2009, First Piedmont Bank had total assets of $115 million and total deposits of approximately $109 million.

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $29 million. ... First Piedmont Bank is the 54th FDIC-insured institution to fail in the nation this year, and the tenth in Georgia. The last FDIC-insured institution to be closed in the state was Neighborhood Community Bank, Newnan, on June 26, 2009.

Market, State Unemployment, Fed Balance Sheet

by Calculated Risk on 7/17/2009 04:00:00 PM

A few graphs ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

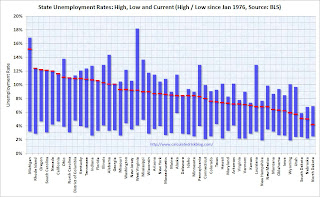

The first graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

Sixteen states now have double digit unemployment rates.

Missouri, Washington, New Jersey and West Virginia are getting close.

Eight states are at record unemployment rates: Rhode Island, Oregon, South Carolina, Nevada, California, Florida, Georgia, and Delaware. The Atlanta Fed is now posting Economic Highlights and Financial Highlights weekly.

The Atlanta Fed is now posting Economic Highlights and Financial Highlights weekly.

I cover most of the economic data as it is released, but these are good summaries.

This graph shows the composition of the Fed's assets. From the Atlanta Fed:

While the overall size of the Fed’s balance sheet has been shrinking slightly over the last two months, the composition of the balance sheet has changed. There have been sizeable declines in short-term lending to financials and lending to nonbank credit markets. For example, combined, TAF credit, currency swaps, and the CPFF have fallen by about one-half from over $1 trillion on April 8 to just under $500 billion on July 8. Offsetting these declines have been increases in holdings of agency debt, agency mortgage backed securities (MBS), and U.S. Treasury securities. Combined, these three categories have increased by about $430 billion since April 8.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Report: CIT in Talks for DIP Financing

by Calculated Risk on 7/17/2009 03:02:00 PM

From CNBC: CIT Talks Now Include Possible Financing in Bankruptcy

CIT Group's talks with many lenders have transitioned primarily to how the company would receive financing once it files for bankruptcy, CNBC has learned.A bad sign ...

Although talks are continuing on financing outside of bankruptcy, sources said that discussions are also focused on a so-called debtor-in-possession loan, in which CIT would receive money after a bankruptcy filing.

For that reason, a bankruptcy filing is unlikely on Friday, although the situation remains fluid.

Hotel RevPAR off 18.4%

by Calculated Risk on 7/17/2009 12:43:00 PM

From HotelNewsNow.com: STR reports U.S. performance for week ending 11 July 2009

In year-over-year measurements, the industry’s occupancy fell 9.7 percent to end the week at 60.3 percent. Average daily rate dropped 9.6 percent to finish the week at US$93.97. Revenue per available room for the week decreased 18.4 percent to finish at US$56.65.Although the occupancy rate was off 9.7 percent compared to the same week in 2008, in both 2006 and 2007 the occupancy rate for the week after the 4th of July weekend was over 74 percent (last year it was 66.8 percent). The occupancy rate is off about 19 percent compared to 2007.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 8.2% from the same period in 2008.

The average daily rate is down 9.6%, and RevPAR is off 18.4% from the same week last year.

Note: Business travel is off much more than leisure travel - so the summer months will probably not be as weak as other times of the year.

States: More Record Unemployment Rates in June

by Calculated Risk on 7/17/2009 11:10:00 AM

Note: the BLS started keeping state records in 1976.

From the BLS: Regional and State Employment and Unemployment Summary

Michigan again reported the highest jobless rate, 15.2 percent, in June. (The last state to have an unemployment rate of 15.0 percent or higher was West Virginia in March 1984.) The states with the next highest rates were Rhode Island, 12.4 percent; Oregon, 12.2 percent; South Carolina, 12.1 percent; Nevada, 12.0 percent; California, 11.6 percent; Ohio, 11.1 percent; and North Carolina, 11.0 percent. The Nevada, Rhode Island, and South Carolina rates were the highest on record for those states. Florida, at 10.6 percent, Georgia, at 10.1 percent, and Delaware, at 8.4 percent, also posted series highs.

GE Conference Call Comments

by Calculated Risk on 7/17/2009 09:39:00 AM

Some comments from the GE Conference call (comments from Brian):

GE: If you look at the environment and the global landscape not much has changed from how we saw it at EPG [investor presentation?]. We're seeing growth in selected markets. Parts of the globe are still robust. China and the middle east, India, places like that. Deflation is helping our margins.

just talking about orders and backlog, we had about $18 billion of second quarter orders, slightly below first quarter and down about 23% FX adjusted versus last year. We're down about 16% year to date. The backlog remains strong. The orders were about the same level as '06 and '07. Backlog remains very strong at $169 billion. If you just look at the orders in some context we had a record first half of '08. That was really the peak of what we saw for major equipment orders. We built $30 billion of backlog over the last four years so we really expected orders to be down even without the recession. A couple positives with major equipment, cancellations are very low. Cancellations are like $100 million…If you look at our backlog conversion rate and current orders and look forward, maybe 12 months, and you think about the fact that about two-thirds of any given year's revenue convert from backlog, and the other third represent current year orders, we look at a rough estimate for 2010 at about, with equipment revenue down about 10 to 15%, some where in that range.

Quick update on stimulus and global growth. First with stimulus. We talked about at EPG having about $190 billion potential from a stimulus standpoint. Almost nothing has come out from this so far. The major buckets are clean energy, affordable healthcare, and then a scattering of other projects. We're seeing some early wins in smart grid with orders up 70%. As we said, the wind tax credits have been clarified. China spending is very strong. We're starting to get some bidding on health information changes and seeing some decent activity around the nuclear business. If you look at it from a global standpoint, some of the global regions are still extremely strong. China was up 31%, India up 46%, Middle East up 10% despite the fact that we're only beginning the Iraq shipments and order completion.

GE Capital

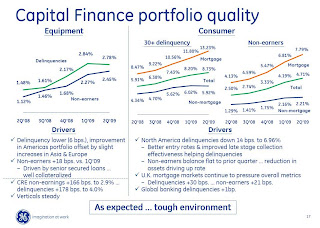

Delinquencies – Equipment and Real Estate [US improved and Asia is worse????]

Next is an update on our delinquencies in non earnings. On the left side is the commercial equipment finance data. You can see the 30 plus day delinquencies for equipment are down six basis points in Q2 versus Q1. That was driven by a decline in delinquencies in the Americas where 30 plus went from 2.81% to 2.45%. So we're very interested in watching this trend and seeing how this develops as we go through the year. That was partially offset by, we had some increased delinquencies in our Asia and European equipment books. We continue to see pressure on non earnings, up 18 basis points versus the first quarter but again the pace of that growth has also leveled off a bit. It's driven by senior secured loans where we're well collateralized. In terms of real estate, which is not in the delinquency for the equipment bar up above, delinquencies increased up to 4% [up 178BP Q/Q] on the real estate book and non earnings are up to 2.9% [up 166BP Q/Q]. You can see we continue to see pressure in the commercial real estate book,  Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the GE Investor Presentation material.

Delinquencies – Consumer

On the right side, consumer data, and this is really developing into the two different categories by type of exposure. We broke out mortgage, global mortgage, and nonmortgage because loss dynamics are so different. You can see the improvements in the non mortgage delinquency as the delinquency went from 6.02 in the first quarter down to 5.92 in the second quarter and that's driven by North America . North American delinquencies are down 14 basis points to 6.96%. We're seeing better entry rates in delinquency. We're seeing improved late-stage collection effectiveness. The non earnings balance was flat to the prior quarter, and the reason the rate increase a little bit is because the balance is down. So as a percent it's a little higher, but we are getting the benefit of all the underwriting actions that we took last year as well as some seasonality benefits. And then the second category are the global mortgage assets. We continue to see growth in 30 plus delinquencies and non earnings. UK mortgage book drives most of the changes

Reserves

Next is an update on how we think about the non earning assets and our reserve coverage. The left side is commercial. Non earnings ended the quarter at 6.4 billion. It's up 1.9 billion from Q1. This represents 2.9% of financing receivables. The bars show the benefit of being senior secured lender. We expect 1.9 billion of non earnings to have 100% recovery. We have another 1.2 billion some type of workout where we expect full recovery. We'll have a renegotiation, some changes to the documents and terms, and then we have another 1.9 billion where we're protected by collateral value. At the end of the day that leaves with you 1.4 billion of estimated loss exposure today. You can see we have 173% coverage with our reserves. [To summarize, they are expecting a 78% recovery on what is largely a junk grade portfolio albeit in a senior secured position] On the right side of the consumer non-earning assets of $6.6 billion and they were up over Q1, represent about 4.7% of the financing receivables. The consumer dynamics are very different between the mortgage and the nonmortgage assets so the green bar represents our non mortgage non earning assets, principally the US retail business, the credit card business and retail sales finance. We have 1.7 billion dollars of non earnings in that book. And we have 3.3 million of reserves against it, 189% coverage. And then the remainder of the non-earning assets on the global mortgage book we expect 1.5 billion of that to cure. With our underwriting positions we expect to recover $2.9 billion of exposure based on loan to value position. We underwrite at about 70 to 75% loan to value. Today they're at about 85% loan to value as house prices have declined. We have some mortgage insurance we expect to recover on leaving with expected loss of $500 million, 173% coverage without that. We believe we're appropriately reserved for non-earning loss exposure. We'll cover more in detail on the 28th meeting. [To summarize, they expect 30% of their non performing mortgage assets to cure, the value of the underlying assets in their mortgage book are down 12-18% from origination, they expect a 15% loss severity rate (including a modest benefit from mortgage insurance) - these guys must the gods of mortgage underwriting – if anyone wants to bet on the trend of future loss estimates, I’ll take the over – their corporate motto “Imagination at Work” seems fully appropriate here )

On the right side of the consumer non-earning assets of $6.6 billion and they were up over Q1, represent about 4.7% of the financing receivables. The consumer dynamics are very different between the mortgage and the nonmortgage assets so the green bar represents our non mortgage non earning assets, principally the US retail business, the credit card business and retail sales finance. We have 1.7 billion dollars of non earnings in that book. And we have 3.3 million of reserves against it, 189% coverage. And then the remainder of the non-earning assets on the global mortgage book we expect 1.5 billion of that to cure. With our underwriting positions we expect to recover $2.9 billion of exposure based on loan to value position. We underwrite at about 70 to 75% loan to value. Today they're at about 85% loan to value as house prices have declined. We have some mortgage insurance we expect to recover on leaving with expected loss of $500 million, 173% coverage without that. We believe we're appropriately reserved for non-earning loss exposure. We'll cover more in detail on the 28th meeting. [To summarize, they expect 30% of their non performing mortgage assets to cure, the value of the underlying assets in their mortgage book are down 12-18% from origination, they expect a 15% loss severity rate (including a modest benefit from mortgage insurance) - these guys must the gods of mortgage underwriting – if anyone wants to bet on the trend of future loss estimates, I’ll take the over – their corporate motto “Imagination at Work” seems fully appropriate here )