by Calculated Risk on 7/16/2009 02:31:00 PM

Thursday, July 16, 2009

Report: CIT Bondholders Considering Debt for Equity Swap

From Bloomberg: CIT Bondholders Said to Consider Debt Swap as Bankruptcy Looms

CIT Group Inc. bondholders are holding calls today to discuss whether to swap some of their claims for equity to reduce the 101-year-old lender’s indebtedness ...Looks like PIMCO expected a bailout.

[PIMCO], CIT’s largest bondholder based on regulatory filings, plans to host a call ... [however] there may not be time to complete a debt exchange before CIT goes bankrupt.

DataQuick: California Bay Area home sales Increase

by Calculated Risk on 7/16/2009 02:10:00 PM

Note: Ignore the median price, especially during periods when the mix is changing rapidly.

From DataQuick: Bay Area home sales and median price rise

Home sales in the Bay Area jumped to their highest level in almost three years, the result of improved mortgage availability and a perception among potential buyers that prices have bottomed out. ...This is still far from a normal market with 37.3% of sales foreclosure resales. And prices will probably continue to fall for some time, especially in the higher priced areas since there are few move-up buyers.

A total of 8,644 new and resale houses and condos sold across the nine-county Bay Area in June. That was up 16.1 percent from 7,447 in May and up 20.4 percent from 7,178 in June 2008, according to San Diego-based MDA DataQuick.

Home sales have increased on a year-over-year basis the last ten months. June sales have varied from a low of 7,118 in 1993 to 15,735 in 2004 in DataQuick’s statistics, which go back to 1988. Last month was 16.1 percent below the 10,306 for an average June.

...

Financing with home loans above the old “jumbo” limit of $417,000 edged up to the highest level in almost a year. Last month 28.8 percent of all Bay Area mortgages were jumbos, the highest since 31.9 percent in August last year and well above the bottom of 17.1 percent last January. Two years ago jumbos accounted for more than 60 percent of all home purchase loans.

...

Last month 37.3 percent of all homes resold in the Bay Area had been foreclosed on in the prior 12 months, down from 40.5 percent in May and the lowest since 36.0 percent in August 2008. The peak was 52.0 percent in February this year. By county, foreclosure resales ranged last month from 6.3 percent of all resales in Marin to 62.7 percent in Solano.

...

Foreclosure activity remains near record levels ...

NAHB: Builder Confidence Increases Slightly In July

by Calculated Risk on 7/16/2009 01:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) increased to 17 in July from 15 in June. The record low was 8 set in January.

This is still very low - and this is what I've expected - a long period of builder depression.

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

Press release from the NAHB (added):

Builder confidence in the market for newly built, single-family homes notched up two points in July to its highest level since September 2008, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI rose two points to 17 in July as builders saw an improvement in current sales conditions but continued to express concerns about the future.

...

“Although today’s HMI is positive news that helps confirm the market is bouncing around a bottom, the gain was entirely contained in the component gauging current sales conditions, while the component gauging sales expectations for the next six months remained virtually flat for a fourth consecutive month,” noted NAHB Chief Economist David Crowe. “Builders recognize the recovery is going to be a slow one and that we are facing a number of substantial negative forces.”

More JPM Comments on Modifications and Foreclosures

by Calculated Risk on 7/16/2009 11:46:00 AM

A few more conference call comments on mods and foreclosures: (ht Brian)

“we definitely saw as all did a build up in loans that were delinquent in all of the delinquency statistics given that we suspended foreclosures during the moratoriums in the Fall and Spring of this year which are described on that side of the page. What I would say is that those will sit there longer in a delinquency bucket so our in prime and subprime you see elevated delinquency stats but we don't expect it to have meaningful accounting or Income Statement impact because as we came out of those moratoriums we originally written down those loans and made adjustments to the writedowns to take account of the longer timeliness to move them through into Real Estate owned and foreclosure, if appropriate, or modify them. So then on modifications, again, I said at the beginning we've approved 138,000 modifications for the Second Quarter here, but those don't have any meaningful impact on our Second Quarter stats, and that's because we have to see three-monthly payments under the terms of the new modification before we'll reunderwrite that loan and it comes out of delinquency and in the meantime, it just continues to roll through delinquency buckets as it otherwise would have per the contract of the term. When we do see, if we do see and we hope to see good success with these modifications perhaps next quarter and in future quarters we'll talk about just the success rate but given that these are largely speaking payment reduction modifications that are done reunderwritten with real income stats and so fourth, we are hopeful that we see some good rates of success in the trial period, but when we do modify, you just see the description at the bottom of how we take into account when we adjust our reserves at the time we modify the expected remaining losses including an assumption for redefault”Next quarter we should see the results of the modicifications.

“when you look at home equity prime and subprime, you'll see the charge-offs continue to trend higher versus prior periods and in a couple of the cases prime and subprime we up our future [loss] guidance but the second point is that across each of these portfolios, the flow into the early delinquency buckets and the dollar value of loans sitting in the early delinquency buckets has started to stabilize over the last 60-90 days across-the-board. That's a new trend versus what we've seen previously and obviously, we don't know if it's going to sustain itself but obviously if it did that would have good implications for future loss trends and could mean that we could be getting near the end of needing to add to reserves in these portfolios.”All the other data (like from the MBA) is showing rising delinquencies, especially for prime loans - so this will be something to watch too.

Philly Fed: "Region's manufacturing still experiencing weakness"

by Calculated Risk on 7/16/2009 10:00:00 AM

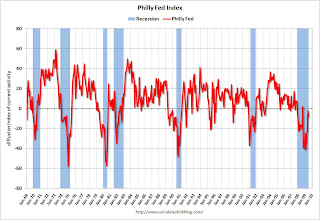

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

The region's manufacturing sector is still experiencing weakness ....

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from -2.2 in June to -7.5 this month. The index has been negative for 19 of the past 20 months, a span that corresponds to the current recession ...

Labor market conditions remain weak, and firms continue to report employment losses and declines in work hours. The current employment index declined to -25.3, from an already weak reading of -21.8. ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

"The index has been negative for 19 of the past 20 months, a span that corresponds to the current recession."

JPM's Dimon: CRE "Big deal for regional banks"

by Calculated Risk on 7/16/2009 09:16:00 AM

JPM Conference call comments on Commercial Real Estate (CRE): (ht Brian)

Analyst: Everyone is still concerned about commercial Real Estate and kind of how it's performing. You haven't really mentioned it as being a problem in the quarter highlighted it. Can you give any color as to how you're seeing general trends in the commercial Real Estate market?

Jamie Dimon: Commercial Real Estate in the United States of America is going to get worse consistently over the next several quarters. That should not be a surprise to anybody. We've got two major Real Estate exposures, we have what we call CTO which is multi-family smaller loans, it's performing fine and-- what we got from WaMu, that's the commercial bank, 30 Billion portfolio from WaMu -- it will get worse but we don't expect it to be significant, materially significant to our numbers, and we also have a more traditional Real Estate portfolio but I would say both the Bank One, JP Morgan and Chase, we've been so conservative of the last eight or nine years it's been doing nothing but in general shrinking other than the acquisition of WaMu [ it’s 12 billion] and losses are, charge-offs were for the Real Estate banking, 186 basis points and the commercial term lending was 36 and both will get worse but they aren't that big a number for us. It [commercial real estate] is a big deal for regional banks.

emphasis added

Report: Record Foreclosure Activity in First Half

by Calculated Risk on 7/16/2009 08:59:00 AM

RealtyTrac ... today released its Midyear 2009 U.S. Foreclosure Market Report, which shows a total of 1,905,723 foreclosure filings — default notices, auction sale notices and bank repossessions — were reported on 1,528,364 U.S. properties in the first six months of 2009, a 9 percent increase in total properties from the previous six months and a nearly 15 percent increase in total properties from the first six months of 2008. The report also shows that 1.19 percent of all U.S. housing units (one in 84) received at least one foreclosure filing in the first half of the year.Something to remember: questions have been raised before about the RealtyTrac numbers (see Foreclosure numbers don’t add up), and RealtyTrac has only been tracking these numbers since 2005. For California, I use the DataQuick numbers for NOD activity (released quarterly), and available since the early '90s - but that is just one state.

Foreclosure filings were reported on 336,173 U.S. properties in June, the fourth straight monthly total exceeding 300,000 and helping to boost the second quarter total to the highest quarterly total since RealtyTrac began issuing its report in the first quarter of 2005. Foreclosure filings were reported on 889,829 U.S. properties in the second quarter, an increase of nearly 11 percent from the previous quarter and a 20 percent increase from the second quarter of 2008.

Weekly Unemployment Claims Decline Sharply

by Calculated Risk on 7/16/2009 08:29:00 AM

NOTE: The seasonally adjusted weekly claims numbers are being impacted by the layoffs in the automobile industry and other manufacturing sectors. Usually companies cut back production in the summer, and the numbers are adjusted for that pattern - but this year the companies cut back much earlier. This distortion is expected to last for another week or two.

The DOL reports on weekly unemployment insurance claims:

In the week ending July 11, the advance figure for seasonally adjusted initial claims was 522,000, a decrease of 47,000 from the previous week's revised figure of 569,000. The 4-week moving average was 584,500, a decrease of 22,500 from the previous week's revised average of 607,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending July 4 was 6,273,000, a decrease of 642,000 from the preceding week's revised level of 6,915,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 22,500, and is now 74,250 below the peak of 14 weeks ago. It appears that initial weekly claims have peaked for this cycle.

The level of initial claims has fallen quickly - but is still very high (over 500K), indicating significant weakness in the job market.

Following the earlier recessions (like '81), weekly claims fell quickly, but in the two most recent recessions, weekly claims fell some and then stayed elevated for some time. I expect the current recession will be more like the '90 and '01 recessions, than the '81 recession.

BofA: Double Secret Probation

by Calculated Risk on 7/16/2009 12:24:00 AM

From the WSJ: U.S. Regulators to BofA: Obey or Else

Bank of America Corp. is operating under a secret regulatory sanction ... the so-called memorandum of understanding gives banks a chance to work out their problems ...

Citigroup Inc. has been operating since last year under a similar order with the Office of the Comptroller of the Currency...

In a letter that was reviewed by The Wall Street Journal, the Fed criticized Bank of America's management and directors for being "overly optimistic" about risk and capital. The bank's capital position "was vulnerable" even before the Merrill deal, the Fed concluded, citing "acquisition activity" that included last year's takeover of mortgage lender Countrywide Financial Corp.

Wednesday, July 15, 2009

Report: California Close to Budget Deal

by Calculated Risk on 7/15/2009 08:39:00 PM

From the LA Times: California Approaches a Deal on Budget Cuts (ht Rob Dawg)

California lawmakers neared a deal Wednesday with Gov. Arnold Schwarzenegger to close the state’s $26 billion budget gap ...The furloughs continue, and this will lead to more layoffs especially at the local level.

Details emerging from the talks suggested that the deal will require extraordinarily deep cuts to school systems and local governments, and ... substantial cuts to health care and other social services.

...

The state’s education budget of nearly $52 billion seemed destined for another large hit — likely $1.5 billion — on top of substantial reductions earlier this year, officials said. ... Public colleges and universities across the state have already prepared for millions of dollars in cutbacks by furloughing employees. Statewide furloughs of three days a month for government employees are likely to continue through the rest of the fiscal year.