by Calculated Risk on 7/15/2009 11:34:00 AM

Wednesday, July 15, 2009

Is the Recession Over?

Last night Merrill Lynch declared the recession over.

From Tom Petruno at the LA Times: 'Recession is over,' BofA Merrill Lynch tells investors

And from CNBC:

It is usually difficult to tell when a recession has ended - especially for a jobless recovery.

It took the National Bureau of Economic Research (NBER) Business Cycle Dating Committee over a year and half after the 2001 recession ended to call the trough of the cycle. And it took 21 months after the 1990-1991 recession ended for NBER to date the end of the recession.

From the 2003 announcement of the end of the 2001 recession:

The committee waited to make the determination of the trough date until it was confident that any future downturn in the economy would be considered a new recession and not a continuation of the recession that began in March 2001.The economy was still struggling in 2003 - especially employment - but the NBER committee members felt that any subsequent downturn would be considered a separate recession:

The committee noted that the most recent data indicate that the broadest measure of economic activity-gross domestic product in constant dollars-has risen 4.0 percent from its low in the third quarter of 2001, and is 3.3 percent above its pre-recession peak in the fourth quarter of 2000. Two other indicators of economic activity that play an important role in the committee's decisions-personal income excluding transfer payments and the volume of sales of the manufacturing and wholesale-retail sectors, both in real terms-have also surpassed their pre-recession peaks. Two other indicators the committee focuses on-payroll employment and industrial production-remain well below their pre-recession peaks. Indeed, the most recent data indicate that employment has not begun to recover at all. The committee determined, however, that the fact that the broadest, most comprehensive measure of economic activity is well above its pre-recession levels implied that any subsequent downturn in the economy would be a separate recession.This is relevant to today. It is very likely that any recovery will be very sluggish, and if the economy turns down within the next 6 to 12 months, the NBER would probably consider that a continuation of the Great Recession.

Here is the NBER dating procedure.

Note that the trough of the 1980 recession was only 12 months before the beginning of the 1981 recession, but the short recovery was fairly robust with real GDP up 4.4%. Those two recessions are frequently called a "double dip" recession, but the NBER considers them as two separate recessions.

I think the "official" recession will probably end sometime in the 2nd half of 2009, but the recovery will be very sluggish and there is a risk of a double dip recession. Roubini argues that the recession will end sometime in early 2010. Maybe. But I also think it will feel like a recession for some time, since the unemployment rate will probably rise through most of 2010, and stay elevated for a long period (a jobless recovery).

Industrial Production Declines, Capacity Utilization at Record Low in June

by Calculated Risk on 7/15/2009 09:15:00 AM

The Federal Reserve reported:

Industrial production decreased 0.4 percent in June after having fallen 1.2 percent in May. For the second quarter as a whole, output fell at an annual rate of 11.6 percent, a more moderate contraction than in the first quarter, when output fell 19.1 percent. Manufacturing output moved down 0.6 percent in June, with declines at both durable and nondurable goods producers. ... The rate of capacity utilization for total industry declined in June to 68.0 percent, a level 12.9 percentage points below its average for 1972-2008. Prior to the current recession, the low over the history of this series, which begins in 1967, was 70.9 percent in December 1982.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series is at another record low (the series starts in 1967).

In addition to the weakness in industrial production, there is little reason for investment in new production facilities until capacity utilization recovers.

CPI up 0.7%; Core CPI up 0.2%

by Calculated Risk on 7/15/2009 08:31:00 AM

From the Census Bureau:

On a seasonally adjusted basis, the CPI-U increased 0.7 percent in June after rising 0.1 percent in May. The acceleration was largely caused by the gasoline index, which rose 17.3 percent in June and accounted for over 80 percent of the increase in the all items index.CPI is now off 1.2% year-over-year (YoY) - the largest YoY decline since the 1950s, but core CPI is up 1.7%.

...

The index for all items less food and energy rose 0.2 percent in June following a 0.1 percent increase in May.

...

The index for shelter rose 0.1 percent for the second straight month, as did the indexes of two of its major components, rent and owners' equivalent rent.

Meanwhile owners' equivalent rent (OER) is up 1.9% year-over-year, although only up 0.1% in June. I expect OER to decline soon.

MBA: Refinance Applications Increase as Mortgage Rates Decline

by Calculated Risk on 7/15/2009 08:11:00 AM

The MBA reports:

The Market Composite Index, a measure of mortgage loan application volume, was 514.4, an increase of 4.3 percent on a seasonally adjusted basis from 493.1 one week earlier.

...

The Refinance Index increased 17.7 percent to 2009.4 from 1707.7 the previous week and the seasonally adjusted Purchase Index decreased 9.4 percent to 258.8 from 285.6 one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.05 percent from 5.34 percent ...

emphasis added

Click on graph for larger image in new window.

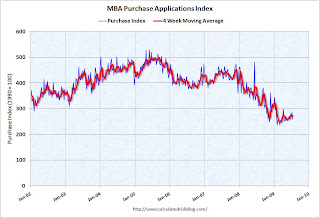

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

Note: The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007, even though activity was actually declining.

The Purchase index is somewhat above the recent lows, but the big story is the Refinance index - refinance activity is up sharply as mortgage rates declined.

Futures and Elizabeth Warren on Consumer Financial Protection

by Calculated Risk on 7/15/2009 12:41:00 AM

Futures are up tonight ...

Futures from barchart.com

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

And the Asian markets are up about 1%.

And Elizabeth Warren, Chair of the Congressional Oversight Panel for TARP.

Note: My personal view is that in a financially literate world, almost all borrowers would pay off their credit card balances monthly (there are exceptions).

Best to all.

Tuesday, July 14, 2009

Report: CIT Aid Package "working on details"

by Calculated Risk on 7/14/2009 08:32:00 PM

UPDATE: From the WSJ: CIT, Regulators Negotiate Details of Multipart Aid Package

CIT Group Inc. and federal regulators are working out details of an aid package ...The deal is not done and the FDIC can't be happy with a high level of brokered deposits. Another BFF candidate.

Under the plan regulators would allow CIT to transfer assets from its holding company to its bank in Utah; the Federal Reserve would let CIT pledge some of those assets at its discount window and the company would take steps to refinance some of its existing debt. ...

One likely concern for regulators is how CIT can fund a steep rise in assets at its Utah bank. Part of the company's strategy is to aggressively seek out deposits through brokers ...

CRE: Higher Vacancy Rates, Lower Rents in San Diego, Orange County and Las Vegas

by Calculated Risk on 7/14/2009 07:58:00 PM

Voit released quarterly reports today for CRE in Las Vegas, San Diego and Orange County.

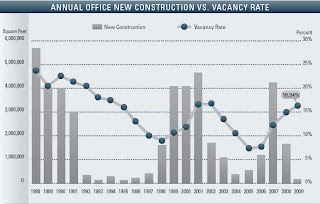

The reports show the vacancy rates are up and lease rates falling. It also shows new construction has slowed sharply. Here are a couple of graphs for Orange County and San Diego. We are seeing a similar pattern nationwide, although new construction in these areas probably slowed earlier than most of the country.

Click on graph for larger image in new window.

This graph shows the annual Orange County office vacancy rate and new construction since 1988. See Voit report for more.

In 2007 the rapid increase in the vacancy rate was due to a huge increase in new space combined with negative absorption as a number of Orange County financial companies (like New Century) went under. New construction has almost stopped, but the net absorption rate is still negative, so the vacancy rate is still rising.

Because of the concentration of subprime lenders in Orange County, the office space market was hit earlier than other areas of the country.

From the Voit report:

Net absorption for the county posted a negative 672,880 square feet for the second quarter of 2009, giving the office market a total of 1.5 million square feet of negative absorption for the year.The record year for new development in Orange County was 1988, when 5.7 million square feet of new space was added. The vacancy rate peaked at approximately 24% in 1988 (the S&L crisis related office boom).

...

During the first half of 2009, Orange County has added a total of 171,863 square feet. Over the past three and a half years, over seven million square feet of new construction has been completed in Orange County. ... Total space under construction checked in at 166,059 square feet at the end of the second quarter, which is almost half the amount that was under construction this same time last year.

The second graph is for San Diego. The dynamics are similar, but construction halted later than in Orange County. From Voit:

The second graph is for San Diego. The dynamics are similar, but construction halted later than in Orange County. From Voit: During the first half of 2009, San Diego County has added a total of 600,000 square feet. Over the past three and a half years, over 9.2 million square feet of new construction has been completed in San Diego County. ... Total space under construction checked in at 956,711 square feet at the end of the second quarter, which is less than half the amount that was under construction this same time last year ...Although Voit didn't provide a similar graph for Las Vegas, the situation is clearly worse:

At the close of the second quarter, approximately 10.9 million square feet of vacant office product remained on the market, producing an average vacancy rate of 22.1 percent. When excluding owner-user buildings, the vacancy rate jumps to 24.2 percent for speculative space. Vacancy rates are up from the 19.6 percent posted three months prior, while the comparison to the 16.9 percent vacancy rate from the second quarter of 2008 is even more dramatic.New office construction has almost stopped in these markets.

...

Some areas are expected to reach 30-percent vacancy rates ...

The market reported 1.4 million square feet of space that remained in some form of construction. It is worth noting that approximately 0.4 million square feet is located in projects that have stalled or delayed activity.

emphasis added

Manhattan Office Vacancy Rate Increases, Effective Rents off 44%

by Calculated Risk on 7/14/2009 05:06:00 PM

From Reuters: Manhattan office vacancies spike to 4-1/2 yr high (ht Brian)

The overall vacancy rate -- which includes space that will become available over the next six months -- rose 0.9 percentage point from the first quarter to 10.5 percent, the highest rate since the fourth quarter 2004, when it touched 11 percent. ...Sharply lower rents, reduced leverage and much higher cap rates - Brian calls this the "neutron bomb for RE equity"; destroys CRE investors, but leaves the buildings still standing.

Asking rent in the second quarter fell to $60.23 per square foot, down 15.9 percent from a year ago, Cushman said.

Factoring in months of free rent and work space improvements, effective rent in Manhattan already is off 44 percent from the peak in the first quarter 2008.

As Foreclosure Activity Surges, Obama Considers Rental Option

by Calculated Risk on 7/14/2009 03:38:00 PM

From Reuters: Obama mulls rental option for some homeowners-sources

Under one idea being discussed, delinquent homeowners would surrender ownership of their homes but would continue to live in the property for several years ... Officials are also considering whether the government should make mortgage payments on behalf of borrowers who cannot keep up with their home loansAnd another surge in foreclosure activity is reported today by ForeclosureRadar:

For the third consecutive month, foreclosure sales jumped significantly as lenders come off the moratorium. Foreclosure sales increased by 24.7 percent following a 31.9 percent increase in May, and a 35 percent April increase. Notices of Trustee Sale dropped by an unexpected 28.7 percent, with the timing of the drop indicating that it was in response to the California Foreclosure Prevention Act. This law was widely believed to have little or no impact on foreclosure filings, as it exempted the majority of large lenders that operate in the state.

...

After a 4.2 percent drop the prior month, Notices of Default, the initial step in the foreclosure process, rose by 11.8 percent to the second highest level on record at 45,691 filings. Year-overyear filings increased by 10.0 percent from June of 2008.

...

A total of 22,291 foreclosures were taken to sale at auction, representing loan value of $9.57 Billion dollars; a 24.7 percent increase from the prior month, though 8.2 percent lower than the prior year. The opening bids set by lenders were an average 39.3 percent lower than the loan balance, with 46.0 percent of sales discounted by 50.0 percent or more.

...

A new statistic we are watching closely is the number of properties actively scheduled for sale – meaning that a Notice of Trustee Sale has been filed to set the auction date and time, but the foreclosure has not yet been sold or cancelled. Under California’s foreclosure code, a foreclosure sale can be postponed repeatedly for one year before a new Notice of Trustee Sale has to be filed. While postponements are quite common, they have reached record levels in recent months, swelling the number of scheduled foreclosures 90.1 percent year-over-year to 113,141.

emphasis added

S&P Cuts Ratings on CMBS

by Calculated Risk on 7/14/2009 02:34:00 PM

Here come some Commercial Mortgage Backed Security (CMBS) rating cuts ...

UPDATE: From Dow Jones: Commercial Mtge-Backed Securities Index Hit By S&P Downgrades-Source

From S&P: S&P Lowers 23 Credit Suisse Comm Mortgage 2007-C3 Rtgs; 3 Afmd

NEW YORK (Standard & Poor's) July 14, 2009--Standard & Poor's Ratings Services today lowered its ratings on 23 classes of commercial mortgage-backed securities (CMBS) from Credit Suisse Commercial Mortgage Trust Series 2007-C3 and removed them from CreditWatch with negative implications...Here is an example: GSMS 2007-GG10 A4's (super senior with 30% credit support) were taken from AAA to BBB-. That is a significant cut, and below the street expectations.

The lowered ratings follow our analysis of the transaction using our recently released U.S. conduit and fusion CMBS criteria, which was the primary driver of the rating actions....

This is the beginning of the rating cuts associated with the S&P June 4th release of The Potential Rating Impact Of Proposed Methodology Changes On U.S. CMBS