by Calculated Risk on 7/09/2009 04:25:00 PM

Thursday, July 09, 2009

Condo Association Files Bankruptcy

This might be the start of a number of condo / homeowner associations filing bankruptcy because of the housing bust ...

From the Daily Business Review: Bankruptcy: $1 million debt sends condo association into Chapter 11 (ht Soylent Green is People)

Facing almost $1 million in claims by unsecured creditors, a troublesome recreational lease, and at least 100 unit owners delinquent on payments of their fees, the association filed a Chapter 11 petition last month in U.S. Bankruptcy Court in Miami.

As one of the first condo association bankruptcies of the current economic crisis ... With residential foreclosures and personal bankruptcies soaring in South Florida, Maison Grande’s decision is expected to become more commonplace, said attorney Aleida Martinez Molina of Becker & Poliakoff in Coral Gables.

...

The significant drop in property values is a key factor pushing associations toward bankruptcy filings, said attorney Robert Kaye of Kaye & Bender in Fort Lauderdale. ... “In prior times, there was enough equity in all the properties [in an association] so that assets would likely exceed liabilities,” he said. “Now, since a large percentage of associations are upside down, that’s changing their view about bankruptcy. Their debts have overtaken their assets.”

Treasury Working on 'Plan C'

by Calculated Risk on 7/09/2009 03:06:00 PM

From the WaPo: Treasury Works on 'Plan C' To Fend Off Lingering Threats

... the Treasury Department has assembled a team to examine what could yet bring it down and has identified several trouble spots ... Informally known as Plan C, the internal project is focused on vexing problems such as the distressed commercial real estate markets, the high rate of delinquencies among homeowners, and the struggles of community and regional banks, said government sources familiar with the effort."A lot of scrutiny and a leap of faith"? More of the later, not enough of the former. It didn't take much "scrutiny" to understand there was substantial overbuilding in CRE, especially for retail space and for hotels. And yet banks kept making loans in 2006, 2007 and even in 2008 ...

...

The team is also responsible for considering potential government responses, but top officials within the Obama administration are wary of rolling out initiatives that would commit massive amounts of federal resources ...

The officials in charge of Plan C -- named to allude to a last line of defense -- face a particular challenge in addressing the breakdown of commercial real estate lending. ... these groups face a tidal wave of commercial real estate debt -- some estimates peg the total at more than $3 trillion -- that they will need to refinance. ...

Thousands of these institutions wrote billions of dollars in mortgages on strip malls, doctors offices and drive-through restaurants. These commercial loans required a lot of scrutiny and a leap of faith, and, for much of the decade, the smaller banks that leapt were rewarded with outsize profits.

In doing so, many took on bigger and bigger risks. By the beginning of the recession in December 2007, the median midsize bank held commercial real estate loans worth 3.55 times its capital cushion -- its reserve against unexpected losses -- according to the Federal Deposit Insurance Corp.

... Another issue identified by the Plan C team is homeowner delinquencies, which continue to rise as large numbers of people lose their jobs and miss monthly payments.

Charity: Mortgage Pig Wear Closeout

by Calculated Risk on 7/09/2009 01:28:00 PM

CR note: This is from Tanta's sister Cathy. For new readers, to find out about Tanta, please see Tanta: In Memoriam. Also see The Compleat UberNerd for some of her incredible articles. I really enjoy my Mortgage Pig sweatshirt! Thanks to everyone for your support, CR

The Last of the Mortgage Pig Wear

Thank you all for your orders – we raised $3,700 and hopefully you have something unique to help you remember Tanta.

We ended up with some extra completed items and we still have a few “Slap It” and “Holidays” transfers left for T-shirts (“Convexity” is sold out). I’m offering these outside of EBay – no additional charge for shipping in the continental US. Simply send an EMAIL to stickelc@live.com with your request and I’ll send back a confirmation. Then mail a check or money order along with shipping instructions and we’ll get the item out to you. The proceeds will be donated to the Ovarian Cancer Research Fund.

Again – thanks for your support and all of the kind words.

Cathy Stickelmaier

Completed Items:

Black Full-Zip, Hooded Sweatshirt w/Tanta Vive in Pink & White – Size XL - $40

Men’s White Polo Shirt – Size L - $32

White Long Sleeved T-Shirt with Slap-It Transfer – size L - $18

White Hooded Sweatshirt with Holidays Transfer – Size 2X - $30

White Hooded Sweatshirt with Holidays Transfer – Size XL - $30

(2) Short Sleeved T-Shirt with Holidays Transfer – size S - $15 each

(2) White Hooded Sweatshirt with Slap It Transfer – size L - $30 each

Transfer Items – made to order while transfers last:

White Long Sleeved T-Shirt with Slap It Transfer – Sizes S to 2XL - $18

White Short Sleeved T-Shirt with Slap It Transfer – Sizes S to 2XL - $15

White Long Sleeved T-Shirt with Holidays Transfer – Sizes S to 2XL - $18

White Short Sleeved T-Shirt with Holidays Transfer – Sizes S to 2XL - $15

Hotel RevPAR off 13%

by Calculated Risk on 7/09/2009 12:45:00 PM

Note: This report included a holiday weekend. Since vacation travel is holding up better than business travel I'd expect year-over-year RevPAR (and occupancy rate) to be off less than earlier this year for the summer months and especially for holiday weekends.

From HotelNewsNow.com: STR reports U.S. hotel performance for week ending 27 June 2009

In year-over-year measurements, the industry’s occupancy fell 6.0 percent to end the week at 57.7 percent. Average daily rate dropped 7.4 percent to finish the week at US$95.16. Revenue per available room for the week decreased 13.0 percent to finish at US$54.94.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 8.8% from the same period in 2008.

The average daily rate is down 7.4%, and RevPAR is off 13.0% from the same week last year.

Note: the occupancy rate will rebound in the next report - this is the normal pattern. The hotel occupancy rate is usually the highest during the peak vacation months of June, July and August and declines on weeks with holiday weekends.

Lawmaker: "The CRE time bomb is ticking"

by Calculated Risk on 7/09/2009 11:44:00 AM

From Dow Jones: US Lawmakers Sound Alarm About Commercial Real Estate Market

"The commercial real estate time bomb is ticking," Joint Economic Committee Chairman Rep. Carolyn Maloney, D-N.Y., said in opening remarks to a hearing before her panel Thursday.The article mentions the Fed's legacy CMBS TALF as helping the CRE market. The first auction is July 16th.

U.S. Sen. Sam Brownback, R-Kansas, said he was distressed about the situation the industry is facing.

Banks have yanked back on lending to developers of shopping malls, apartment complexes, hotels and office parks. ... The U.S. commercial real estate market is roughly $6.7 trillion in size and is underpinned by about $3.5 trillion of debt.

A few CRE stories this week:

Strip Mall Vacancy Rate Hits 10%, Highest Since 1992

"[W]e do not foresee a recovery in the retail sector until late 2012 at the earliest."Apartment Vacancy Rate at 22 Year High

Victor Calanog, director of research for Reis on Retail CRE

Hotel Recession Reaches 20 Months

U.S. Office Vacancy Rate Hits 15.9% in Q2

"It's bad. It's decaying and getting worse. Given the depth and magnitude of the recession, you can argue that we are facing a storm of epic proportions and we're only at the beginning."CRE: Another Half Off Sale

Victor Calanog, Reis director of research on the Office Market.

Property Taxes Fall in California

by Calculated Risk on 7/09/2009 10:24:00 AM

Even with plummeting house prices, it is hard for overall property taxes to decline in California. This is because the assessed value of properties held by long term homeowners is frequently far below market value - even after the recent steep decline in prices - so the assessed value for those homeowners continues to increase at 2% per year.

From the SacBee: California counties see property revenue fall

For the first time since the taxpayers' revolt of the 1970s, the total assessed value of properties is dropping in Sacramento and across California.For communities with many long term property owners, the property taxes are still increasing - because the assessed values are still below current market values.

The property tax roll in Sacramento County is down 6.4 percent from last year – to $131.6 billion; in Contra Costa County it's down 7 percent; and in Merced County it's down almost 13 percent.

...

While Sacramento County is dropping the assessed value on more than 170,000 properties, most of the remaining 230,000 residential properties won't see a reduction. Those owners can expect their normal 2 percent annual increase, county Assessor Ken Stieger said.

...

Also, the current assessment on many homes is still well below their actual market value, meaning they don't qualify for a reduction.

This is often the case for people who have owned their home for many years. The Proposition 13-mandated 2 percent annual increase has likely not kept pace with the double-digit annual percentage increases in market value.

Jon Lansner at the O.C. Register has a breakdown by cities in Orange County: Steepest property tax-value dips hit Santa Ana

Orange County’s first drop in taxable property values in 14 years was by no means an across-the-board drop.The increases are mostly for cities with long term homeowners.

The Assessor’s recap of the new taxable values for homes and other properties — remember, that’s different that actual values — show that 25 of Orange County’s 34 cities saw their taxable values driven down by falling home prices, with an average decline of 2.4%. And 9 had increases, with an average gain of 1.2%.

Weekly Unemployment Claims Decline, Record Continuing Claims

by Calculated Risk on 7/09/2009 08:42:00 AM

Note: The numbers are adjusted for the holiday, but this might still be an aberration.

The DOL reports on weekly unemployment insurance claims:

In the week ending July 4, the advance figure for seasonally adjusted initial claims was 565,000, a decrease of 52,000 from the previous week's revised figure of 617,000. The 4-week moving average was 606,000, a decrease of 10,000 from the previous week's revised average of 616,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending June 27 was 6,883,000, an increase of 159,000 from the preceding week's revised level of 6,724,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows weekly claims and continued claims since 1971.

Continued claims increased to a record 6.88 million.

The four-week average of weekly unemployment claims decreased this week by 10,000, and is now 52,750 below the peak of 13 weeks ago. It appears that initial weekly claims have peaked for this cycle.

However the level of initial claims (over 600 thousand 4-week average) is still very high, indicating significant weakness in the job market.

As a reminder, when looking at this report, I'd focus on the 4-week moving average of initial claims, not continued claims.

Depression Era Unemployment Rate

by Calculated Risk on 7/09/2009 12:14:00 AM

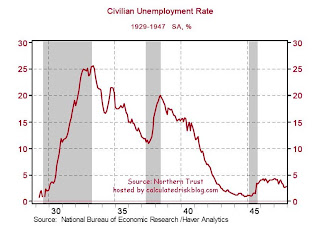

Just for information purposes, the following graph is from Northern Trust.

What was the high of the unemployment rate in the Great Depression?

The civilian unemployment rate was around 25% during several months of 1932-1933

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the unemployment rate from 1929 through 1947.

The surge in unemployment in 1937 was related to an attempt to unwind the monetary and fiscal stimulus policies, with disastrous results for employment. Just something to remember when the Fed and Treasury start to unwind the current stimulus programs.

Several people have commented on 1937 lately ...

Alan Blinder wrote in the New York Times in May:

From its bottom in 1933 to 1936, the G.D.P. climbed spectacularly (albeit from a very low base), averaging gains of almost 11 percent a year. But then, both the Fed and the administration of Franklin D. Roosevelt reversed course.And from Paul Krugman in the NY Times in June:

In the summer of 1936, the Fed looked at the large volume of excess reserves piled up in the banking system, concluded that this mountain of liquidity could be fodder for future inflation, and began to withdraw it. ...

About the same time, President Roosevelt looked at what seemed to be enormous federal budget deficits, concluded that it was time to put the nation’s fiscal house in order and started raising taxes and reducing spending. ...

Thus, both monetary and fiscal policies did an abrupt about-face in 1936 and 1937, and the consequences were as predictable as they were tragic. The United States economy, which had been rapidly climbing out of the cellar from 1933 to 1936, was kicked rudely down the stairs again ...

The first example of policy in a liquidity trap comes from the 1930s. The U.S. economy grew rapidly from 1933 to 1937, helped along by New Deal policies. America, however, remained well short of full employment.

Yet policy makers stopped worrying about depression and started worrying about inflation. The Federal Reserve tightened monetary policy, while F.D.R. tried to balance the federal budget. Sure enough, the economy slumped again, and full recovery had to wait for World War II.

Wednesday, July 08, 2009

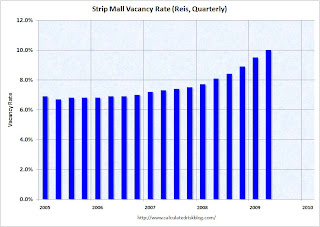

Reis: Strip Mall Vacancy Rate Hits 10%, Highest Since 1992

by Calculated Risk on 7/08/2009 08:38:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Reis reports the strip mall vacancy rate hit 10% in Q2 2009, the vacancy rate since highest since 1992. And rents are cliff diving ...

From Reuters: U.S. mall vacancy rate soars, rent dives - report

During the second quarter, the vacancy rate at U.S. strip malls reached 10 percent, the highest level since 1992, [Reis] said. ... asking rent fell 1.7 percent from a year ago to $19.28 per square foot. Asking rent fell 0.7 percent from the prior quarter. It was the largest single-quarter decline since Reis began tracking quarterly figures in 1999. ... effective rent declined 3.2 percent year-over-year to $17.01 per square foot. Effective rent fell 1.1 percent from the prior quarter.A record decline in rents. Record regional mall vacancies. And no recovery seen in the retail CRE sector "until 2012 at the earliest". Grim.

About 7.9 million square feet of space was returned to the market during the quarter. The amount was second only to the 8.1 million square feet in the first quarter. ... U.S. regional malls ... vacancy rate rose to 8.4 percent, the highest vacancy level since Reis began tracking regional malls in 2000. Asking rents for regional malls continued to deteriorate but at a faster rate, falling 1.4 percent in the second quarter, compared with 1.2 percent in the first. ...

"Right now it looks like all signs are pointing to rents and vacancies, big components of income, getting shot down," [Victor Calanog, director of research for Reis] Inc said. "Until we see stabilization and recovery take root in both consumer spending and business spending and hiring, we do not foresee a recovery in the retail sector until late 2012 at the earliest."

More Mortgage Fraud

by Calculated Risk on 7/08/2009 07:18:00 PM

This is definitely "brazen" ...

From CNN: 25 charged in $100 million mortgage fraud

The D.A.'s office said the following banks were ripped off over a four-year period, ending in April: Countrywide, New Century Bank, Saxon Bank, Greenpoint Bank, ABC Bank, Bank of America, Wells Fargo and SunTrust. Some of the defendants were bank employees, according to the D.A.For more mortgage fraud, here is the Mortgage Fraud blog.

"The conspirators caused the banks to front millions of dollars to finance purchases of the properties," read a statement from the D.A.'s office. "They then walked away with most of the cash, leaving behind over-valued properties and worthless mortgage papers."

The D.A.'s office described a "particularly brazen sham transaction" where one of the suspects, Stephen Martini, allegedly wrote up a bogus appraisal of $500,000 for a two-family home, but "in reality, the location was a vacant lot."