by Calculated Risk on 7/09/2009 08:42:00 AM

Thursday, July 09, 2009

Weekly Unemployment Claims Decline, Record Continuing Claims

Note: The numbers are adjusted for the holiday, but this might still be an aberration.

The DOL reports on weekly unemployment insurance claims:

In the week ending July 4, the advance figure for seasonally adjusted initial claims was 565,000, a decrease of 52,000 from the previous week's revised figure of 617,000. The 4-week moving average was 606,000, a decrease of 10,000 from the previous week's revised average of 616,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending June 27 was 6,883,000, an increase of 159,000 from the preceding week's revised level of 6,724,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows weekly claims and continued claims since 1971.

Continued claims increased to a record 6.88 million.

The four-week average of weekly unemployment claims decreased this week by 10,000, and is now 52,750 below the peak of 13 weeks ago. It appears that initial weekly claims have peaked for this cycle.

However the level of initial claims (over 600 thousand 4-week average) is still very high, indicating significant weakness in the job market.

As a reminder, when looking at this report, I'd focus on the 4-week moving average of initial claims, not continued claims.

Depression Era Unemployment Rate

by Calculated Risk on 7/09/2009 12:14:00 AM

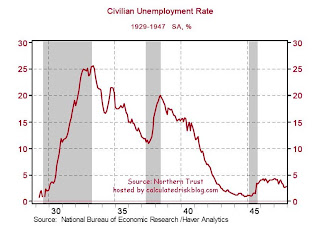

Just for information purposes, the following graph is from Northern Trust.

What was the high of the unemployment rate in the Great Depression?

The civilian unemployment rate was around 25% during several months of 1932-1933

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the unemployment rate from 1929 through 1947.

The surge in unemployment in 1937 was related to an attempt to unwind the monetary and fiscal stimulus policies, with disastrous results for employment. Just something to remember when the Fed and Treasury start to unwind the current stimulus programs.

Several people have commented on 1937 lately ...

Alan Blinder wrote in the New York Times in May:

From its bottom in 1933 to 1936, the G.D.P. climbed spectacularly (albeit from a very low base), averaging gains of almost 11 percent a year. But then, both the Fed and the administration of Franklin D. Roosevelt reversed course.And from Paul Krugman in the NY Times in June:

In the summer of 1936, the Fed looked at the large volume of excess reserves piled up in the banking system, concluded that this mountain of liquidity could be fodder for future inflation, and began to withdraw it. ...

About the same time, President Roosevelt looked at what seemed to be enormous federal budget deficits, concluded that it was time to put the nation’s fiscal house in order and started raising taxes and reducing spending. ...

Thus, both monetary and fiscal policies did an abrupt about-face in 1936 and 1937, and the consequences were as predictable as they were tragic. The United States economy, which had been rapidly climbing out of the cellar from 1933 to 1936, was kicked rudely down the stairs again ...

The first example of policy in a liquidity trap comes from the 1930s. The U.S. economy grew rapidly from 1933 to 1937, helped along by New Deal policies. America, however, remained well short of full employment.

Yet policy makers stopped worrying about depression and started worrying about inflation. The Federal Reserve tightened monetary policy, while F.D.R. tried to balance the federal budget. Sure enough, the economy slumped again, and full recovery had to wait for World War II.

Wednesday, July 08, 2009

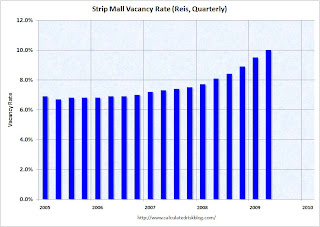

Reis: Strip Mall Vacancy Rate Hits 10%, Highest Since 1992

by Calculated Risk on 7/08/2009 08:38:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Reis reports the strip mall vacancy rate hit 10% in Q2 2009, the vacancy rate since highest since 1992. And rents are cliff diving ...

From Reuters: U.S. mall vacancy rate soars, rent dives - report

During the second quarter, the vacancy rate at U.S. strip malls reached 10 percent, the highest level since 1992, [Reis] said. ... asking rent fell 1.7 percent from a year ago to $19.28 per square foot. Asking rent fell 0.7 percent from the prior quarter. It was the largest single-quarter decline since Reis began tracking quarterly figures in 1999. ... effective rent declined 3.2 percent year-over-year to $17.01 per square foot. Effective rent fell 1.1 percent from the prior quarter.A record decline in rents. Record regional mall vacancies. And no recovery seen in the retail CRE sector "until 2012 at the earliest". Grim.

About 7.9 million square feet of space was returned to the market during the quarter. The amount was second only to the 8.1 million square feet in the first quarter. ... U.S. regional malls ... vacancy rate rose to 8.4 percent, the highest vacancy level since Reis began tracking regional malls in 2000. Asking rents for regional malls continued to deteriorate but at a faster rate, falling 1.4 percent in the second quarter, compared with 1.2 percent in the first. ...

"Right now it looks like all signs are pointing to rents and vacancies, big components of income, getting shot down," [Victor Calanog, director of research for Reis] Inc said. "Until we see stabilization and recovery take root in both consumer spending and business spending and hiring, we do not foresee a recovery in the retail sector until late 2012 at the earliest."

More Mortgage Fraud

by Calculated Risk on 7/08/2009 07:18:00 PM

This is definitely "brazen" ...

From CNN: 25 charged in $100 million mortgage fraud

The D.A.'s office said the following banks were ripped off over a four-year period, ending in April: Countrywide, New Century Bank, Saxon Bank, Greenpoint Bank, ABC Bank, Bank of America, Wells Fargo and SunTrust. Some of the defendants were bank employees, according to the D.A.For more mortgage fraud, here is the Mortgage Fraud blog.

"The conspirators caused the banks to front millions of dollars to finance purchases of the properties," read a statement from the D.A.'s office. "They then walked away with most of the cash, leaving behind over-valued properties and worthless mortgage papers."

The D.A.'s office described a "particularly brazen sham transaction" where one of the suspects, Stephen Martini, allegedly wrote up a bogus appraisal of $500,000 for a two-family home, but "in reality, the location was a vacant lot."

PPIP Update

by Calculated Risk on 7/08/2009 04:50:00 PM

Press Release: Joint Statement by Secretary of the Treasury Timothy F. Geithner, Chairman of the Board of Governors of the Federal Reserve System Ben S. Bernanke, and Chairman of the Federal Deposit Insurance Corporation Sheila Bair

Today, the Treasury Department, the Federal Reserve, and the FDIC are pleased to describe the continued progress on implementing these programs including Treasury's launch of the Legacy Securities Public-Private Investment Program.There is a list of approved PPIP firms (no PIMCO!)

Financial market conditions have improved since the early part of this year, and many financial institutions have raised substantial amounts of capital as a buffer against weaker than expected economic conditions. While utilization of legacy asset programs will depend on how actual economic and financial market conditions evolve, the programs are capable of being quickly expanded if these conditions deteriorate. Thus, while the programs will initially be modest in size, we are prepared to expand the amount of resources committed to these programs.

Legacy Securities Program

The Legacy Securities program is designed to support market functioning and facilitate price discovery in the asset-backed securities markets, allowing banks and other financial institutions to re-deploy capital and extend new credit to households and businesses. Improved market function and increased price discovery should serve to reinforce the progress made by U.S. financial institutions in raising private capital in the wake of the Supervisory Capital Assessment Program (SCAP) completed in May 2009.

The Legacy Securities Program consists of two related parts, each of which is designed to draw private capital into these markets.

Legacy Securities Public-Private Investment Program ("PPIP")

Under this program, Treasury will invest up to $30 billion of equity and debt in PPIFs established with private sector fund managers and private investors for the purpose of purchasing legacy securities. Thus, Legacy Securities PPIP allows the Treasury to partner with leading investment management firms in a way that increases the flow of private capital into these markets while maintaining equity "upside" for US taxpayers.

Initially, the Legacy Securities PPIP will participate in the market for commercial mortgage-backed securities and non-agency residential mortgage-backed securities. To qualify, for purchase by a Legacy Securities PPIP, these securities must have been issued prior to 2009 and have originally been rated AAA -- or an equivalent rating by two or more nationally recognized statistical rating organizations -- without ratings enhancement and must be secured directly by the actual mortgage loans, leases, or other assets ("Eligible Assets").

...

Legacy Loan Program (this is the second program, and is essentially on hold)

And some more info:

To view the Letter of Intent and Term Sheets, please visit link

To view the Conflict of Interest Rules, please visit link

To view the Legacy Securities FAQs, please visit link

AmEx CEO: Some Stabilization, Hopes for Recovery in 2nd Half of 2010

by Calculated Risk on 7/08/2009 04:00:00 PM

First, a stick save for the market today (end of day rally) ... Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

From CNBC: AmEx CEO: Way Too Early To Call A Recovery

American Express Chief Executive Kenneth Chenault says he has seen signs of stabilization in the economy, but there have not been any signs of improvement yet.

He adds, he is hopeful for a recovery by the second half of 2010, but that is not how he is planning the company's business.

"I think it is way too early to say that we're in an economic recovery," Chenault says, in an interview with CNBC. "I think what is important is that at least what we are seeing is some stabilization. If we think about where things were last fall with the credit markets seizing up, it was a frightening situation. So stability, I think is important, and I think that's been very helpful."

Consumer Credit Declines in May

by Calculated Risk on 7/08/2009 03:00:00 PM

From MarketWatch: May consumer credit down in fourth straight month

U.S. consumers reduced their debt in May for the fourth consecutive month, the Federal Reserve reported Wednesday. Total seasonally adjusted consumer debt fell $3.22 billion ... Consumer credit fell in eight of the past ten months. ... This is the longest string of declines in credit since 1991. Credit-card debt had the biggest drop in May, falling $2.86 billion, or 3.7% to $928 billion.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the year-over-year (YoY) change in consumer credit. Consumer credit is off 1.8% over the last 12 months. The record YoY decline was 1.9% in 1991 - and that record will be broken over the next couple of months.

Note: Consumer credit does not include real estate debt.

Chicago Fed's Evans: Recession to end in 2nd Half

by Calculated Risk on 7/08/2009 12:55:00 PM

Update: Bob_in_MA points to Evans' forecast in Oct 2007: recovery in 2008 and concerned about inflation.

From Chicago Fed President Charles Evans: Nontraditional Monetary Policy and the Economic Outlook

Here is an excerpt of the economic outlook:

I'm not sure why some people keep repeating that existing home sales are at "very low levels". Actually existing home sales are at normal levels, although there is a very high level of distressed sales.... there have been some favorable developments of late, and the possibility that the economy is closer to a turning point is stronger now than just three months ago. Although the data have been uneven, our reading of the recent indicators is that the pace of contraction is slowing and that activity is bottoming out. We expect modest increases in output in the second half of this year followed by somewhat stronger growth in 2010.

So what are these signs of improvement that underlie this forecast? First, financial market conditions have improved, with credit spreads and other measures of market stress much lower than they were in late 2008 and early 2009.

Consumer spending, which had dropped sharply since the second half of last year, has been roughly flat so far in 2009. Housing markets, after more than three years of decline, have also shown some signs of stabilizing. Sales of both new and existing homes have appeared to flatten out in recent months, though both remain at very low levels. Meanwhile, homebuilders have reduced their backlog of unsold new homes—a precondition for any recovery in homebuilding. But the backlog of unsold existing homes remains high, and delinquency and foreclosure rates continue to be a substantial risk to the housing market recovery.

Labor markets remain weak, but there has been a (somewhat uneven) decline in the pace of job losses. The May and June average of monthly declines in employment was about half the rate of contraction as the beginning of this year, and newly filed jobless claims seem to have peaked in late March. However, firms are still reluctant to hire, and the unemployment rate reached 9-1/2 percent in June and will likely further increase through the remainder of the year before it flattens out in 2010.

The industrial side of the economy has been especially hard hit this year, but there are signs that the worst of the decline in the sector is in the past. Business fixed investment remains weak, but the decline is getting shallower. Steep inventory liquidations made significant negative contributions to output growth in late 2008 and early 2009. But this means that inventories are in better alignment with sales, so we expect to see less dramatic liquidation in the months ahead. In turn, the smaller declines translate into a net positive for GDP growth. Finally, in the coming months, the fiscal stimulus will continue to have positive influences on the economy.

emphasis added

Once again Evans discussed unwinding the Fed's balance sheet and he is somewhat concerned about inflation (Evans is a voting member of the FOMC):

Currently, core inflation is near 2 percent, a level I generally find acceptable. In the near term, I think the downward forces on inflation will be greater than the upward forces, and we could see some declines in core inflation. But over the medium term I see the risks to the inflation forecast as being more balanced.

FBI: U.S. Mortgage Fraud "Rampant" and "Escalating"

by Calculated Risk on 7/08/2009 10:27:00 AM

The FBI released their 2008 Mortgage Fraud Report today. (ht Bob_in_MA)

Mortgage fraud trends in 2008 reflected the overall downturn in the US economy ... the mortgage loan industry reported a spike in foreclosures and defaults; and financial markets continued to contract, diminishing credit to financial institutions, businesses, and homeowners. These combined factors uncovered and fueled a rampant mortgage fraud climate fraught with opportunistic participants desperate to maintain or increase their current standard of living. Industry employees sought to maintain the high standard of living they enjoyed during the boom years of the real estate market and overextended mortgage holders were often desperate to reduce or eliminate their bloated mortgage payments.Committing fraud to "maintain their high standard of living" ... hopefully these guys will enjoy some free state accomodations for a few years.

Mortgage fraud continues to be an escalating problem in the United States and a contributing factor to the billions of dollars in losses in the mortgage industry.

emphasis added

There is some state specific data and some discussion of some common schemes. Here are a few (there is much more detail in the report):

Builder-Bailout Schemes: Builders are employing builder-bailout schemes to offset losses, and circumvent excessive debt and potential bankruptcy, as home sales suffer from escalating foreclosures, rising inventory, and declining demand. Builder-bailout schemes are common in any distressed real estate market and typically consist of builders offering excessive incentives to buyers, which are not disclosed on the mortgage loan documents. Builder-bailout schemes often occur when a builder or developer experiences difficulty selling their inventory and uses fraudulent means to unload it. In a common scenario, the builder has difficulty selling property and offers an incentive of a mortgage with no down payment. For example, a builder wishes to sell a property for $200,000. He inflates the value of the property to $240,000 and finds a buyer. The lender funds a mortgage loan of $200,000 believing that $40,000 was paid to the builder, thus creating home equity. However, the lender is actually funding 100 percent of the home’s value. The builder acquires $200,000 from the sale of the home, pays off his building costs, forgives the buyer’s $40,000 down payment, and keeps any profits. If the home forecloses, the lender has no equity in the home and must pay foreclosure expenses.

Short-Sale Schemes: Short-sale schemes are desirable to mortgage fraud perpetrators because they do not have to competitively bid on the properties they purchase, as they do for foreclosure sales. Perpetrators also use short sales to recycle properties for future mortgage fraud schemes. Short-sale fraud schemes are difficult to detect since the lender agrees to the transaction, and the incident is not reported to internal bank investigators or the authorities. As such, the extent of short sale fraud nationwide is unknown. A real estate short sale is a type of pre-foreclosure sale in which the lender agrees to sell a property for less than the mortgage owed. In a typical short sale scheme, the perpetrator uses a straw buyer to purchase a home for the purpose of defaulting on the mortgage. The mortgage is secured with fraudulent documentation and information regarding the straw buyer. Payments are not made on the property loan causing the mortgage to default. Prior to the foreclosure sale, the perpetrator offers to purchase the property from the lender in a short-sale agreement. The lender agrees without knowing that the short sale was premeditated. The mortgage owed on the property often equals or exceeds 100 percent of the property’s equity.

Foreclosure Rescue Schemes: Foreclosure rescue schemes are often used in association with advance fee/loan modification program schemes. The perpetrators convince homeowners that they can save their homes from foreclosure through deed transfers and the payment of up-front fees. This “foreclosure rescue” often involves a manipulated deed process that results in the preparation of forged deeds. In extreme instances, perpetrators may sell the home or secure a second loan without the homeowners’ knowledge, stripping the property’s equity for personal enrichment.

MBA: Mortgage Refinance Activity Up from Recent Lows

by Calculated Risk on 7/08/2009 08:51:00 AM

The MBA reports:

This week’s results include an adjustment to account for the holiday. The Market Composite Index, a measure of mortgage loan application volume, was 493.1, an increase of 10.9 percent on a seasonally adjusted basis from 444.8 one week earlier.

...

The Refinance Index increased 15.2 percent to 1707.7 from 1482.2 the previous week and the seasonally adjusted Purchase Index increased 6.7 percent to 285.6 from 267.7 one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages remained unchanged at 5.34 percent ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

Note: The increase in 2007 was due to the method used to construct the index: a combination of lender failures, and borrowers filing multiple applications pushed up the index in 2007, even though activity was actually declining.

The Purchase index has moved some above the recent lows, but the big story is the Refinance index - the index had declined sharply in recent weeks as mortgage rates increased, but the index was up this week.