by Calculated Risk on 7/08/2009 12:56:00 AM

Wednesday, July 08, 2009

Apartment Vacancy Rate at 22 Year High

From Reuters: U.S. apartment vacancies near historic high: report

The vacancy rate for U.S. apartments reached its highest level in more than 20 years...Note: the Reis numbers are for cities. The overall vacancy rate from the Census Bureau was at 10.1% in Q1 2009. This fits with the NMHC apartment market survey.

The national vacancy rate rose to 7.5 percent ... The record high was 7.8 percent in 1986.

"We are reaching that historic high very quickly," said Victor Calanog, Reis director of research.

... effective rent was down 1.9 percent from the prior year and 0.9 percent from the first quarter to $975, Reis said.

... "With general expectations of an economic recovery pushed back to early 2010 at the earliest, it seems likely that apartments will have to endure a few more quarters of distress, lower rents and higher vacancies," Calanog said.

Rising vacancies. Falling Rents. This time for apartments ...

Tuesday, July 07, 2009

More Evidence of the "Foreclosure Backlog"

by Calculated Risk on 7/07/2009 09:00:00 PM

From Peter Hong at the LA Times: L.A. County's May default rate double last year

May's 9.5% [seriously] delinquency rate [more than 90 days] for L.A. County was up from 5% of mortgages ... in May 2008 [First American CoreLogic reported today].Ramsey Su (REO broker in San Diego) sent me some data today. He wrote:

... the final foreclosure stage -- has shrunk. In May, the L.A. County repossession rate was down to 1% of mortgages, from 1.1% a year ago. This discrepancy is the "foreclosure backlog" now looming over the housing market. ...

Nationally, First American reported 6.5% of mortgages were in default in May, up from 4% in May 2008. The national repossession rate was 0.7% in May, up from 0.6% in May 2007.

[Pent Up Foreclosures - a stat Ramsey follows] measures the difference between foreclosures completed versus defaults. This gap is widening as a result of government intervention. ... If they do not ACCELERATE the foreclosure process and release some of the pressure now, the consequences will be disastrous.The foreclosures are coming. The foreclosures are coming!

CNBC Interview with Bryan Marsal, CEO of Lehman Brothers Holdings

by Calculated Risk on 7/07/2009 06:32:00 PM

This is an interesting interview from early this morning with Bryan Marsal, CEO of Lehman Brothers Holdings, who is unwinding Lehman Brothers ... especially at the 18 minute mark:

One of my partners said yesterday that we are going to call this phase the "extend and pretend" phase in our economy. Which is you extend someone's maturity - because they are going to default - and you pretend that business will come back or that leverage factor is going to come back.This applies to all kinds of debt - extend and pretend - that sounds like most of the residential loan modifications! But eventually many of those same loans will reach the "send" phase.

Then we'll enter phase two, which he said is the request to extend or "amend".

Then "send". In other words send the keys.

That is the phases we are in right now. Everyone is trying to buy time, as opposed to dealing with the leverage, they are trying to buy time. Whether you are a banker or a company, they are all trying to buy time. I don't see the leverage coming back, and I don't see the consumption of good and services coming back.

Bryan Marsal, CEO of Lehman Brothers Holdings.

CRE: Another Half Off Sale and Market

by Calculated Risk on 7/07/2009 03:54:00 PM

First, the market was off about 2% today ... Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

And from Bloomberg: Deutsche Bank to Sell New York Tower for $605 Million (ht Brad, Brian)

Deutsche Bank AG, Germany’s largest bank, plans to sell Manhattan’s Worldwide Plaza to ... RCG Longview and George Comfort & Sons ... for about $605 million ...More like 65% off, but all that vacant space was probably a huge factor.

Deutsche Bank is selling the last of seven buildings it seized from developer Harry Macklowe. He paid $1.74 billion for the 1.75 million square-foot property in February 2007, according to Real Capital Analytics Inc. data. Manhattan office building prices have dropped 30 percent to 50 percent since the peak in 2007, according to Woody Heller, head of the capital transactions group at Studley, a New York-based brokerage. Heller wasn’t involved in the transaction.

...The 47-story building will have more than 700,000 square- feet of vacant space with the expected departure of advertising and public relations firm Ogilvy & Mather.

Office Vacancy Rate and Unemployment

by Calculated Risk on 7/07/2009 02:33:00 PM

Last night Reis reported that the U.S. office vacancy rate hits 15.9 percent in Q2. (See Reis: U.S. Office Vacancy Rate Hits 15.9% in Q2 for a graph). Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the office vacancy rate vs. the quarterly unemployment rate and recessions.

The unemployment rate and the office vacancy rate tend to move in the same direction - and the peaks and troughs mostly line up.

As the unemployment rate continues to rise over the next year or more, the office vacancy rate will probably rise too. Reis' forecast is for the office vacancy rate to peak at 18.2 percent in 2010, and for rents to continue to decline through 2011.

One of the questions is why - given 9.5% unemployment - the office vacancy rate isn't even higher? This is probably a combination of less overbuilding as compared to the S&L related overbuilding in the '80s, and the tech bubble overbuilding a few years ago. And possibly because a higher percentage of construction, manufacturing and retail workers (non-office workers) have lost their jobs in the recession (I'll have to check that).

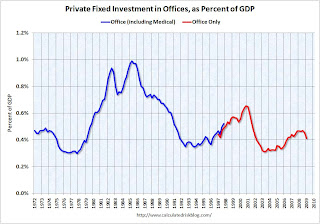

Note: Hotel and retail structure investment were off the charts during the recent boom, but office investment was somewhat muted in comparison ... The second graph shows office investment as a percent of GDP since 1972 through Q1 2009. Office investment peaked in Q3 2008, and with the office vacancy rate rising sharply, office investment will probably decline at least through 2010.

The second graph shows office investment as a percent of GDP since 1972 through Q1 2009. Office investment peaked in Q3 2008, and with the office vacancy rate rising sharply, office investment will probably decline at least through 2010.

Note: In 1997, the Bureau of Economic Analysis changed the office category. In the earlier years, offices included medical offices. After '97, medical offices were not included (The BEA presented the data both ways in '97).

There is still too much space coming online. From Reuters:

During the second quarter, office space coming on the market topped rented space by about 20 million square feet, slightly less than the 25.2 million square feet in the first quarter.

Year-to-date, 45.2 million more square feet came onto the market than was rented, in line with Reis' projection of about 67.6 million square feet for all of 2009.

If the projection holds true, 2009 will be the worst year for net absorption of office space since Reis began tracking it in 1980.

Hotel Recession Reaches 20 Months

by Calculated Risk on 7/07/2009 12:21:00 PM

From HotelNewsNow: Industry enters 20th month of recession

Economic research firm e-forecasting.com, in conjunction with Smith Travel Research, announced HIP edged down 0.7 percent in June, following a decline of 1.2 percent in May. HIP, the Hotel Industry’s Pulse index, is a composite indicator that gauges business activity in the U.S. hotel industry in real-time. The latest decrease brought the index to a reading of 82.5. The index was set to equal 100 in 2000.

...

“This recession continues to drag out, just one month shy of matching the longest one the industry felt back in May ’81 to January ’83, which lasted 21 months,” said Maria Simos, CEO of e-forecasting.com

| Click on graph for larger image in new window. |

And a quote from The Arizona Republic: Resorts suffer financial strains (ht Jonathan)

Richard Warnick of Warnick & Co. said he'd be surprised if nearly all hotels and resorts, here and across the country, weren't in technical default on their loans, falling below required minimums on debt service coverage, for example, given the sad state of travel. That is often a precursor to more serious financial problems that prompt lenders to foreclose.Actually the hotel industry has "committed economic suicide" by overbuilding and taking on too much debt.

...

He and others say hotels have committed economic suicide by slashing rates to levels not seen even in the aftermath of 9/11, and many are concerned it will take years to get back to "normal," or at least the new normal.

Smith Travel Research is now forecasting RevPAR (revenue per available room) off 17.1% this year and declining another 3.7% next year.

Banks Will Stop Accepting California IOUs Friday

by Calculated Risk on 7/07/2009 11:04:00 AM

From the WSJ: Big Banks Don't Want California's IOUs

A group of the biggest U.S. banks said they would stop accepting California's IOUs on Friday ... if California continues to issue the IOUs, creditors will be forced to hold on to them until they mature on Oct. 2, or find other banks to honor them.I guess the banks don't think the 3.75% annual interest rate is worth the risk for a "BBB" rated debtor on the Rating Watch Negative list.

...

The group of banks included Bank of America Corp., Citigroup Inc., Wells Fargo & Co. and J.P. Morgan Chase & Co., among others.

ABA: Record Home-Equity Loan Delinquencies

by Calculated Risk on 7/07/2009 09:25:00 AM

From Bloomberg: U.S. Home-Equity Loan Delinquencies Set Record in First Quarter (ht Bob_in_MA)

Late payments on home-equity loans rose to a record in the first quarter ...Update: headline corrected, ABA, not MBA.

Delinquencies on home-equity loans climbed to 3.52 percent of all accounts in the quarter from 3.03 percent in the fourth and late payments on home-equity lines of credit climbed to a record 1.89 percent, the group said. ...

“The number one driver of delinquencies is job loss,” James Chessen, the group’s chief economist, said in an e-mailed statement. “Delinquencies won’t improve until companies start hiring again and we see a significant economic turnaround.”

Bank Failures and Trust-preferred securities

by Calculated Risk on 7/07/2009 08:46:00 AM

From the WSJ: Hybrid Securities Doomed Six Banks (ht Brian)

The six family-controlled Illinois banks that collapsed on Thursday were doomed by massive holdings of trust preferred securities, Wall Street instruments that came into vogue during the industry's boom but are now battering a growing number of small banks.These trust-preferred securities (TPS) were attractive investments for small banks because they have characteristics of both debt and equity. If the securities were issued by a bank holding company (BHC) - with certain characteristics - they were treated as a tier 1 capital by regulators.

... Wall Street brokerage firms bought the securities from individual banks and packaged them into collateralized-debt obligations. The firms then sold slices of the CDOs to investors, marketing them as lucrative but low risk. Many of the buyers were small and regional banks.

One of the big disadvantages for investors (usually small banks) was that the securities were subordinated to all of the issuing BHC's other debt, and the issuer could opt to stop paying dividends on the securities for several years. As the WSJ notes:

When the credit crisis hit, the values of the securities and pools into which they were packaged rapidly lost value, partly because some banks stopped paying dividends on the securities. Under accounting rules, the banks were required to write down the securities to market value. That forced the banks to absorb big losses, winnowing their capital cushions.From the Philly Fed: Emerging Issues Regarding Trust Preferred Securities

As of December 31, 2008, almost 1,400 bank holding companies had approximately $148.8 billion in outstanding TPS, compared to 110 BHCs with $31.0 billion outstanding in 1999.

...

TPS have proven to be an effective way to bolster a BHC's capital position when financial performance is strong. If a BHC or its subsidiary bank's financial condition (particularly, its capital levels) deteriorates, however, the limitations on including TPS for regulatory capital purposes and the restrictive covenants in the debentures could further exacerbate the institution's financial problems and raise supervisory concerns.

...

Adverse economic and market conditions have resulted in rating downgrades of TPS and significant valuation declines for these securities. For instance, on February 10, 2009, Standard and Poor's Ratings Services lowered its ratings on 35 tranches from 14 U.S. trust preferred CDOs. These downgrades reflect fears that institutions issuing TPS may be more likely to defer interest payments as the current economic crisis continues.

...

Given the interrelated ownership of a financial institution's TPS by another banking organization, the underlying stability and strength of the issuing bank must be considered when assessing the risk associated with holding a security which is currently in the deferral phase of dividend payment. Given the extensive issuance of TPS over the past 10 years and the present danger for bank failures, the potential exists for many of these securities to default permanently.

emphasis added

Reis: U.S. Office Vacancy Rate Hits 15.9% in Q2

by Calculated Risk on 7/07/2009 12:14:00 AM

"It's bad. It's decaying and getting worse. Given the depth and magnitude of the recession, you can argue that we are facing a storm of epic proportions and we're only at the beginning."

Victor Calanog, Reis director of research.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the office vacancy rate starting 1991.

Reis is reporting the vacancy rose to 15.9% in Q2; the peak following the previous recession was 17%.

From Reuters: US office market continues to spiral down--report

The U.S. office market vacancy rate reached 15.9 percent in the second quarter, its highest in four years and rent fell by the largest amount in more than seven as demand from companies and other office renters remained weak, real estate research firm Reis said Inc.I'll take the over.

... Factoring in rent-free months and improvement costs to landlords, effective rent -- the net amount of cash landlords take in -- fell 2.7 percent in the quarter to $23.42 per square foot. The second-quarter drop was more severe than the first quarter's 2.3 percent ...

... Reis ... forecast [is] for the U.S. office vacancy rate to top out at 18.2 percent in 2010 and for rent to continue to fall through 2011.