by Calculated Risk on 6/29/2009 01:27:00 PM

Monday, June 29, 2009

A comment on Fed Chairman Ben Bernanke

Given all the recent attacks, I'd be remiss if I didn't write something about Bernanke, but first ...

I've been a regular critic of Ben Bernanke. I thought he missed the housing and credit bubble when he was a member of the Fed Board of Governors from 2002 to 2005. And I frequently ridiculed his comments when he was Chairman of the President Bush's Council of Economic Advisers from June 2005 to January 2006.

In 2005, I posted these comments from Bernanke and disagreed strongly:

"While speculative behavior appears to be surfacing in some local markets, strong economic fundamentals are contributing importantly to the housing boom," ...And after Bernanke wrote a commentary in the WSJ: The Goldilocks Economy, I called it "bunkum" and I argued Bernanke was channeling Calvin Coolidge:

Those fundamentals, Bernanke said, include low mortgage rates, rising employment and incomes, a growing population and a limited supply of homes or land in some areas.

"For example, states exhibiting higher rates of job growth also tend to have experienced greater appreciation in house prices,"

The entire commentary is bunkum. But instead of correcting each of Bernanke's false assertions, I've found the template for his talking points:And I disagreed again in July 2005 when Bernanke said:No Congress of the United States ever assembled, on surveying the state of the Union, has met with a more pleasing prospect than that which appears at the present time. In the domestic field there is tranquillity and contentment, harmonious relations between management and wage earner, freedom from industrial strife, and the highest record of years of prosperity.Bernanke is now channeling Coolidge's monument to economic shortsightedness.

Calvin Coolidge, State of the Union Address, December 4, 1928

Top White House economic adviser Ben Bernanke said on Friday strong U.S. housing prices reflect a healthy economy and he doubts there will be a national decline in prices.And we can't forget Bernanke's "contained" to subprime comments in March 2007?

"House prices have gone up a lot," Bernanke said in an interview on CNBC television. "It seems pretty clear, though, that there are a lot of strong fundamentals underlying that.

"The economy is strong. Jobs have been strong, incomes have been strong, mortgage rates have been very low," the chairman of the White House Council of Economic Advisers said.

The pace of housing prices may slow at some point, Bernanke said, but they are unlikely to drop on a national basis.

"We've never had a decline in housing prices on a nationwide basis," he said, "What I think is more likely is that house prices will slow, maybe stabilize ... I don't think it's going to drive the economy too far from its full-employment path, though."

Although the turmoil in the subprime mortgage market has created severe financial problems for many individuals and families, the implications of these developments for the housing market as a whole are less clear. The ongoing tightening of lending standards, although an appropriate market response, will reduce somewhat the effective demand for housing, and foreclosed properties will add to the inventories of unsold homes. At this juncture, however, the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained.That became a running joke.

With that lengthy prelude, I've felt once Bernanke started to understand the problem, he was very effective at providing liquidity for the markets. The financial system faced both a liquidity and a solvency crisis, and it is the Fed's role to provide appropriate liquidity (we can disagree on what is appropriate). I don't think it is the Fed's role to run an insurance company - but I think that is as much the failure of Paulson's Treasury as overreach by the Fed.

And given all the recent attacks on Bernanke - many of them very personal - I'd like to reprint some of Jim Hamilton's comments: On grilling the Fed Chair

It is one thing to have different views from those of the Fed Chair on particular decisions that have been made-- I certainly have plenty of areas of disagreement of my own. But it is another matter to question Bernanke's intellect or personal integrity. As someone who's known him for 25 years, I would place him above 99.9% of those recently in power in Washington on the integrity dimension, not to mention IQ. His actions over the past two years have been guided by one and only one motive, that being to minimize the harm caused to ordinary people by the financial turmoil. Whether you agree or disagree with all the steps he's taken, let's start with an understanding that that's been his overriding goal.I agree with Professor Hamilton.

Fed's Rosengren on Macroprudential Oversight

by Calculated Risk on 6/29/2009 12:28:00 PM

Boston Fed President Eric Rosengren spoke this morning on The Roles and Responsibilities of a Systemic Regulator

One of my complaints five years ago was that lending standards were too lax (or non-existent), leverage was increasing rapidly, and lenders were clearly making loans that would probably not be repaid.

Rosengren addresses this issue:

Frequently, examiners spend significant time analyzing the adequacy of reserves, given asset quality. Reserve levels are calculated based on accounting standards that focus on incurred losses at the bank, rather than expected or unexpected losses. The incurred-loss model can sometimes be at odds with a more risk-based view that is more forward looking. By focusing on reserves in the manner defined by accounting rules, examiners are looking at history rather than focusing on whether banks have adequately provided for future losses. During periods when asset prices are rising rapidly and when nonperforming loans tend to be low, this construct can result in lower estimates for incurred losses and thus lower reserves – while at the same time, earnings and capital will likely be growing.UPDATE: Lama notes that Rosengren is incorrect about accounting just looking at "history", and reminds me of the guest piece he wrote in 2008: The Pig and The Balance Sheet

Periods when earnings are strong and nonperforming loans are low are likely the times that a macroprudential supervisor would need to be particularly vigilant. Rising asset prices are often accompanied by increases in leverage, as financial institutions provide financing for sectors of the economy that are growing rapidly. This growth frequently occurs with lessened attention to underwriting standards, a greater willingness to finance long-run positions with short-term liabilities, and a greater concentration of loans in areas that have grown rapidly. So – unlike the focus on incurred losses and accounting reserves of traditional safety and soundness supervision – a systemic regulator would need to be focused on forward-looking estimates of potential losses that could cause contagious failures of financial institutions.

bold emphasis added

And Rosengren concludes:

A systemic regulator or macroprudential supervisor would need not only the ability to monitor systemically important institutions, but also the ability to change behavior if firms are financing a boom by increasing leverage and liquidity risk. It follows that legislation that aims to design an effective systemic regulator needs to provide the regulator with the authority to make such changes. Understanding the activities of systemically important firms would require a clear picture of their leverage, their liquidity, and their risk management. Furthermore, to be truly effective in “leaning against the wind,” such a regulator would need the ability to prevent the build-up of excessive leverage or liquidity risk.However Rosengren doesn't address how the macroprudential supervisor would identify excessive leverage or liquidity risk. During every bubble there are always people in position of authority arguing everything is fine. As an example, here is what then Treasury Secretary Snow said on June 28, 2005 (has it really been 4 years?):

Snow tried to alleviate concerns that climbing nationwide housing prices could ultimately lead to an asset bubble that will burst at some point.He was flat-out wrong. And that was almost at the peak of the bubble (in activity).

"I think in some markets housing prices have risen out of alignment with underlying earnings," Snow said. But also answering the question whether there was a housing bubble in the United States his answer was a flat-out "no."

I think we need to clearly understand how we identify - in real time - these macroeconomic and systemic risks.

Romer: Big Stimulus Impact Starts Now

by Calculated Risk on 6/29/2009 10:20:00 AM

From the Financial Times: Romer upbeat on US economy

Ms Romer, chairman of the US president’s council of economic advisers, told the Financial Times in an interview she was “more optimistic” that the economy was close to stabilisation.I think a normal V-shaped recovery is very unlikely since the two usual drivers of economic recovery - residential investment and personal consumption expenditure - will both be crippled for some time.

...

Ms Romer said stimulus spending was “going to ramp up strongly through the summer and the fall”.

“We always knew we were not going to get all that much fiscal impact during the first five to six months. The big impact starts to hit from about now onwards,” she said.

Ms Romer said that stimulus money was being disbursed at almost exactly the rate forecast by the Office of Management and Budget. “It should make a material contribution to growth in the third quarter.”

But she acknowledged that cutbacks by states facing budget crises would push in the opposite direction.

Ms Romer said the latest economic data were encouraging, following a weaker patch a month ago. “I am more optimistic that we are getting close to the bottom,” she said.

...

But she added: “I still hold out hope it will be a V-shaped recovery. It might not be the most likely scenario but it is not as unlikely as many people think.

“We are going to get some serious oomph from the stimulus, there is the inventory cycle and I believe there is some pent-up demand by consumers.”

Freddie Mac June Investor Presentation

by Calculated Risk on 6/29/2009 08:48:00 AM

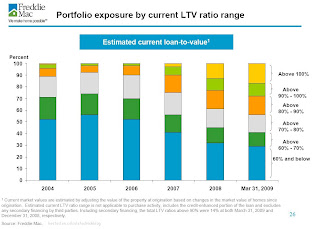

Here are a few graphs from the Freddie Mac June Investor Presentation. Click on graph for large image.

Click on graph for large image.

The first graph shows the average LTV of the Freddie Portfolio (graph doesn't start at zero).

The second graph shows the current breakdown by LTV and credit score.

According to Freddie Mac's estimate, 17% of the mortgages in their portfolio have negative equity. Another 11% of the loans have less than 10% equity.

Another 11% of the loans have less than 10% equity.

According to the Census Bureau, 51.6 million U.S. owner occupied homes had mortgages (end of 2007, see data here)

This would suggest that 8.8 million households have negative equity (51.6 million times 17%), and another 5.7 have 10% or less equity. However, the loans from Freddie Mac were better than most, and this is probably the lower bound for homeowners with negative equity. The third graphs show how the LTV breakdown has shifted over time as house prices have fallen.

The third graphs show how the LTV breakdown has shifted over time as house prices have fallen.

I'm surprised that any loans had negative equity in 2004, but just over 10% of the portfolio appeared to have LTV portfolio risk in 2004. Falling house prices has changed the mix!

Note: I'd consider the Zillow estimate of 20.4 million homeowners with negative equity as the upper bound (and I think their estimate is too high).

About 20.4 million of the 93 million houses, condos and co- ops in the U.S. were worth less than their loans as of March 31, according to Seattle-based real estate data service Zillow.com.There is much more in the Freddie Mac presentation.

Sunday, June 28, 2009

BIS: Toxic Assets Still a Threat

by Calculated Risk on 6/28/2009 09:52:00 PM

The Bank of International Settlements (BIS) will release their annual report tomorrow. The Guardian has a preview: Recovery threatened by toxic assets still hidden in key banks

... Despite months of co-ordinated action around the globe to stabilise the banking system, hidden perils still lurk in the world's financial institutions according to the Basle-based Bank of International Settlements.Also, the WSJ has an article on the incredibly shrinking PPIP: Wary Banks Hobble Toxic-Asset Plan

"Overall, governments may not have acted quickly enough to remove problem assets from the balance sheets of key banks," the BIS says in its annual report. "At the same time, government guarantees and asset insurance have exposed taxpayers to potentially large losses."

... As one of the few bodies consistently sounding the alarm about the build-up of risky financial assets and under-capitalised banks in the run-up to the credit crisis, the BIS's assessment will carry weight with governments. It says: "The lack of progress threatens to prolong the crisis and delay the recovery because a dysfunctional financial system reduces the ability of monetary and fiscal actions to stimulate the economy."

It also expresses concern about the dilemma facing policymakers on when to start reining in the recovery. "Tightening too early could thwart the recovery, whereas tightening too late may result in inflationary pressures from the stimulus in place, or contribute to yet another cycle of increasing leverage and bubbling asset prices. Identifying when to tighten is difficult even at the best of times, but even more so at the current stage," it says.

I think the stress tests showed that the U.S. should have pre-privatized BofA, Citigroup and GMAC. Oh well ...

How many Homeowners Sold to Rent at the Peak?

by Calculated Risk on 6/28/2009 07:26:00 PM

TJ & The Bear asks: "ocrenter had an interesting question over at JtR's BubbleInfo. Specifically, what percentage of homeowners that sold during the height of the bubble (04 to 06) went to cash and rented?" ocrenter is obviously curious about "cash on the housing sidelines".

We don't have the data to answer that question, but using the Census Bureau Residential Vacancies and Homeownership report, we can see that the number of occupied rental units bottomed in Q2 2004. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).

The number of occupied rental units bottomed in Q2 2004, and has increased by 3.8 millions units since then.

The homeownership rate also peaked in 2004, although it didn't start declining sharply until 2007.  Note: graph starts at 60% to better show the change.

Note: graph starts at 60% to better show the change.

There are probably several reasons why the number of renters started increasing in the 2nd half of 2004 (even though the housing bubble didn't peak in activity until the summer of 2005, and in prices until the summer of 2006.) More and more renters probably thought housing prices were too high by 2004 and put off buying, and some homeowners probably sold and became renters ...

To answer ocrenters question (somewhat), the number of renters increased by about 1.6million in the 2004 to 2006 period. A large number of those renters could have been homeowners who decided to sell and rent. We just don't have the data ...

Scientific American: Bubbles and Busts

by Calculated Risk on 6/28/2009 02:03:00 PM

Scientific American has a discussion of behavioral economics (Shiller's area) in the July issue. Here is a funny quote:

“Economists suffer from a deep psychological disorder that I call ‘physics envy'. We wish that 99 percent of economic behavior could be captured by three simple laws of nature. In fact, economists have 99 laws that capture 3 percent of behavior. Economics is a uniquely human endeavor ..."It probably isn't as dismal as Lo suggests!

Andrew Lo, a professor of finance at the Massachusetts Institute of Technology

Here is the article from Scientific American: The Science of Economic Bubbles and Busts (ht Jonathan) and a short excerpt:

... [T]he ideas of behavioral economists, who study the role of psychology in making economic decisions, are gaining increasing attention today, as scientists of many stripes struggle to understand why the world economy fell so hard and fast. And their ideas are bolstered by the brain scientists who make inside-the-skull snapshots of the [ventromedial prefrontal cortex] VMPFC and other brain areas. Notably, an experiment reported in March ... demonstrated that some of the brain’s decision-making circuitry showed signs of money illusion on images from a brain scanner. A part of the VMPFC lit up in subjects who encountered a larger amount of money, even if the relative buying power of that sum had not changed, because prices had increased as well.I've argued before that many buyers during the late stages of the bubble acted rationally. They could buy with little or no money down, and their house payments were below the comparable rent for a couple of years . If prices went up, they could sell as a profit - and if prices went down, they could strategically default. That was a systemic problem.

The illumination of a spot behind the forehead responsible for a misconception about money marks just one example of the increasing sophistication of a line of research that has already revealed brain centers involved with the more primal investor motivations of fear and greed ... A high-tech fusing of neuroimaging with behavioral psychology and economics has begun to provide clues to how individuals, and, aggregated on a larger scale, whole economies may run off track. Together these disciplines attempt to discover why an economic system, built with nominal safeguards against collapse, can experience near-catastrophic breakdowns.

...

The behavioral economists who are trying to pinpoint the psychological factors that lead to bubbles and severe market disequilibrium are the intellectual heirs of psychologists Amos Tversky and Daniel Kahneman, who began studies in the 1970s that challenged the notion of financial actors as rational robots. Kahneman won the Nobel Prize in Economics in 2002 for this work; Tversky would have assuredly won as well if he were still alive. Their pioneering work addressed money illusion and other psychological foibles, such as our tendency to feel sadder about losing, say, $1,000 than feeling happy about gaining that same amount.

A unifying theme of behavioral economics is the often irrational psychological impulses that underlie financial bubbles and the severe downturns that follow. Shiller, a leader in the field, cites “animal spirits”—a phrase originally used by economist John Maynard Keynes—as an explanation. The business cycle, the normal ebbs and peaks of economic activity, depends on a basic sense of trust for both business and consumers to engage one another every day in routine economic dealings. The basis for trust, however, is not always built on rational assessments. Animal spirits—the gut feeling that, yes, this is the time to buy a house or that sleeper stock—drive people to overconfidence and rash decision making during a boom. These feelings can quickly transmute into panic as anxiety rises and the market heads in the other direction. Emotion-driven decision making complements cognitive biases—money illusion’s failure to account for inflation, for instance—that lead to poor investment logic.

But animal spirits definitely helps explain the rush to buy that we saw at the peak of the bubble.

As an aside, I highlighted the one sentence because I've seen that behavior frequently. Some people are so afraid of losing money on each investment that they pass up on some very good investments. These individuals appear to assign a higher value to losing $1000, than gaining the same amount.

Boom Time: Personal Bankruptcies in SoCal

by Calculated Risk on 6/28/2009 10:29:00 AM

From the LA Times: Personal bankruptcies surge in Southern California

Going legally broke has made a big comeback -- especially in the Los Angeles area -- despite a mid-decade revision to the U.S. Bankruptcy Code intended to curb filings.Ahhh ... "adventuresome borrowers" ... sounds better than gamblers or speculators.

The number of Southern Californians seeking bankruptcy protection nearly doubled in 2008 from 2007 in the U.S. Bankruptcy Court's seven-county California Central District, by far the biggest increase in the nation.

Bankruptcy is still booming. Personal filings from January through April, the most recent month available, rose 75% in the Central District compared with the year-earlier period.

Bankruptcy experts attribute the growth mainly to the mortgage meltdown, which hit the region's adventuresome borrowers particularly hard.

| Click on cartoon for larger image in new window. Repeat: Cartoon from Eric G. Lewis, a freelance cartoonist living in Orange County, CA. |

Foreclosure Auction Bidding Wars

by Calculated Risk on 6/28/2009 01:31:00 AM

First from Matt Padilla: Frenzied bidding on discounted foreclosures

Whenever I attended auctions in 2007 and 2008, investors generally passed on properties. But on June 26 they jumped on houses and condos with discounts of greater than $100,000 on the debt and fees owed on each property.Normally lenders just bid what they are owed at auction, but I've been hearing for several months about some lenders bidding substantial under the amount owed. Jillayne discussed this a couple of months ago for an auction in Bellevue, WA.

For example, at least four people bid on a two-bedroom house in Anaheim on Zeyn Street. Winning bid: $206,000. Amount owed before foreclosure: $565,000. Discount: $359,000. ...

The discount is what the bank is willing to accept; it’s not directly related to the current market value, though I am sure the bank has a ballpark value in mind when it decides how much to accept.

...

A few other examples:

•Another property in Anaheim, a condominium on South Walnut, sold for $154,000, 57% off the debt owed of $358,000. At least three investors bid on it.

...

•A property on West Sunflower in Santa Ana went for $110,500, close to a third of $319,663 owed. ...

On a slightly different topic - many REOs are receiving multiple bids (because some lenders are trying to price them to start bidding wars). Here is a video from Jim the Realtor (after the ice cream truck bit) of an REO with 18 offers: