by Calculated Risk on 6/24/2009 12:30:00 PM

Wednesday, June 24, 2009

Shadow Housing Inventory: Walked Away, but Lender Hasn't Foreclosed

From the WaPo: Not Paying the Mortgage, Yet Stuck With the Keys (ht Bob_in_MA)

A growing number of American homeowners are falling into financial limbo: They're badly behind on payments, but their banks have not yet foreclosed.There is much more in the article.

The backlog of seriously delinquent mortgages, which so far affects about 1 million borrowers, is a shadow over hopes for a rebound in the nation's housing markets. It masks the full extent of the foreclosure crisis ...

"I have even begged them for a foreclosure," delinquent mortgage-holder Charlotte Jensen said. When she realized she couldn't save her Glen Allen home last year, she filed for bankruptcy, packed up her family and moved out. Nearly a year later, Bank of America has yet to take back the home.

...

Some of the backlog reflects the inability of lenders to keep up with the swelling rolls of delinquent properties.

... some of the backlog also reflects an intentional slowdown in the pace of foreclosures as government and industry step up efforts to help borrowers who want to save their homes. Fannie Mae and Freddie Mac, the government-run mortgage financing companies, put a temporary moratorium on foreclosures late last year and many of the country's largest lenders followed suit.

...

"What we're seeing more and more right now are cases of a lender threatening foreclosure and the foreclosure sale is canceled at the last minute," said Jeanne Hovenden, a Richmond bankruptcy attorney, who handled Jensen's case. "It's more like the lenders don't want to own any more real estate and are using foreclosures as a pressure tactic."

...

Jensen visits her home weekly to ensure it hasn't been vandalized or taken over by squatters. She pays landscapers to keep the lawn mowed.

...

For the Jensens, the delay has extended a painful period. "There was a sense of responsibility that until someone says we no longer own that property, we wanted to make sure it's handed off correctly," Jensen said. "We could have walked away like everyone else and said, 'We don't care.' But we loved our neighbors and our neighborhood. We hold ourselves responsible."

Distressing Gap: Ratio of Existing to New Home Sales

by Calculated Risk on 6/24/2009 11:47:00 AM

For graphs based on the new home sales report this morning, please see: New Home Sales: Record Low for May

Yesterday, the National Association of Realtors (NAR) reported that distressed properties accounted for one-third of all sales in May. Distressed sales include REO sales (foreclosure resales) and short sales, and based on the 4.77 million existing home sales (SAAR) that puts distressed sales at about a 1.6 million annual rate in April.

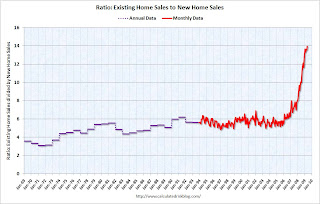

All this distressed sales activity has created a gap between new and existing sales as shown in the following graph that I've jokingly labeled the "Distressing" gap.

This is an update including May new and existing home sales data. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows existing home sales (left axis) and new home sales (right axis) through March.

As I've noted before, I believe this gap was caused by distressed sales - in many areas home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.  The second graph shows the same information, but as a ratio for existing home sales divided by new home sales.

The second graph shows the same information, but as a ratio for existing home sales divided by new home sales.

Although distressed sales will stay elevated for some time, eventually I expect this ratio to decline - probably with a combination of falling existing home sales and eventually rising new home sales.  The third graph shows the ratio back to 1969 (annual data before 1994).

The third graph shows the ratio back to 1969 (annual data before 1994).

Note: the NAR has changed their data collection over time and the older data does not include condos: Single-family data collection began monthly in 1968, while condo data collection began quarterly in 1981; the series were combined in 1999 when monthly collection of condo data began.

New Home Sales: Record Low for May

by Calculated Risk on 6/24/2009 10:00:00 AM

The Census Bureau reports New Home Sales in May were at a seasonally adjusted annual rate (SAAR) of 342 thousand. This is essentially the same as the revised rate of 344 thousand in April. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. This is the lowest sales for May since the Census Bureau started tracking sales in 1963. (NSA, 32 thousand new homes were sold in May 2009; the record low was 36 thousand in May 1982).

As the graph indicates, sales in May 2009 were substantially worse than the previous years. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in May 2009 were at a seasonally adjusted annual rate of 342,000 ...And another long term graph - this one for New Home Months of Supply.

This is 0.6 percent (±17.8%)* below the revised April rate of 344,000 and is 32.8 percent (±10.9%) below the May 2008 estimate of 509,000..

There were 10.2 months of supply in May - significantly below the all time record of 12.4 months of supply set in January.

There were 10.2 months of supply in May - significantly below the all time record of 12.4 months of supply set in January.The seasonally adjusted estimate of new houses for sale at the end of May was 292,000. This represents a supply of 10.2 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

It appears the months-of-supply for inventory has peaked, and there is some chance that sales of new homes has bottomed for this cycle - but we won't know for many months. However any recovery in sales will likely be modest because of the huge overhang of existing homes for sale.

This is another weak report. I'll have more later ...

American Institute of Architects: Recovery has stalled

by Calculated Risk on 6/24/2009 08:38:00 AM

From Reuters: Architecture billings index steady in May - AIA

A leading indicator of U.S. nonresidential construction spending held steady for a second month in May, suggesting an economic recovery has stalled, an architects' trade group said on Wednesday.

The Architecture Billings Index edged up a tenth of a point to 42.9 last month after a slight decline in the prior month, according to the American Institute of Architects.

...

A measure of inquiries for projects dipped to 55.2, the third straight month that inquiries have held at a similar level but have not led to improved billings. The data indicated recovery has stalled, the AIA said.

"Numerous firms (have) bid for the same project, which is why the high level of inquiries is not necessarily translating into additional billings for project work at many firms," AIA Chief Economist Kermit Baker said in a statement.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Architecture Billings Index since 1996. The index is still below 50 indicating falling demand.

Historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on commercial real estate (CRE). This suggests further dramatic declines in CRE investment later this year.

MBA: Mortgage Rates Decrease Slightly

by Calculated Risk on 6/24/2009 08:25:00 AM

The MBA reports:

The Market Composite Index, a measure of mortgage loan application volume, was 548.2, an increase of 6.6 percent on a seasonally adjusted basis from 514.4 one week earlier.

...

The Refinance Index increased 5.9 percent to 2116.3 from 1998.1 the previous week and the seasonally adjusted Purchase Index increased 7.3 percent to 280.3 from 261.2 one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.44 percent from 5.50 percent ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

Note: The increase in 2007 was due to the method used to construct the index. Since the MBA surveyed mostly the major lenders, when lenders like New Century went under - this pushed more borrowers to lenders included in the survey. As smaller lenders went out of business, the remaining lenders saw more applications. Plus a number of borrowers started submitting multiple applications. Both factors distorted the index. That increase in 2007 fooled many people, like Alan Greenspan. See, from Bloomberg: Greenspan Says `Worst' May Be Past in U.S. Housing (Oct 6, 2006)

Although we can't compare directly to earlier periods because of the changes in the index, this shows no significant pick up in overall sales activity.

Tuesday, June 23, 2009

Housing Bust and Mobility

by Calculated Risk on 6/23/2009 10:52:00 PM

From the SF Gate: Housing, unemployment woes leave movers shaken

Sinking home prices and a weak job market have forced normally restless Americans to stay put in an uncharacteristic shift that has, among other things, clobbered the moving industry.A few previous mobility posts: Housing Bust Impacts Worker Mobility April 2008, Housing Bust Impacting Labor Mobility, Dec 2008, Housing Bust and Geographical Mobility, April 2009

"Property values have dropped so much people can't pick up and move the way they used to," said Michael Hicks, a demographer at Ball State University in Indiana who has tracked the nationwide slowdown using data from several sources, including moving companies.

That industry data mirrors a Census Bureau report that looked at moves in 2008, said William Frey, a demographer at the Brookings Institution in Washington, D.C.

"The annual migration rate has gone way down to historic low levels," Frey said. "This includes long distance moves and moving across town."

During the 1950s and 1960s, Frey said, as many as 20 percent of Americans moved in any given year. Mobility rates slowed to 15 percent to 16 percent during the 1990s. But in 2008, only 11.9 percent of Americans moved, he said.

Martin Wolf on Finanical Reform and Incentives

by Calculated Risk on 6/23/2009 08:19:00 PM

From Martin Wolf in the Financial Times: Reform of regulation has to start by altering incentives

Proposals for reform of financial regulation are now everywhere. The most significant have come from the US, where President Barack Obama’s administration last week put forward a comprehensive, albeit timid, set of ideas. But will such proposals make the system less crisis-prone? My answer is, no. The reason for my pessimism is that the crisis has exacerbated the sector’s weaknesses. It is unlikely that envisaged reforms will offset this danger.Wolf discusses how it is rational for management and shareholders to gamble when the risks are asymmetrical (huge potential winnings, limited losses). And he argues that "creditors ... appear to have lent to a bank. In reality, they have lent to the state." He also discusses how tighter regulation isn't enough because the banks will find a way round the new regulations.

At the heart of the financial industry are highly leveraged businesses. Their central activity is creating and trading assets of uncertain value, while their liabilities are, as we have been reminded, guaranteed by the state. This is a licence to gamble with taxpayers’ money. The mystery is that crises erupt so rarely.

Wolf concludes:

Such a crisis is not only the result of a rational response to incentives. Folly and ignorance play a part. Nor do I believe that bubbles and crises can be eliminated from capitalism. Yet it is hard to believe that the risks being run by huge institutions had nothing to do with incentives. The unpleasant truth is that, today, the incentive to behave in this risky way is, if anything, even bigger than it was before the crisis.Talk about pessimism.

Regulatory reform cannot end with incentives. But it has to start from incentives. A business that is too big to fail cannot be run in the interests of shareholders, since it is no longer part of the market. Either it must be possible to close it down or it has to be run in a different way. It is as simple – and brutal – as that.

Another financial crisis is unfortunately inevitable - all we hope to do with reform is to put it off for a couple of decades or more.

Another Hotel Defaults on Mortgage Debt

by Calculated Risk on 6/23/2009 04:50:00 PM

From the WSJ: Red Roof Inn Defaults on Mortgage Debt (hat tips to all in the comments!)

Red Roof Inn Inc. ... defaulted on $332 million of mortgage debt ... Red Roof confirmed the defaults Tuesday.The drop in occupancy rates are similar to the overall industry decline. And not only are occupancy rates off sharply, but so are room rates. Smith Travel Research reported last week that revenue per available room (RevPAR) was off 18.6 percent for the comparable week last year. I think this is just the beginning for the hotel related defaults.

All told, Red Roof's properties carry at least $1 billion in debt, including mortgages, mezzanine loans and other notes.

"As a result of the extraordinary stress in the hospitality industry and the economy overall, we have entered into some restructuring discussions with our lenders," said Andrew Alexander, an executive vice president of Red Roof.

...

Occupancy at Red Roof's properties, which averaged 62% when the mortgages were originated in 2007, sank to 50.7% in the first four months of this year.

Misleading House Price Data

by Calculated Risk on 6/23/2009 02:31:00 PM

From FHFA Director James B. Lockhart, June 23, 2009:

“Although monthly data are volatile, we may be starting to see signs of stabilization in prices for houses funded by conventional conforming loans, as the HPI is only down 0.3 percent for the first four months of the year.”From the National Association of Realtors, June 23, 2009:

The national median existing-home price for all housing types was $173,000 in May, down 16.8 percent from a year earlier. Distressed properties, which declined to 33 percent of all sales in May from 45 percent in April, continue to downwardly distort the median price because they generally sell at a discount relative to traditional homes.Which is it? The answer is both are flawed.

James Hagerty at the WSJ has a good analysis: FHFA Data May Signal False Bottom in Housing

The Realtors’ data cover a broader range of the market than does the FHFA index. ... But the Realtors’ median price is skewed by changes in the mix of homes sold each month. ...As the sales of mid-to-high end houses pick up (sales at the high end have slowed to a trickle in many areas), the median price might rise even as prices continue to fall because of change in the mix - and this will confuse some observers.

The FHFA index, like the S&P Case-Shiller index, is based on repeat sales of the same homes and so avoids the distortions of a shifting mix in sales. But the Case-Shiller index includes more foreclosure-related transactions and gives more weight to higher-priced homes than to lower-priced ones. Thus, when sales of higher-end homes increase, the Case-Shiller index is likely to look much worse, even as the Realtors’ median price will look better.

And the FHFA index is based on GSE loans, and as the most recent data showed, a higher percentage of the problem loans were non-GSE private label loans. Also, the FHFA misses many larger loans in general, and high end prices have held up better so far - but that will change when people realize there are few move-up buyers!

The following graphic (repeat) is from the Harvard Report on Housing 2009. Note: this data is informative, but use caution when using the Harvard analysis (see: Harvard on Housing 2005)

Click on image for larger graph in new window.

Click on image for larger graph in new window.This shows that the worst mortgages were the private label securities (as an example mortgages originated by New Century, and securitized by Bear Stearns).

The Freddie and Fannie portfolios accounted for 56% of all mortgages in Dec 2008, but only 20% of the seriously delinquent loans. So the FHFA index is based on some of the better performing loans. Case-Shiller (to be released next Tuesday) includes these other loans.

S&P Downgrades Prime Jumbo MBS

by Calculated Risk on 6/23/2009 01:56:00 PM

From MarketWatch: S&P downgrades prime jumbo mortgage securities

S&P said it lowered ratings on 102 classes from 33 U.S. prime jumbo residential mortgage-backed securities that were issued from 1998 to 2004. The rating agency also affirmed ratings on 669 classes from 32 of the downgraded deals, as well as 34 other deals.From 1998?

"The downgrades reflect our opinion that projected credit support for the affected classes is insufficient to maintain the previous ratings, given our current projected losses," S&P said in a statement.