by Calculated Risk on 6/16/2009 09:25:00 PM

Tuesday, June 16, 2009

The Accidental Slumlord

I've been joking about "accidental landlords" for a couple of years, and how these properties are just more shadow housing inventory.

Daniel McGinn takes it a step further, and describes his own misadventures in Newsweek How I became an Accidental Slumlord (ht Tim waiting for 2012)

... As America copes with a painful hangover from a decade-long real-estate orgy, I'm dealing with a headache of my own. Four years ago, at the height of the boom, I visited Pocatello to write a story for NEWSWEEK about how out-of-state investors had begun buying cheap rental properties there, drawn by ultralow sales prices and a solid rental market. ... A year later, while writing a book about the housing boom, I decided to dive in myself. In late 2006, after seeing only e-mailed photos, an appraisal and an inspection report, I paid $62,750 for a two-unit rental property in Pocatello, which is 2,450 miles from my Massachusetts home. I didn't expect to get rich; my main motivation was to have a good story for the book. By that measure, the deal was a success; when House Lust came out in 2008, the chapter in which I described my early misadventures as a property magnate (an early tenant went to jail; my first property manager made off with $1,300) helped fuel reviews and interviews. But now, long after the buzz over the book has died down, I'm stuck with a house in Idaho—and friends who call me a long-distance slumlord.This is more nightmare than investment. But it could have been worse. I'll never understand why people invest in properties sight unseen.

...

Thanks to an energetic local property manager, my two apartments have never been vacant. Many months the combined rent of $690 covers the $503 mortgage payment and other expenses. Still, I'm frequently hit with repair bills (a broken stove, a leaking underground water line) that send me into the red. And even after the tax write-offs, my costs have exceeded the rental income by more than $2,500 since I purchased it.

...

My reaction to seeing my property and my tenants for the first time is common among out-of-state landlords who've visited their property. "When somebody is paying $300 a month in rent, in general they aren't the Rothschilds," says a 47-year-old Los Angeles schoolteacher who visited his own Pocatello duplex for the first time in December. "You're getting somebody who that's all they can afford." Although he'd seen photos of his property before he purchased it, this investor—who declined to be named because he's embarrassed to have made such a "boneheaded" investment—was surprised by its poor condition, citing holes in the walls, an awkward layout and general dinginess.

Cramer Gets Confused on Housing

by Calculated Risk on 6/16/2009 07:04:00 PM

NOTE: I'm not just picking on Cramer. I'm trying to emphasize two key points: 1) there will be two bottoms for housing, and 2) the median price is useless with a changing mix.

I've cautioned that people would make the following analysis errors ...

From CNBC: Cramer: Housing Has Officially Bottomed

Residential real estate has finally found a floor, Cramer told viewers on Tuesday.First, for almost every housing bust there have been two distinct bottoms: the first for activity (like housing starts) and the second for prices. Maybe this time is different, but I think Cramer is confusing activity for price.

...

How can Cramer be so sure? New housing data reported today showed a dramatic change for the better, especially in some of the hardest-hit areas in the US. That news, along with much lower prices and the working off of inventory, validate his prediction, made last August, that housing would stabilize this month, ending its multiyear declines.

...

What does a bottom look like? It’s the combination of ramping sales, and sales in certain areas are up ten times those of last year, and an end to falling prices. That’s exactly what we’ve seen for the past three months, Cramer said.

For more on the two bottoms, see: More on Housing Bottoms

On price, Cramer is probably looking at the median sales price from the National Association of Realtors. This shows that the median price has flattened over the last four months. But the median price has been heavily distorted by foreclosure sales in low end areas. A much better measure of price is the Case-Shiller index, and that shows prices fell at a 25% annual rate in Q1 nationally on a seasonally adjusted basis.

It was predictable that some people would confuse activity with price (remember there will probably be two bottoms). And it was predictable that some people would get confused when the median price started to flatten out (as the mix slowly changed) even though prices are still falling.

Jim the Realtor: Tour of Shadow Inventory

by Calculated Risk on 6/16/2009 04:54:00 PM

Jim takes us on a tour of a few REOs not yet on the market in the north San Diego County Coastal region. Jim says he couldn't find many foreclosed properties that aren't listed.

Some of these homeowners really dipped into the home ATM. Amazing. The home on 3 acres in Rancho Santa Fe isn't much, but that is a very nice area (and that is why the price is so high).

Stock Market Update

by Calculated Risk on 6/16/2009 04:00:00 PM

By popular demand ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

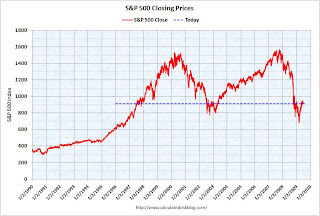

The first graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

The S&P 500 is up almost 35% from the bottom (235 points), and still off almost 42% from the peak (653 points below the max). The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Tiered House Prices

by Calculated Risk on 6/16/2009 03:18:00 PM

In the previous post, I disagreed a little with the JPMorgan analysts - I noted:

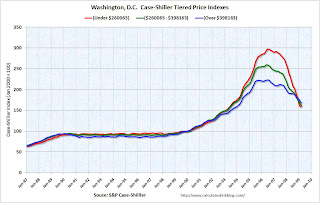

Prices increased more in percentage terms in the low priced areas of California (like the Inland Empire and Sacramento) than in the high priced coastal areas. So prices will probably fall further in percentage terms from the peak in the low priced areas.Case-Shiller has some tiered house price indices for a number of cities, and most of the bubble cities show this pattern (more appreciation in the low priced areas).

| Click on graph for larger image in new window. Here are a few select cities. The first is Washington, D.C. Note the price range of the tiers changes by city. |

The second graph is for Miami. |  |

| The third graph is for San Francisco. Most other bubble areas show a similar pattern of larger percentage price increases for the lower tier. |

JPMorgan Analysts Predict 60% House Price Decline for High End

by Calculated Risk on 6/16/2009 01:30:00 PM

From Bloomberg: ‘Millionaire Homes’ May Lose Value Until 2012 (ht James)

... “Tighter lending standards and the lack of cheap financing for these borrowers continue to be key issues,” the New York- based [JPMorgan Chase & Co. analysts] wrote [in a June 12 report], referring to “jumbo” mortgages. That’s after so-called interest-only and option adjustable-rate loans were a “major driver” of soaring values, they said.Most of the low end sales are "one and done" (the seller is a bank), and this will lead to a dearth of move up buyers. This lack of move up buyers, and tight financing will impact demand for the mid-to-high end. Although the percentage of foreclosures will be less in the high end areas than the low priced areas, the foreclosures are still coming (see Alt-A Foreclosures in Sonoma and Foreclosure Resales: Slow in High Priced Areas )

...

“Currently, we have national home prices bottoming in 2011,” they said. “However, prices for more expensive homes may not bottom out until 2012, and ultimately result in peak-to- trough declines in excess of 60 percent (compared to 40 percent nationally).”

“California is probably worse than other states, but higher-priced homes in general are going to be a problem,” Sim said in a telephone interview today.

However I disagree with the JPMorgan analysts on the relative price declines. Prices increased more in percentage terms in the low priced areas of California (like the Inland Empire and Sacramento) than in the high priced coastal areas. So prices will probably fall further in percentage terms from the peak in the low priced areas.

Also, I think the price declines will occur over a longer period in the high priced areas (like the JPMorgan analysts), so the nominal price declines will be less (assuming a little inflation). But those are minor details - I agree there are further substantial price declines ahead.

$13.9 Trillion Total Maximum Government Support Announced

by Calculated Risk on 6/16/2009 12:14:00 PM

The FDIC released the Summer 2009 Supervisory Insights today. The report includes the following table showing all the government support announced in 2008 and soon thereafter. The maximum capacity is $13.9 trillion.

I thought people would like to see the details (not all will be used).

Government Support for Financial Assets and Liabilities Announced in 2008 and Soon Thereafter ($ in billions) | |||

|---|---|---|---|

| Important note: Amounts are gross loans, asset and liability guarantees and asset purchases, do not represent net cost to taxpayers, do not reflect contributions of private capital expected to accompany some programs, and are announced maximum program limits so that actual support may fall well short of these levels | |||

| Year-end 2007 | Year-end 2008 | Subsequent or Announced Capacity If Different | |

| Treasury Programs | |||

| TARP investments1 | $0 | $300 | $700 |

| Funding GSE conservatorships2 | $0 | $200 | $400 |

| Guarantee money funds3 | $0 | $3,200 | |

| Federal Reserve Programs | |||

| Term Auction Facility (TAF)4 | $40 | $450 | $900 |

| Primary Credit5 | $6 | $94 | |

| Commercial Paper Funding Facility (CPFF)6 | $0 | $334 | $1,800 |

| Primary Dealer Credit Facility (PDCF)5 | $0 | $37 | |

| Single Tranche Repurchase Agreements7 | $0 | $80 | |

| Agency direct obligation purchase program8 | $0 | $15 | $200 |

| Agency MBS program8 | $0 | $0 | $1,250 |

| Asset-backed Commercial Paper Money Market Mutual Fund Liquidity Facility (AMLF)9 | $0 | $24 | |

| Maiden Lane LLC (Bear Stearns)9 | $0 | $27 | |

| AIG (direct credit)10 | $0 | $39 | $60 |

| Maiden Lane II (AIG)5 | $0 | $20 | |

| Maiden Lane III (AIG)5 | $0 | $27 | |

| Reciprocal currency swaps11 | $14 | $554 | |

| Term securities lending facility (TSLF) and TSLF options program(TOP)12 | $0 | $173 | $250 |

| Term Asset-Backed Securities Loan Facility (TALF)13 | $0 | $0 | $1,000 |

| Money Market Investor Funding Facility (MMIFF)14 | $0 | $0 | $600 |

| Treasury Purchase Program (TPP)15 | $0 | $0 | $300 |

| FDIC Programs | |||

| Insured non-interest bearing transactions accounts16 | $0 | $684 | |

| Temporary Liquidity Guarantee Program (TLGP)17 | $0 | $224 | $940 |

| Joint Programs | |||

| Citi asset guarantee18 | $0 | $306 | |

| Bank of America asset guarantee19 | $0 | $0 | $118 |

| Public-Private Investment Program (PPIP)20 | $0 | $0 | $500 |

| Estimated Reductions to Correct for Double Counting | |||

| TARP allocation to Citi and Bank of America asset guarantee21 | – $13 | ||

| TARP allocation to TALF21 | – $80 | ||

| TARP allocation to PPIP21 | – $75 | ||

| Total Gross Support Extended During 2008 | $6,788 | ||

| Maximum capacity of support programs announced through first quarter 200922 | $13,903 | ||

Table notes:

1 $300 is as of 1-23-2009 as reported in SIGTARP report of February 6 2009; EESA authorized $700.

2 Year-end reflects Treasury announcement of September 7, 2009, capacity reflects Treasury announcement of February 18, 2009; funding authorized under Housing and Economic Recovery Act.

3 Informal estimate of amount guaranteed at year-end 2008, provided by Treasury staff.

4 Year-end balances from Federal Reserve Statistical Release H.R. 1, “Factors Affecting Reserve Balances” (henceforth, H.R. 1); capacity from “Domestic Open Market Operations During 2008” (Report to the Federal Open Market Committee, January 2009), page 24.

5 Year-end balances from H.R. 1.

6 Year-end balances from H.R. 1; capacity from “Report Pursuant to Section 129 of the Emergency Economic Stabilization Act of 2008: Commercial Paper Funding Facility,” accessed May 26, 2009, from http://www.newyorkfed.org/aboutthefed/annual/annual08/CPFFfinstmt2009.pdf.

7 Year-end balances from H.R. 1; see also “Domestic Open Market Operations During 2008” (henceforth “DOMO report”) report to the Federal Open Market Committee, January 2009, page 11, summary of activity in program announced March 7 by the Federal Reserve.

8 Year-end balances from H.R. 1, capacity from Federal Reserve announcements of November 25, 2008 and March 18, 2009.

9 H.R. 1.

10 Year-end balances from H.R. 1; capacity from periodic report pursuant to EESA, “Update on Outstanding Lending Facilities Authorized by the Board Under Section 13(3) of the Federal Reserve Act,” February 25, 2009, page 8, henceforth referred to as “Update;” Federal Reserve AIG support is separate from Treasury support that is included in the TARP line item.

11 Year-end balances reported in DOMO report, page 25.

12 Year-end balances from H.R. 1; capacity from Federal Reserve announcement of March 11, 2008, Federal Reserve Bank of New York press release of August 8, 2008, and discussion at page 22 of DOMO report.

13 From “Update,” page 2.

14 From “Report Pursuant to Section 129 of the Emergency Economic Stabilization Act of 2008: Money Market Investor Funding Facility,” accessed May 26, 2009, from http://www.federalreserve.gov/monetarypolicy/files/129mmiff.pdf; Federal Reserve to fund 90 percent of financing or $540 billion.

15 Program and capacity announced by the Federal Reserve, March 18, 2009.

16 FDIC Quarterly Banking Profile, Fourth Quarter 2008, (henceforth, “QBP”) Table III-C.

17 Year-end outstanding from QBP, Table IV-C; total estimated cap for all entities opting in the program from QBP, Table II-C.

18 Announcement by FDIC, Treasury, and Federal Reserve November 23, 2008.

19 Announcement by FDIC, Treasury, and Federal Reserve of January 16, 2009.

20 To purchase legacy assets, as described in Treasury, FDIC, and Federal Reserve announcement of March 23, 2009. $500 refers to maximum capacity of Legacy Loans Program; funding for the Legacy Securities Program is believed to be subsumed under the TALF.

21 SIGTARP quarterly report of April, 2009, page 38.

22 Year-end 2008 amounts plus the amount by which announced capacity exceeds the year-end 2008 amount, minus the amount of known double counting.

U.S. Rejects California Aid Request

by Calculated Risk on 6/16/2009 10:15:00 AM

From the WaPo: Calif. Aid Request Spurned By U.S

The Obama administration has turned back pleas for emergency aid from one of the biggest remaining threats to the economy -- the state of California.Hey, hoocoodanode?

Top state officials have gone hat in hand to the administration, armed with dire warnings of a fast-approaching "fiscal meltdown" caused by a budget shortfall. Concern has grown inside the White House in recent weeks as California's fiscal condition has worsened, leading to high-level administration meetings. But federal officials are worried that a bailout of California would set off a cascade of demands from other states.

...

The administration is worried that California will enact massive cuts to close its deficit, estimated at $24 billion for the fiscal year that begins July 1, aggravating the state's recession and further dragging down the national economy.

After a series of meetings, Treasury Secretary Timothy F. Geithner, top White House economists Lawrence Summers and Christina Romer, and other senior officials have decided that California could hold on a little longer and should get its budget in order rather than rely on a federal bailout.

...

The state entered the downturn burdened with an inflexible budgeting apparatus, constrained by a state ballot initiative approved by voters in 1978 that severely limited property taxes in California. The signature example of "ballot box budgeting" left the Golden State inordinately reliant on the personal income tax, which accounts for half of revenue to Sacramento.

California's budget is also heavily dependent on taxes paid on capital gains and stock options, which have been clobbered during the meltdown of financial markets. State budget analysts made their annual estimate of revenue a month before the crisis spiked in the fall and have been backpedaling ever since.

"Those revenue projections turned out to be wildly optimistic, but nobody was predicting the October collapse of the financial markets," said Michael Cohen, deputy analyst in the Legislative Analyst's Office.

California enjoyed the housing bubble, but is now being hit hard by the housing bust with house prices falling sharply and double digit unemployment. And it doesn't help that the state system of government is completely dysfunctional.

Industrial Production Declines, Capacity Utilization at Record Low

by Calculated Risk on 6/16/2009 09:15:00 AM

The Federal Reserve reported:

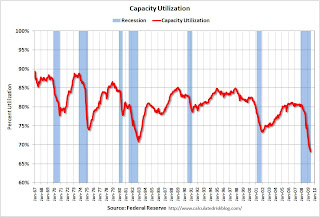

Industrial production decreased 1.1 percent in May after having fallen a downward-revised 0.7 percent in April. The average decrease in industrial production during the first three months of the year was 1.6 percent. Manufacturing output moved down 1.0 percent in May with broad-based declines across industries. Outside of manufacturing, the output of mines dropped 2.1 percent, and the output of utilities fell 1.4 percent. At 95.8 percent of its 2002 average, overall industrial output in May was 13.4 percent below its year-earlier level. The rate of capacity utilization for total industry declined further in May to 68.3 percent, a level 12.6 percentage points below its average for 1972-2008. Prior to the current recession, the low over the history of this series, which begins in 1967, was 70.9 percent in December 1982.emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series is at another record low (the series starts in 1967).

In addition to the weakness in industrial production, there is little reason for investment in new production facilities until capacity utilization recovers.

Housing Starts May

by Calculated Risk on 6/16/2009 08:30:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

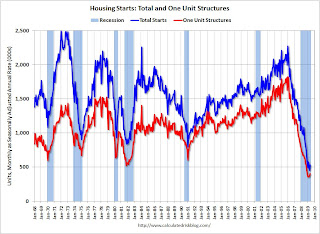

Total housing starts were at 532 thousand (SAAR) in May, rebounding from the all time record low in April of 454 thousand. The previous record low was 488 thousand in January (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 401 thousand (SAAR) in May; above the record low in January and February (357 thousand) and above 400 thousand for the first time since last November.

Permits for single-family units were 408 thousand in May, suggesting single-family starts will remain at about the same level in June.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Building Permits:

Privately-owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 518,000. This is 4.0 percent (±1.7%) above the revised April rate of 498,000, but is 47.0 percent (±2.1%) below the May 2008estimate of 978,000.

Single-family authorizations in May were at a rate of 408,000; this is 7.9 percent (±1.5%) above the revised April figure of 378,000.

Housing Starts:

Privately-owned housing starts in May were at a seasonally adjusted annual rate of 532,000. This is 17.2 percent (±14.4%) above the revised April estimate of 454,000, but is 45.2 percent (±5.8%) below the May 2008 rate of 971,000.

Single-family housing starts in May were at a rate of 401,000; this is 7.5 percent (±14.2%)* above the revised April figure of 373,000.

Housing Completions:

Privately-owned housing completions in May were at a seasonally adjusted annual rate of 811,000. This is 3.3 percent (±20.6%)* below the revised April estimate of 839,000 and is 28.8 percent (±11.1%) below the May 2008 rate of 1,139,000.

Single-family housing completions in May were at a rate of 491,000; this is 9.4 percent (±13.8%)* below the revised April figure of 542,000.

Note that single-family completions of 491 thousand are still significantly higher than single-family starts (401 thousand). This is important because residential construction employment tends to follow completions, and completions will probably decline further.

It is still too early to call the bottom for single family starts in January, however I do expect single family housing starts to bottom sometime in 2009.