by Calculated Risk on 6/15/2009 07:48:00 PM

Monday, June 15, 2009

WSJ: Major Banks Try to Block MBIA Split

From the WSJ: Banks Challenge N.Y. Insurance Regulator Over MBIA Split

A group of large banks stepped up their fight against MBIA Inc.'s decision to split its businesses, filing a petition claiming the New York State Insurance Department had no right to approve the move.The New York State Insurance Department earlier approved MBIA's restructuring plan to split its municipal-bond insurance business from its mortgage-backed securities insurance business. Many banks and hedge funds bought MBIA insurance on their structured product portfolios, and they are concerned about the financial strength of the MBS insurance business (and whether they will be paid or suffer further losses).

The banks contend the move benefited some policyholders at the expense of others.

The 18 financial institutions, which include Barclays PLC., Bank of America Corp. and J.P. Morgan Chase & Co ...

Green Shoots Artwork

by Calculated Risk on 6/15/2009 06:38:00 PM

LA Area Port Traffic in May

by Calculated Risk on 6/15/2009 05:16:00 PM

Note: this is not seasonally adjusted. There is a very distinct seasonal pattern for imports, but not for exports.

Sometimes port traffic gives us an early hint of changes in the trade deficit. The following graph shows the loaded inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Inbound traffic was 19.7% below May 2008.

Outbound traffic was 15.3% below May 2008.

There has been some recovery in exports over the last few months (the year-over-year comparison was off 30% from December through February). But this is the 3nd worst YoY comparison for imports - only February and April were worse. So imports from Asia appear especially weak.

This suggests a little more improvement in the trade balance with Asia in the May trade report. Of course the overall trade deficit will probably be worse because of rising oil prices.

Record Credit Card Default Rate

by Calculated Risk on 6/15/2009 03:52:00 PM

From CNBC: Credit Card Default Rate Hits Record High

U.S. credit card defaults rose to record highs in May, with a steep deterioration of Bank of America's lending portfolio ...For the stress tests, the indicative two year loss rate for the more adverse scenario was 18% to 20% for credit cards (around 9% per year). That test might have been too lenient.

Bank of America—the largest U.S. bank—said its default rate, those loans the company does not expect to be paid back, soared to 12.50 percent in May from 10.47 percent in April.

In addition, American Express ... said its default rate rose to 10.4 percent from 9.90 ...

Capital One said its credit card default rate rose to 9.41 percent from 8.56 percent, while Discover said its charge-off rate increased to 8.91 percent from 8.26 percent.

JPMorgan Chase ... said its default rate rose to 8.36 percent in May from 8.07 percent in April

NAHB: Builder Confidence Decreases Slightly in June

by Calculated Risk on 6/15/2009 01:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) decreased to 15 in June from 16 in May. The record low was 8 set in January.

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

Press release from the NAHB (added): Builder Caution Reflects Fragile Housing Market In June

Indicating that single-family home builders remain cautious and concerned about the fragile state of today’s economy and housing market, the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) declined one point to 15 in June.

...

“As expected, the housing market continues to bump along trying to find a bottom,” said NAHB Chief Economist David Crowe. “Meanwhile, builders are taking their cue from consumers, who remain uncertain about the economy and their own situation. Builders are also finding it difficult to complete a sale because customers cannot sell their existing homes.”

...

Two out of three of the HMI’s component indexes were unchanged in June, including the index gauging current home sales, which held at 14, and the index gauging traffic of prospective buyers, which held at 13. Meanwhile, the index gauging expectations for the next six months declined a single point, to 26.

Regionally, the decline was entirely focused in the South, which is the nation’s largest housing market. There, the HMI declined 3 points to 15, while the rest of the regions posted gains. The Northeast had a one-point gain to 20, the Midwest, a one-point gain to 15, and the West, a two-point gain to 14.

Fitch: U.S. CMBS Delinquencies Past 2%

by Calculated Risk on 6/15/2009 11:56:00 AM

Large loan defaults coupled with declining performance on multifamily and retail properties resulted in a 29 basis point (bp) climb to 2.07% for U.S. CMBS delinquencies in May, according to the latest Fitch Ratings Loan Delinquency Index. This marks the highest percentage of delinquencies since Fitch began its Index in 2001.Some CRE loans were based on overly optimistic proforma income (aka wishful thinking like stated income), and the loans included reserves to pay interest until rents increased (like a negatively amortizing option ARM). When the reserves run dry, and the proforma income is "unrealized", the borrower defaults.

"Defaults on larger loans continue to drive delinquency increases because later vintage transactions have larger loans, many underwritten with now unrealized proforma income, as well as now-depleted debt service reserves and high leverage," said Managing Director and U.S. CMBS group head Susan Merrick.

emphasis added

And by sector:

Declining performance, particularly in oversupplied markets, as well as in secondary and tertiary markets, has pushed the multifamily delinquency rate to 4.55%, the highest of all property types. Multifamily properties have been highly susceptible to default in CMBS during the current economic downturn.

The 60 days or more delinquency rate for retail properties is slightly higher than the index at 2.24%.

...

Loans backed by hotels have thus far withstood economic pressures and continue to slightly outperform the Index with a 1.91% delinquency rate.

Extended Stay Hotels Files Bankruptcy

by Calculated Risk on 6/15/2009 10:56:00 AM

From Bloomberg: Extended Stay Hotels Chain Declares Bankruptcy in New York

Extended Stay Hotels ... which has more than 680 properties, said it had $7.1 billion in assets and $7.6 billion in debts at the end of last year. The company employs approximately 10,000 ...Hotel occupancy is off more than 10% compared to last year - and revenue per available room off more than 20% - a very difficult operating environment, especially for hotel chains laden with debt.

Added: Some background from the WSJ :

Wachovia, Bear Stearns and others lent Lightstone founder David Lichtenstein $7.4 billion so he could buy the 684-hotel chain from Blackstone Group for $8 billion in April 2007. Mr. Lichtenstein, with help from Arbor Realty Trust, put in about $600 million. He estimated earnings were around $575 million, meaning the deal was levered at nearly 13 times -- high even for that era.

Much of the debt in the 2007 buyout of Extended Stay was converted into commercial mortgage-backed securities, or CMBS ...

The hotel chain has $4.1 billion in a senior first mortgage that was mostly sold to investors as CMBS. Behind those secured creditors is the $3.3 billion of mezzanine debt divided into 10 classes ranked one through 10 in seniority. Most of the holders of junior mezzanine debt bought at a discount, some around 60 cents on the dollar, but others as low as 10-15 cents, say debt holders. Both the senior and mezzanine loans mature June 12, with extension options.

Empire State Manufacturing "Conditions continued to deteriorate"

by Calculated Risk on 6/15/2009 08:38:00 AM

From the NY Fed: Empire State Manufacturing Survey

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers continued to deteriorate in June, at a moderately faster pace than in May. The general business conditions index fell 5 points, to -9.4. The new orders index remained negative and near last month’s level, while the shipments index fell 6 points to -4.8.Here is the general business conditions index. Note that the data only goes back to July 2001 (chart to Jan 2002). Any reading below zero is contraction, so this index shows manufacturing is contracting in June.

...

In a series of supplementary questions, manufacturers were asked about their capital spending plans for 2009 relative to their actual spending for 2008, both overall and for a few broad categories of capital (see Supplemental Report tab). Similar questions had been asked in June 2008 and June 2007. In the current survey, 56 percent of respondents reported reductions in overall capital spending in 2009, while just 20 percent reported increases. These results contrast fairly markedly with those of the June 2008 survey, which showed nearly as many respondents reporting increases (32 percent) as decreases (36 percent).

Krugman: Stay the Course

by Calculated Risk on 6/15/2009 12:06:00 AM

From Paul Krugman in the NY Times: Stay the Course

The debate over economic policy has taken a predictable yet ominous turn: the crisis seems to be easing, and a chorus of critics is already demanding that the Federal Reserve and the Obama administration abandon their rescue efforts. For those who know their history, it’s déjà vu all over again — literally.Let me add I think the "green shoots" metaphor we keep hearing is wrong. That implies new growth and some sort of immaculate recovery. Yes, right now the pace of contraction appears to have slowed - and that is good news - but even if we are nearing the bottom of the economic cliff, the eventual "recovery" will be very sluggish.

For this is the third time in history that a major economy has found itself in a liquidity trap ...

The first example of policy in a liquidity trap comes from the 1930s. The U.S. economy grew rapidly from 1933 to 1937, helped along by New Deal policies. America, however, remained well short of full employment.

Yet policy makers stopped worrying about depression and started worrying about inflation. The Federal Reserve tightened monetary policy, while F.D.R. tried to balance the federal budget. Sure enough, the economy slumped again, and full recovery had to wait for World War II.

The second example is Japan in the 1990s. After slumping early in the decade, Japan experienced a partial recovery, with the economy growing almost 3 percent in 1996. Policy makers responded by shifting their focus to the budget deficit, raising taxes and cutting spending. Japan proceeded to slide back into recession.

And here we go again.

...

To sum up: A few months ago the U.S. economy was in danger of falling into depression. Aggressive monetary policy and deficit spending have, for the time being, averted that danger. And suddenly critics are demanding that we call the whole thing off, and revert to business as usual.

Those demands should be ignored. It’s much too soon to give up on policies that have, at most, pulled us a few inches back from the edge of the abyss.

As I've written over and over (see A Return to Trend Growth in 2010? and The Impact of Changes in the Saving Rate on PCE ), the usual engines of recovery - personal consumption expenditures (PCE) and residential investment (RI) - will both remain under pressure (even if they show some sluggish growth).

The end of cliff diving is not the same as new growth.

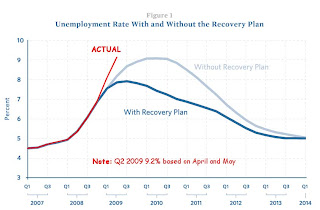

And look at the unemployment rate ...

UPDATE: ht Geoff at Innocent Bystanders

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph compares the actual quarterly unemployment rate (in red) with the Obama economic forecast from January 10th: The Job Impact of the American Recovery and Reinvestment Plan

If anything the situation is worse than expected, not better.

Sunday, June 14, 2009

Office Building Sells at 40% Below Construction Costs

by Calculated Risk on 6/14/2009 08:06:00 PM

From the WSJ: Maguire Sells Office Site at 40% Off (ht Ron)

Maguire Properties Inc ... sold a newly developed office building in Irvine, Calif., for about $160 million, a price representing an estimated 40% discount to its construction cost.Quite a haircut. New Century still causing damage ...

...

Emmes Group of Cos. ... purchased the 19-story building, which was completed in 2007 and is about 60% leased. ...

The building ... was originally slated to be anchored by [subprime lender] New Century Financial Corp. ... The building is roughly estimated to have cost about $500 a square foot, according to Michael Knott, a senior adviser with Green Street Advisors in Newport Beach, Calif. Emmes's price was about $300 a square foot.