by Calculated Risk on 6/06/2009 04:10:00 PM

Saturday, June 06, 2009

Foreclosures and the Home ATM

From Matt Padilla at the O.C. Register: Do these homeowners deserve help?

Homeowners who treated their houses like cash machines, tapping the equity as home values rose, are among the most likely to end in foreclosure, even more than those who bought at housing’s peak, a new study finds.During the housing bubble, many bought homes they could not afford using "affordability products" like Option ARMs. But there was another group of speculators that lived beyond their means, using their homes like ATM cash machines. I think this an important issues and I'm looking forward to Padilla's article.

Often homeowners have had second, third and even fourth mortgages at time of foreclosure — a trend not adequately addressed by any of the federal or state foreclosure avoidance progams, said Michael LaCour-Little, a finance professor at Cal State Fullerton who authored the study.

...

I plan a bigger story on his findings, but wanted to share a few results now.

...

For example, for the early November 2008 data sample, he tracked 2,358 properties. Here’s what he found:

•They were purchased at an average price of $354,000 and average year of 2002 (long before the housing peak of 2005).

•Total debt on the properties averaged $551,000 at time of foreclosure. That’s 56% more than the properties were worth when purchased, meaning at least that much was cashed out!

•An automatic valuation model estimated average value at time of foreclosure was $317,000, which suggests a combined loan-to-value at foreclosure of more than 170% ($551,000/$317,000). And that is a conservative estimate. Properties that banks later sold had an average resale price of $271,000!

Unemployment Rate and Level of Education

by Calculated Risk on 6/06/2009 11:19:00 AM

By request ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the unemployment rate by four level of education.

And here is a graphic from the BLS based on 2008 data: Education pays ...

Note that the unemployment rate has risen sharply for all categories in 2009. For "less than a high school diploma" the rate has increased from 9% in 2009 to almost 16% in May.

Education matters!

Consumer Bankruptcy Filings up Sharply

by Calculated Risk on 6/06/2009 08:26:00 AM

From the American Bankruptcy Institute: Consumer Bankruptcy Filings up 37 Percent in May

U.S. consumer bankruptcy filings rose 37 percent nationwide in May from the same period a year ago, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). The overall May consumer filing total of 124,838 was roughly level from the April total of 125,618. Chapter 13 filings constituted 27 percent of all consumer cases in May, slightly above the April rate.

“As consumers continue to face increasing levels of unemployment and rising foreclosure rates, bankruptcy filings will continue to accelerate as families seek financial relief from the tough economic climate,” said ABI Executive Director Samuel J. Gerdano. “We predict more than 1.4 million new bankruptcies by year end.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter.

Note: Quarterly data from Administrative Office of the U.S. Courts, Q1 data and Q2 estimate (based on April and May) from American Bankruptcy Institute.

The quarterly rate is close to the levels prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

| Click on cartoon for larger image in new window. Another great cartoon from Eric G. Lewis, a freelance cartoonist living in Orange County, CA. |

The American Bankruptcy Institute is predicting over 1.4 million new bankruptcies by year end - I'll definitely take the over!

TARP Repayments may exceed $50 Billion

by Calculated Risk on 6/06/2009 12:14:00 AM

From the WaPo: Bank Repayments May Exceed Estimate

The Obama administration is set to announce next week that a larger-than-expected number of big financial firms can repay their bailout funds ... The size of the repayments may double the initial estimate of $25 billion by the Treasury Department, the sources said. That would mean that many, perhaps nearly all, of the nine firms that regulators found to have sufficient reserves in a recent "stress test" would be allowed to return federal aid.MarketWatch has a list : JP Morgan, Goldman among banks set to repay TARP

J.P. Morgan Chase ($25 billion), Goldman Sachs ($10 billion) and some other large U.S. banks ... include Morgan Stanley ($10 billion), American Express ($3.4 billion), Bank of New York Mellon ($3 billion), State Street ($2 billion), US Bancorp ($6.6 billion) and BB&T Corp. ($3.1 billion)That totals $63.1 billion.

Bailout amounts from Pro Publica : Eye on the Bailout

Friday, June 05, 2009

This American Life on the Rating Agencies

by Calculated Risk on 6/05/2009 09:20:00 PM

This weekend's 'This American Life' is about the rating agencies.

Here is preview (with a 7 min audio): Economy Got You Down? Many Blame Rating Firms. (ht Bob) A few excerpts:

"We hired a specialist firm that used a methodology called maximum entropy to generate this equation," says Frank Raiter, who until 2005 was in charge of rating mortgages at Standard and Poors. "It looked like a lot of Greek letters."

...

Managing director Tom Warrack was in the room when Standard and Poor's gave those mortgage-backed securities AAA ratings. He stands by that decision.

"I wouldn't say anything was missed," he says. "Never before in the history of the country, dating back to the Great Depression, have we had the type of nationwide market value declines, declines in home prices, and the associated default levels."

Warrack says that his agency required riskier loans to have more protections built in to receive the highest grade. He says the agency knew plenty about the mortgages inside those bonds. "We had lots of data," he says. "We had years' worth of data as to how borrowers perform over time."

Courts Affirms Chrysler Sale

by Calculated Risk on 6/05/2009 06:58:00 PM

From the WSJ: Court Affirms Chrysler Sale but Puts Deal on Hold Until Monday

From attorney Steve Jakubowski at the Bankrutpcy Litigation Blog: Chrysler's Bankruptcy Sale Opinion - Part I: Proving "What Goes Around, Comes Around" Well it's official, and really no surprise:

Judge Gonzalez in this opinion (WL) approved the sale of Chrysler's assets in the Fiat Transaction "free and clear of liens, claims, interests and encumbrances."

...Was it a sub rosa plan? The Court said no. And I actually agree. ... Was the absolute priority rule violated? The Court danced around this issue pretty well, taking the position, well stated in this Credit Slips blog post, that "the allocation of ownership interests in the new enterprise is irrelevant to the estates' economic interests" and that "in addition, the UAW, VEBA, and the Treasury are not receiving distributions on account of their prepetition claims ... [but] under separately-negotiated agreements with New Chrysler ... [that are] not value which would otherwise inure to the benefit of the Debtors' estates."

...Has the "Rule of Law" Been Withered (as questioned here)? Maybe, as I'll discuss later in Part II, but not for the reasons the Indiana Pension Funds are arguing on appeal. In fact, if anything, the following well-worn rules have been affirmed in this case: 1. You can't circumvent chapter 11's plan process when you can't even fund next week's payroll.

2. You can't violate the absolute priority rule if junior creditors necessary to the new enterprise get something out of the deal.

3. Lenders of last resort owe no duty to anyone but themselves and can dictate the terms of a plan or sale so long as the terms aren't unconscionable, which they aren't here.

Bank Failure #37: Bank of Lincolnwood, Lincolnwood, Illinois

by Calculated Risk on 6/05/2009 06:38:00 PM

Tangelo will soon perp walk

Lincolnwood as well?

by Soylent Green is People

From the FDIC: Republic Bank of Chicago, Oak Brook, Illinois, Assumes All of the Deposits of Bank of Lincolnwood, Lincolnwood, Illinois

As of May 26, 2009, Bank of Lincolnwood had total assets of approximately $214 million and total deposits of $202 million. Republic Bank of Chicago agreed to purchase approximately $162 million in assets. The FDIC will retain the remaining assets for later disposition.

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $83 million. Republic Bank of Chicago's acquisition of all the deposits was the "least costly" resolution for the DIF compared to alternatives. Bank of Lincolnwood is the 37th FDIC-insured institution to fail in the nation this year and the sixth in Illinois. The last bank to fail in the state was Citizens National Bank, Macomb, on May 22, 2009.

Miscellaneous: Market and Bank Failure

by Calculated Risk on 6/05/2009 04:02:00 PM

First the market graph from Doug:

| Click on graph for larger image in new window. The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. |

And since it is BFF (bank failure friday), here is an update from Bloomberg: FDIC Closes Seized Silverton Bank After Failing to Sell Assets (ht lncolnpk, mark, ron and others)

The Federal Deposit Insurance Corp. will shut Georgia’s Silverton Bank, seized by regulators in May, after failing to find a buyer for the assets.Silverton was seized by regulators in early May.

A sale is “no longer feasible” and Silverton will be sold in parts, spokesman Andrew Gray said today in an e-mailed statement. The FDIC unsuccessfully sought a buyer before the bank was taken over by regulators May 1, he said.

Consumer Credit Declines at 7% Annual Rate in April

by Calculated Risk on 6/05/2009 03:11:00 PM

From MarketWatch: U.S. consumer debt falls by $15.7 billion

Consumer credit fell by $15.7 billion, or 7.4% at an annual rate, to $2.52 trillion. It was the second largest decline in outstanding debt on record, exceeded by March's $16.6 billion drop.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the year-over-year change in consumer credit. Consumer credit is off 1.4% over the last 12 months - however, consumer credit has declined at a 6.6% rate over the last 6 months - a record pace.

Note: Consumer credit does not include real estate debt.

Employment-Population Ratio and Part Time Workers

by Calculated Risk on 6/05/2009 01:39:00 PM

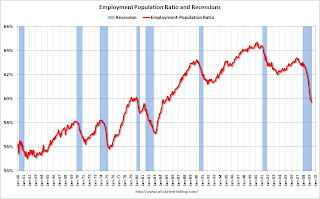

A couple more graphs based on the (un)employment report ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph show the employment-population ratio; this is the ratio of employed Americans to the adult population.

Note: the graph doesn't start at zero to better show the change.

The general upward trend from the early '60s was mostly due to women entering the workforce. As an example, in 1964 women were about 32% of the workforce, today the percentage is close to 50%.

This measure is at the lowest level since the early '80s and shows the weak recovery following the 2001 recession - and the current cliff diving!

From the BLS report:

The number of persons working part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in May at 9.1 million. The number of such workers has risen by 4.4 million during the recession.Note: "This category includes persons who would like to work full time but were working part time because their hours had been cut back or because they were unable to find full-time jobs."

Not only has the unemployment rate risen sharply to 9.4%, but the number of workers only able to find part time jobs (or have had their hours cut for economic reasons) is now at a record 9.1 million.

Not only has the unemployment rate risen sharply to 9.4%, but the number of workers only able to find part time jobs (or have had their hours cut for economic reasons) is now at a record 9.1 million.Of course the U.S. population is significantly larger today (about 305 million) than in the early '80s (about 228 million) when the number of part time workers almost reached 7 million. That is the equivalent of about 9.3 million today, so population adjusted this isn't quite a record.

Earlier employment posts today: