by Calculated Risk on 5/26/2009 03:01:00 PM

Tuesday, May 26, 2009

Revisiting the JPMorgan / WaMu Acquisition

From Bloomberg: JPMorgan’s WaMu Windfall Turns Bad Loans Into Income (ht Mike in Long Island)

When JPMorgan bought WaMu out of receivership last September for $1.9 billion, the New York-based bank used purchase accounting, which allows it to record impaired loans at fair value, marking down $118.2 billion of assets by 25 percent. Now, as borrowers pay their debts, the bank says it may gain $29.1 billion over the life of the loans in pretax income before taxes and expenses.Let's review the JPMorgan's "judgment at the time" of the acquisition. First, here is the presentation material from last September.

...

JPMorgan took a $29.4-billion writedown on WaMu’s holdings, mostly for option adjustable-rate mortgages (ARMs) and home- equity loans.

“We marked the portfolio based on a number of factors, including housing-price judgment at the time,” said JPMorgan spokesman Thomas Kelly. “The accretion is driven by prevailing interest rates.”

JPMorgan said first-quarter gains from the WaMu loans resulted in $1.26 billion in interest income and left the bank with an accretable-yield balance that could result in additional income of $29.1 billion.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.Here are the bad asset details. Also see page 16 for assumptions.

This shows the $50 billion in Option ARMs, $59 billion in home equity loans, and $15 billion in subprime loans on WaMu's books at the time of the acquisition. Plus another $15 billion in other mortgage loans.

And the second excerpt shows JPMorgan's economic judgment at the time of the acquisition.

JPMorgan's marks assumed that the unemployment rate would peak at 7.0% and house prices would decline about 25% peak-to-trough.

JPMorgan's marks assumed that the unemployment rate would peak at 7.0% and house prices would decline about 25% peak-to-trough.Note that the projected losses at the bottom of the table are from Dec 2007. As the article noted, in September 2008, JPMorgan took a writedown of close to $30 billion mostly for Option ARMs and home equity loans.

This graphic shows the unemployment rate when the deal was announced (in purple), the three scenarios JPMorgan presented (the writedowns were based on unemployment peaking at 7%) and the current unemployment rate (8.9%).

This graphic shows the unemployment rate when the deal was announced (in purple), the three scenarios JPMorgan presented (the writedowns were based on unemployment peaking at 7%) and the current unemployment rate (8.9%).Clearly JPMorgan underestimated the rise in unemployment, and this suggests the $29.4 billion writedown was too small.

And the last graph compares JPMorgan's forecast for additional house price declines and the actual declines using the Case-Shiller national home price index and the Case-Shiller composite 20 index.

And the last graph compares JPMorgan's forecast for additional house price declines and the actual declines using the Case-Shiller national home price index and the Case-Shiller composite 20 index.House prices have declined about 32.2% peak-to-trough according to Case-Shiller - nearing JPMorgan's 37% projection for a severe recession.

This shows JPMorgan underestimated additional house price declines when they acquired WaMu. Instead of $36 billion in additional losses since December 31, 2007 (and the $29.4 billion writedown), this suggests JPMorgan expects losses will be $54 billion or more.

GM Closer to Bankruptcy

by Calculated Risk on 5/26/2009 02:03:00 PM

A couple of stories ...

From Reuters: GM Bondholders Reject Plan, Setting Stage for Bankruptcy

General Motors has failed to persuade enough bondholders to accept a debt-for-equity swap, setting the stage for the largest-ever U.S. industrial bankruptcy ...And from The WSJ: UAW Discloses Terms of GM Deal

Reuters' sources said GM will likely file for bankruptcy some time after midnight Tuesday, but before June 1.

According to the WSJ, the UAW Voluntary Employee Beneficiary Association (VEBA) was owed $20 billion, but will take $10 billion in cash, a note for $2.5 billion (payable over the next 7 years), $6.5 billion in preferred stock, and own 17.5% of GM - plus a warrant for 2.5% more of GM's new common stock.

It sounds like the bankruptcy will be filed this week.

Chicago Fed: April National Activity Index

by Calculated Risk on 5/26/2009 12:12:00 PM

Note: the title for the Chicago Fed report says "activity improved in April". That is not accurate - the index improved, but economic activity is still declining, just at a slower pace.

From the Chicago Fed: Index shows economic activity improved in April

The Chicago Fed National Activity Index was –2.06 in April, up from –3.36 in March. All four broad categories of indicators improved in April, but each continued to make a negative contribution to the index. The index’s three-month moving average in April reached its highest level since October 2008.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

"[T]he Chicago Fed National Activity Index (CFNAI), is a weighted average of 85 existing, monthly indicators of national economic activity. The CFNAI provides a single, summary measure of a common factor in these national economic data ...

[T]he CFNAI-MA3 appears to be a useful guide for identifying whether the economy has slipped into and out of a recession. This is useful because the definitive recognition of business cycle turning points usually occurs many months after the event. For example, even though the 1990-91 recession ended in March 1991, the NBER business cycle dating committee did not officially announce the recession’s end until 21 months later in December 1992. ...

When the economy is coming out of a recession, the CFNAI-MA3 moves significantly into positive territory a few months after the official NBER date of the trough. Specifically, after the onset of a recession, when the index first crosses +0.20, the recession has ended according to the NBER business cycle measures."

Note: this is based on only a few recessions, but this is one of the indicators to watch for when the recession ends. Obviously not yet!

House Prices: Real Prices, Price-to-Rent, and Price-to-Income

by Calculated Risk on 5/26/2009 11:00:00 AM

Note earlier house price posts: Case-Shiller: Prices Fall Sharply in March and Case-Shiller: House Prices Tracking More Adverse Scenario

Here are three key measures of house prices: Price-to-Rent, Price-to-Income and real prices based on the Case-Shiller quarterly national home price index.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through Q1 2009 using the Case-Shiller National Home Price Index: Click on image for larger graph in new window.

Click on image for larger graph in new window.

This graph shows the price to rent ratio (Q1 1997 = 1.0) for the Case-Shiller national Home Price Index. For rents, the national Owners' Equivalent Rent from the BLS is used.

Looking at the price-to-rent ratio based on the Case-Shiller index, the adjustment in the price-to-rent ratio is maybe 85% complete as of Q1 2009 on a national basis. This ratio will probably continue to decline.

It is important to note that it appears rents are now falling (this is not showing up in the OER measure yet) and rents will probably continue to decline. Goldman Sachs notes that declining rents for REITS typically lead declines in Owners' equivalent rent of primary residence (OER) - so OER will probably be falling later this year and in 2010.

And declining rents will impact the price-to-rent ratio.

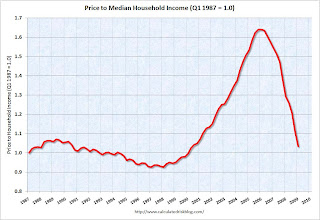

Price-to-Income:

The second graph shows the price-to-income ratio: This graph is based off the Case-Shiller national index, and the Census Bureau's median income Historical Income Tables - Households (and an estimate of 2% increase in household median income for 2008 and flat for 2009).

This graph is based off the Case-Shiller national index, and the Census Bureau's median income Historical Income Tables - Households (and an estimate of 2% increase in household median income for 2008 and flat for 2009).

Using national median income and house prices provides a gross overview of price-to-income (it would be better to do this analysis on a local area). However this does shows that the price-to-income is still too high, and that this ratio needs to fall another 10% or so. A further decline in this ratio could be a combination of falling house prices and/or rising nominal incomes.

In Q2 2008 this index was over 1.25. In Q4, the index was just over 1.1. Now the index is at 1.04. At this pace the index will hit 1.0 in mid-2009. However, during a recession, nominal household median incomes are usually stagnate - so it might take a little longer. And the index might overshoot too.

Real Prices This graph shows the real and nominal house prices based on the Case-Shiller national index. (Q1 2000 = 100 for nominal index)

This graph shows the real and nominal house prices based on the Case-Shiller national index. (Q1 2000 = 100 for nominal index)

Nominal prices are adjusted using CPI less Shelter.

The Case-Shiller real prices are still significantly above prices in the '90s and perhaps real prices will decline another 10% to 20%.

Summary

These measures are useful, but somewhat flawed. These measures give a general idea about house prices, but there are other important factors like inventory levels and credit issues. All of this data is on a national basis and it would be better to use local area price-to-rent, price-to-income and real prices.

One thing is pretty certain - as long as inventory levels are elevated, prices will continue to decline. And right now inventory levels of existing homes (especially distressed properties) are still very high.

Case-Shiller: House Prices Tracking More Adverse Scenario

by Calculated Risk on 5/26/2009 09:33:00 AM

Please see: Case-Shiller: Prices Fall Sharply in March for the seasonally adjusted composite indices.

The first graph compares the Case-Shiller Composite 10 NSA index with the Stress Test scenarios from the Treasury (stress test data is estimated from quarterly forecasts). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

Case-Shiller Composite 10 Index, March: 151.41

Stress Test Baseline Scenario, March: 154.82

Stress Test More Adverse Scenario, March: 149.96

It has only been three months, but prices are tracking close to the 'More Adverse' scenario so far.

The second graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. In Phoenix, house prices have declined 53% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are off about 11% to 12% from the peak. Prices have declined by double digits everywhere.

In Phoenix, house prices have declined 53% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are off about 11% to 12% from the peak. Prices have declined by double digits everywhere.

Prices fell sharply in most Case-Shiller cities in March, with Minneapolis off 6.1% for the month alone. Denver, Dallas, and Charlotte showed small price gains.

I'll have more on price-to-rent and price-to-income using the National Index soon.

Case-Shiller: Prices Fall Sharply in March

by Calculated Risk on 5/26/2009 09:08:00 AM

S&P/Case-Shiller released their monthly Home Price Indices for March this morning and also the quarterly national house price index.

The monthly data includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). Note: This is not the quarterly national index soon. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32.4% from the peak, and off 2.0% in March.

The Composite 20 index is off 31.4% from the peak, and off 2.2% in March.

Prices are still falling and will probably decline for some time. The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 18.6% over the last year.

The Composite 20 is off 18.7% over the last year.

This is near the worst year-over-year price declines for the Composite indices since the housing bubble burst started.

I'll have much more soon (on individual cities, comparing to the stress test scenarios, price-to-rent, price-to-income).

Monday Night Futures

by Calculated Risk on 5/26/2009 12:11:00 AM

Big week for housing data: Case-Shiller house prices will be released Tuesday, existing home sales on Wednesday, and new home sales on Thursday.

The U.S. futures are flat tonight:

CBOT mini-sized Dow

Futures from barchart.com

CME Globex Flash Quotes

And the Asian markets are mixed.

Best to all.

Monday, May 25, 2009

Housing: More problems ahead for the low end?

by Calculated Risk on 5/25/2009 08:06:00 PM

Bob_in_MA points out some interesting comments on low price areas in the WaPo article: Housing Bust Leaves Most Sellers at a Loss

In the Virginia and Maryland suburbs, prices for single-family homes are down to where they were five years ago. In Prince William and Loudoun counties, a flood of foreclosures has pushed prices so low that bargain hunters have flocked there in recent months, helping to boost sales.It will be interesting to see if sales in the low end areas start to decline after the recent reports of booming sales to another round of investors and first time buyers ...

But while in past slumps a surge in sales has signaled the start of a rebound, this downturn is unlike any in recent times and it's premature to call a recovery, said Barry Merchant, senior housing policy analyst at the Virginia Housing Development Authority.

The encouraging signs have been offset by more troublesome ones, he said. After tapering off for a few months, foreclosures in Northern Virginia are starting to creep up again and may keep climbing now that several lenders have lifted foreclosure moratoriums.

Meanwhile, the year-over-year sales increases of the past few months are petering out in some Virginia suburbs, suggesting that interest in the fire-sale prices may have peaked, Merchant said. In April, Loudoun sales declined 12.5 percent from a year earlier.

"If sales are not increasing and foreclosures are on the uptick, then the question is: 'Is there another shoe to fall?' " Merchant said. "Maybe what we were hoping was the bottom was just a bump on the way down."

The low end of the real estate market [in Phoenix] — and in some equally hard-hit places like inland California and coastal Florida — is becoming as wild as anything during the boom.and

... record or near-record-high sales this spring in many of the [California] Bay Area’s most affordable, foreclosure-heavy communities.and

... the number of single-family houses that resold last month was at record or near-record-high levels for an April in many of the more affordable, foreclosure-heavy [Southern California] inland markets.

GM Bondholders watching Chrysler Bankruptcy

by Calculated Risk on 5/25/2009 05:22:00 PM

An update on a key court ruling tomorrow - not just for Chrysler, but probably for GM too.

From the Financial Times: GM creditors watch Chrysler lawsuit (ht jb)

General Motors bondholders ... will be watching a New York court on Tuesday as a group of Chrysler creditors tries to block the imminent emergence of GM’s smaller rival from bankruptcy protection.So Chrysler will probably emerge from bankruptcy this week - and GM will likely file for bankruptcy by next Monday, June 1st.

GM’s offer to the bondholders of a 10 per cent equity stake in the restructured company expires at midnight. The bondholders, with $27bn in unsecured claims, are widely expected to reject the proposal, setting the stage for GM to file for bankruptcy protection by June 1.

...

The bankruptcy court is expected to approve the deal tomorrow, paving the way for the new company to emerge from Chapter 11.

Krugman: World economy stabilising

by Calculated Risk on 5/25/2009 02:09:00 PM

From Reuters: World economy stabilising says Krugman

"I will not be surprised to see world trade stabilise, world industrial production stabilise and start to grow two months from now," Krugman told a seminar [in the UAE].And Krugman also suggested the GCC countries might consider abandoning the dollar peg, from BI-ME and Bloomberg: Gulf countries should drop dollar peg, says Paul Krugman

"I would not be surprised to see flat to positive GDP growth in the United States, and maybe even in Europe, in the second half of the year."

...

"In some sense we may be past the worst but there is a big difference between stabilising and actually making up the lost ground," he said.

"We have averted utter catastrophe, but how do we get real recovery?

"We can't all export our way to recovery. There's no other planet to trade with."

emphasis added

“You have a region that does as much trade with the eurozone as the United States,” Krugman, an economics professor at Princeton University in New Jersey, told reporters in Dubai. “If you feel that you must have a peg, the economics suggest that it ought to be a basket that reflects trade weights.”I hope Krugman posts on his impressions of Dubai.