by Calculated Risk on 5/19/2009 07:51:00 PM

Tuesday, May 19, 2009

Home Depot on Housing Market

From the Financial Times: Home Depot chief warns on US housing

Growing optimism over the US housing market may be premature, a leading retailer warned on Tuesday.Now that the foreclosure moratorium is over, the pace of foreclosures is picking up again. And, according to Mr. Blake, this will probably impact the home improvement companies.

...

"We are concerned about the accelerating rates of foreclosures, particularly in the western part of the country,” [Frank Blake, chief executive of Home Depot] said, noting that one out of every 54 homes in California was in foreclosure.

Mr Blake said that a slowing foreclosure rate in California during the fourth quarter had led to an improvement in regional store sales but the trend had then reversed as foreclosure rates rose again in the first quarter.

The shift “provides a cautionary note on signalling a recovery prematurely”, he said. “Before we see real improvement we believe we need to see sustainable deceleration in foreclosures.”

Median Price Mix Example

by Calculated Risk on 5/19/2009 05:35:00 PM

The following table shows how the mix of units can skew the median price. This is just an example (not based on actual data).

In this example, from 2002 to 2005 low priced homes doubled in price, and high priced homes increased by two-thirds. The mix remained the same (50 units of each), and the median price increased 75%.

| Item | 2002 | 2005 | 2007 | 2009 | 2010 |

|---|---|---|---|---|---|

| Low Price | $100 | $200 | $200 | $100 | $100 |

| High Price | $300 | $500 | $500 | $400 | $300 |

| Low End Units Sold | 50 | 50 | 40 | 40 | 20 |

| High End Units Sold | 50 | 50 | 50 | 10 | 30 |

| Median Price | $200 | $350 | $500 | $100 | $300 |

| Change in Low Price | -- | 100% | none | -50% | none |

| Change in High Price | -- | 67% | none | -20% | -25% |

| Change in Median Price | -- | 75% | 43% | -80% | 200% |

Now look at what happened in 2007. Since subprime imploded first, the number of units sold at the low end decreased to 40 from 50. Everything else stayed the same - and just the change in the mix (higher percentage of high end homes) pushed up the median price! Note that the median price (light blue) increased WITHOUT any actual prices increasing. This happened at the beginning of the housing bust in many areas.

In the period I marked as 2009, the low end prices have fallen all the way back to 2002 prices. However the high end prices have only fallen 20%. The low end is seeing fairly high activity (40 units), but at the high end sales activity has collapsed (10 units). Look at the median price (in orange) - it has fallen more than the prices have declined for even the low end!

And finally, in 2010, prices fall further at the high end - and have stabilized at the low end. As prices fall, the volume picks up at the high end. And what happens to the median price? It increases by 200% (marked in red)!

UPDATE: Oops - I used average instead of median a couple of places (sorry - technical problems today),

This illustrates why we need to be very careful with median prices (like from NAR, DataQuick or other sources). The mix can distort the price, and I expect to read about median prices increasing later this year or in 2010, even though actual prices are still falling!

Market and GM Update

by Calculated Risk on 5/19/2009 04:01:00 PM

From Reuters: GM Bankruptcy Would Include Quick Sale to Feds

If General Motors files for bankruptcy ... plans include a quick sale of the automaker's healthy assets to a new company owned by the U.S. government, a source familiar with the situation said Tuesday.

...the plan also called for the government to forgive the bulk of $15.4 billion worth of emergency loans that the U.S. has already provided to GM.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

This is still the 2nd worst S&P 500 / DOW bear market in the U.S. in 100 years.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

The second graph shows the S&P 500 since 1990.

The second graph shows the S&P 500 since 1990. The dashed line is the closing price today.

The market is only off 42% from the peak.

SoCal House Sales: "Hot Inland, Cool on Coast"

by Calculated Risk on 5/19/2009 02:46:00 PM

Note: I think California data provides an overview of the key dynamics in the housing market.

From DataQuick: Southland home sales hot inland, cool on coast; median price dips

Southern California homes sold at a faster pace than a year ago for the 10th consecutive month in April as first-time buyers and investors continued to target distressed inland properties. ...Key points:

A total of 20,514 new and resale houses and condos closed escrow in the six-county Southland last month. That was up 5.2 percent from 19,506 in March and up 31.4 percent from 15,615 a year ago ... Last month’s sales were the highest for that month since April 2006, when 27,114 homes sold, but were 18.2 percent below the average April sales total since 1988, when DataQuick’s statistics begin.

Foreclosure resales – homes sold in April that had been foreclosed on in the prior 12 months – accounted for 53.6 percent of all Southland resales last month. It was the seventh consecutive month in which post-foreclosure properties made up more than half of all resales.

The deep discounts associated with foreclosures have created stiff competition for builders, who last month sold the lowest number of newly constructed homes for an April since at least 1988.

At the same time, the number of single-family houses that resold last month was at record or near-record-high levels for an April in many of the more affordable, foreclosure-heavy inland markets. They included Palmdale, Lancaster, Moreno Valley, Perris, Indio, San Jacinto, Lake Elsinore and Victorville.

The sales picture was dramatically different in many older, high-end communities closer to the coast, where foreclosures and deep discounts are less common. Sales of existing houses remained at or near record lows for an April in markets such as Beverly Hills, Malibu, Palos Verdes Peninsula, Manhattan Beach and Pacific Palisades.

Fed Announces TALF for Legacy CMBS

by Calculated Risk on 5/19/2009 02:15:00 PM

From the Federal Reserve: Federal Reserve announces that certain high-quality commercial mortgage-backed securities will become eligible collateral under the Term Asset-Backed Securities Loan Facility (TALF)

The Federal Reserve Board on Tuesday announced that, starting in July, certain high-quality commercial mortgage-backed securities issued before January 1, 2009 (legacy CMBS) will become eligible collateral under the Term Asset-Backed Securities Loan Facility (TALF).Term Asset-Backed Securities Loan Facility (Legacy CMBS): Terms and Conditions

...

The CMBS market, which has financed approximately 20 percent of outstanding commercial mortgages, including mortgages on offices and multi-family residential, retail and industrial properties, came to a standstill in mid-2008. The extension of eligible TALF collateral to include legacy CMBS is intended to promote price discovery and liquidity for legacy CMBS. The resulting improvement in legacy CMBS markets should facilitate the issuance of newly issued CMBS, thereby helping borrowers finance new purchases of commercial properties or refinance existing commercial mortgages on better terms.

To be eligible as collateral for TALF loans, legacy CMBS must be senior in payment priority to all other interests in the underlying pool of commercial mortgages and, as detailed in the attached term sheet, meet certain other criteria designed to protect the Federal Reserve and the Treasury from credit risk. The FRBNY will review and reject as collateral any CMBS that does not meet the published terms or otherwise poses unacceptable risk.

Eligible newly issued and legacy CMBS must have at least two triple-A ratings from DBRS, Fitch Ratings, Moody’s Investors Service, Realpoint, or Standard Poor’s and must not have a rating below triple-A from any of these rating agencies.

Term Asset-Backed Securities Loan Facility (Legacy CMBS): Frequently Asked Questions

TARP Repayment Restrictions

by Calculated Risk on 5/19/2009 01:28:00 PM

From CNBC: Banks Are Facing Restrictions On Repaying TARP: Sources

Among the conditions: no bank will be allowed to repay the TARP until after June 8, when 10 of the 19 biggest banks must present plans to boost their capital under the government's stress tests.I'm not sure what "another stress test" means or why they will only be approved in batches. Being able to issue non-government guaranteed debt makes sense.

...

The government also won't allow any one bank to repay the TARP first but will approve them in batches.

...

The banks face other restrictions: they still have to pass another stress test, issue debt that isn't government guaranteed, demonstrate the ability to self-fund in the market and win the approval of their banking supervisor.

...

The Treasury will also announce a process for auctioning TARP warrants ...

Quarterly Housing Starts and New Home Sales

by Calculated Risk on 5/19/2009 10:58:00 AM

The Census Bureau has released the "Quarterly Starts and Completions by Purpose and Design" report for Q1 2009 today.

Monthly housing starts (even single family starts) cannot be compared directly to new home sales, because the monthly housing starts report from the Census Bureau includes apartments, owner built units and condos that are not included in the new home sales report.

However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis. The quarterly report shows that there were 52,000 single family starts, built for sale, in Q1 2009 and that is less than the 87,000 new homes sold for the same period. This data is Not Seasonally Adjusted (NSA). This suggests homebuilders are selling more homes than they are starting.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions), although this is not perfect because homebuilders have recently been stuck with “unintentional spec homes” because of the high cancellation rates. Click on graph for larger image in new window.

Click on graph for larger image in new window.

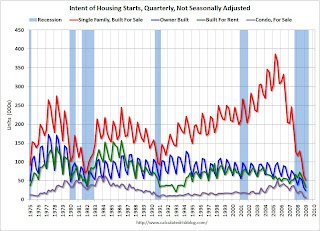

This graph provides a quarterly comparison of housing starts and new home sales. In 2005, and most of 2006, starts were higher than sales, and inventories of new homes rose sharply. For the last six quarters, starts have been below sales – and new home inventories have been falling. The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

The second graph shows the NSA quarterly starts intent for four categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Condo starts have collapsed to almost zero (5,000 started in Q1 2009) and owner built units have fallen by about 75% from the peak. Units built for rent have held up the best, and they are still off about 60% from the highs of recent years.

Condo starts in Q1 were the all time record low for Condos built for sale (5,000), breaking the previous record of 8,000 set in Q1 1991 (data started in 1975). Owner built units set a new record low (24,000 units compared to 35,000 units in Q1 1982), and of course single family units built for sale set a record low (52,000 compared to 64,000 in Q4 2008 and 71,000 in Q4 1981).

FDIC Receives Bids for BankUnited

by Calculated Risk on 5/19/2009 10:31:00 AM

Form Bloomberg: WL Ross, Carlyle Group Said to Make Bid for BankUnited Assets

WL Ross & Co. and private-equity firms including Carlyle Group made a bid to buy BankUnited Financial Corp. assets out of receivership from the government, a person familiar with the matter said."Out of receivership" says it all. This is unusual in that the bidders are picking over the carcass in public (usually the FDIC is more secretive about bank seizures).

The firms, which also include Blackstone Group LP and Centerbridge Capital Partners LLC, submitted their offer to the Federal Deposit Insurance Corp. this morning ...

emphasis added

Housing Starts at Record Low in April

by Calculated Risk on 5/19/2009 08:30:00 AM

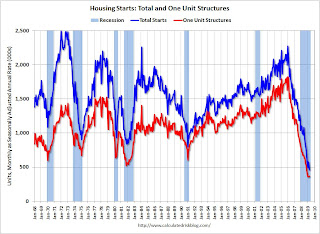

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 458 thousand (SAAR) in April, the all time record low. The previous record low was 488 thousand in January (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 368 thousand (SAAR) in April; just above the revised record low in January (357 thousand).

Permits for single-family units were 373 thousand in April, suggesting single-family starts will remain at about the same level in May.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Note that single-family completions of 549 thousand are still significantly higher than single-family starts (368 thousand). This is important because residential construction employment tends to follow completions, and completions will probably decline further.

It is still too early to call the bottom for single family starts in January, however I do expect housing starts to bottom sometime in 2009.

Monday, May 18, 2009

Credit Card Changes: Make the Prudent Pay

by Calculated Risk on 5/18/2009 11:42:00 PM

From the NY Times: Overhaul Likely for Credit Cards

Banks are expected to look at reviving annual fees, curtailing cash-back and other rewards programs and charging interest immediately on a purchase instead of allowing a grace period of weeks, according to bank officials and trade groups.This seems unlikely (reviving annual fees, charging immediate interest) because of competition. At least I hope it is unlikely!

“It will be a different business,” said Edward L. Yingling, the chief executive of the American Bankers Association, which has been lobbying Congress for more lenient legislation on behalf of the nation’s biggest banks. “Those that manage their credit well will in some degree subsidize those that have credit problems.”