by Calculated Risk on 5/14/2009 01:36:00 PM

Thursday, May 14, 2009

Hotel Recession Reaches 18 months, RevPAR off 22.4%

From HotelNewsNow: Hotel industry enters 18th month of recession

Economic research firm e-forecasting.com in conjunction with Smith Travel Research announced that following a decline of 3.7 percent in March, HIP went down 1.1 percent in April. HIP, the Hotel Industry's Pulse index, is a composite indicator that gauges business activity in the U.S. hotel industry in real-time. The latest decrease brought the index to a reading of 84.2.See article for graph of HPI.

...

“With April’s reading of HIP, the hotel industry is creeping up to the weak performance of the industry during the recession in 1981-1982, which lasted 20 months. Even still, there is some promise in April’s reading as it appears the decline may have hit a bottom, looking at the six-month growth rate and monthly decline,” noted Evangelos Simos, chief economist of e-forecasting.com.

Also from HotelNewsNow.com: STR reports US hotel performance for week ending 9 May 2009

In year-over-year measurements, the industry’s occupancy fell 14.0 percent to end the week at 53.6 percent. Average daily rate dropped 9.8 percent to finish the week at US$97.58. Revenue per available room for the week decreased 22.4 percent to finish at US$52.32.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 12.1% from the same period in 2008. The comparable week off 14.0%.

The average daily rate is down 9.8%, so RevPAR is off 22.4% from the same week last year.

BankUnited Deadline Extended

by Calculated Risk on 5/14/2009 12:44:00 PM

From Dow Jones: BankUnited Auction Extended As Thrift Scrambles For Capital

The auction to find a new buyer for struggling BankUnited Financial Corp. (BKUNA) has been extended until next week, according to a person familiar with the matter.Pitches to the FDIC? Kind of says it all ...

Bidders were originally asked to submit their pitches to the Federal Deposit Insurance Corporation by noon Thursday. However, that deadline has been extended to next Tuesday, the person said.

Update from Bloomberg: BankUnited Bidders Said to Seek Receivership Before Purchase

Bidders for BankUnited Financial Corp. are asking federal regulators to put the company into receivership before selling its assets, a step that could wipe out shareholders, people familiar with the matter said.

Potential buyers, including a private-equity group led by former North Fork Bancorp Chief Executive Officer John Kanas, have expressed an interest in purchasing the Coral Gables, Florida-based lender out of receivership ... The bidding deadline was pushed to May 19 from today ...

MBA: Commercial/Multifamily Mortgage Loan Originations Decline in Q1

by Calculated Risk on 5/14/2009 10:19:00 AM

Click on graph for larger image.

Click on graph for larger image.

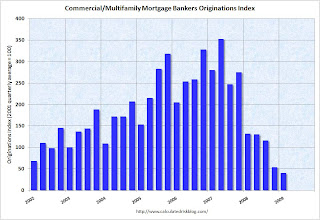

This graph shows the Mortgage Bankers Association Commercial/Multifamily Mortgage Originations index since 2001.

A couple of points:

Here is the press release from the Mortgage Bankers Association (MBA): MBA Survey Shows Continued Slowdown of Commercial/Multifamily Mortgage Lending in First Quarter 2009

Commercial and multifamily mortgage loan originations continued to drop in the first quarter of 2009, according to the Mortgage Bankers Association’s (MBA) Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations. First quarter originations were 70 percent lower than during the same period last year and 26 percent lower than during the fourth quarter of 2008. The year-over-year decrease was seen across all investor groups and most property types.There are more details in the quarterly report.

“In the first quarter of 2009 we saw the effects of the continued recession coupled with little demand from borrowers and a constrained supply from lenders as a result of the credit crunch,” said Jamie Woodwell, Vice President of Commercial Real Estate Research at the Mortgage Bankers Association. ...

Decreases in total commercial/multifamily mortgage originations continued to be led by a drop in commercial mortgage-backed security (CMBS) conduit loans.

Unemployment Claims: Continued Claims Surge Past 6.5 Million

by Calculated Risk on 5/14/2009 08:31:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending May 9, the advance figure for seasonally adjusted initial claims was 637,000, an increase of 32,000 from the previous week's revised figure of 605,000. The 4-week moving average was 630,500, an increase of 6,000 from the previous week's revised average of 624,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending May 2 was 6,560,000, an increase of 202,000 from the preceding week's revised level of 6,358,000. The 4-week moving average was 6,337,250, an increase of 128,750 from the preceding week's revised average of 6,208,500.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four-week moving average is at 630,500, off 28,250 from the peak 5 weeks ago.

Continued claims are now at 6.56 million - an all time record.

The second graph shows the four-week average of initial unemployment claims and recessions.

The second graph shows the four-week average of initial unemployment claims and recessions.Typically the four-week average peaks near the end of a recession.

The four-week average increased this week by 6,000, and is now 28,250 below the peak. There is a reasonable chance that claims have peaked for this cycle, but it is still too early to be sure, and if so, continued claims should peak soon.

The level of initial claims (over 630 thousand) is still very high, indicating significant weakness in the job market.

Summary, Futures and the Tan Man

by Calculated Risk on 5/14/2009 12:11:00 AM

Here is a summary for Wednesday:

The administration asked Congress to move quickly on legislation that would allow federal oversight of many kinds of exotic instruments, including credit-default swaps ... The Treasury secretary, Timothy F. Geithner, said the measure should require swaps and other types of derivatives to be traded on exchanges or clearinghouses and backed by capital reserves, much like the capital cushions that banks must set aside in case a borrower defaults on a loan. ...

The proposal will probably force many types of derivatives into the open, reducing the role of the so-called shadow banking system that has arisen around them.

[T]he SEC sent a "Wells" notice to Mozilo weeks ago alerting him of the planned charges, which included alleged violations of insider-trading laws, as well as failing to disclose material information to shareholders.The U.S. futures are off slightly tonight:

CBOT mini-sized Dow

Futures from barchart.com

CME Globex Flash Quotes

And the Asian markets are mostly off 1% to 3%.

Best to all.

Wednesday, May 13, 2009

MEW, Consumption and Personal Saving Rate

by Calculated Risk on 5/13/2009 09:29:00 PM

Here is a new paper on Mortgage Equity Withdrawal (MEW): House Prices, Home Equity-Based Borrowing, and the U.S. Household Leverage Crisis by Atif Mian and Amir Sufi (both University of Chicago Booth School of Business and NBER) (ht Jan Hatzius)

From the authors abstract (the entire paper is available at the link):

Using individual-level data on homeowner debt and defaults from 1997 to 2008, we show that borrowing against the increase in home equity by existing homeowners is responsible for a significant fraction of both the sharp rise in U.S. household leverage from 2002 to 2006 and the increase in defaults from 2006 to 2008. Employing land topology-based housing supply elasticity as an instrument for house price growth, we estimate that the average homeowner extracts 25 to 30 cents for every dollar increase in home equity. Money extracted from increased home equity is not used to purchase new real estate or pay down high credit card debt, which suggests that consumption is a likely use of borrowed funds. Home equity-based borrowing is stronger for younger households, households with low credit scores, and households with high initial credit card utilization rates. Homeowners in high house price appreciation areas experience a relative decline in default rates from 2002 to 2006 as they borrow heavily against their home equity, but experience very high default rates from 2006 to 2008. Our estimates suggest that home equity based borrowing is equal to 2.3% of GDP every year from 2002 to 2006, and accounts for over 20% of new defaults in the last two years.A couple of key points:

emphasis added

And this brings us to the personal saving rate.

In an earlier post I argued that the saving rate declined into the early '90s because of demographic changes, however I expected the saving rate to start to rise as the boomers reached their mid-40s (in the late 1990s). Obviously this didn't happen.

I posited that the wealth effect from the twin bubbles - stock market and housing - had led the boomers into believing they had saved more than they actually had.

This research suggests that MEW played a significant role in suppressing the saving rate too. And since the Home ATM is now closed, this is more evidence that the saving rate will increase (probably back to 8% or so) - and keep pressure on the growth of personal consumption expenditures (PCE).

For background, here are couple of graphs:

Click on graph for large image.

Click on graph for large image.The first graph shows the annual saving rate back to 1929.

Notice that the saving rate went negative during the Depression as household used savings to supplement income. And the saving rate rose to over 25% during WWII.

There is a long period of a rising saving rate (from after WWII to about 1974) and a long period of a declining saving rate (from the early '80s to 2008). (corrected text)

Some of the change in saving rate was related to demographics. As the large baby boom cohort entered the work force in the mid '70s, the saving rate declined (younger families usually save less). But, as I noted above, I expected the saving rate to start to increase in the last '90s.

And here are the Kennedy-Greenspan estimates (NSA - not seasonally adjusted) of home equity extraction through Q4 2008, provided by Jim Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41.

NOTE: Anyone who wants the Equity Extraction data, please see this post for a spreadsheet and how to credit Dr. Kennedy's work.

This graph shows what Dr. Kennedy calls "active MEW" (Mortgage Equity Withdrawal). This is defined as "Gross cash out" plus the change in the balance of "Home equity loans".

This graph shows what Dr. Kennedy calls "active MEW" (Mortgage Equity Withdrawal). This is defined as "Gross cash out" plus the change in the balance of "Home equity loans".This measure is near zero ($7.2 billion for the quarter) and is an estimate of the impact of MEW on consumption. When people refinance with cash out or draw down HELOCs, they usually spend the money.

William Seidman

by Calculated Risk on 5/13/2009 07:02:00 PM

From Bloomberg: William Seidman, Who Led Cleanup of S&L Crisis, Dies

In his memoir [published in 1993], Seidman offered a set of lessons learned. They included, “Instruct regulators to look for the newest fad in the industry and examine it with great care. The next mistake will be a new way to make a loan that will not be repaid.”Those two sentences should be emblazoned above every desk of every financial regulator.

My condolences to Mr. Seidman's family and friends.

Regulatory Reform for Derivatives

by Calculated Risk on 5/13/2009 05:38:00 PM

From the U.S. Treasury: Regulatory Reform Over-The-Counter (OTC) Derivatives

As the AIG situation has made clear, massive risks in derivatives markets have gone undetected by both regulators and market participants. But even if those risks had been better known, regulators lacked the proper authorities to mount an effective policy response.The press release has the details, but basically the Obama Administration is proposing all derivatives must be centrally cleared and subject to oversight and regulation.

Today, to address these concerns, the Obama Administration proposes a comprehensive regulatory framework for all Over-The-Counter derivatives.

From Reuters: U.S. regulators propose OTC derivatives crackdown

Authorities proposed subjecting all over-the-counter derivatives dealers to "a robust regime of prudential supervision and regulation," including conservative capital, reporting and margin requirements.About time.

Treasury Secretary Timothy Geithner, Securities and Exchange Commission Chairman Mary Schapiro, and Mike Dunn, acting chairman of the Commodity Futures Trading Commission, announced the proposal at a news conference.

Under current law, over-the-counter (OTC) derivatives are largely excluded or exempted from regulation.

"We're going to require for the first time all standardized over-the-counter derivative products be centrally cleared," said Geithner.

Market Update

by Calculated Risk on 5/13/2009 04:00:00 PM

Click on graph for larger image in new window.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

This is still the 2nd worst S&P 500 / DOW bear market in the U.S. in 100 years.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. The second graph shows the S&P 500 since 1990.

The second graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

The market is only off 43.5% from the peak.

Note: I'm still looking for Derivatives announcement (previous thread)

Geithner to Announce Tougher Derivatives Rules at 4 PM ET

by Calculated Risk on 5/13/2009 03:50:00 PM

From Dow Jones: Treasury, SEC, CFTC To Unveil OTC Derivatives Regulatory Plan

The Treasury Department will unveil its plan for regulatory reform of over-the-counter derivatives late Wednesday afternoon, Michael Dunn, the acting chairman of the Commodity Futures Trading Commission, said Wednesday.Here is the CNBC feed. (hopefully)

Speaking at an advisory committee meeting at the CFTC's offices, Dunn said he will appear alongside Treasury Secretary Timothy Geithner and Securities and Exchange Commission Chairman Mary Schapiro at 4 p.m. EDT to discuss the details.