by Calculated Risk on 5/13/2009 04:00:00 PM

Wednesday, May 13, 2009

Market Update

Click on graph for larger image in new window.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

This is still the 2nd worst S&P 500 / DOW bear market in the U.S. in 100 years.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. The second graph shows the S&P 500 since 1990.

The second graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

The market is only off 43.5% from the peak.

Note: I'm still looking for Derivatives announcement (previous thread)

Geithner to Announce Tougher Derivatives Rules at 4 PM ET

by Calculated Risk on 5/13/2009 03:50:00 PM

From Dow Jones: Treasury, SEC, CFTC To Unveil OTC Derivatives Regulatory Plan

The Treasury Department will unveil its plan for regulatory reform of over-the-counter derivatives late Wednesday afternoon, Michael Dunn, the acting chairman of the Commodity Futures Trading Commission, said Wednesday.Here is the CNBC feed. (hopefully)

Speaking at an advisory committee meeting at the CFTC's offices, Dunn said he will appear alongside Treasury Secretary Timothy Geithner and Securities and Exchange Commission Chairman Mary Schapiro at 4 p.m. EDT to discuss the details.

"Green Shoots Wilting"

by Calculated Risk on 5/13/2009 01:32:00 PM

A few excerpts from Economists React: ‘Green Shoots Withering’ in Retail

We now have to expect flat consumption in April, which means there has been no net increase since January ... the freefall is over but shredded balance sheets and declining incomes mean a broadly flat trend is about the best we can expect. Greens shoots withering ...Some people mistook the end of "cliff diving" for "green shoots" and started predicting a "V-shaped" recovery. Although the worst of the declines is probably over, an immaculate recovery seems very unlikely. (See Immaculate Recovery? )

Ian Shepherdson, High Frequency Economics

Overall, these data suggest consumers could not sustain the modest first quarter gains in spending and at least one “green shoot” appears to be wilting.

Nomura Global Economics

Update on Inventory Correction

by Calculated Risk on 5/13/2009 11:05:00 AM

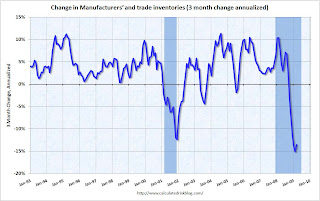

The Q1 GDP report showed a strong inventory correction is under way, with the BEA reporting inventories declined -136.8 billion (SAAR) in Q1. The Manufacturing and Trade Inventories and Sales report from the Census Bureau today showed more evidence of declining inventories. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Census Bureau reported:

Manufacturers' and trade inventories, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $1,404.1 billion, down 1.0 percent (±0.1%) from February 2009 and down 4.8 percent (±0.3%) from March 2008.The above graph shows the 3 month change (annualized) in manufacturers’ and trade inventories. The inventory correction was slow to start in this recession, but inventories are now declining sharply.

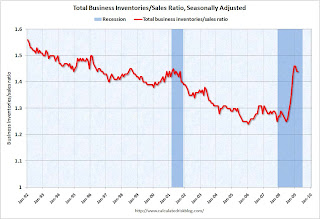

However, even with the sharp decline in inventories, the inventory to sales ratio was flat in March at 1.44.

However, even with the sharp decline in inventories, the inventory to sales ratio was flat in March at 1.44.There has been a race between declining sales and declining inventory. And even if sales start to stabilize, inventory levels are still too high, and further inventory reductions are coming.

LA Times: Sour CRE Loans

by Calculated Risk on 5/13/2009 10:13:00 AM

This is a story we've discussed for a few years, but it is probably worth repeating: Small and regional banks couldn't compete in the residential mortgage market during the housing bubble (with some exceptions), so they focused on Construction & Development (C&D) and other Commercial Real Estate (CRE) loans. The C&D loans are defaulting in large numbers now and this is impacting a number of regional banks (like BankUnited and Corus).

And defaults are just starting to increase on other CRE loans. Most of the coming bank failures will be due to C&D and CRE loans.

From the LA Times: Sour commercial real estate loans threaten to hurt regional banks

The slumping market for commercial real estate -- viewed by many as the next big shoe to drop on the economy -- now threatens to drag down regional banks as they struggle to collect on loans made against shopping centers and office buildings.For a few graphs on C&D loan concentrations and noncurrent rates (from the FDIC Q4 Quarterly Banking Profile), see: Bank Failures and C&D Loans . The Q1 FDIC report should be released in a few weeks.

Seriously overdue loans against commercial developments have shot up dramatically in recent months, as delinquencies snowball on construction loans and mortgages for office buildings, malls and apartments.

...

"Commercial lending is our bread and butter, the lion's share of our business," said Dominic Ng, chairman of East West Bancorp, which with $12 billion in assets is the second-largest bank based in Los Angeles County.

The Pasadena bank ... set aside $226 million to cover loan losses last year, up from $12 million in 2007. The bank lost $49 million in 2008, compared with a profit of $161 million in 2007.

Land development and construction loans, the main problem so far for East West, total about 20% of the bank's loan portfolio. Now Ng says he is nervously watching delinquencies on commercial mortgages -- about 40% of East West's loans.

Retail Sales Decline in April

by Calculated Risk on 5/13/2009 02:07:00 AM

On a monthly basis, retail sales decreased 0.4% from March to April (seasonally adjusted), and sales are off 11.4% from April 2008 (retail and food services decreased 10.1%).

The following graph shows the year-over-year change in nominal and real retail sales since 1993. Click on graph for larger image in new window.

Click on graph for larger image in new window.

To calculate the real change, the monthly PCE price index from the BEA was used (April PCE prices were estimated as the average increase over the previous 3 months).

Although the Census Bureau reported that nominal retail sales decreased 11.4% year-over-year (retail and food services decreased 10.1%), real retail sales declined by 11.9% (on a YoY basis). The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

NOTE: The graph doesn't start at zero to better show the change.

This shows that retail sales fell off a cliff in late 2008, and are still declining - but at a slower pace.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for April, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $337.7 billion, a decrease of 0.4 percent (±0.5%)* from the previous month and 10.1 percent (±0.7%) below April 2008. Total sales for the February through April 2009 period were down 9.2 percent (±0.5%) from the same period a year ago. The February to March 2009 percent change was revised from -1.2 percent (±0.5%) to -1.3 percent (±0.3%).No green shoots here.

Retail trade sales were down 0.4 percent (±0.7%)* from March 2009 and 11.4 percent (±0.7%) below last year. Gasoline stations sales were down 36.4 percent (±1.5%) from April 2008 and motor vehicle and parts dealers sales were down 20.7 percent (±2.3%) from last year.

RealtyTrac: Record Foreclosure Activity in April

by Calculated Risk on 5/13/2009 12:12:00 AM

From RealtyTrac: Foreclosure Activity Remains at Record Levels in April

RealtyTrac ... today released its April 2009 U.S. Foreclosure Market Report(TM), which shows foreclosure filings - default notices, auction sale notices and bank repossessions - were reported on 342,038 U.S. properties during the month, an increase of less than 1 percent from the previous month and an increase of 32 percent from April 2008. The report also shows that one in every 374 U.S. housing units received a foreclosure filing in April, the highest monthly foreclosure rate ever posted since RealtyTrac began issuing its report in January 2005.

"Total foreclosure activity in April ended up slightly above the previous month, once again hitting a record-high level," said James J. Saccacio, chief executive officer of RealtyTrac. "Much of this activity is at the initial stages of foreclosure - the default and auction stages - while bank repossessions, or REOs, were down on a monthly and annual basis to their lowest level since March 2008. This suggests that many lenders and servicers are beginning foreclosure proceedings on delinquent loans that had been delayed by legislative and industry moratoria. It's likely that we'll see a corresponding spike in REOs as these loans move through the foreclosure process over the next few months."

emphasis added

Tuesday, May 12, 2009

BKUNA Needs $1 Billion in Capital

by Calculated Risk on 5/12/2009 09:04:00 PM

BankUnited filed a Notification of Late Filing with the SEC today (ht Brian). Here are a few excerpts:

We are not able to file a timely Second Quarter 2009 Form 10-Q because we have not completed the preparation of our financial results for either the fiscal year ended September 30, 2008 (the “fiscal 2008”) or the fiscal quarters ended March 31, 2009 and December 31, 2008. This delay results from the continuing adverse market conditions, the complexity of accounting and disclosure issues, which increased the need for additional review and analysis of our business including, without limitation, regulatory issues, liquidity and capital and the material weaknesses in internal control over financial reporting discussed below.And the bank needs approximately $1 billion in capital:

Most recently, on April 14, 2009, the Board of Directors of the Bank entered into a Stipulation and Consent to Prompt Corrective Action Directive (the “PCA Agreements”) with the OTS. ... The PCA Agreements further required the Bank to achieve and maintain, at a minimum, the following ratios: (i) Total Risk Based Capital Ratio of 8%; (ii) Tier I Core Risk Based Capital Ratio of 4%; and (iii) Leverage Ratio of 4% within twenty days of the effective date of the PCA Agreements. Based on our March 31, 2009 reported capital levels, we would need to raise approximately $1.0 billion to meet the Total Risk Based Capital Ratio of 8%, approximately $706 million to meet the Tier I Core Risk Based Capital Ratio of 4% and approximately $937 million to meet the Leverage Ratio of 4%. The twenty-day period to raise capital and achieve the mandatory minimum capital requirements under the PCA Agreements expired on May 4, 2009 without compliance by the Bank.It was reported in the Miami Herald that BKUNA was granted an extension until Thursday May 14th:

The Federal Deposit Insurance Corp. allowed a two-week extension and extended the deadline until May 14 for prospective buyers or investors to submit their bids ...I couldn't find mention of the extension in BKUNA's NT 10-Q filing.

Something to watch this Friday.

Freddie Mac: Falling Prices "significantly affecting behavior" of Borrowers

by Calculated Risk on 5/12/2009 06:25:00 PM

From MarketWatch: Freddie reports quarterly net loss of $9.9 billion

Freddie's first-quarter loss widened to $9.85 billion ... Freddie set aside $8.8 billion in provisions to cover credit losses during the first quarter. That's up from $7 billion in the final three months of 2008. The rise was driven by increases in the number and rate of delinquent mortgages and the rising severity of losses from foreclosures, Freddie explained.From the SEC filing:

Freddie also invests in mortgage-backed securities and is suffering as rising delinquencies and foreclosures cut into the value of these holdings. The company recorded $7.1 billion in impairments on securities that are available for sale.

...

Freddie Mac said its conservator asked for $6.1 billion in extra funding from the Treasury Department.

Home prices nationwide declined an estimated 1.4% in the first quarter of 2009 based on our own internal index, which is based on properties underlying our single-family mortgage portfolio. The percentage decline in home prices in the last twelve months has been particularly large in the states of California, Florida, Arizona and Nevada, where we have significant concentrations of mortgage loans.There are several key points:

...

While temporary suspensions of foreclosure transfers reduced our charge-offs and REO activity during the first quarter of 2009, our provision for credit losses includes expected losses on those foreclosures currently suspended. We also observed a continued increase in market-reported delinquency rates for mortgages serviced by financial institutions, not only for subprime and Alt-A loans but also for prime loans, and we experienced an increase in delinquency rates for all product types during the first quarter of 2009. This delinquency data suggests that continuing home price declines and growing unemployment are significantly affecting behavior by a broader segment of mortgage borrowers. Additionally, as the slump in the U.S. housing market has persisted for more than a year, increasing numbers of borrowers that began with significant equity are now “underwater,” or owing more on their mortgage loans than their homes are currently worth. Our loan loss severities, or the average amount of recognized losses per loan, also continued to increase in the first quarter of 2009, especially in the states of California, Florida, Nevada and Arizona, where home price declines have been more severe and where we have significant concentrations of mortgage loans with higher average loan balances than in other states.

emphasis added

Sounds like walking away ... in prime time!

Can't Sell? Try Renting

by Calculated Risk on 5/12/2009 04:24:00 PM

From CNBC: Homeowners Turn to Renting, Waiting for Market to Recover

Still having trouble selling your house? More homeowners are deciding to rent out their homes while they wait for the market to recover.And here is a video I took this morning in Newport Beach (note: this also fits with the Home Sales: One and Done post too. Who will buy in these more expensive beach communities when there are no move up buyers?

"I had my condo on the market for three months and I didn't have any bites," says Molly Smith, a public relations executive in Newburyport, Massachusetts. "I realized if I was going to sell it, I'd take a big loss."

So the 29-year-old Smith, who wanted a shorter commute to her job, decided to rent out her house and move into a rental herself.

Please be patient with me - I'm still working on this video stuff!

The construction noise at the beginning of the video is a new Senior Center being built (still demolishing the old structure and grading the property).

Although rentals are common in Newport Beach, the market is usually very tight. Not right now.