by Calculated Risk on 5/10/2009 03:19:00 PM

Sunday, May 10, 2009

NY Times: Falling Apartment Rents in Manhattan

From the NY Times: Manhattan Calling

... Great Recession prices are drawing even the most loyal outer-borough dwellers back to Manhattan. ...This is mostly anecdotal data, but it does appear apartment rents are falling in much of the country.

Among the lures: $1,600 one-bedrooms on the Lower East Side. Lenient landlords who no longer require security deposits. And an overriding sense that an obscenely overpriced borough is now, well, slightly more reasonably overpriced.

... "[T]his was a unique moment in real estate history where renters have the upper hand, which seemed unbelievable a couple of years ago." [said] Keith O’Brien, a 30-year-old in marketing and public relations ...

In the first three months of the year, one-bedroom rents in Manhattan fell 6.7 percent compared with the previous year, while Brooklyn one-bedrooms dropped just 3.2 percent, according to data from Citi Habitats and Ideal Properties Group ... Other reports show some Manhattan rents down by 10 percent from a year ago.

... prices at upscale rental buildings like 45 Wall Street have come down significantly, discounted by 15 to 20 percent in recent weeks.

SNL: Geithner Cold Open

by Calculated Risk on 5/10/2009 11:48:00 AM

From Saturday Night Live sorry about the ad.

(For serious posts on banking scroll down)

Report: Banks Can Reduce Capital Needs if Profits Higher

by Calculated Risk on 5/10/2009 10:50:00 AM

From the Financial Times: US banks claim line softened on $74bn (ht Bo)

US banks have been given government assurances they will be allowed to raise less than the $74.6bn in equity mandated by stress tests if earnings over the next six months outstrip regulators’ forecasts, bankers said.The banks have a real incentive to book profits during Q2 and Q3 - something to remember.

The agreement, which was not mentioned when the government revealed the results on Thursday, means some banks may not have to raise as much equity through share issues and asset sales as the market is expecting. It could also increase the incentive for banks to book profits in the next two quarters.

The banks have 28 days to announce their capital-raising plans and until November 9 to implement them. Wells Fargo and other banks that will have to raise capital told the Financial Times that if operating profits were greater than the government’s stress-case forecast for the second and third quarter, they would receive credit for the difference. That, in turn, would reduce the need to raise fresh equity from other sources.

For more, see the comments of Nouriel Roubini and Jan Hatzius (Goldman's chief economist) that I posted yesterday: The Race: Future Earnings vs. Writedowns

Saturday, May 09, 2009

More Foreclosure Auction Video

by Calculated Risk on 5/09/2009 10:31:00 PM

Here is another video from Jillayne Schlicke at a foreclosure auction on April 24, 2009 in Bellevue, WA.

Did he say "Calculated Risk"? (1 min 14 sec)

The Race: Future Earnings vs. Writedowns

by Calculated Risk on 5/09/2009 06:07:00 PM

The results of the stress test showed that the bulk of future bank losses will come from accrual loan portfolios, as opposed to exotic securities (most of the writedowns to date have come from these securities). Here is the quote from the stress test results:

"The bulk of the estimated losses – approximately $455 billion – come from losses on the BHCs’ accrual loan portfolios, particularly from residential mortgages and other consumer‐related loans. ... Estimated possible losses from trading‐related exposures and securities held in investment portfolios totaled $135 billion."Here is Professor Roubini's comment (from Ten Reasons Why the Stress Tests Are “Schmess” Tests and Why the Current Muddle-Through Approach to the Banking Crisis May Not Succeed):

Federal Reserve, The Supervisory Capital Assessment Program: Overview of Results, May 7, 2009

Second, the capital/needs of these banks depend on a race between retained earnings before writedowns/provisioning that will be positive given a high net interest rate margin and the losses deriving from further writedowns. It appears that regulators have overestimated the amount of such retained earnings for 2009-2010. The IMF recently estimated that retained earnings (after taxes and dividends) for all US banks – not just these 19 ones – would be only $300 bn total over the 2009-2010 period. The stress tests – instead – assumed much higher retained earnings - $362 bn - for these 19 banks alone for the 2009-2010 period in the more adverse scenario. Since these 19 banks account for about half of US banks assets if one were to use the IMF estimate of net retained earnings for these 19 banks their net retained earnings for 2009-2010 would be $150 bn rather than the $362 bn assumed by the regulators. While the IMF may have been too conservative in its estimates of net retained earnings it appears that regulators may have been too generous to these 19 banks in forecasting their earnings in an adverse scenario. Thus, ex-post capital needs will be significantly higher if net retained earnings turn out to be lower than assumed in the stress tests.And a more optimistic view from Jan Hatzius:

"The enormous volume of securities writedowns in 2008 basically overwhelmed the pre-provision earnings power of the banking industry. ... We think that most of the loss recognitions in securities has now occurred. U.S. banks will still need to recognize substantial losses, but this will be mainly the provisions for whole loans that are spread out over a somewhat longer period of time, and somewhat more predictable, and therefore won't be as violent as the securities write-downs, and as a result these remaining losses can be offset via pre-provision earnings to a much greater degree."This brings up a key concept:

Jan Hatzius, Chief Economist, Goldman Sachs, Conference Call, May 8, 2009 (no link)

Imagine a bank holds a RMBS (Residential Mortgage Back Security). Forget about tranches - just imagine the security is based on 100 mortgage loans. All of the loans are current, but the security is actively traded, and the price falls to 50 cents on the dollar because investors believe that there are many default (and losses) coming. The bank has lost 50% immediately. The bank holds the security, not the loans - so it is the change in the value of the security that hits their income statement.

Perhaps the bank believes the most profitable thing to do is just keep the loans in its own portfolio (fair value accounting principle called "highest and best use"). Now the bank also has a portfolio of 100 loans with exactly the same characteristics as the RMBS. The Fair Value estimate for income producing loans for which there is no available market or counterparty will be based on the Income approach (discounted future cash flows). As before all of the loans are current, so the bank takes writedowns based on estimates of discounted future cash flows (they are being held to maturity). As the losses, both current and future, become estimable, the bank takes the writedown.

A large portion of Alt-A (like Option ARMs) is held on bank balance sheets. So the building Alt-A crisis will be written down as the losses are estimable. Tanta mentioned this last year in: Subprime and Alt-A: The End of One Crisis and the Beginning of Another

If the "subprime crisis" was about "exotic securities," the "Alt-A crisis" is going to be about bank balance sheets.And this brings up a second key point:

The Fed estimated both future losses and future earnings. As Dr. Roubini noted, there will be a race between losses and earnings - and if the Fed overestimated earnings or underestimated losses, the banks will need additional capital. If Hatzius is correct, the banks will win (or draw) the race - if Roubini is correct, the banks will lose.

But whether the banks win or lose the race, the rapidly rising defaults for Alt-A (and HELOCs and Jumbo Prime) loans will impact house prices in neighborhoods where the loans are concentrated (mostly mid-to-high end areas).

NY Times on Saving Rate

by Calculated Risk on 5/09/2009 04:27:00 PM

From the NY Times: Shift to Saving May Be Downturn’s Lasting Impact

The economic downturn is forcing a return to a culture of thrift that many economists say could last well beyond the inevitable recovery.The NY Times article notes the need to repair household balance sheets, but there is a second factor that will push up the saving rate too: changing demographics. Here is what I wrote a week ago:

This is not because Americans have suddenly become more financially virtuous or have learned the error of their free-spending ways. Instead, these experts say, Americans may have no choice but to continue pinching pennies.

This shift back to thrift may seem to be a healthy change for a consumer class known for spending more than it earns, but there is a downside: American businesses have become so dependent on consumer spending that any pullback sends ripples through the economy.

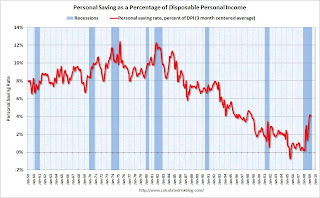

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the March Personal Income report. The saving rate was 4.1% in March.I expect the saving rate to continue to rise to 8% or so, although the future increases will probably not be as rapid as the last few months.

This suggest households are saving substantially more than during the last few years (when the saving rate was close to zero). The saving rate will probably continue to rise (an aging population usually pushes the saving rate higher) and a rising saving rate will repair household balance sheets, but ... this will also keep pressure on personal consumption.

Saturday Morning Summary

by Calculated Risk on 5/09/2009 10:17:00 AM

Jon Lansner at the O.C Register has some quotes on housing: When will housing bottom? Depends on who is talking! I'll add my two cents later ...

And for those that missed them, here are some reset / recast charts.

And a graph comparing job losses with previous recessions.

And a video of a mothballed condo project in Irvine, CA

Best to all

Bank Failure #33: Westsound Bank, Bremerton, Washington

by Calculated Risk on 5/09/2009 12:37:00 AM

Bogus Kabuki theatre.

Truth remains hidden.

by Soylent Green is People

From the FDIC: Kitsap Bank, Port Orchard, Washington, Assumes All of the Deposits of Westsound Bank, Bremerton, Washington

Westsound Bank, Bremerton, Washington, was closed today by the Washington Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver....

As of March 31, 2009, Westsound Bank had total assets of $334.6 million and total deposits of $304.5 million. ...

The transaction is the least costly resolution option, and the FDIC estimates the cost to its Deposit Insurance Fund will be $108 million. Westsound Bank is the 33rd FDIC-insured institution to be closed this year and the second in Washington. The last bank to be closed in the state was the Bank of Clark County on January 16, 2009.

Friday, May 08, 2009

WSJ Report: Banks Negotiated Concessions on Stress Tests

by Calculated Risk on 5/08/2009 08:31:00 PM

From the WSJ: Banks Won Concessions on Tests

The Federal Reserve at the last minute significantly scaled back the size of the capital hole facing some of the nation's biggest banks, following days of intense bargaining over the stringency of the stress tests.

...

When the Fed last month informed banks of its preliminary stress-test findings, executives at banks including Bank of America Corp., Citigroup Inc. and Wells Fargo & Co. were furious ...

At Fifth Third, the Fed was preparing to tell the Cincinnati-based bank to find $2.6 billion in capital, but the final tally dropped to $1.1 billion.

Loan Reset / Recast Schedule

by Calculated Risk on 5/08/2009 06:13:00 PM

Before reading, please see Tanta's: Reset Vs. Recast, Or Why Charts Don't Match

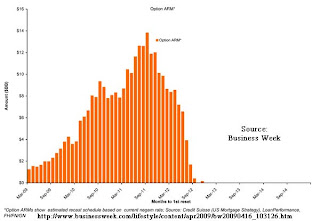

"Reset" refers to a rate change. "Recast" refers to a payment change.Here are two Credit Suisse charts:

Click on image for larger graph in new window.

Click on image for larger graph in new window.The first chart is from Business Week in April: Good News: Option ARM Resets Delayed

The reset and recast confusion continues! The x-axis is labeled "months to 1st reset", but the notes to the graph says: "estimated recast schedule".

And here is more from a Credit Suisse research report released in February (no link):

It appears Credit Suisse is using recast dates for Option ARMs and reset dates for all other loans. Resets are not a huge problem with low interest rates, but recasts could be significant.

It appears Credit Suisse is using recast dates for Option ARMs and reset dates for all other loans. Resets are not a huge problem with low interest rates, but recasts could be significant.Looking at these charts it would be easy to conclude that the recast problem last through 2012. However there is a difference between the original recast date, and the actual recast date - because negatively amortizing loans hit the recast ceiling earlier than the original forecast. I suspect the peak in recasts for Option ARMs will be in 2010.