by Calculated Risk on 5/06/2009 01:32:00 PM

Wednesday, May 06, 2009

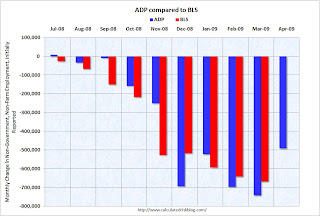

ADP and BLS

I added a caution with the ADP employment report this morning: "The ADP employment report hasn't been very useful in predicting the BLS numbers ..."

Several readers have sent me graphs showing that ADP and BLS employment numbers track pretty well over time. That is true - after revisions.

However I think in real time the ADP report isn't that useful for forecasting the BLS numbers (although it might offer a suggestion). Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the ADP and BLS employment numbers (note: non-government) as originally released since last Summer.

Here is the original releases for ADP and for the BLS.

Although the two reports generally move together, there have been a number of significant misses; as examples: September, November and December of last year.

The consensus for BLS reported job losses is 630,000 (including government, to be announced Friday), and the ADP report suggests the losses might be a little lower.

However, initial weekly unemployment claims only declined slightly in April, and for the headline number (that includes government - not included in ADP) there have been a number of reports of local government layoffs.

John A. Challenger, chief executive officer of the placement company, said [this morning] ... “state and local governments, as well as school districts, are really feeling the impact of this downturn.”I think the job losses could be less than the average of the last 5 months (averaged 660 thousand per month), but not much less.

Report: Wells Fargo Needs $15 Billion in Capital

by Calculated Risk on 5/06/2009 12:15:00 PM

From Bloomberg: Wells Fargo Said to Need $15 Billion in New Capital

Wells Fargo & Co., the fourth-largest U.S. bank by assets, requires about $15 billion in new capital as a result of regulators’ stress test on the lender ...The leaks just keep coming ...

JPMorgan Chase & Co. doesn’t need to raise its capital, people with knowledge of its results said, while Goldman Sachs Group Inc. and Bank of New York Mellon Corp. have taken actions that suggest they also passed their reviews.

Foreclosures: More movin' on up!

by Calculated Risk on 5/06/2009 10:10:00 AM

From Bloomberg: Rich Americans Default on Luxury Homes Like Subprime Victims (ht Lance)

Chuck Dayton put down a quarter of the $950,000 purchase price when he bought his house in Newport Beach, California, in 2004. ... Dayton, 43, went into default four months ago because he couldn’t afford payments on the three-bedroom home, located within a block of the Pacific Ocean.The next wave of defaults is building ... this time in the mid-to-high range.

...

Dayton said he financed the purchase of his home, 40 miles south of Los Angeles in Orange County, with a payment-option adjustable-rate mortgage now serviced by JPMorgan’s Washington Mutual.

...

Dayton refinanced in February 2007 with a $1 million loan from Washington Mutual ... He also took out two private mortgages and now has a balance of $106,000 on those loans ... Dayton went into default on Jan. 29 and owes $46,584 in delinquent payments and penalties, according to First American CoreLogic ...

The number of U.S. homes valued at more than $729,750, the jumbo-loan limit in the most affluent areas, entering the foreclosure process jumped 127 percent during the first 10 weeks of this year from the same period of 2008, data compiled by RealtyTrac Inc. of Irvine, California, show. The rate rose 72 percent for homes valued at less than $417,000 and 78 percent for all homes

Other Employment Reports

by Calculated Risk on 5/06/2009 08:50:00 AM

The ADP employment report hasn't been very useful in predicting the BLS numbers, but here it is anyway: April ADP Report:

Nonfarm private employment decreased 491,000 from March to April 2009 on a seasonally adjusted basis, according to the ADP National Employment Report®. The estimated change of employment from February to March was revised by 34,000, from a decline of 742,000 to a decline of 708,000.And from Bloomberg: U.S. April Job Cuts Rise 47% From a Year Ago, Challenger Says

Job cuts announced by U.S. employers in April increased 47 percent from a year earlier, led by government agencies and companies in the automotive industry, while the total was the lowest since October.The BLS report for April will be released Friday. Hopefully the pace of job losses has slowed - over the last 5 months the BLS has reported 3.3 million net jobs lost!

...

“Job cuts are still at recession levels, but the fact that they are falling is certainly promising and may suggest that employers are starting to feel a little more confident about future business conditions,” John A. Challenger, chief executive officer of the placement company, said in a statement. Still, he said, “state and local governments, as well as school districts, are really feeling the impact of this downturn.”

Tuesday, May 05, 2009

Report: BofA Needs $34 Billion in Capital

by Calculated Risk on 5/05/2009 11:58:00 PM

From Reuters: Bank of America to need $34 billion in capital: source

Bank of America (BAC.N) has been deemed to need an additional $34 billion in capital, according to the results of a government stress test, a source familiar with the results said on Tuesday.From the WSJ: BofA Needs $35 Billion Jolt

And Bloomberg: Tests Said to Show Bank of America Has Biggest Need

Regulators have determined that Bank of America Corp. has the largest need for new capital among the 19 biggest U.S. banks subjected to stress tests, according to people familiar with the matter.

Citigroup Inc.’s shortfall is more limited because the company already plans to convert government preferred shares to common stock, the people said.

Homeowners Underwater

by Calculated Risk on 5/05/2009 09:47:00 PM

There is substantial disagreement on the number of homeowners underwater (they owe more than their homes are worth). At the end of 2008, American CoreLogic estimated there were 8.2 million homeowners underwater.

Zillow.com is now estimating 26.9 million homeowners with negative equity.

From the WSJ: House-Price Drops Leave More Underwater

Real-estate Web site Zillow.com said that overall, the number of borrowers who are underwater climbed to 26.9 million at the end of the first quarter from 16.3 million at the end of the fourth quarter.This is a substantial difference. Apparently Zillow assumes that borrowers with HELOCs have drawn down the maximum amount, and I suppose they use their house price software. My guess is Economy.com's estimate is closer.

...

Moody's Economy.com estimates that of 78.2 million owner-occupied single-family homes, 14.8 million borrowers, or 19%, owed more than their homes were worth at the end of the first quarter, up from 13.6 million at the end of last year.

No matter - the number is huge. And many of these borrowers are in danger of default if they experience a negative event (death, disease, divorce, unemployment, etc.)

Report: U.S. Setting Conditions for Banks to Repay TARP

by Calculated Risk on 5/05/2009 07:18:00 PM

From the WSJ: U.S. to Set Condition for Banks Repaying TARP (ht MrM)

Banks that want to return Troubled Asset Relief Program funds will have to demonstrate their ability to wean themselves off ... a guarantee of debt issuance offered by the Federal Deposit Insurance Corp. ...One of the running jokes is that the banks will repay the TARP funds "soon". If the banks have to wait until they are weaned off the FDIC loan guarantee program, "soon" will probably be a couple of years.

Firms will have to show they don't need the FDIC guarantee to issue debt ... Regulators could detail the complete set of guidelines dictating how banks can repay TARP as early as Wednesday.

There are 97 financial institutions that have issued $336 billion in debt under the FDIC Temporary Liquidity Guarantee Program (TLGP). Summary here.

However most of this debt was issued by just 31 very large Bank and Thrift Holding Companies (update: cap is based on secured debt, not just liabilities).

Homebuilders on the Housing Market

by Calculated Risk on 5/05/2009 05:39:00 PM

Several major homebuilders have just reported. Here are a few quotes:

“The operating environment for housing remained very difficult during the first quarter of 2009. The housing market continues to face rising unemployment, tight mortgage availability, increased foreclosure activity and declining home prices, all putting negative pressure on buyer demand."

Richard J. Dugas, Jr., President and CEO of Pulte Homes, Press Release

["M]arket conditions in the homebuilding industry are still challenging, characterized by rising foreclosures, high inventory levels of both new and existing homes, increasing unemployment, tight credit for homebuyers and eroding consumer confidence."

Donald R. Horton, Chairman of the Board, D.R. Horton Press Release

"Housing markets remained challenged throughout the quarter, with the positives of historic affordability and low interest rates offset by rising foreclosures and high resale inventories."

Timothy R. Eller, chairman and CEO of Centex, Press Release

Challenging. Difficult. Rising Foreclosures. High inventory levels. Still a very difficult environment for the homebuilders.

The little bit of good news was the cancellation rate improved (after skyrocketing in the 2nd of 2008):

Pulte: The cancellation rate improved to 21% for the first quarter of 2009 compared with 47% for the fourth quarter of 2008 and 28% for the first quarter of 2008.

D.R. Horton: The Company’s cancellation rate (cancelled sales orders divided by gross sales orders) for the second quarter of fiscal 2009 was 30%.

These cancellation rates are still above normal (Note: "Normal" for Horton is in the 16% to 20% range, so 30% is still high.), but these are the lowest cancellation rates since early 2006.

Krugman's White House Dinner

by Calculated Risk on 5/05/2009 03:49:00 PM

From Newsweek: Prisoners of the White House (ht Jonathan)

On the night of April 27, for instance, the president invited to the White House some of his administration's sharpest critics on the economy, including New York Times columnist Paul Krugman and Columbia University economist Joseph Stiglitz. Over a roast-beef dinner, Obama listened and questioned while Krugman and Stiglitz, both Nobel Prize winners, pushed for more aggressive government intervention in the banking system.I haven't seen any comments from Stiglitz or on Krugman's blog - maybe the food wasn't very good.

Update: Krugman: Nothing to say "... the conversation was off the record."

More on Demolished Houses in Victorville

by Calculated Risk on 5/05/2009 02:36:00 PM

Last week a number of blogs posted a video from VisionVictory of new homes being demolished in Victorville, CA.

Here is the story from Peter Hong in the LA Times: Housing crunch becomes literal in Victorville

The Victorville demolition is one of the most dramatic ends to a bad bet made during the housing boom, but abandoned developments have become an all-too-common sight in California. Nearly 250 residential developments totaling 9,389 homes have been halted across the state, according to one research firm.And from the WSJ: No Sale: Bank Wrecks New Houses

The developer of the Victorville project had hoped to sell the houses for more than $300,000 as they were being built last year, Forrester said. But reality quickly diverged from that vision. ...

Officials of Guaranty Bank of Austin, Texas, which took over the development last year, were unavailable for comment. But Victorville city spokeswoman Yvonne Hester said the bank decided not to throw good money after bad.

"It just didn't pencil out for them," she said. "They'd have to spend a lot of money to turn around and sell the houses. They just made a financial decision to just demolish them."

A video of a backhoe knocking down homes in Victorville, Calif., was posted on YouTube by the founder of a Web site called Vision Victory.And more video at MarketWatch.

A Texas bank is about done demolishing 16 new and partially built houses acquired in Southern California through foreclosure, figuring it was better to knock them down than to try selling them in the depressed housing market.

Guaranty Bank of Austin is wrecking the structures to provide a "safe environment" for neighbors of the abandoned housing tract in Victorville, a high-desert city about 85 miles northeast of Los Angeles, a bank spokesman said.