by Calculated Risk on 5/05/2009 12:26:00 PM

Tuesday, May 05, 2009

Fact Checking Bernanke on Real Estate

Here are some comments by Fed Chairman Ben Bernanke on real estate:

Data: Existing home sales peaked in June 2005, new home sales in July 2005, and housing starts in January 2006. Prices peaked in July 2006 (Case-Shiller Composite 10 index) and residential investment has been a drag on GDP starting in Q1 2006. If anything, the housing market has been in decline for almost four years.

Click on graph for larger image in new window.

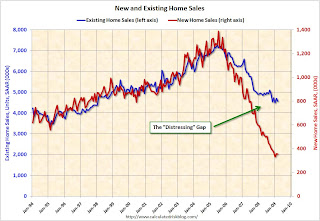

Click on graph for larger image in new window.This graph shows existing home sales (left axis) and new home sales (right axis) since January 1994 through March 2009.

If you look closely, you can see that Bernanke is correct that existing home sales have been "fairly stable since late last year" and "new homes have firmed a bit recently".

Note: I believe the recent gap between existing and new home sales was caused by distressed sales. With all of the REO and short sales, builders can't compete. This has pushed down new home sales, and kept existing home sales relatively high (compared to new home sales).

But I believe Bernanke is wrong about both new and existing home sales being at "depressed levels".

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.There is no question that new home sales are at depressed levels. This is the lowest level of new home sales activity since the Census Bureau started tracking the data in 1963. And this data is not adjusted for changes in population (or number of households), and that would make the current slump even worse.

But the story is different for existing home sales:

This graph shows existing home turnover as a percent of owner occupied units. Sales for 2009 are estimated at the March rate of 4.57 million units.

This graph shows existing home turnover as a percent of owner occupied units. Sales for 2009 are estimated at the March rate of 4.57 million units.I've also included inventory as a percent of owner occupied units (all year-end inventory, except 2009 is for March).

The turnover rate is just below the median of the last 40 years - and will probably fall further in coming years.

Existing home sales are not at "depressed levels", unless you exclude all the foreclosure resales.

I think foreclosure resales are much more significant than lower mortgage rates. According to the NAR, something like 40% to 45% of all existing home sales are distressed (Foreclosure resales or short sales). And according to DataQuick in California:

Of the existing homes sold last month [March], 57.4 percent were properties that had been foreclosed on. A year ago it was 35.5 percent.I'd argue that the primary reason existing home sales appear to have stabilized is because of foreclosure-related activity.

This is correct. New home inventory is declining and new home sales have been higher than new home "built for sale" starts since late 2007 (see Quarterly Housing Starts and New Home Sales). Progress is being made on reducing inventory, but the months of supply is still elevated (at 10.7 months in March).

"Poor" doesn't describe the level of distress, but Bernanke is correct. About a month ago I compiled a summary of articles and data for retail, offices, apartments and lodging: Vacancies, vacancies, vacancies ... and falling rents There has been more data since then, but it all shows vacancy rates are rising in all categories (occupancy rates falling for hotels), and rents (and room rates) are falling. Conditions in CRE are definitely grim.

My only disagreement with Dr. Bernanke is on the existing home market. I don't think current existing home sales are "depressed" and I believe sales will fall further in the future.

April ISM Non-Manufacturing Index Shows Slower Contraction

by Calculated Risk on 5/05/2009 12:06:00 PM

This was released earlier this morning ...

From the ISM: April 2009 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector contracted in April ...Still contracting, but at a slower rate.

"The NMI (Non-Manufacturing Index) registered 43.7 percent in April, 2.9 percentage points higher than the 40.8 percent registered in March, indicating contraction in the non-manufacturing sector for the seventh consecutive month, but at a slower rate. The Non-Manufacturing Business Activity Index increased 1.1 percentage points to 45.2 percent. The New Orders Index increased 8.2 percentage points to 47 percent, and the Employment Index increased 4.7 percentage points to 37 percent. The Prices Index increased 0.9 percentage point to 40 percent in April, indicating a slightly slower decrease in prices from March." [said Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee]

Bernanke on the Economic Outlook at 10 AM ET

by Calculated Risk on 5/05/2009 09:43:00 AM

Fed Chairman Ben Bernanke will testify before Congress on the economic outlook.

Prepared testimony below the video links ...

Here is the CNBC feed.

And a live feed from C-SPAN.

Prepared Testimony: The economic outlook. A few excerpts:

Recent Economic Developments

The U.S. economy has contracted sharply since last autumn, with real gross domestic product (GDP) having dropped at an annual rate of more than 6 percent in the fourth quarter of 2008 and the first quarter of this year. Among the enormous costs of the downturn is the loss of some 5 million payroll jobs over the past 15 months. The most recent information on the labor market--the number of new and continuing claims for unemployment insurance through late April--suggests that we are likely to see further sizable job losses and increased unemployment in coming months.

However, the recent data also suggest that the pace of contraction may be slowing, and they include some tentative signs that final demand, especially demand by households, may be stabilizing. Consumer spending, which dropped sharply in the second half of last year, grew in the first quarter. In coming months, households' spending power will be boosted by the fiscal stimulus program, and we have seen some improvement in consumer sentiment. Nonetheless, a number of factors are likely to continue to weigh on consumer spending, among them the weak labor market and the declines in equity and housing wealth that households have experienced over the past two years. In addition, credit conditions for consumers remain tight.

The housing market, which has been in decline for three years, has also shown some signs of bottoming. Sales of existing homes have been fairly stable since late last year, and sales of new homes have firmed a bit recently, though both remain at depressed levels. Although some of the boost to sales in the market for existing homes is likely coming from foreclosure-related transactions, the increased affordability of homes appears to be contributing more broadly to the steadying in the demand for housing. In particular, the average interest rate on conforming 30-year fixed-rate mortgages has dropped almost 1-3/4 percentage points since August, to about 4.8 percent. With sales of new homes up a bit and starts of single-family homes little changed from January through March, builders are seeing the backlog of unsold new homes decline--a precondition for any recovery in homebuilding.

In contrast to the somewhat better news in the household sector, the available indicators of business investment remain extremely weak. Spending for equipment and software fell at an annual rate of about 30 percent in both the fourth and first quarters, and the level of new orders remains below the level of shipments, suggesting further near-term softness in business equipment spending. Recent business surveys have been a bit more positive, but surveyed firms are still reporting net declines in new orders and restrained capital spending plans. Our recent survey of bank loan officers reported further weakening of demand for commercial and industrial loans.1 The survey also showed that the net fraction of banks that tightened their business lending policies stayed elevated, although it has come down in the past two surveys.

Conditions in the commercial real estate sector are poor. Vacancy rates for existing office, industrial, and retail properties have been rising, prices of these properties have been falling, and, consequently, the number of new projects in the pipeline has been shrinking.

...

The Economic Outlook

We continue to expect economic activity to bottom out, then to turn up later this year. Key elements of this forecast are our assessments that the housing market is beginning to stabilize and that the sharp inventory liquidation that has been in progress will slow over the next few quarters. Final demand should also be supported by fiscal and monetary stimulus. An important caveat is that our forecast assumes continuing gradual repair of the financial system; a relapse in financial conditions would be a significant drag on economic activity and could cause the incipient recovery to stall. I will provide a brief update on financial markets in a moment.

Even after a recovery gets under way, the rate of growth of real economic activity is likely to remain below its longer-run potential for a while, implying that the current slack in resource utilization will increase further. We expect that the recovery will only gradually gain momentum and that economic slack will diminish slowly. In particular, businesses are likely to be cautious about hiring, implying that the unemployment rate could remain high for a time, even after economic growth resumes.

In this environment, we anticipate that inflation will remain low.

More Losses at GMAC

by Calculated Risk on 5/05/2009 09:26:00 AM

From Bloomberg: GMAC Reports $675 Million Loss as Loan Defaults Rise

GMAC LLC, the auto and home lender that received a $6 billion government bailout, reported a first- quarter loss of $675 million on surging loan defaults ...GMAC is one of the 19 stress test banks.

New vehicle loans plunged 74 percent from a year earlier to $3.4 billion, an increase compared with the fourth quarter’s $2.7 billion, GMAC said. Auto loans more than 30 days past due rose to 3.1 percent in the first quarter from 2.4 percent in the same period a year earlier ...

Chrysler Bankruptcy: Take III

by Calculated Risk on 5/05/2009 02:02:00 AM

For those interested in the legal issues surrounding the Chrysler bankruptcy, here is another post from attorney Steven Jakubowski.

Chrysler Bankruptcy Analysis - Part III: Will The "Absolute Priority Rule" Kill The Sale?

... Chrysler's (and soon GM's) court battles afford us a rare opportunity to witness one of bankruptcy law's most fundamental questions being litigated in the highest stakes battles of all time, that being:Fascinating stuff. And the clock is ticking ...When does the "absolute priority rule" (see FRB-Cleveland's strict construction of the rule back in 1996 here and compare it to the US Government's position today), which establishes a hierarchy of recovery rights among creditor classes, take a back seat to the "fresh start," rehabilitative policy of chapter 11?Chrysler's opening memorandum touched upon this question by focusing on the US Supreme Court'd classic pronouncement in NLRB v. Bildisco & Bildisco, 465 U.S. 513, 528 (1984), where the Court stated that the "fundamental purpose of reorganization is to prevent the debtor from going into liquidation, with an attendant loss of jobs and possible misuse of economic resources." This principle, Chrysler argues, is paramount and (quoting NY's judicial patriarch, Bankruptcy Judge Lifland, in the old Eastern Airline case) "all other bankruptcy policies are subordinated" to it. (Mem. at 4).

Many, however, will surely disagree with Judge Lifland's statement from 20 years ago that all bankruptcy policies should be subordinated to the reorganization objectives of the Bankruptcy Code.

Monday, May 04, 2009

Merle Hazard Meets John Taylor

by Calculated Risk on 5/04/2009 11:19:00 PM

I've featured a few of Merle Hazard's videos like Merle Hazard Meets Arthur Laffer and Mark to Market.

Here Merle chats with Stanford economist John Taylor:

And that inspires Merle: Inflation or Deflation

WSJ: About 10 of 19 Banks will need Capital

by Calculated Risk on 5/04/2009 09:20:00 PM

From the WSJ: More Banks Will Need Capital

The U.S. is expected to direct about 10 of the 19 banks undergoing government stress tests to boost their capital ...Wells Fargo will probably suffer enormous losses from Wachovia's Option ARM portfolio (originally from Golden West) and from their own HELOC portfolio. The estimated losses will apparently be broken out into the 12 categories listed in the Fed's White Paper, and that should show substantial losses for Wells Fargo in these categories.

One big risk worrying industry officials is that the market will view banks on the list as insolvent when the official results are announced Thursday, even though Fed officials have repeatedly said that's not the case.

...

An initial stress test identified Wells Fargo as among the banks needing a bigger buffer ... It is unclear whether Wells would be forced to raise fresh capital or if regulators would accept the bank's argument that it can earn its way through the losses in future years. Wells expects more clarity Tuesday.

Citi, BofA, Wells ... the constant leaks are pretty amazing ...

Stock Market Update

by Calculated Risk on 5/04/2009 06:11:00 PM

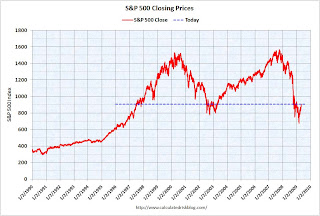

By popular demand ... Click on graph for larger image in new window.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

The S&P 500 is up 34% from the bottom, and still off 42% from the peak.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. The second graph shows the S&P 500 since 1990.

The second graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

This puts the recent rally into perspective.

ManhattanWest Photos

by Calculated Risk on 5/04/2009 04:23:00 PM

This isn't breaking news - just a couple of photos from reader Anthony of the ManhattanWest project in Las Vegas (photos taken yesterday). Click on graph for larger image in new window.

Click on graph for larger image in new window.

Photo Credit: Anthony.

Construction was halted on ManhattanWest in December.

From the Las Vegas Review-Journal in March: ManhattanWest latest casualty of crisis

ManhattanWest, a $350 million development that would include 700 condo units, restaurants, offices and shops on a 20-acre site near Las Vegas Beltway ... Gemstone topped off the nine-story Element House at ManhattanWest in August. The mid-rise residential buildings are about 80 percent finished.ManhattenWest isn't the only halted project in Las Vegas:

Last year, Mira Villa condos and Vantage Lofts stopped construction and went into bankruptcy. Sullivan Square had barely begun excavation before the project was canceled. Spanish View Towers was the first high-rise project to stop construction after partially building an underground parking garage.

The second photo shows the only activity at the site; a security guard relaxing in the sun.

The second photo shows the only activity at the site; a security guard relaxing in the sun.There are halted condo projects in many cities - and this is inventory that will some day come on the market. Note: as a reminder, high rise condo inventory is not included in the new home sales report - so this is additional inventory that is sometimes overlooked.

Fed: Banks Tighten Lending Standards Further

by Calculated Risk on 5/04/2009 02:07:00 PM

From the Fed: The April 2009 Senior Loan Officer Opinion Survey

on Bank Lending Practices

In the April survey, the net percentages of respondents that reported having tightened their business lending policies over the previous three months, although continuing to be very elevated, edged down for the second consecutive survey. In contrast, somewhat larger net percentages of domestic banks than in the January survey reported having tightened credit standards on residential mortgages. The net percentage of domestic respondents that reported having tightened their lending policies on credit card loans remained about unchanged from the January survey, whereas the net percentage that reported having tightened their policies on other consumer loans fell. Respondents indicated that demand for loans from both businesses and households continued to weaken for nearly all types of loans over the survey period, an exception being demand for prime mortgages, a category of loans that registered an increase in demand for the first time since the survey began to track prime mortgages separately in April 2007.Charts here for CRE, residential mortgage, consumer loans and C&I.

In response to the special questions on the outlook for loan quality, a significant majority of banks reported that credit quality for all types of loans is likely to deteriorate over the year if the economy progresses according to consensus forecasts.