by Calculated Risk on 5/04/2009 06:11:00 PM

Monday, May 04, 2009

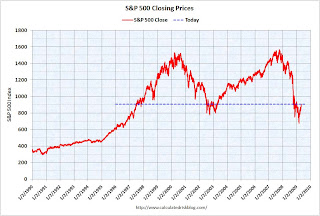

Stock Market Update

By popular demand ... Click on graph for larger image in new window.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

The S&P 500 is up 34% from the bottom, and still off 42% from the peak.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. The second graph shows the S&P 500 since 1990.

The second graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

This puts the recent rally into perspective.

ManhattanWest Photos

by Calculated Risk on 5/04/2009 04:23:00 PM

This isn't breaking news - just a couple of photos from reader Anthony of the ManhattanWest project in Las Vegas (photos taken yesterday). Click on graph for larger image in new window.

Click on graph for larger image in new window.

Photo Credit: Anthony.

Construction was halted on ManhattanWest in December.

From the Las Vegas Review-Journal in March: ManhattanWest latest casualty of crisis

ManhattanWest, a $350 million development that would include 700 condo units, restaurants, offices and shops on a 20-acre site near Las Vegas Beltway ... Gemstone topped off the nine-story Element House at ManhattanWest in August. The mid-rise residential buildings are about 80 percent finished.ManhattenWest isn't the only halted project in Las Vegas:

Last year, Mira Villa condos and Vantage Lofts stopped construction and went into bankruptcy. Sullivan Square had barely begun excavation before the project was canceled. Spanish View Towers was the first high-rise project to stop construction after partially building an underground parking garage.

The second photo shows the only activity at the site; a security guard relaxing in the sun.

The second photo shows the only activity at the site; a security guard relaxing in the sun.There are halted condo projects in many cities - and this is inventory that will some day come on the market. Note: as a reminder, high rise condo inventory is not included in the new home sales report - so this is additional inventory that is sometimes overlooked.

Fed: Banks Tighten Lending Standards Further

by Calculated Risk on 5/04/2009 02:07:00 PM

From the Fed: The April 2009 Senior Loan Officer Opinion Survey

on Bank Lending Practices

In the April survey, the net percentages of respondents that reported having tightened their business lending policies over the previous three months, although continuing to be very elevated, edged down for the second consecutive survey. In contrast, somewhat larger net percentages of domestic banks than in the January survey reported having tightened credit standards on residential mortgages. The net percentage of domestic respondents that reported having tightened their lending policies on credit card loans remained about unchanged from the January survey, whereas the net percentage that reported having tightened their policies on other consumer loans fell. Respondents indicated that demand for loans from both businesses and households continued to weaken for nearly all types of loans over the survey period, an exception being demand for prime mortgages, a category of loans that registered an increase in demand for the first time since the survey began to track prime mortgages separately in April 2007.Charts here for CRE, residential mortgage, consumer loans and C&I.

In response to the special questions on the outlook for loan quality, a significant majority of banks reported that credit quality for all types of loans is likely to deteriorate over the year if the economy progresses according to consensus forecasts.

Report: Wells Fargo Asked to Raise Capital

by Calculated Risk on 5/04/2009 12:55:00 PM

From CNBC: Wells Fargo Is Asked to Raise More Capital After Stress Test

Regulators have told Wells Fargo to shore up its finances after government "stress tests" showed the bank would have trouble surviving a deeper recession.The leaks continue ... Citi, BofA, and Wells need to raise capital ... more to come.

Kansas Fed President Hoenig: Let Troubled Banks Fail

by Calculated Risk on 5/04/2009 11:51:00 AM

Dr. Thomas Hoenig, President of Federal Reserve of Kansas City speaks today in New York at Demos: A Better Way To Restore The Banking System

Yesterday Hoenig wrote in the Financial Times: Troubled banks must be allowed a way to fail. Excerpts below the video.

Here is a live webcast of Hoenig's speech (starts at 12:30PM ET):

Excerpts from Hoenig's opinion piece:

... I believe there is an alternative method for addressing this crisis that deals more effectively with the issues we currently face while also considering the long-run consequences of those actions: the implementation of a systematic plan to resolve large, problem financial institutions.

... Boiled down to its simplest elements, the plan would require those firms seeking government assistance to make the taxpayer senior to all shareholders, with the government determining the circumstances for managers and directors. ...

Non-viable institutions would be allowed to fail and be placed into a negotiated conservatorship or a bridge institution, with the bad assets liquidated while the remainder of the firm is operated under new management and re-privatised as soon as is feasible. This plan is similar to what was done in Sweden in the 1990s and in the US with the failure of Continental Illinois in the 1980s.

This plan has many advantages, including that management and shareholders bear the costs for their actions before taxpayer funds are committed. This process also is equitable across all firms; is similar to what is currently done with smaller banks; and provides a definitive process that should reduce market uncertainty. These are important reasons to implement this kind of resolution process.

....

Certainly, the approach I suggest for resolving these large firms also is not without substantial cost, but it looks to both the short and long run.

A systematic approach would reduce the uncertainty that has paralysed financial markets; the cost is more measurable and therefre manageable; and there will be fewer adverse consequences compared to the path we are on now.

Because we still have far to go in this crisis, there remains time to define a clear process for resolving large institutional failure. Without one, the consequences will involve a series of short-term events and far more uncertainty for the global economy in the long run.

While I agree that central banks must sometimes take actions affecting the short run, they must keep the long run in focus or risk failing their mission.

Private Construction Spending Declines Slightly in March

by Calculated Risk on 5/04/2009 10:01:00 AM

Private residential construction spending is 61.8% below the peak of early 2006.

Private non-residential construction spending is 5.7% below the peak of last September. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending is still declining, and now nonresidential spending has peaked and will probably decline sharply over the next 18 months to two years. The second graph shows the year-over-year change for private residential and nonresidential construction spending.

The second graph shows the year-over-year change for private residential and nonresidential construction spending.

Nonresidential spending is essentially flat on a year-over-year basis, and will turn strongly negative going forward. Residential construction spending is still declining, although the YoY change will probably be less negative going forward.

As I've noted before, these will probably be two key stories for 2009: the collapse in private non-residential construction, and the probable bottom for residential construction spending. Both stories are just developing ...

From the Census Bureau: February 2009 Construction at $967.5 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $661.0 billion, 0.1 percent (±1.4%) below the revised February estimate of $661.6 billion. Residential construction was at a seasonally adjusted annual rate of $258.4 billion in March, 4.2 percent (±1.3%) below the revised February estimate of $269.6 billion. Nonresidential construction was at a seasonally adjusted annual rate of $402.6 billion in March, 2.7 percent (±1.4%) above the revised February estimate of $392.0 billion.

Pending Home Sales Up Slightly in March

by Calculated Risk on 5/04/2009 10:00:00 AM

From MarketWatch: U.S. March pending home sales index up 3.2%

The housing market improved in March, a trade group said Monday. The pending home sales index rose 3.2% compared with February and was up 1.1% compared with a year earlier, the National Association of Realtors reported.Note: Existing home sales are reported at the close of escrow, pending home sales are reported when contracts are signed. The Pending Home Sales index leads existing home sales by about 45 days, so the March pending report suggests existing home sales will increase slightly from April to May. (March is the most recent existing home sales report).

Financial Times: BofA plans to raise more than $10 Billion in Capital

by Calculated Risk on 5/04/2009 12:48:00 AM

From the Financial Times: BofA and Citi in last push on stress tests

Citigroup and Bank of America are working on plans to raise more than $10bn each in fresh capital ... Citi, BofA and at least two other lenders will on Monday attempt to convince the Treasury and the Federal Reserve that the findings of “stress tests” into their financial health were too pessimistic.This will be an interesting week.

... the government will present the final test results to 19 banks tomorrow with an announcement scheduled for Thursday ...

emphasis added

David Leonhardt reports the NY Times: Tests of Banks May Bring Hope More Than Fear

The results of the bank stress tests to be released by the Obama administration this week are expected to include more detailed information about individual banks — assessing specific parts of their loan portfolios ...It sounds like regulators will release loss projections by the 12 loan categories included in the Fed White Paper: The Supervisory Capital Assessment Program: Design and Implementation

Sunday, May 03, 2009

Krugman: Falling Wage Syndrome

by Calculated Risk on 5/03/2009 11:24:00 PM

Paul Krugman writes in the NY Times: Falling Wage Syndrome

Wages are falling all across America.It sure seems many analysts suffer from a bipolar disorder. A few months ago it was depression, now it is "green shoots". As Krugman notes, it appears the pace of deterioration has slowed, and perhaps the economy will bottom sometime this year - but that is different from new growth. Stagnation is a real concern.

...

[A]ccording to the Bureau of Labor Statistics, the average cost of employing workers in the private sector rose only two-tenths of a percent in the first quarter of this year — the lowest increase on record. Since the job market is still getting worse, it wouldn’t be at all surprising if overall wages started falling later this year.

...

Suppose that workers at the XYZ Corporation accept a pay cut. That lets XYZ management cut prices, making its products more competitive. Sales rise, and more workers can keep their jobs. So you might think that wage cuts raise employment — which they do at the level of the individual employer.

But if everyone takes a pay cut, nobody gains a competitive advantage. So there’s no benefit to the economy from lower wages. Meanwhile, the fall in wages can worsen the economy’s problems on other fronts.

In particular, falling wages, and hence falling incomes, worsen the problem of excessive debt ...

There has been a lot of talk lately about green shoots and all that, and there are indeed indications that the economic plunge that began last fall may be leveling off. ... the risk that America will ... face years of deflation and stagnation — seems, if anything, to be rising.

WSJ: Banks Tighten Corporate Credit Lines

by Calculated Risk on 5/03/2009 08:26:00 PM

From the WSJ: Banks Get Tougher on Credit Line Conditions

Banks are shortening the terms on lines of credit ... They are charging significantly higher fees for the lines of credit, known as revolvers. And instead of promising an interest rate determined mainly by the company's credit rating, banks will now charge more if the cost of insuring the company's debt against default is higher.There are two key changes: the duration has been shortened, and the interest rate is based on the price of default insurance (as opposed to credit rating). Another snub of the ratings agencies!

...

About 72% of the revolving credit facilities obtained by investment-grade companies in the first quarter of 2009 had 364-day maturities, or tenors, and no companies received five-year lines ... In the same period a year ago, 30% of the facilities were for 364 days and 41% had five-year maturities.

Also on lending standards, the Fed's April Senior Loan Officer Survey on bank lending practices will probably be released this week.