by Calculated Risk on 4/30/2009 11:40:00 AM

Thursday, April 30, 2009

Chrysler Bankruptcy Announcement at Noon ET

From CNBC: Chrysler To File for Bankruptcy, Sources Tell CNBC

Chrysler will file for bankruptcy ... two administration officials said Thursday.Here is the CNBC feed.

...

A statement from President Barack Obama and members of his autos task force on Chrysler's situation and the auto industry is scheduled for 12 Noon EST.

...

The stance will likely set the tone for similar discussions with bondholders of General Motors which is now on the clock to restructure its operations by the end of May.

Restaurant Performance Index Increases Slightly

by Calculated Risk on 4/30/2009 11:06:00 AM

Note: Any reading below 100 shows contraction. So the improvement in the index to 97.7 means the business is still contracting, but contracting at a slower pace.

From the National Restaurant Association (NRA): Restaurant Industry Outlook Improved as the Restaurant Performance Index Rose for the Third Consecutive Month

The outlook for the restaurant industry improved in March, as the National Restaurant Association’s comprehensive index of restaurant activity rose for the third consecutive month. The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 97.7 in March, up 0.2 percent from February and 1.3 percent during the last three months.

“Although the RPI remained below 100 for the 17th consecutive month, which signals contraction, there are clear signs of improvement,” said Hudson Riehle, senior vice president of Research and Information Services for the Association. “Restaurant operators reported a positive six-month economic outlook for the first time in 18 months, and capital spending plans rose to a 9-month high.”

...

Restaurant operators also reported negative customer traffic levels for the 19th consecutive month in March.

...

Capital spending activity in the restaurant industry held relatively steady in recent months.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.Unfortunately the data for this index only goes back to 2002.

The index values above 100 indicate a period of expansion; index values below 100 indicate a period of contraction.

Based on this indicator, the restaurant industry has been contracting since November 2007.

Q1: Office, Mall and Lodging Investment

by Calculated Risk on 4/30/2009 09:27:00 AM

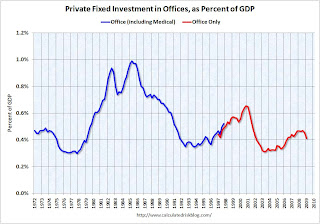

Here are some graphs of office, mall and lodging investment through Q1 2009 based on the underlying detail data released this morning by the BEA ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows investment in lodging (based on data from the BEA) as a percent of GDP. The recent boom in lodging investment has been stunning. Lodging investment peaked at 0.33% of GDP in Q3 2008 and is now declining sharply (0.28% in Q1 2009).

I expect lodging investment to continue to decline through at least 2010, to perhaps one-third of the peak.

Note: prior to 1997, the BEA included Lodging in a category with a few other buildings. This earlier data was normalized using 1997 data, and is an approximation. Investment in multimerchandise shopping structures (malls) peaked in Q4 2007 and is continuing to decline. As projects are completed, mall investment should fall much further.

Investment in multimerchandise shopping structures (malls) peaked in Q4 2007 and is continuing to decline. As projects are completed, mall investment should fall much further.

As David Simon, Chief Executive Officer or Simon Property Group, the largest U.S. shopping mall owner said earlier this year:

"The new development business is dead for a decade. Maybe it’s eight years. Maybe it’s not completely dead. Maybe I’m over-dramatizing it for effect."

The third graph shows office investment as a percent of GDP since 1972. Office investment peaked in Q3 2008, and with the office vacancy rate rising sharply, office investment will probably decline at least through 2010.

The third graph shows office investment as a percent of GDP since 1972. Office investment peaked in Q3 2008, and with the office vacancy rate rising sharply, office investment will probably decline at least through 2010.Note: In 1997, the Bureau of Economic Analysis changed the office category. In the earlier years, offices included medical offices. After '97, medical offices were not included (The BEA presented the data both ways in '97).

The non-residential structures investment bust is here and will continue for some time.

Unemployment Claims: Record Continued Claims

by Calculated Risk on 4/30/2009 08:45:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending April 25, the advance figure for seasonally adjusted initial claims was 631,000, a decrease of 14,000 from the previous week's revised figure of 645,000. The 4-week moving average was 637,250, a decrease of 10,750 from the previous week's revised average of 648,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending April 18 was 6,271,000, an increase of 133,000 from the preceding week's revised level of 6,138,000. The 4-week moving average was 6,076,000, an increase of 131,500 from the preceding week's revised average of 5,944,500.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 637,250, off 21,500 from the peak 3 weeks ago.

Continued claims are now at 6.27 million - the all time record.

Next week I'll add the chart that normalizes the data by covered employment.

This is another very weak report, however the decline in the four-week average of weekly claims suggests there is a reasonable chance that the peak in weekly claims has happened for this cycle.

Wednesday, April 29, 2009

Chrysler Deal Collapses, Bankruptcy all but Certain

by Calculated Risk on 4/29/2009 11:57:00 PM

From the NY Times: Chrysler Bankruptcy Looms as Deal on Debt Falters

Last-minute efforts by the Treasury Department to win over recalcitrant Chrysler debtholders failed Wednesday night, setting up a near-certain bankruptcy filing by the American automaker ... Chrysler was expected to seek Chapter 11 protection on Thursday ...It sounds like the Administration expects a short bankruptcy. It will be interesting to see if the debtholders do better than the $2.25 billion they were offered.

Milken Conference: Credit Markets and the Role of Finance

by Calculated Risk on 4/29/2009 10:39:00 PM

A couple of videos from the Milken conference. The first one includes Lewis Ranieri, who is generally given significant credit for creating the private MBS market, and has been warning about the MBS market for several years.

Ranieri makes a number of comments on housing starting at 11:50. I disagree with his assertion about prices being near the bottom - although it is probably true in some areas.

The second video is on the Credit Markets (ht Bob_in_MA). He suggests the discussion is interesting near the end when Milken draws parallels to the 1970s:

More Chrysler: Treasury Increases Offer to Debtholders

by Calculated Risk on 4/29/2009 07:15:00 PM

From the WSJ: Treasury Sweetens Offer to Lenders In Chrysler Bankruptcy Talks

The U.S. Treasury, in a last-ditch effort to avoid a bankruptcy filing by Chrysler LLC, has sweetened its most recent offer to lenders by $250 million ... Lenders, who had until 6 p.m. to vote on the offer ... were notified at 4:30 via conference call and were sent to a Web site to vote for the deal.Down to the last few hours ...

Such a deal can't be approved outside bankruptcy court without 100% consent from lenders....

One reason Chrysler may need to file for bankruptcy is so that Fiat can clear out hundreds of auto dealers from its sales network, which is easier to do in bankruptcy where dealer franchisee agreements can quickly be rejected or amended. The automaker also has asbestos and environmental liabilities which Fiat does not want and are more easily shed in bankruptcy court.

...

Plans were under way for President Barack Obama to deliver a speech about Chrysler on Thursday morning. People who have been briefed on the matter said two versions of the speech were being drafted ...

WaPo: Chrysler BK Would Install Fiat Management

by Calculated Risk on 4/29/2009 05:37:00 PM

From the WaPo: Sources: Chrysler Bankruptcy Plan Would Oust CEO, Install Fiat Management

Chrysler chief executive Robert Nardelli would be replaced by the management of Italian automaker Fiat under a bankruptcy plan that the United States is preparing for the storied automaker...The deadline is tomorrow.

If the bankruptcy proceeds as expected ... The ownership of the new company would be divided between the union's retiree health fund, which would get a 55 percent stake, Fiat, which would get at least a 35 percent stake, and the United States, which would take an 8 percent stake. The Canadian government would receive two percent.

Chrysler's creditors would get $2 billion in cash and no equity stake. The automaker's current owner Cerberus Capital Management would be wiped out.

Ranieri: Housing Is ‘Shouting Distance’ From Bottom

by Calculated Risk on 4/29/2009 03:55:00 PM

From Bloomberg: Lewis Ranieri Says Housing Is ‘Shouting Distance’ From Bottom

“I’m actually very enthusiastic about housing, and I haven’t said that in five years,’’ Ranieri said, speaking on a panel at the Milken Institute Global Conference in Beverly Hills, California. “We’re within shouting distance of a bottom.”The article says Ranieri was talking about prices, but that isn't clear from the quote. He might be talking about residential investment. Prices will fall further ...

And a look at the markets ...

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

See Doug's: "The Mega-Bear Quartet and L-Shaped Recoveries".

FOMC Statement: As Previous Announced, Will Buy $1.75 Trillion in MBS, Agency Debt and Treasuries

by Calculated Risk on 4/29/2009 02:15:00 PM

Information received since the Federal Open Market Committee met in March indicates that the economy has continued to contract, though the pace of contraction appears to be somewhat slower. Household spending has shown signs of stabilizing but remains constrained by ongoing job losses, lower housing wealth, and tight credit. Weak sales prospects and difficulties in obtaining credit have led businesses to cut back on inventories, fixed investment, and staffing. Although the economic outlook has improved modestly since the March meeting, partly reflecting some easing of financial market conditions, economic activity is likely to remain weak for a time. Nonetheless, the Committee continues to anticipate that policy actions to stabilize financial markets and institutions, fiscal and monetary stimulus, and market forces will contribute to a gradual resumption of sustainable economic growth in a context of price stability.

In light of increasing economic slack here and abroad, the Committee expects that inflation will remain subdued. Moreover, the Committee sees some risk that inflation could persist for a time below rates that best foster economic growth and price stability in the longer term.

In these circumstances, the Federal Reserve will employ all available tools to promote economic recovery and to preserve price stability. The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and anticipates that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period. As previously announced, to provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve will purchase a total of up to $1.25 trillion of agency mortgage-backed securities and up to $200 billion of agency debt by the end of the year. In addition, the Federal Reserve will buy up to $300 billion of Treasury securities by autumn. The Committee will continue to evaluate the timing and overall amounts of its purchases of securities in light of the evolving economic outlook and conditions in financial markets. The Federal Reserve is facilitating the extension of credit to households and businesses and supporting the functioning of financial markets through a range of liquidity programs. The Committee will continue to carefully monitor the size and composition of the Federal Reserve's balance sheet in light of financial and economic developments.