by Calculated Risk on 4/28/2009 06:45:00 PM

Tuesday, April 28, 2009

Jim the Realtor: Still Flippin'

This REO was bought for $163,000 in January, repaired, and then listed for $265,000. It went pending the first week.

Jim says this house was in similar condition as this REO disaster.

Tiered House Price Indices

by Calculated Risk on 4/28/2009 05:03:00 PM

On more Case-Shiller graph ...

The following graph is based on the Case-Shiller Tiered Price Indices for San Francisco. Case-Shiller has tiered pricing data for all 20 cities in the Composite 20 index. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This shows that prices increased faster for lower priced homes than higher priced homes. And prices have also fallen faster too.

It now appears mid-to-high priced homes are overpriced compared to lower priced homes - although prices will probably continue to fall for all three tiers. Because of foreclosure activity, I expect the lower priced areas to bottom (especially in real terms) before the higher priced areas.

For those interested, Case-Shiller also has condo price indices for five cities: Los Angeles, San Francisco, Chicago, Boston and New York.

Liberty Property Trust on Leasing and Cap Rates

by Calculated Risk on 4/28/2009 03:46:00 PM

Here are a few interesting comment from the Liberty Property Trust conference call (ht Brian). Note LRY is a REIT specializing in industrial and office properties.

Let me turn to our operating performance and real estate fundamentals. Normally the first quarter is our slowest quarter for the year. But in addition, we clearly felt the full impact of the economic downturn in our markets. We leased 2.8 million square feet in the quarter, down 50% from our leasing productivity in the fourth quarter. This decline is totally consistent with what we are seeing in the markets, a 40% decline in deal activity from 2008 levels. Occupancy declined to 90.1% driven by a decline in our renewal percentage to 54.1%. This renewal decline was driven by our industrial portfolio, since our office and flex renewal rates were 72 and 63% respectively. What happened were three large industrial expirations that simply shut down their operations. A pattern that I think we are going the see more of throughout the rest of 2009. Consistent with the competitive nature of the markets, rents were flat.New tenants are making sure their landlords will stay in business! And from the Q&A on cap rates:

...

We are seeing the manifestation of the [soft economy] as more tenants downsize at the end of their lease. On last quarters call we discussed a recent trend where tenants were asking for rent relief and for the most part we were saying no, but more recently we were seeing an additional trend where good tenants with strong credit come to us before the end of their lease looking for rate reduction in current rent in exchange for additional lease term. In these instances we conduct a thorough economic analysis considering the credit of the tenant, the length of the proposed term, the health of the market and the extent to which we do business or could do business with that customer in multiple markets to. To date we are only completed a few of these “blend and extend” transactions, but we believe in a tenant driven market tenants will continue to ask their landlord to participate. While our portfolio has higher occupancy than the market in most of our cities, aggressive competitive behavior is rapidly affecting rental rates and concessions. On new leases and to a lesser degree on renewal leases, market rents are generally lower, varying by product type availability of competitive space, size, credit and term. The range is wide from slightly up to down as much as 20%. Concessions on new leases primarily in the form of free rent have increased during the first quarter and also vary by market and by lease term. Some leases have none. Some leases a few months and some as much as one month per year to as much as six months in the lease…A new phenomenon that is beginning to have a positive impact on our ability to get deals done is the fact that tenants and brokers that represent them are now underwriting landlords [for credit quality].

Analyst: With $100 million of asset sales that you guys are looking to do, are you looking for a range of cap rates or what kind of timing you are looking at there?These are probably industrial buildings with higher cap rates than offices or retail, but cap rates have clearly risen significantly. Rents are falling, cap rates are rising - and that means prices are cliff diving.

LRY: We’re staying with our original guidance on the range which I believe was eight to 11% ...

Analyst: Maybe I missed it but for the 35 million that you sold in the quarter did you guys provide a cap rate on that.

LRY: It was about mid nines.

More Details on Making Home Affordable Second Lien Program

by Calculated Risk on 4/28/2009 01:21:00 PM

Press Release from the U.S. Treasury: Obama Administration Announces New Details on Making Home Affordable Program

Under the Second Lien Program, when a Home Affordable Modification is initiated on a first lien, servicers participating in the Second Lien Program will automatically reduce payments on the associated second lien according to a pre-set protocol. Alternatively, servicers will have the option to extinguish the second lien in return for a lump sum payment under a pre-set formula determined by Treasury, allowing servicers to target principal extinguishment to the borrowers where extinguishment is most appropriate.Here is the program update.

And a couple of examples of how the 2nd lien program would work.

Here are the basics (the interest rate reduction is for 5 years):

For amortizing loans (loans with monthly payments of interest and principal), we will share the cost of reducing the interest rate on the second mortgage to 1 percent. Participating servicers will be required to follow these steps to modify amortizing second liens:The interest only second lien structure is similar with the interest rate being reduced to 2%.Reduce the interest rate to 1 percent; Extend the term of the modified second mortgage to match the term of the modified first mortgage, by amortizing the unpaid principal balance of the second lien over a term that matches the term of the modified first mortgage; Forbear principal in the same proportion as any principal forbearance on the first lien, with the option of extinguishing principal under the Extinguishment Schedule; After five years, the interest rate on the second lien will step up to the then current interest rate on the modified first mortgage, subject to the Interest Rate Cap on the first lien, set equal to the Freddie Mac Survey Rate; The second mortgage will re-amortize over the remaining term at the higher interest rate(s); and Investors will receive an incentive payment from Treasury equal to half of the difference between (i) the interest rate on the first lien as modified and (ii) 1 percent, subject to a floor.

Although this is a serious reduction in the interest rate, this will probably attractive to 2nd lien investors - since the loss severity on second liens is so high. What happens in five years when the rates change for all these borrowers with negative equity?

Chrysler: Deal Reached with Creditors

by Calculated Risk on 4/28/2009 12:23:00 PM

From the NY Times: Deal Is Set on Chrysler Debt That May Avert Bankruptcy

The Treasury Department has worked out a preliminary agreement with Chrysler’s largest secured creditors ...The initial Treasury offer was $1.0 billion, and the banks countered at $4.5 billion and 40% equity in the new Chrysler. These is no mention of equity in the story.

Chrysler has about $6.9 billion in secured debt owned by big banks such as Citigroup and JPMorgan Chase and a group of hedge funds. Under the proposal, all of the debt would be canceled in exchange for $2 billion in cash...

Case-Shiller: City Data

by Calculated Risk on 4/28/2009 11:22:00 AM

The following graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. In Phoenix, house prices have declined more than 50% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are off about 11% to 12% from the peak. Prices have declined by double digits everywhere.

In Phoenix, house prices have declined more than 50% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are off about 11% to 12% from the peak. Prices have declined by double digits everywhere.

Prices fell by 1% or more in most Case-Shiller cities in February, with Phoenix off 5.0% for the month alone.

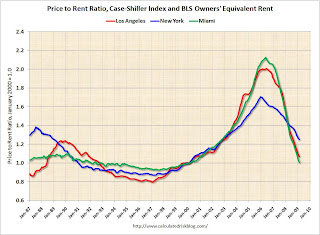

And here is the price-to-rent ratio for a few cities ... The second graph shows the price-to-rent ratio for Miami, Los Angeles and New York. This is similar to the national price-to-rent ratio, but uses local prices and local Owners' equivalent rent.

The second graph shows the price-to-rent ratio for Miami, Los Angeles and New York. This is similar to the national price-to-rent ratio, but uses local prices and local Owners' equivalent rent.

This ratio is getting close to normal for LA and Miami (Miami is back to the Jan 2000 ratio), but still has further to fall in NY.

Note: The Owners' Equivalent Rent (OER) is still increasing according to the BLS, however there are many reports of falling rents that isn't showing up yet in the OER.

House Prices: Compared to Stress Test Scenarios, and Seasonal Pattern

by Calculated Risk on 4/28/2009 10:14:00 AM

For more on house prices, please see: Case-Shiller: Prices Fall Sharply in February Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph compares the Case-Shiller Composite 10 index with the Stress Test scenarios from the Treasury (stress test data is estimated from quarterly forecasts).

The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

Case-Shiller Composite 10 Index, February: 154.70

Stress Test Baseline Scenario, February: 157.26

Stress Test More Adverse Scenario, February: 154.01

It has only been two months, but prices are tracking the More Adverse scenario so far.

But we have to remember the headline Case-Shiller is not seasonally adjusted, and there is a strong seasonal pattern. Update: there is a seasonally adjusted data set here. This graph shows the month to month change (annualized) for the Case-Shiller Composite 10 index.

This graph shows the month to month change (annualized) for the Case-Shiller Composite 10 index.

Prices usually decline at the fastest rate in the winter months (or increase the least with rising prices), and prices decline the slowest during the summer. Just something to remember when the month-to-month price declines slow this summer.

This is why we use the year-over-year (YoY) price change too (in previous post). The YoY change for the Composite 10 is -18.8%, the worst YoY change was last month (January 2009 at -19.4%). About the same.

I'll have some Case-Shiller city data soon.

Case-Shiller: House Prices Fall Sharply in February

by Calculated Risk on 4/28/2009 09:05:00 AM

S&P/Case-Shiller released their monthly Home Price Indices for February this morning. This includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). Note: This is not the quarterly national house price index. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.6% from the peak, and off 2.1% in February.

The Composite 20 index is off 30.7% from the peak, and off 2.2% in February.

Prices are still falling and will probably decline for some time. The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 18.8% over the last year.

The Composite 20 is off 18.6% over the last year.

This is near the worst year-over-year price declines for the Composite indices since the housing bubble burst started.

I'll have more on house prices including a comparison to the stress test scenarios soon.

Report: BofA, Citi Told May Need to Raise Capital

by Calculated Risk on 4/28/2009 12:48:00 AM

From the WSJ: Fed Pushes Citi, BofA to Increase Capital

Regulators have told Bank of America Corp. and Citigroup Inc. that the banks may need to raise more capital ...The article also notes that the results of the stress test could be released the week of May 4th - and not on May 4th as originally announced.

Executives at both banks are objecting to the preliminary findings ...

Industry analysts and investors predict that some regional banks, especially those with big portfolios of commercial real-estate loans, likely fared poorly on the stress tests. Analysts consider Regions Financial Corp., Fifth Third Bancorp and Wells Fargo & Co. to be among the leading contenders for more capital....

No one will believe the test results if Citi isn't required to raise more capital.

Monday, April 27, 2009

Robert Shiller at Seattle Pacific University

by Calculated Risk on 4/27/2009 08:49:00 PM

Professor Shiller spoke at Seattle Pacific University today. After the Q&A, reader Erik asked Shiller:

Q: Why does the FHFA (OFHEO) index show house price gains for the last two months, whereas the Case-Shiller is showing prices are still falling.I'll revisit this question soon, but I prefer the Case-Shiller index.

A (Erik's notes): He thought about it for a bit, and said "I haven't studied it yet", I think it is because the "OFHEO index doesn't capture foreclosures as much our index." They tend to use conventional mortgages more and conventional mortgages seem to hold out longer and as a result "there may be an upward bias to their numbers." He then paused and said, the OFHEO numbers are a bit fishy (he looked perplexed) to me because they seem to have broken the smooth trend (he gestured with his hand the trend and finished with an upward movement) and I can't quite figure out where they came from, but I suspect it is from them capturing too few foreclosures or us capturing too many (laughs) even OFHEO has said they don't know why or can't explain their own numbers from the last two months.

Tim at the Seattle Bubble Blog has more: Robert Shiller at SPU—Psychology and the Housing Market

One amusing part of the afternoon session was a story Dr. Shiller related about a localized Los Angeles housing bubble in 1885. In describing the mentality in 1885 Los Angeles, he said that people thought “Los Angeles is special!” He also quoted from an article in the LA Times which was published during the aftermath of the collapse in 1886:Also, the Case-Shiller house price index for February will be released tomorrow morning (Tuesday).We Californians have learned something. And that is that home prices can’t just go up forever—they have to be supported by something. Never again will Californians make this mistake....

For anyone interested in hearing the entire afternoon lecture, you can listen to it right here: