by Calculated Risk on 4/24/2009 02:00:00 PM

Friday, April 24, 2009

Federal Reserve Releases Stress Test White Paper

From the Fed: The Supervisory Capital Assessment Program: Design Summary (287 KB PDF)

Press Release:

A white paper describing the process and methodologies employed by the federal banking supervisory agencies in their forward-looking capital assessment of large U.S. bank holding companies was published on Friday.I'm reading it now.

The white paper is intended to assist analysts and other interested members of the public in understanding the results of the Supervisory Capital Assessment Program, expected to be released in early May. All U.S. bank holding companies with year-end 2008 assets exceeding $100 billion were required to participate in the assessment, which began February 25. These institutions collectively hold two-thirds of the assets and more than half the loans in the U.S. banking system.

More than 150 examiners, supervisors and economists from the Federal Reserve, Office of the Comptroller of the Currency, and Federal Deposit Insurance Corporation participated in this supervisory process. Starting from two economic scenarios--a consensus estimate of private-sector forecasters and an economic situation more severe than is generally anticipated--they developed a range of loss estimates and conducted an in-depth review of the banks’ lending portfolios, investment portfolios and trading-related exposures, and revenue opportunities. In doing so, they examined bank data and loss projections, compared loss projections across firms, and developed independent benchmarks against which to evaluate the banks’ estimates. From this analysis, supervisors determined the capital buffer needed to ensure that the firms would remain appropriately capitalized at the end of 2010 if the economy proves weaker than expected.

Geithner News Conference at 4:30 PM ET

by Calculated Risk on 4/24/2009 12:24:00 PM

UPDATE: CNBC is reporting that Treasury Stress Test white paper will be released at 2 PM ET.

The Treasury white paper on the stress tests will probably be released prior to Geithner's news conference.

From Eric Dash at the NY Times: Edgy Banks Start to Get Word Today on Stress Tests

After a two-month wait, the nation’s 19 largest banks will start learning on Friday how they fared in important federal examinations — and which among them will need another bailout from the government or private investors.Dash discusses several individual banks in the article. But what does "fate will be decided by regulators" mean? I thought preprivatization was off the table.

...

The Federal Reserve intends to disclose, in general terms, how it conducted the stress tests on Friday afternoon, but the government will not publicly reveal the results until May 4.

...

Analysts are already betting that the stress tests will show that banks need to raise significant amounts of new capital ... the 19 banks subject to stress tests are starting to divide into three groups: the strong that can weather the storm; the weak that will need new, perhaps significant, support; and the ones on the verge, whose fate will be decided by regulators.

Also from Bloomberg: Emanuel Says Stress Tests Will Reveal ‘Gradation’

... Rahm Emanuel said stress tests on the biggest 19 U.S. banks will reveal a “gradation,” with some being “very, very healthy” and others needing assistance.

...

Emanuel said that President Barack Obama has “100 percent” confidence in Federal Reserve Chairman Ben S. Bernanke.

Home Sales: The Distressing Gap

by Calculated Risk on 4/24/2009 11:07:00 AM

Real Time Economics at the WSJ excerpted some analyst comments about the existing home sales report yesterday: Economists React: ‘Plunge Is Over’ in Existing-Home Sales. A few comments from analysts:

"Home sales have stabilized following the post-Lehmans plunge..."As I've noted before, I believe this "stabilization" discussion in existing home sales analysis is all wrong.

"This is a bit disappointing but the big picture is still clear; the plunge in sales following the Lehman blowup is over."

"The weaker-than-expected result does not change the broad trend in sales, however, which continues to point to a tenuous stabilization..."

"Although home resales were down in March, one can make a reasonable argument that resales are bottoming ..."

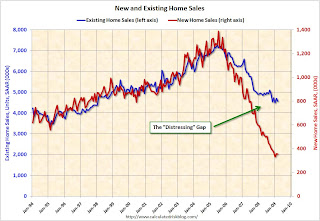

Close to half of existing home sales are distressed sales: REO sales (foreclosure resales) or short sales. This has created a gap between new and existing sales as shown in the following graph that I've jokingly labeled the "Distressing" gap.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales (left axis) and new home sales (right axis) through March.

I believe this gap was caused by distressed sales - in many areas home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.

Over time, as we slowly work through the distressed inventory of existing homes, I expect existing home sales to fall further. See Existing Home Sales: Turnover Rate

So I believe those analysts looking at the existing home sales report for stability are looking in the wrong place. The first "signs of stability" in the housing market will be declining inventory (see 3rd graph here), a bottom in new home sales (see previous post), and the gap between new and existing home sales closing.

New Home Sales: 356 Thousand SAAR in March

by Calculated Risk on 4/24/2009 10:00:00 AM

The Census Bureau reports New Home Sales in March were at a seasonally adjusted annual rate (SAAR) of 356 thousand. This is slightly below the upwardly revised rate of 358 thousand in February. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. This is the lowest sales for March since the Census Bureau started tracking sales in 1963. (NSA, 34 thousand new homes were sold in March 2009; the previous low was 36 thousand in March 1982).

As the graph indicates, sales in March 2009 are substantially worse than the previous years. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in March 2009 were at a seasonally adjusted annual rate of 356,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.And one more long term graph - this one for New Home Months of Supply.

This is 0.6 percent (±19.0%)* below the revised February rate of 358,000 and is 30.6 percent (±10.7%) below the March 2008 estimate of 513,000.

There were 10.7 months of supply in March - significantly below the all time record of 12.5 months of supply set in January.

There were 10.7 months of supply in March - significantly below the all time record of 12.5 months of supply set in January.The seasonally adjusted estimate of new houses for sale at the end of March was 311,000. This represents a supply of 10.7 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

Although sales were at a March record low, there are positives in this report - especially considering the upward revisions for previous months. It appears the months-of-supply has peak, and there is a reasonable chance that new home sales has bottomed for this cycle - however any recovery in sales will be modest because of the huge overhang of existing homes for sale. I'll have more soon.

Ford: "Turning the tide in North America"

by Calculated Risk on 4/24/2009 08:36:00 AM

From CNBC: Ford Loss Narrower than Expected

Ford Motors posted a smaller-than-expected first-quarter loss and said it was on track to at least break even in 2011 and did not expect to seek U.S. government loans ...Ford is probably being helped by the threat of bankruptcy at GM and Chrysler. At the same time Ford is increasing production, GM is considering shutting down factories for several weeks - so I wouldn't read too much into the Ford increase in production.

"We are really turning the tide in North America," Mulally said, adding that the industry may have hit bottom.

In response to that, Ford will increase production in the U.S. by 25 percent in the second quarter, he added.

Meanwhile, durable goods orders were down in March, the seventh decline in the past eight months.

Bloomberg Video about BofA CEO Ken Lewis and Merrill

by Calculated Risk on 4/24/2009 01:07:00 AM

A late night thread ...

Here is the letter from Cuomo to Congress today (2.0 MB PDF). And a Bloomberg discussion:

Thursday, April 23, 2009

NY Times Norris: "Subprime Loans, Corporate-Style"

by Calculated Risk on 4/23/2009 10:09:00 PM

From Floyd Norris at the NY Times: Subprime Loans, Corporate-Style, Will Fuel Defaults

It appears that defaults on leveraged loans and corporate bonds will soon rise to levels not seen since the Great Depression.Just another area with rapidly rising defaults. Norris also discusses toggle-PIKs (kind of like Option ARMs for corporations).

...

The default rate on leveraged loans and speculative grade bonds is rising rapidly. “We expect the default rate to get to the range of 14 percent by the end of the year,” said Kenneth Emery, a senior vice president of Moody’s. That compares to peak default rates of 10 to 12 percent during the last two recessions ...

How did we get into this mess? The story is remarkably similar to the tale of subprime mortgages.

Note: PIK stands for Payment-in-kind (i.e. pay interest with more debt). These were used in the '80s LBO craze with predictable results (high defaults). Toggle means the borrower has the choice of paying in cash or PIK.

There were negatively amortizing loans everywhere: Option ARMs for homeowners, toggle PIKs for corporations, and of course interest reserves for Construction & Development loans (always common, but are blowing up on lenders).

AmEx: Conference Call Comments

by Calculated Risk on 4/23/2009 07:10:00 PM

From Brian on AmEx Conference Call:

They expect to see writeoff rates climb from 8.5% to 10.5-11.0% in Q2 and up another 50 BP in Q3 and flattening out in Q4. Part of the driver of writeoff rates is their denominator is falling fairly quickly as charge volumes decline (denominator for CC cos will drop faster than for mortgages and other loan categories). They are assuming 9.7% unemployment in December 09.And some CC comments:

They are seeing some improvement in early stage DQ and roll rates. There is probably some seasonality involved, but they also think that there is some non seasonal improvement. 30DQ increase for last 4 Q’s (starting with Q2 08) are +10BP, +60BP, +80BP, +40BP – so it isn’t going down, it’s just another second derivative thing.

Analyst: American Express has more exposure as we all know in California and Florida and some of the housing states where you have higher income as well and I think credit maybe started to go bad in the fourth quarter of '07, maybe a little bit ahead of the competition because of your exposure in some of those states, and as you looked closely and I think tightened sooner than others did because of that, when you're looking at your roll rates improving and understanding there's seasonality and it's too early to get too constructive on that, but are you seeing signs of improvement in more so in states that went bad earlier because of the tightening? You know, where are you seeing that improvement?

AmEx: I would say that early in the cycle I think that housing was a significant driver of higher delinquencies and writeoff rates and we certainly did see that in states that had larger drops in housing. However, at this juncture, I really think that unemployment has taken over as the primary driver of delinquency and writeoff rates, so I think that's what we will need to see for a real turn. I think stabilization in the housing market will be important. I think consumer confidence will be critically important, people have to feel comfortable that we are going to retain their job and when those things start to happen, I think is when we will really start to see some notable improvements.

emphasis added

Wells Fargo and Auction Rate Securities

by Calculated Risk on 4/23/2009 06:31:00 PM

A friend called me up early last year and told me that she had just put a significant amount of money in Auction Rate Securities with Wells Fargo. She started to tell me what a great deal it was, and I interrupted her: "Hang up. Call Wells Fargo. Get out now." She called Wells Fargo immediately, and she couldn't sell - and she has been stuck in this "investment" ever since.

From the LA Times: Wells Fargo accused of securities fraud by state lawsuit

California today sued investment subsidiaries of Wells Fargo & Co. for securities fraud, alleging that the San Francisco financial services company misled investors by selling $1.5 billion worth of risky securities that it peddled as being as safe as cash.My friend was also told these securities were "as good as cash" and she could get her money back with eight days notice. It is especially irritating to see a Wells Fargo spokesperson say:

The securities "were sold to customers on the basis that they were like cash and people could get their money back in eight days," Atty. Gen. Jerry Brown said in an interview. "Now, it turns out they were not like cash and people can't get their money back even after many, many months, and they're mad as hell."

"We fully understand and deeply regret the effects this prolonged liquidity crisis has had on our clients," Charles W. Daggs, chief executive of Wells Fargo Investments, said in a statement.Yeah, hoocoodanode?

"Wells Fargo could not have predicted these extraordinary circumstances, and even with the benefit of hindsight is not responsible for them."

Federal Reserve Assets Continue to Increase

by Calculated Risk on 4/23/2009 04:40:00 PM

The Federal Reserve released the Factors Affecting Reserve Balances today. Total assets increased to $2.2 trillion.

The Term Asset-Backed Securities Loan Facility (TALF) is off to a slow start, with just under $6.4 billion in assets.

Click on graph for larger image in new window.

After spiking last year to $2.31 trillion the week of Dec 18th, the Federal Reserve assets then declined somewhat. Now the Federal Reserve is starting to expand their balance sheet again.

Three trillion here we come!

Note: the graph shows Total Factors Supplying Federal Reserve Funds and is an available series that is close to assets.

Most of the increase this week in factors supplying reserve funds came from the Fed buying MBS (increased by $75 billion). This is still pushing down mortgage rates: see Freddie Mac: Long-term rates Now Lower than Short-term

Freddie Mac (NYSE:FRE) today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 4.80 percent with an average 0.7 point for the week ending April 23, 2009, down from last week when it averaged 4.82 percent. Last year at this time, the 30-year FRM averaged 6.03 percent.