by Calculated Risk on 4/16/2009 04:08:00 PM

Thursday, April 16, 2009

TARP COP Elizabeth Warren on the Daily Show

Elizabeth Warren on the Daily Show talking about the TARP.

"That is the first time in probably six months to a year that I felt better. Something - I don't know what it is you just did right there - but for a second that was like financial chicken soup for me."For Canadians

Jon Stewart

Part 1:

Part 2:

Regulators Give BankUnited 20 Days to Deal or Die

by Calculated Risk on 4/16/2009 02:54:00 PM

From South Florida Business Journal: BankUnited given 20 days to strike deal (ht FFF)

In a prompt corrective action directive, posted on the Office of Thrift Supervision’s Web site Thursday and issued two days earlier, Florida’s largest bank was ordered to submit a binding merger or acquisition agreement to the OTS within 15 days ...Here is the corrective action: PROMPT CORRECTIVE ACTION DIRECTIVE

BankUnited’s $5.89 billion in option ARMs accounted for 51 percent of its loan portfolio on Dec. 31.

The bank ended 2008 with $13.95 billion in assets, 1,098 employees, $8.61 billion in deposits in 86 branches, and 11 percent of its loans noncurrent.

Just a tease for BFF (Bank Failure Friday).

DataQuick: California Bay Area Home Sales Increase

by Calculated Risk on 4/16/2009 02:04:00 PM

From DataQuick: Bay Area home sales continue climb, median still below $300K

The number of homes sold in the Bay Area rose for the seventh month in a row in March, the result of continued bargain hunting in the East Bay and other foreclosure-discounted communities. ...Once again, ignore the median price - it is distorted by the mix.

A total of 6,325 new and resale houses and condos closed escrow in the nine-county Bay Area last month. That was up 25.7 percent from 5,032 in February and up 29.1 percent from 4,898 in March 2008, according to MDA DataQuick of San Diego.

Last year's March was the slowest in DataQuick's statistics, which go back to 1988. Last month was the third-slowest March of all time, ahead of last year and 6,210 sales in March 1995. March sales have averaged 9,025 and peaked in March 2004 at 12,645 sales.

...

"For now, the extent to which prices have fallen in the upscale markets is more difficult to gauge," he added, "because many of those areas are essentially in hibernation, with scant sales."

...

The use of government-insured FHA loans - a common choice among first-time buyers - represented a record 25.4 percent of all Bay Area purchase loans in March, up from 1.5 percent a year ago.

...

Last month 51.2 percent of all Bay Area resale homes had been foreclosed on at some point in the prior 12 months, down from 52.0 percent in February and up from 23.2 percent a year ago. By county it ranged from 11.5 percent in San Francisco to 70.0 in Solano.

...

Foreclosure activity is nearing its 2008 peak ...

This is the same story as SoCal - the sales activity is mostly in foreclosure ravaged areas, and the high end areas are in "hibernation".

Hotel Occupancy: RevPAR Off 28.1 Percent

by Calculated Risk on 4/16/2009 01:05:00 PM

More bad news for CRE today. General Growth (2nd largest mall owner) filed bankruptcy this morning. And Cushman & Wakefield reported the downtown office vacancy rate increased sharply in Q1.

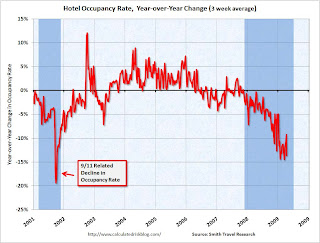

And for lodging, occupancy and RevPAR (Revenue per available room), are off sharply year-over-year.

From HotelNewsNow.com: STR reports U.S. data for week ending 11 April 2009

In year-over-year measurements, the industry’s occupancy fell 17.9 percent to end the week at 52.6 percent (64.1 percent in the comparable week in 2008). Average daily rate dropped 12.5 percent to finish the week at US$96.60 (US$110.36 in the comparable week in 2008). Revenue per available room for the week decreased 28.1 percent to finish at US$50.85 (US$70.76 in the comparable week in 2008).

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 13.7% from the same period in 2008.

The average daily rate is down 12.5%, so RevPAR is off 28.1% from the same week last year.

Report: Downtown Office Vacancy Rate Rises to 12.5%

by Calculated Risk on 4/16/2009 11:22:00 AM

Note: This report just covers downtown areas. The REIS report covers more area and shows the nationwide U.S. office vacancy rate at 15.2% in Q1.

From Bloomberg: U.S. Office Vacancies Rise to Three-Year High, Cushman Says

Office vacancies in U.S. downtowns increased to 12.5 percent in the first quarter, the highest in three years, as companies cut jobs and new buildings came onto the market, Cushman & Wakefield said.You think?

The national [downtown] office vacancy rate climbed from 11.2 percent in the fourth quarter and 9.9 percent a year earlier ...

“This will be a very difficult year for commercial real estate and for office markets in particular,” said Maria Sicola, executive managing director and head of Americas Research for Cushman & Wakefield ...

On falling rents:

Downtown office landlords cut their asking rents by an average of 2.2 percent in the first quarter ... “We are just entering into what will be a very strong market for the tenant. We can see rents come down 10 or 15 percent or even 20 percent before this is over.” [Sicola said]CRE is getting crushed.

Philly Fed: Manufacturing "contracted less severely" this Month

by Calculated Risk on 4/16/2009 10:05:00 AM

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

The region's manufacturing sector contracted less severely this month ... Indexes for general activity, new orders, and employment remained negative but improved somewhat from March. ... Most of the survey's broad indicators of future activity improved notably this month, suggesting that the region's manufacturing executives expect declines to bottom out over the next six months.

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, increased from -35.0 in March to -24.4 this month. Although clearly indicating continued overall decline, this reading is the highest since January. The index has been negative for 16 of the past 17 months, a span that corresponds to the current recession ...

Employment losses remained widespread this month, with over 45 percent of the firms reporting declines. The current employment index, though still negative at -44.9, increased seven points from its record low reading last month.

...

Broad indicators of future activity showed significant improvement this month. The future general activity index remained positive for the fourth consecutive month and increased markedly from 14.5 in March to 36.2, its highest reading in 18 months (Note:click here for Philly Fed chart of future activity index).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

"The index has been negative for 16 of the past 17 months, a period that corresponds to the current recession ."

Unemployment Insurance: Continued Claims above 6 Million

by Calculated Risk on 4/16/2009 08:47:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending April 11, the advance figure for seasonally adjusted initial claims was 610,000, a decrease of 53,000 from the previous week's revised figure of 663,000. The 4-week moving average was 651,000, a decrease of 8,500 from the previous week's revised average of 659,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending April 4 was 6,022,000, an increase of 172,000 from the preceding week's revised level of 5,850,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows weekly claims and continued claims since 1971. This is not adjusted for changes in population (I'll add that graph next week).

The four week moving average is at 651,000.

Continued claims are now at 6.02 million - the all time record.

The decline to 610,000 initial claims this week is potentially good news, but this is just one week of data, and this series is very volatile. As I mentioned in End of Recessions and Unemployment Claims, the four-week average of initial weekly unemployment claims is a closely watched indicator of the possible end of a recession. However, we need to see the four-week average decline by 20,000 to 40,000 or more from the peak before we get excited - and so far the four-week average is only off 8,500 from the peak of 659,500 last week.

Housing Starts: Near Record Low

by Calculated Risk on 4/16/2009 08:30:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 510 thousand (SAAR) in March, just above the revised record low of 488 thousand in January (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 358 thousand in March; just above the revised record low in January (356 thousand).

Permits for single-family units were 361 thousand in March, suggesting single-family starts will remain at about the same level in April.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Note that single-family completions of 550 thousand are still significantly higher than single-family starts (358 thousand). This is important because residential construction employment tends to follow completions, and completions will probably decline further.

Total starts and single family starts declined in March (compared to February), and are both just above the record low set in January. This is the second month in a row with starts slightly above the record low - this is just a slight increase in total starts and single family starts are essentially flat with the record low.

It is still too early to call the bottom in January, however I do expect housing starts to bottom sometime in 2009.

General Growth Properties Files Bankruptcy

by Calculated Risk on 4/16/2009 08:13:00 AM

From the WSJ: Mall Titan Enters Chapter 11

Mall owner General Growth Properties Inc. sought bankruptcy protection early Thursday in one of the largest real-estate failures in U.S. history ...The Mall is Flattened ...

The bankruptcy will have far-reaching implications for the mall industry, including putting pressure on already declining property values of U.S. malls ...

China GDP increases 6.1% from Q1 2008

by Calculated Risk on 4/16/2009 12:58:00 AM

From MarketWatch: China's economy expands 6.1% in first quarter

Gross domestic product expanded 6.1% in the first quarter from a year earlier, after expanding 6.8% in the fourth quarter, government data showed Thursday.China reports GDP growth on a year-over-year basis, so this is the growth from Q1 2008 (as opposed to quarterly growth annualized like in the U.S.). Since growth was fairly robust early last year, this suggest GDP is probably slightly positive in the most recent quarter.

...

The Chinese government said Thursday that recent economic data showed "positive changes with better performance than expected."

A spokesman for the National Bureau of Statistics in a statement Thursday cited improvement in agriculture and a steady increase in industrial production, despite falling profits.

However, the bureau also warned that problems remain, including a fall in demand for Chinese exports, reduced government revenue and increased difficulties on employment.

"The national economy is confronted with the pressure of slowdown," the spokesman said.