by Calculated Risk on 4/14/2009 12:19:00 PM

Tuesday, April 14, 2009

Goldman Sachs Raises $5 Billion

That was fast ...

From Bloomberg: Goldman Sachs Raises $5 Billion to Repay TARP Funds

Goldman Sachs Group Inc. ... raised $5 billion in the largest stock sale this year to help repay $10 billion in government rescue funds.Looks like TARP will have more money for AIG and Citi ...

The bank sold 40.65 million shares at $123 each ... The price was the same as when Goldman Sachs last sold shares in September.

...

While many analysts and investors applauded Goldman Sachs’s plan to repay the TARP money, others said it may pressure other banks to follow suit or risk appearing dependent on the government.

The government favors letting banks return money if they fare well on stress tests completed by the end of this month and can get private capital, according to people familiar with the matter.

Obama: Glimmers of Hope, but More Job Loss, More Foreclosures, More Pain

by Calculated Risk on 4/14/2009 10:35:00 AM

President Obama will speak at 11:30 AM ET.

Here is the CNBC feed.

Here are some excerpts from the WSJ:

... All of these actions – the Recovery Act, the bank capitalization program, the housing plan, the strengthening of the non-bank credit market, the auto plan, and our work at the G20 – have been necessary pieces of the recovery puzzle. They have been designed to increase aggregate demand, get credit flowing again to families and businesses, and help them ride out the storm. And taken together, these actions are starting to generate signs of economic progress. Because of our recovery plan, schools and police departments have cancelled planned layoffs. Clean energy companies and construction companies are re-hiring workers to build everything from energy efficient windows to new roads and highways. Our housing plan has helped lead to a spike in the number of homeowners who are taking advantage of historically-low mortgage rates by refinancing, which is like putting a $2,000 tax cut in your in pocket. Our program to support the market for auto loans and student loans has started to unfreeze this market and securitize more of this lending in the last few weeks. And small businesses are seeing a jump in loan activity for the first time in months.

This is all welcome and encouraging news, but it does not mean that hard times are over. 2009 will continue to be a difficult year for America’s economy. The severity of this recession will cause more job loss, more foreclosures, and more pain before it ends. ...

There is no doubt that times are still tough. By no means are we out of the woods just yet. But from where we stand, for the very first time, we are beginning to see glimmers of hope. And beyond that, way off in the distance, we can see a vision of an America’s future that is far different than our troubled economic past.

Retail Sales Decline in March

by Calculated Risk on 4/14/2009 08:30:00 AM

On a monthly basis, retail sales decreased 1.1% from February to March (seasonally adjusted), but sales are off 10.7% from March 2008 (retail and food services decreased 9.4%). Automobile and parts sales declined 2.3% in March (compared to February), but excluding autos, all other sales declined -0.9%.

The following graph shows the year-over-year change in nominal and real retail sales since 1993. Click on graph for larger image in new window.

Click on graph for larger image in new window.

To calculate the real change, the monthly PCE price index from the BEA was used (March PCE prices were estimated as the same increase from January to February).

Although the Census Bureau reported that nominal retail sales decreased 10.7% year-over-year (retail and food services decreased 9.4%), real retail sales declined by 11.6% (on a YoY basis).  The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

The second graph shows real retail sales (adjusted with PCE) since 1992. This is monthly retail sales, seasonally adjusted.

NOTE: The graph doesn't start at zero to better show the change.

This shows that retail sales fell off a cliff in late 2008, but have been somewhat stable the last four months.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for March, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $344.4 billion, a decrease of 1.1 percent (±0.5%) from the previous month and 9.4 percent (±0.7%) below March 2008. Total sales for the January through March 2009 period were down 8.8 percent (±0.5%) from the same period a year ago. The January 2009 to February 2009 percent change was revised from -0.1 percent (±0.5%)* to +0.3 percent (±0.3%).Seasonally adjusted Q1 retail sales are still about 1.5% below sales in Q4, but have been at about the same level since December.

Gasoline stations sales were down 34.0 percent (±1.5%) from March 2008 and motor vehicle and parts dealers sales were down 23.5 percent (±2.3%) from last year.

Although Q1 GDP will be very weak - because investment fell off a cliff and there was apparently a significant inventory correction - Q1 PCE will probably be close to neutral.

Monday, April 13, 2009

WSJ: General Growth Bondholders Seek Lawsuit

by Calculated Risk on 4/13/2009 10:51:00 PM

From the WSJ: General Growth Bondholders Ask Trustee to Sue (ht bearly)

A group of bondholders have ratcheted up the pressure on General Growth Properties Inc. by asking their trustee to sue the debt-laden mall owner for payment of their past-due bonds.Here is the story from Reuters: General Growth bondholders seek to sue company--WSJ

...

The bondholders' action pushes General Growth closer to a bankruptcy filing but doesn't mean that one is imminent.

End of Recessions and Unemployment Claims

by Calculated Risk on 4/13/2009 08:54:00 PM

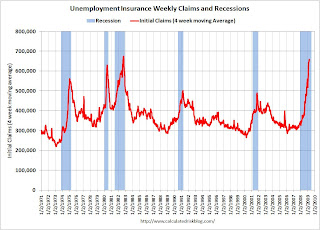

A number of forecasters have mentioned Unemployment Claims as an important indicator of the end of a recession. Professor Hamilton mentioned this last week: Initial unemployment claims and the end of recessions. Historically this is a useful indicator.

Back on March 28th, the WSJ quoted Robert J. Gordon, an economist at Northwestern University and a member of the National Bureau of Economic Research committee:

[Gordon] points to one indicator in particular with a remarkable track record: the number of Americans filing new claims for unemployment benefits. In past recessions, it has hit its peak about four weeks before the economy hit a trough and began to grow again. As of right now, the four-week average of new claims hit its peak of 650,000 in the week ended March 14. Based on the model, "if there's no further rise, we're looking at a trough coming in April or May," he said, which is far earlier than most forecasts currently anticipate.Since then, the four-week average has risen further (now at 657,250). So much for a trough in April ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the four-week average of initial unemployment claims and recessions.

Typically the four-week average peaks near the end of a recession.

Also important - in the last two recessions, initial unemployment claims peaked just before the end of the recession, but then stayed elevated for a long period following the recession - a "jobless recovery". There is a good chance this recovery will be very sluggish too, and we will see claims elevated for some time (although below the peak).

We need to see a significant decline in the four-week average before we start talking about the peak. In a note today, Goldman Sachs economist Seamus Smyth estimated a significant decline as:

Roughly speaking, a 20,000 decline in the 4-week moving average corresponds to a 50% probability that the peak has already been reached, and a 40,000 improvement to a 90% probability.So we need to see the four-week average decline by 20,000 to 40,000 or more. Don't hold your breathe ...

Mortgage Fraud in 2008: Part II

by Calculated Risk on 4/13/2009 06:29:00 PM

Here is the 2nd part of the VoiceofSanDiego article: A Staggering Swindle: How It Could Happen in 2008

In 2008, when the loans were made to McConville's buyers, some of the only companies still willing to buy these bundles of mortgages were Fannie Mae and Freddie Mac, even though the mortgage mess had affected them, too.Ask Wall Street what happens when they push back loans to the small lenders - they just close up shop.

At the tail end of McConville's deals, last September, the federal government took over Fannie and Freddie, assuming more direct control of the companies' day-to-day operation and pumped in funding to absorb their losses. Now the taxpayers own 79.9 percent of Fannie Mae and Freddie Mac.

"You and I are getting stuck with these inflated loans, via Fannie and Freddie," [Real estate appraiser Todd Lackner] said.

There is a way out, as long as the smaller lenders who made the loans to McConville's buyers still exist. On any loans Fannie and Freddie bought, if they discover fraud or faults in underwriting in the loans, they'll send them down the chain, requiring the investor that sold the loans to the giants to buy them back. Ultimately, the original lenders might face those buybacks, said Michael Lea, a former chief economist for Freddie Mac.

But the small lenders who made these mortgages might not be in business anymore -- like Nazari's All American Finance.

Here was Part I: Rented Identities, Extravagant Prices and Foreclosure: A Post-Boom Real Estate Scam

And a related article: Mafia-Esque Charges Brought Against Alleged Mortgage Fraud Ring

Goldman Sachs Reports $1.8 Billion Profit

by Calculated Risk on 4/13/2009 04:29:00 PM

From MarketWatch: Goldman Sachs swings to profit, plans $5 billion offering

Goldman Sachs Group Inc. said Monday it swung to a profit in the first-quarter, and announced it has commenced a public offering of $5 billion of its common stock. Goldman Sachs said net earnings for the period ended in March were $1.8 billion ... compared to a loss of $2.1 billion ... in the same period a year earlier.The $5 billion will be used to repay the TARP money Goldman received last year.

Oregon Unemployment Rate Ties Record High in 60+ Years

by Calculated Risk on 4/13/2009 04:09:00 PM

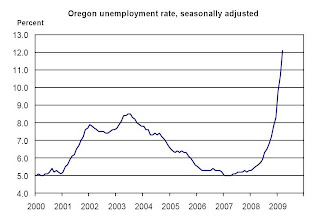

From Oregon.gov (ht Justin):  This graph is from Oregon’s Employment Situation: March 2009 and shows the Oregon unemployment rate since Jan 2000.

This graph is from Oregon’s Employment Situation: March 2009 and shows the Oregon unemployment rate since Jan 2000.

The unemployment rate is at the peak level of the 1982 recession - the highest since record keeping started in 1947. The unemployment rate is increasing rapidly, and the rate of increase appears to be accelerating.

Oregon’s seasonally adjusted unemployment rate rose to 12.1 percent in March from 10.7 percent (as revised) in February. The state’s unemployment rate has risen rapidly and substantially over the past nine months, from a rate of 5.9 percent in June 2008.

...

Manufacturing shed 2,100 jobs in March, during a time of year when a flat employment pattern is typical. Employment stood at 171,600 in March, which was by far the lowest employment level since comparable records began in 1990.

...

Construction losses steepened, dropping 1,700 jobs at a time of year when a gain of 700 was the expected normal seasonal movement. The rate of seasonally adjusted losses in construction has quickened, as the industry is down 12,600 jobs or 13.6 percent over the past six months.

Seasonally adjusted construction employment, at 80,000, is now below its level of approximately 83,000 jobs seen during much of 1997 through 2000. Despite a drop of more than 25,000 jobs since reaching its peak in 2007, construction is still slightly above its low point over the past dozen years—75,500, which was reached in June 2003.

...

Oregon’s seasonally adjusted unemployment rate rose to 12.1 percent from 10.7 percent in February. This tied Oregon’s unemployment rate in November 1982, the highpoint of the early 1980s recession. While historical records prior to 1976 are not exactly comparable, it appears clear that the 12.1 percent level is Oregon’s highest since 1947, when the Employment Department first started publishing unemployment rates.

Another Story of Falling Apartment Rents

by Calculated Risk on 4/13/2009 03:00:00 PM

From Bloomberg: Manhattan Apartment Rents Fall as Unemployment Rises

Manhattan apartment rents fell as much as 5.9 percent in March from a year earlier as rising unemployment damped demand, Citi-Habitats Inc. said.Some asking prices are falling even faster. From Amanda Fung at Crain's on New York: Big landlord takes hit on falling apt. rents

...

Rents for studios dropped 2.1 percent to an average of $1,812, while those for one-bedroom apartment fell 5.9 percent to $2,595. The cost of renting two-bedroom homes declined 2.2 percent to $3,631 and three-bedrooms fell 1.6 percent to an average of $4,670.

The average declines for March don’t reflect concessions offered by landlords, such as a free month’s rent, that lower the overall cost, [Gary Malin, president of Citi-Habitats] said.

“There is a greater degree of price decline than those numbers show,” he said.

Since February alone, Equity Residential has lowered its Manhattan asking rents by an average of 13%, said Michael Levy, an analyst at Macquarie. That reduction came on top of a 15% cut over the previous year.

Mortgage Fraud: RICO Charges Filed Against Straw Buyers

by Calculated Risk on 4/13/2009 01:49:00 PM

Here is another story from VoiceofSanDiego: Mafia-Esque Charges Brought Against Alleged Mortgage Fraud Ring

Federal prosecutors on Tuesday announced unprecedented charges against individuals involved in an alleged mortgage fraud ring involving 220 properties in San Diego County, with total purchase prices topping $100 million.This is a different case than the previous story, but notice that the straw buyers are facing charges too. "Lend" out your good credit, sign false documents - and face prosecution and jail time.

The 24 defendants were all charged with participating in a "corrupt enterprise" under a federal law created by the Racketeer Influenced and Corrupt Organizations (RICO) Act...

... defendants include several real estate professionals ... a public notary ... a licensed real estate agent ... a licensed real estate appraiser ... a CPA; and ... registered tax preparers.

...

Prosecutors also name several straw buyers as participants in the corrupt enterprise ...