by Calculated Risk on 4/13/2009 06:29:00 PM

Monday, April 13, 2009

Mortgage Fraud in 2008: Part II

Here is the 2nd part of the VoiceofSanDiego article: A Staggering Swindle: How It Could Happen in 2008

In 2008, when the loans were made to McConville's buyers, some of the only companies still willing to buy these bundles of mortgages were Fannie Mae and Freddie Mac, even though the mortgage mess had affected them, too.Ask Wall Street what happens when they push back loans to the small lenders - they just close up shop.

At the tail end of McConville's deals, last September, the federal government took over Fannie and Freddie, assuming more direct control of the companies' day-to-day operation and pumped in funding to absorb their losses. Now the taxpayers own 79.9 percent of Fannie Mae and Freddie Mac.

"You and I are getting stuck with these inflated loans, via Fannie and Freddie," [Real estate appraiser Todd Lackner] said.

There is a way out, as long as the smaller lenders who made the loans to McConville's buyers still exist. On any loans Fannie and Freddie bought, if they discover fraud or faults in underwriting in the loans, they'll send them down the chain, requiring the investor that sold the loans to the giants to buy them back. Ultimately, the original lenders might face those buybacks, said Michael Lea, a former chief economist for Freddie Mac.

But the small lenders who made these mortgages might not be in business anymore -- like Nazari's All American Finance.

Here was Part I: Rented Identities, Extravagant Prices and Foreclosure: A Post-Boom Real Estate Scam

And a related article: Mafia-Esque Charges Brought Against Alleged Mortgage Fraud Ring

Goldman Sachs Reports $1.8 Billion Profit

by Calculated Risk on 4/13/2009 04:29:00 PM

From MarketWatch: Goldman Sachs swings to profit, plans $5 billion offering

Goldman Sachs Group Inc. said Monday it swung to a profit in the first-quarter, and announced it has commenced a public offering of $5 billion of its common stock. Goldman Sachs said net earnings for the period ended in March were $1.8 billion ... compared to a loss of $2.1 billion ... in the same period a year earlier.The $5 billion will be used to repay the TARP money Goldman received last year.

Oregon Unemployment Rate Ties Record High in 60+ Years

by Calculated Risk on 4/13/2009 04:09:00 PM

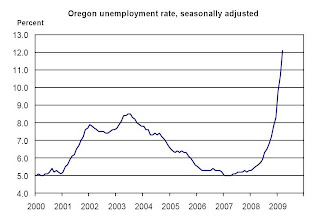

From Oregon.gov (ht Justin):  This graph is from Oregon’s Employment Situation: March 2009 and shows the Oregon unemployment rate since Jan 2000.

This graph is from Oregon’s Employment Situation: March 2009 and shows the Oregon unemployment rate since Jan 2000.

The unemployment rate is at the peak level of the 1982 recession - the highest since record keeping started in 1947. The unemployment rate is increasing rapidly, and the rate of increase appears to be accelerating.

Oregon’s seasonally adjusted unemployment rate rose to 12.1 percent in March from 10.7 percent (as revised) in February. The state’s unemployment rate has risen rapidly and substantially over the past nine months, from a rate of 5.9 percent in June 2008.

...

Manufacturing shed 2,100 jobs in March, during a time of year when a flat employment pattern is typical. Employment stood at 171,600 in March, which was by far the lowest employment level since comparable records began in 1990.

...

Construction losses steepened, dropping 1,700 jobs at a time of year when a gain of 700 was the expected normal seasonal movement. The rate of seasonally adjusted losses in construction has quickened, as the industry is down 12,600 jobs or 13.6 percent over the past six months.

Seasonally adjusted construction employment, at 80,000, is now below its level of approximately 83,000 jobs seen during much of 1997 through 2000. Despite a drop of more than 25,000 jobs since reaching its peak in 2007, construction is still slightly above its low point over the past dozen years—75,500, which was reached in June 2003.

...

Oregon’s seasonally adjusted unemployment rate rose to 12.1 percent from 10.7 percent in February. This tied Oregon’s unemployment rate in November 1982, the highpoint of the early 1980s recession. While historical records prior to 1976 are not exactly comparable, it appears clear that the 12.1 percent level is Oregon’s highest since 1947, when the Employment Department first started publishing unemployment rates.

Another Story of Falling Apartment Rents

by Calculated Risk on 4/13/2009 03:00:00 PM

From Bloomberg: Manhattan Apartment Rents Fall as Unemployment Rises

Manhattan apartment rents fell as much as 5.9 percent in March from a year earlier as rising unemployment damped demand, Citi-Habitats Inc. said.Some asking prices are falling even faster. From Amanda Fung at Crain's on New York: Big landlord takes hit on falling apt. rents

...

Rents for studios dropped 2.1 percent to an average of $1,812, while those for one-bedroom apartment fell 5.9 percent to $2,595. The cost of renting two-bedroom homes declined 2.2 percent to $3,631 and three-bedrooms fell 1.6 percent to an average of $4,670.

The average declines for March don’t reflect concessions offered by landlords, such as a free month’s rent, that lower the overall cost, [Gary Malin, president of Citi-Habitats] said.

“There is a greater degree of price decline than those numbers show,” he said.

Since February alone, Equity Residential has lowered its Manhattan asking rents by an average of 13%, said Michael Levy, an analyst at Macquarie. That reduction came on top of a 15% cut over the previous year.

Mortgage Fraud: RICO Charges Filed Against Straw Buyers

by Calculated Risk on 4/13/2009 01:49:00 PM

Here is another story from VoiceofSanDiego: Mafia-Esque Charges Brought Against Alleged Mortgage Fraud Ring

Federal prosecutors on Tuesday announced unprecedented charges against individuals involved in an alleged mortgage fraud ring involving 220 properties in San Diego County, with total purchase prices topping $100 million.This is a different case than the previous story, but notice that the straw buyers are facing charges too. "Lend" out your good credit, sign false documents - and face prosecution and jail time.

The 24 defendants were all charged with participating in a "corrupt enterprise" under a federal law created by the Racketeer Influenced and Corrupt Organizations (RICO) Act...

... defendants include several real estate professionals ... a public notary ... a licensed real estate agent ... a licensed real estate appraiser ... a CPA; and ... registered tax preparers.

...

Prosecutors also name several straw buyers as participants in the corrupt enterprise ...

Mortgage Fraud in 2008

by Calculated Risk on 4/13/2009 11:24:00 AM

Kelly Bennett and Will Carless at the VoiceofSanDiego investigate: Rented Identities, Extravagant Prices and Foreclosure: A Post-Boom Real Estate Scam

Over the course of several months last year, [James D. McConville] picked up at least 81 condo conversions from distressed developers and orchestrated their sale to more than 20 buyers who'd rented him their identities ...McConville bought distressed condos from developers in bulk, and then sold them to straw buyers (individuals with solid credit records who agreed to sign for the loans for a fee). McConville pocketed the difference between the straw buyer price and the bulk price - approximately $12.5 million.

By arranging purchase prices well above market value, McConville was able to pay off the developers and capture what the developers' records state as more than $12.5 million. Now, 74 of the 81 homes involved in the deals in Sommerset Villas and Sommerset Woods in Escondido and Westlake Ranch in San Marcos are in the first stage of foreclosure.

McConville promised to rent the properties, and pay the mortgages from the rental income.

The individuals had pristine credit, and one mortgage lender said:

"Everything was just absolutely perfect -- some of the cleanest loans we'd seen."Of course the relationship with McConville was apparently never disclosed.

This was happening in 2008. Lenders were supposed to be back to the three C's: creditworthiness, capacity, and collateral. These straw buyers - who apparently were willing to falsely sign that they were the actual buyers - satisfied the creditworthiness and capacity criteria. But this raises serious questions about the appraisals.

Also McConville timed the multiple applications perfectly so the lender wouldn't see the other loans apps when they performed a credit check - that is pretty amazing.

Part II will be out today tonight ...

Roubini and the Stress Test Scenarios

by Calculated Risk on 4/13/2009 09:08:00 AM

Professor Roubini writes: Stress Testing the Stress Test Scenarios: Actual Macro Data Are Already Worse than the More Adverse Scenario for 2009 in the Stress Tests. So the Stress Tests Fail the Basic Criterion of Reality Check Even Before They Are Concluded

[I]f you look at the actual data today macro data for Q1 on the three variables used in the stress tests – growth rate, unemployment rate, and home price depreciation – are already worse than those in FDIC baseline scenario for 2009 AND even worse than those for the more adverse stressed scenario for 2009. Thus, the stress test results are meaningless as actual data are already running worse than the worst case scenario.I've noted before that the baseline case is no longer useful, and that the more adverse case is the new baseline. Roubini is taking this a step further and saying the more adverse case is also meaningless. I think this is premature - although I agree with Roubini that there is no real stress test.

First, Roubini is working from the annual stress test forecasts. The following table shows the quarterly data being used by the banks.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This table shows the quarterly GDP growth rate (annualized), unemployment rate, and house prices being used for the stress test scenarios.

House prices are based on the Case-Shiller Composite 10 Index with Dec 2008 = 100.

For the unemployment rate, Roubini is correct. The unemployment rate was 8.1% in Q1 - above both the baseline (7.8%) and more adverse (7.9%) scenario rates.

[B]ased on current and likely trends the unemployment rate will be – at best over 10% by year end – and more likely closer to 11% by year end (and average 9.8% for the year) 2009 data are already worse than the adverse scenario and will for sure be worse than the adverse scenario. But more importantly by year end 2009 the actual unemployment rate – even with a growth recovery in H2 – will be higher at 10.5% - than the average unemployment rate assumed by the FDIC in the adverse scenario for 2010, not 2009!In a recent note, S&P mentioned their stress test "assumes that an economic recovery does not begin until at least late 2010" and that "the unemployment rate rises to the mid-teens". That is a real stress test!

From Bloomberg: Wall Street in Wells Fargo Moment as Euphoria Meets Stress Test

“The bottom line is if the unemployment rate peaks at 10 percent these banks can make it through,” [Paul Miller, an analyst at FBR Capital Markets] said. “But if it peaks closer to 12 percent, nobody makes it. Or very few people make it.”So far the baseline case is meaningless, and for unemployment, the economy is tracking worse than the more adverse scenario.

Roubini writes:

A similar analysis suggests that the FDIC assumptions for GDP growth and home prices are already worse than the adverse scenario – let alone the baseline scenario – for Q1 of 2009. A first estimate of Q1 2009 GDP growth will be out only at the end of April 2009 but the current consensus is that the figure will be around -5% for the SAAR figure in Q1. ... the current consensus forecast for 2009 GDP growth is – at 3.2% - practically identical to the adverse scenario GDP growth for 2009; and most reputable research institutions are forecasting for 2009 a figure that is actually worse than the consensus scenario. Also, while the current consensus forecast for 2010 growth (2.0%) is practically identical to the baseline scenario for 20010 GDP growth (2.1%) a number of more accurate than consensus source are predicting a much weaker scenario for 2010: for example Goldman Sachs has a current forecast of 1.2% for 2010 GDP growth as opposed to the baseline scenario figure of 2.0%. So, in all likelihood even the current consensus forecasts is close – or worse – than the more adverse scenario while the baseline scenario is already out of the window both for Q1 and the year overall.Once again, Roubini is working off the annual stress test forecasts. The above table shows that a 5% annualized decline in real GDP is the baseline case.

Earlier I compared the quarterly stress test forecasts with forecasts from Paul Kasriel at Northern Trust, and from Goldman Sachs (no link). See: Stress Test, Quarterly Forecasts for Unemployment and GDP

This graph compares the stress test forecasts for changes in real GDP with recent forecasts. Note: Kasriel has announced he is revising his Q1 GDP forecast upwards.

This graph compares the stress test forecasts for changes in real GDP with recent forecasts. Note: Kasriel has announced he is revising his Q1 GDP forecast upwards.An interesting note: the stress test scenario is using the advanced GDP release estimate for Q4 2008 of -3.8%, as opposed to the revised estimate of -6.2%.

These bearish private forecasts are tracking slightly better than the more adverse scenario.

Roubini:

[H]ome prices have been falling in recent months at a rate that is much higher than the 14% assumed in the FDIC baseline for 2009. They are also running currently at an annual rate that is higher than the 22% in the more adverse scenario of the FDIC; and even considering actual figures for the last few months – that show an accelerated rate of fall in homes prices between the spring of 2008 and the most recent data – home prices have been falling in the last few months at rates – average of y-o-y and m-o-m figures – of about 20% with an upward trend in the data. So the actual and trend figures are well above the baseline figure of 14% and closer to the 22% of more adverse scenario.As Roubini notes, we only have one month of data since the stress tests scenarios were released. The Case-Shiller index is released with almost a two month lag (January data was released near the end of March). Also, we have to be careful because there is a strong seasonal component to house prices.

This graph compares the Case-Shiller Composite 10 index with the Stress Test scenarios from the Treasury (stress test data is estimated from quarterly forecasts).

This graph compares the Case-Shiller Composite 10 index with the Stress Test scenarios from the Treasury (stress test data is estimated from quarterly forecasts).This is the first month and it is difficult to see the track on the graph. Here are the numbers:

Case-Shiller Composite 10 Index, January: 158.04

Stress Test Baseline Scenario, January: 159.69

Stress Test More Adverse Scenario, January: 158.07

It is only one month, but prices tracked the more adverse scenario in January.

Roubini concludes in bold:

Conclusion: Actual macro data for 2009 are already worse than the more adverse scenario in the stress tests. These are not stress tests but rather fudge testsI agree there is no real stress test, and the more adverse scenario is the real baseline. But I think it is premature to say that the more adverse scenario is meaningless.

Treasury Directs GM to Prepare for BK

by Calculated Risk on 4/13/2009 12:39:00 AM

From the NY Times: ‘Surgical’ Bankruptcy Possible for G.M.

The Treasury Department is directing General Motors to lay the groundwork for a bankruptcy filing by a June 1 deadline... The goal is to prepare for a fast “surgical” bankruptcy, the people who had been briefed on the plans said.For discussion:

...

One plan under consideration would create a new company that would buy the “good” assets of G.M. almost immediately after the carmaker files for bankruptcy.

...

Treasury officials are examining one potential outcome in which the “good G.M.” enters and exits bankruptcy protection in as little as two weeks ...

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

Sunday, April 12, 2009

Protest at the San Francisco Fed

by Calculated Risk on 4/12/2009 09:36:00 PM

A couple of photos from the "A New Way Forward" protest at the San Francisco Fed yesterday. Photo credit: Darin Greyerbiehl, 4/11/2009. More photos here.

|  |

Another House Price Round Trip to the 1990s

by Calculated Risk on 4/12/2009 06:55:00 PM

Zach Fox at the North County Times brings us another house "Deal of the Week": Sans stability in San Marcos

San Marcos is in north county San Diego.

Here is the price history for the featured 3 bedroom, 2 bath, 2 car garage home:

May 1992: $115,500

April 2003: $275,000

April 2006: $440,000

March 2009: $135,000 (REO)

The March 2009 price was a distressed sale, and is half off the 2003 price. Once again, I wonder what buyers (and lenders) were thinking in 2006?