by Calculated Risk on 4/03/2009 03:51:00 PM

Friday, April 03, 2009

Chrysler Pier Loans Still Haunting Banks

UPDATE: From the WSJ: Banks Balk at Obama Demand to Cut Chrysler Debt

Banks that loaned Chrysler LLC $6.8 billion are resisting government pressure to swap $5 billion of that for stock to slash the car maker's debt, according to several people familiar with the matter ...The banks still holding Chrysler pier loans are facing even more write-downs. (Pier loans are bridge loans that couldn't be sold and have been stuck on the bank's balance sheet). This was obvious before the Cerberus deal even closed: Chrysler's Bankers: Long Walk, Short Pier?

The lenders, which include J.P. Morgan Chase & Co., Goldman Sachs, Citigroup and Morgan Stanley ... own the rights to take control of Chrysler plants and assets, which were pledged as collateral for the loans, if the company files for bankruptcy protection.

...the Obama administration is demanding that these lenders cut their debt by $5 billion of its face value, or about 75%, said people familiar with the talks.

I'm sure Goldman is happy to have sold some of their loans at 80 cents on the dollar in early 2008.

OCC: More Seriously Delinquent Prime Loans than Subprime

by Calculated Risk on 4/03/2009 12:37:00 PM

From the Office of the Comptroller of the Currency and the Office of Thrift Supervision: OCC and OTS Release Mortgage Metrics Report for Fourth Quarter 2008

The Office of the Comptroller of the Currency and the Office of Thrift Supervision today jointly released their quarterly report on first lien mortgage performance for the fourth quarter of 2008. The report covers mortgages serviced by nine large banks and four thrifts, constituting approximately two-thirds of all outstanding mortgages in the United States.Much of the report focuses on modifications and recidivism (see Housing Wire). But this report also shows - for the first time - more seriously delinquent prime loans than subprime loans (by number, not percentage).

The report showed that credit quality continued to decline in the fourth quarter of 2008. At the end of the year, just under 90 percent of mortgages were performing, compared with 93 percent at the end of September 2008. This decline in credit quality was evident in all loan risk categories, with subprime mortgages showing the highest level of serious delinquencies. However, the biggest percentage jump was in prime mortgages, the lowest loan risk category and one that accounts for nearly two-thirds of all mortgages serviced by the reporting institutions. At the end of the fourth quarter, 2.4 percent of prime mortgages were seriously delinquent, more than double the 1.1 percent recorded at the end of March 2008.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Note: "Approximately 14 percent of loans in the data were not accompanied by credit scores and are classified as “other.” This group includes a mix of prime, Alt-A, and subprime. In large part, the loans were result of acquisitions of loan portfolios from third parties where borrower credit scores at the origination of the loans were not available."

This report covers about two-thirds of all mortgages. There are far more prime loans than subprime loans - and the percentage of delinquent prime loans is much lower than for subprime loans. However, there are now more prime loans than subprime loans seriously delinquent. And prime loans tend to be larger than subprime loans, so the losses from each prime loan will probably be higher.

We're all subprime now!

Bernanke on Fed's Balance Sheet

by Calculated Risk on 4/03/2009 12:08:00 PM

From Federal Reserve Chairman Ben Bernanke: The Federal Reserve's Balance Sheet. In this speech Bernanke discusses the recent Fed initiatives in terms of the impact on the balance sheet.

One key question is how all of this will be unwound. Here are some excerpts from Bernanke's speech:

In pursuing our strategy, which I have called "credit easing," we have also taken care to design our programs so that they can be unwound as markets and the economy revive. In particular, these activities must not constrain the exercise of monetary policy as needed to meet our congressional mandate to foster maximum sustainable employment and stable prices.Not that we have to worry about unwinding any time soon.

...

The large volume of reserve balances outstanding must be monitored carefully, as--if not carefully managed--they could complicate the Fed's task of raising short-term interest rates when the economy begins to recover or if inflation expectations were to begin to move higher. We have a number of tools we can use to reduce bank reserves or increase short-term interest rates when that becomes necessary. First, many of our lending programs extend credit primarily on a short-term basis and thus could be wound down relatively quickly. In addition, since the lending rates in these programs are typically set above the rates that prevail in normal market conditions, borrower demand for these facilities should wane as conditions improve. Second, the Federal Reserve can conduct reverse repurchase agreements against its long-term securities holdings to drain bank reserves or, if necessary, it could choose to sell some of its securities. Of course, for any given level of the federal funds rate, an unwinding of lending facilities or a sale of securities would constitute a de facto tightening of policy, and so would have to be carefully considered in that light by the FOMC. Third, some reserves can be soaked up by the Treasury's Supplementary Financing Program. Fourth, in October of last year, the Federal Reserve received long-sought authority to pay interest on the reserve balances of depository institutions. Raising the interest rate paid on reserves will encourage depository institutions to hold reserves with the Fed, rather than lending them into the federal funds market at a rate below the rate paid on reserves. Thus, the interest rate paid on reserves will tend to set a floor on the federal funds rate.

Report: Banks Considering Gaming PPIP

by Calculated Risk on 4/03/2009 10:42:00 AM

The Financial Times reports: Bailed-out banks eye toxic asset buys (ht Scot)

US banks that have received government aid, including Citigroup, Goldman Sachs, Morgan Stanley and JPMorgan Chase, are considering buying toxic assets to be sold by rivals under the Treasury’s $1,000bn (£680bn) plan to revive the financial system.This is just a report, and it would appear to be inappropriate for any bank receiving TARP funds to buy "legacy assets" using the PPIP. My suggestion is to explicitly ban this activity to help build confidence in the PPIP.

The plans proved controversial, with critics charging that the government’s public-private partnership - which provide generous loans to investors - are intended to help banks sell, rather than acquire, troubled securities and loans.

...

The government plan does not allow banks to buy their own assets, but there is no ban on the purchase of securities and loans sold by others.

“It’s an open programme designed to get markets going,” a Treasury official said. But he added: “It is between a bank and their supervisor whether they are healthy enough to acquire assets,” raising the possibility regulators may prevent weak banks from becoming buyers.

Employment: Comparing Recessions and Diffusion Index

by Calculated Risk on 4/03/2009 09:36:00 AM

Note: earlier Employment post: Employment Report: 663K Jobs Lost, 8.5% Unemployment Rate and Part Time for Economic Reasons Hits 9 Million Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

For the current recession, employment peaked in December 2007, and this recession was a slow starter (in terms of job losses and declines in GDP).

However job losses have really picked up in recent months (red line cliff diving on the graph), and the current recession is now the worst recession in percentage terms since the 1950s - although not in terms of the unemployment rate.

In the early post-war recessions (1948, 1953, 1958), there were huge swings in manufacturing employment and that lead to larger percentage losses. For the current recession, the job losses are more widespread.

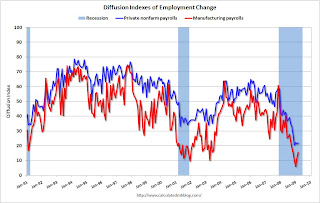

In March, job losses were large and widespread across the major industry sectorsHere is a look at how "widespread" the job losses are using the employment diffusion index from the BLS.

BLS, March Employment Report

The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct.

The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct.From the BLS handbook:

The diffusion indexes for private nonfarm payroll employment are based on estimates for 278 industries, while the manufacturing indexes are based on estimates for 84 industries. Each component series is assigned a value of 0, 50, or 100 percent, depending on whether its employment showed a decrease, no change, or an increase over a given period. The average (mean) value is then calculated, and this percent is the diffusion index number.So it is possible for the diffusion index to increase (like manufacturing increased from 11.4 to 15.7) not because industries are hiring, but because fewer industries are losing jobs.

Think of this as a measure of how widespread the job losses are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS.

Before September, the all industries employment diffusion index was close to 40, suggesting that job losses were limited to a few industries. However starting in September the diffusion index plummeted. In December, the index hit 20.5, suggesting job losses were very widespread. The index has only recovered slightly since then (22 in March).

The manufacturing diffusion index has fallen even further, from 40 in May 2008 to just 6 in January 2009. The manufacturing index recovered slightly to 15.7 in March.

Part Time for Economic Reasons Hits 9 Million

by Calculated Risk on 4/03/2009 09:11:00 AM

From the BLS report:

In March, the number of persons working part time for economic reasons (some-times referred to as involuntary part-time workers) climbed by 423,000 to 9.0 million.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Not only has the unemployment rate risen sharply to 8.5%, but the number of workers only able to find part time jobs (or have had their hours cut for economic reasons) is now at a record 9.0 million.

Of course the U.S. population is significantly larger today (about 305 million) than in the early '80s (about 228 million) when the number of part time workers almost reached 7 million. That is the equivalent of about 9.3 million today, so population adjusted this isn't quite a record - yet - but it is getting close.

And the rapid increase is stunning ...

Employment Report: 663K Jobs Lost, 8.5% Unemployment Rate

by Calculated Risk on 4/03/2009 08:30:00 AM

From the BLS:

Nonfarm payroll employment continued to decline sharply in March (-663,000), and the unemployment rate rose from 8.1 to 8.5 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Since the recession began in December 2007, 5.1 million jobs have been lost, with almost two-thirds (3.3 million) of the decrease occurring in the last 5 months. In March, job losses were large and widespread across the major industry sectors.

Click on graph for larger image.

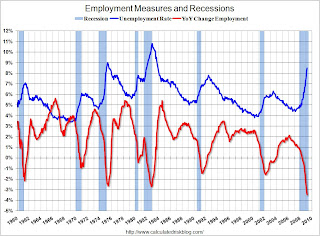

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 663,000 in March. January job losses were revised to

741,000. The economy has lost almost 3.3 million jobs over the last 5 months, and over 5 million jobs during the 15 consecutive months of job losses.

The unemployment rate rose to 8.5 percent; the highest level since 1983.

Year over year employment is strongly negative (there were 4.8 million fewer Americans employed in Mar 2009 than in Mar 2008). This is another extremely weak employment report ... more soon.

Thursday, April 02, 2009

Office Vacancy Rate Rises to 15.2% in Q1

by Calculated Risk on 4/02/2009 09:09:00 PM

From the WSJ: Companies Sold Office Space at a Fast Pace

Companies struggling to cut costs dumped a near-record 25 million square feet of office space in the first quarter, driving vacancy up and rents down, according to data to be released today by Reis Inc.

...

The office vacancy rate nationwide rose to 15.2% from 14.5% in the previous quarter, and likely will surpass 19.3% over the next year, according to Reis, a New York firm that tracks commercial property. That would put the vacancy rate above the level during the real-estate bust of the early 1990s, the worst on record.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the office vacancy rate starting 1991.

A little over one month ago, REIS was forecasting office vacancy rates would reach 17.6% in 2010. Now they are forecasting 19.3%!

Homeowner-Aid: When Interests Collide

by Calculated Risk on 4/02/2009 07:34:00 PM

From Ruth Simon and Michael Phillips at the WSJ: Homeowner-Aid Plan Caught in Second-Loan Spat

The Obama administration's $75 billion effort to help troubled homeowners avoid foreclosure has hit a stumbling block: a fight over how to aid borrowers who have more than one home loan.This refers to Part II of the Obama plan - under Part II the lender must bring the total monthly payments on mortgages to 38% of the borrowers gross income, and then the U.S. will match dollar for dollar from 38% down to 31% debt-to-income ratio for the borrower. But it was never clear what happens if the borrower had a 2nd mortgage. The only references in Part II to 2nd liens was in the Home Affordable Modification Program Housing Counselor Q&As:

...

One problem is that first and second mortgages are often owned by different parties and may be handled by different mortgage servicers, the companies that collect checks from the borrowers.

What if the borrower has a second mortgage and would like to apply for a Home Affordable Modification?That definitely isn't very clear, and most 2nd lien holders wouldn't want to take $1,000. As the WSJ notes:

Under the Home Affordable Modification program, junior lien holders will be required to subordinate to the modified loan. However, through the Home Affordable Modification an incentive payment of up to $1,000 is available to pay off junior lien holders. Servicers are eligible to receive an additional $500 incentive payment for efforts made to extinguish second liens on loans modified under this program.

Banks and other financial institutions own as much as 90% of the $1.08 trillion in home-equity loans and lines of credit in the marketplace ... Bank of America Corp., Wells Fargo & Co., J.P. Morgan Chase & Co. and Citigroup Inc. have the largest home-equity portfolios, SMR said.And here is one possibility being discussed:

...

"We are going to have to take a haircut on the second" lien, said one bank executive. "But we don't think we should get wiped out."

One proposal would require lenders to cap monthly payments on second loans at a set percentage of the borrower's gross income. The lender would be expected to "eat the vast majority" of the cost, with the government subsidizing a small portion ...Conflicting interests ... what a surprise.

More Stories of Falling Apartment Rents

by Calculated Risk on 4/02/2009 06:34:00 PM

From Amanda Fung at Crain's on New York: Big landlord takes hit on falling apt. rents (ht Jennifer)

Declining Manhattan rents are taking a toll on Equity Residential, a large real estate investment trust that owns 47 apartment buildings in the New York metropolitan area.And in San Diego from Zach Fox at the NC Times: HOUSING: Rents falling as vacancies rise at major complexes

...

Since February alone, Equity Residential has lowered its Manhattan asking rents by an average of 13%, said Michael Levy, an analyst at Macquarie. That reduction came on top of a 15% cut over the previous year.

A handful of big local apartment complexes have cut rents in an attempt to fill empty units ...

Tradition, an apartment complex near the Aviara Golf Course in Carlsbad, has cut its asking rent for a three-bedroom apartment from $2,015 to $1,799 per month, said Kris Nelson, business manager for the complex.

Tradition has seen its vacancy rate rise from a fairly consistent 3 percent to 8 percent recently, Nelson said.

...

In Temecula, Somerset Apartments has seen its vacancy rate shoot up from 3 percent to 20 percent. Managers responded by slashing rents by 25 percent for two bedroom, two bath apartments ---- from $1,200 to $900 per month.