by Calculated Risk on 2/27/2009 01:49:00 PM

Friday, February 27, 2009

GE Cuts Dividend

This is a big story because it shows how quickly the economy has changed. Just last November, GE once again promised not to cut the dividend through the end of 2009.

From MarketWatch: GE to cut dividend to 10 cents from 31 cents: WSJ

General Electric will cut its quarterly dividend to 10 cents from 31 cents, the Wall Street Journal reported on its Web site Friday.And from GE last November: An update on the GE dividend

On Sept. 25, GE stated that its Board of Directors had approved management’s plan to maintain GE’s quarterly dividend of $0.31 per share, totaling $1.24 per share annually, through the end of 2009. That plan is unchanged.This dividend cut was inevitable. But hoocoodanode? Apparently not GE management.

The Stress Test Schedule

by Calculated Risk on 2/27/2009 12:05:00 PM

It has been widely reported that the stress tests will be completed "no later than the end of April", based on this FAQ:

Q10: When will the process be completed?Just to let everyone know, I've heard the banks have been told to submit their stress test results by Wednesday March 11th. Too bad the results will not be made public.

A: The Federal supervisory agencies will conclude their work as soon as possible, but no later than the end of April.

UPDATE: Questions from a reader:

Just to repeat the first question: With all that is happening in Asia and Europe (especially the exposure to Eastern Europe and other emerging markets), what are the macro assumptions for these markets? I'm sure other readers have excellent questions too.The Fed published macroeconomic assumptions for the US. What about international markets? Should the banks assume mark-to-market accounting will stay or will be repealed? Should the banks still assume that in 2010 they will have to bring off-balance sheet exposures back on their books?

Restaurant Performance Index Rebounds Slightly

by Calculated Risk on 2/27/2009 10:57:00 AM

From the National Restaurant Association (NRA): Restaurant Industry Outlook Improved Somewhat in January as Restaurant Performance Index Rebounded From December’s Record Low

The outlook for the restaurant industry improved somewhat in January, as the National Restaurant Association’s comprehensive index of restaurant activity bounced back from December’s record low. The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 97.4 in January, up 1.0 percent from December’s record low level of 96.4.

“Despite the encouraging January gain, the RPI remained below 100 for the 15th consecutive month, which signifies contraction in the key industry indicators,” said Hudson Riehle, senior vice president of Research and Information Services for the Association. “Same-store sales and customer traffic remained negative in January, and only one out of four operators expect to have stronger sales in six months.”

...

Restaurant operators reported negative customer traffic levels for the 17th consecutive month in January.

...

Along with soft sales and traffic levels, capital spending activity remained dampened in recent months. Thirty-four percent of operators said they made a capital expenditure for equipment, expansion or remodeling during the last three months, matching the proportion who reported similarly last month and tied for the lowest level on record.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.Unfortunately the data for this index only goes back to 2002.

The index values above 100 indicate a period of expansion; index values below 100 indicate a period of contraction.

Based on this indicator, the restaurant industry has been contracting since November 2007. Also note the record low business investment by restaurant operators - this is happening in most industries, and is showing up as a significant decline in equipment and software investment in the GDP report (-28.8% annualized in the Q4 report!)

Citi Deal Details

by Calculated Risk on 2/27/2009 09:13:00 AM

From the NY Times: U.S. Agrees to Raise Its Stake in Citigroup

[T]he government will increase its stake in the company to 36 percent from 8 percent.From MarketWatch: Citi CEO says latest deal should end nationalization fear

...

Under the deal, Citibank said that it would offer to exchange common stock for up to $27.5 billion of its existing preferred securities and trust preferred securities at a conversion price of $3.25 a share, a 32 percent premium over Thursday’s closing price.

The government will match this exchange up to a maximum of $25 billion of its preferred stock at the same price. In its statement, the Treasury Department said the dollar-for-dollar match was intended to strengthen Citigroup’s capital base.

The government of Singapore Investment Corporation, Saudi Prince Walid bin Talal, Capital Research Global Investors and Capital World Investors have already agreed to participate in the exchange, Citibank said in a statement. Existing shareholders will own about 26 percent of the outstanding shares.

...

The bank will also suspend dividends on its preferred shares and its common stock.

"[F]or those people who have a concern about nationalization, this announcement should put those concerns to rest," Pandit said.Here is the Treasury statement: Treasury Announces Participation in Citigroup's Exchange Offering

GDP Revision: Q4 GDP Declined at 6.2%

by Calculated Risk on 2/27/2009 09:00:00 AM

From the WSJ: GDP Shrank 6.2% in 4th Quarter, Deeper Than First Thought

The U.S. recession deepened a lot more in late 2008 than first reported, according to government data showing a big revision down because businesses cut supplies to adjust for shriveling demand.I'll have more on investment, but this is more in line with expectations in Q4.

...

The sharply lower revision to a decline of 6.2% reflected adjustments downward of inventory investment, exports and consumer spending.

The report showed businesses inventories shrank $19.9 billion in the fourth quarter, instead of rising by $6.2 billion as Commerce originally estimated.

...

Fourth-quarter investment in structures decreased 5.9%. Equipment and software plunged 28.8%.

Report: Citi and U.S. Government Reach Agreement

by Calculated Risk on 2/27/2009 12:07:00 AM

From the WSJ: Citi, U.S. Reach Deal on Government Stake

... expected to be announced Friday morning ... the Treasury has agreed to convert some of its current holdings of preferred Citigroup shares into common stock ... The government will convert its stake only to the extent that Citigroup can persuade private investors such as sovereign wealth funds do so as well ... The Treasury will match private investors' conversions dollar-for-dollar up to $25 billion.MarketWatch has some details.

The size of the government's new stake will hinge on how many preferred shares private investors agree to convert into common stock. The Treasury's stake is expected to rise to up to 40% of Citigroup, the people said.

Thursday, February 26, 2009

Summary Post: New Home Sales at Record Low

by Calculated Risk on 2/26/2009 08:34:00 PM

Another summary post and open thread (for discussion).

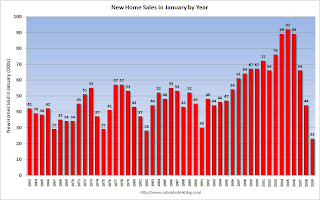

New home sales in January 2009 (309 thousand SAAR) were 10.2% lower than last month, and were 48% lower than January 2008 (597 million SAAR). See link for graphs of sales and inventory.

There was some discussion that the seasonal adjustment might be distorting the sales number. The following graph of the January sales numbers (no adjustment) shows this decline in sales wasn't a seasonal issue.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This shows the Census Bureau reported sales for every January since 1963. The label is the sales for the month (in thousands).

Clearly January 2009 was the worst ever - and this wasn't adjusted for changes in population either, and the U.S. population has grown substantially since 1963.

Initial unemployment claims hit 667,000 last week (highest since 1982) and continued claims were over 5 million for the first time ever. The numbers aren't quite as bad when adjusted by covered employment (see graphs)

Here was an analysis on the impact of falling rents: What If Rents Cliff Dive?

Fannie Mae reported a loss of $25.2 billion, the U.S. may backstop AIG CDS losses (likely to be announced Sunday or Monday morning), and oh yeah, we are still waiting for the Citi deal!

Scroll down for more ... and there will probably be more tonight. Best to all.

Obama Proposes to Cap Mortgage Interest Deduction for Higher Income Taxpayers

by Calculated Risk on 2/26/2009 07:19:00 PM

Jon Lansner at the O.C. Register has more including responses from the NAR and the NAHB: Obama plans mortgage-deduction cut (ht John and Tom)

From the WSJ: $318 Billion Tax Hit Proposed

The tax increases would ... [reduce] the value of such longstanding deductions as mortgage interest ... for people in the highest tax brackets. Households paying income taxes at the 33% and 35% rates can currently claim deductions at those rates. Under the Obama proposal, they could deduct only 28% of the value of those payments.The mortgage interest deduction is capped to $1 million in mortgage debt.

The changes would be phased in gradually over the next few years. For the 2009 tax year, the 33% tax bracket starts with couples with taxable earnings of $208,850, when adjusted for personal exemptions and various deductible expenses. A taxpayer in the top bracket paying $1,000 of mortgage interest, for example, would see a tax break worth $350 reduced to $280.

Fannie Mae: $25.2 Billion Loss

by Calculated Risk on 2/26/2009 06:11:00 PM

From Fannie Mae:

Fannie Mae reported a loss of $25.2 billion ... in the fourth quarter of 2008, compared with a third-quarter 2008 loss of $29.0 billion ...The confessional is very busy ...

On February 25, 2009, the Director of FHFA submitted a request for $15.2 billion from the U.S. Department of the Treasury on our behalf under the terms of the Senior Preferred Stock Purchase Agreement in order to eliminate our net worth deficit as of December 31, 2008. FHFA has requested that Treasury provide the funds on or prior to March 31, 2009.

...

We expect the market conditions that contributed to our net loss for each quarter of 2008 to continue and possibly worsen in 2009, which is likely to cause further reductions in our net worth.

S&P May Downgrade $140 Billion in Prime Jumbos

by Calculated Risk on 2/26/2009 05:58:00 PM

From Reuters: S&P may cut $140 bln of prime jumbo mortgage deals (ht Brian)

Standard & Poor's said on Thursday it may downgrade 3,279 prime tranches of jumbo residential mortgage-backed deals with a market value of around $140 billion, after increasing its loss expectations for deals issued in 2006 and 2007.More details from S&P (no link):

Standard & Poor's Ratings Services today placed its ratings on 3,279 classes from 209 U.S. first-lien prime jumbo residential mortgage-backed securities (RMBS) transactions issued in 2006 and 2007 on CreditWatch with negative implications. The affected classes totaled approximately $172.02 billion of original par amount, and have a current principal balance of $139.96 billion.Just more downgrades coming ...

...

The CreditWatch placements reflect an increase in projected losses for prime jumbo transactions from these vintage years ... Our revised loss projections reflect an increase in our loss severity assumption to 40% from 30% for prime jumbo transactions issued in 2006 and 2007. This change is based on our belief that the influence of continued foreclosures, distressed sales, an increase in carrying costs for properties in inventory, costs associated with foreclosures, and more declines in home sales will depress prices further and lead loss severities higher than we had previously assumed. Additionally, there has been a persistent rise in the level of delinquencies among the prime mortgage loans supporting these transactions. ...

We anticipate reviewing and resolving these CreditWatch actions over the next several weeks.