by Calculated Risk on 11/28/2008 12:09:00 AM

Friday, November 28, 2008

Hoocoodanode?

Earlier today, I saw Greg "Bush economist" Mankiw was a little touchy about a Krugman blog comment. My reaction was that Mankiw has some explaining to do. A key embarrassment for the economics profession in general, and Bush economists Greg Mankiw and Eddie Lazear in particular, is how they missed the biggest economic story of our times.

Sure, quite a few people got it right. But those that saw it coming were frequently marginalized. This was a typical response from the right (this is from a post by Professor Arnold Kling) in August 2006:

Apparently, the echo chamber of left-wing macro pundits has pronounced a recession to be imminent. For example, Nouriel Roubini writes,Sure Roubini was early (I thought so at the time), but show me someone who has been more right!Given the recent flow of dismal economic indicators, I now believe that the odds of a U.S. recession by year end have increased from 50% to 70%.For these pundits, the most dismal indicator is that we have a Republican Administration. They have been gloomy for six years now.

And this brings me to Krugman's column: Lest We Forget

... Why did so many observers dismiss the obvious signs of a housing bubble, even though the 1990s dot-com bubble was fresh in our memories?Krugman goes on to argue that the Obama Administration should not put off financial reform; "The time to start preventing the next crisis is now."

Why did so many people insist that our financial system was “resilient,” as Alan Greenspan put it, when in 1998 the collapse of a single hedge fund, Long-Term Capital Management, temporarily paralyzed credit markets around the world?

Why did almost everyone believe in the omnipotence of the Federal Reserve when its counterpart, the Bank of Japan, spent a decade trying and failing to jump-start a stalled economy?

One answer to these questions is that nobody likes a party pooper. ...

There’s also another reason the economic policy establishment failed to see the current crisis coming. The crises of the 1990s and the early years of this decade should have been seen as dire omens, as intimations of still worse troubles to come. But everyone was too busy celebrating our success in getting through those crises to notice.

I agree.

But in addition to looking forward, I think certain economists need to do some serious soul searching. Instead of leaving it to us to guess why their analysis was so flawed, I believe the time has come for Mankiw, Kling and many other economists to write a post titled "Why I was wrong".

Thursday, November 27, 2008

Japan's Economy: "the world stopped turning"

by Calculated Risk on 11/27/2008 09:45:00 PM

From Bloomberg: Japan’s Recession Deepens as Output Falls, Consumers Spend Less

Japan’s recession deepened last month as companies cut production, consumers spent less and fewer people looked for work.And also from Bloomberg: Panasonic Cuts Profit Forecast on Prices, Demand Drop

Factory output fell 3.1 percent from September .... Household spending slid 3.8 percent ...

Companies surveyed said they plan the sharpest production cuts in 35 years as exports decline in the wake of the worst financial crisis since the Great Depression.

...

“This is an unprecedented export recession,” said Richard Jerram, chief economist at Macquarie Securities Ltd. in Tokyo. “The world stopped turning for about a month and a half after the middle of September ...

Panasonic said prices for flat-panel TVs will probably drop 30 percent this fiscal year ... because of deteriorating demand for consumer electronics.Shutting down the Home ATM equals far fewer flat screen TVs. Hoocoodanode?

...

``Even such a successful company as Panasonic can't weather this harsh economic environment,'' said Naoki Fujiwara, who oversees about $720 million at Shinkin Asset Management Co. ``Plasma TVs, digital cameras, camcorders and DVD players: demand for these products has completely died down.''

Everything you wanted to know about China ...

by Calculated Risk on 11/27/2008 11:35:00 AM

Brad Setser writes: If you only read one thing on China this fall ...

Make sure it is the latest World Bank China Quarterly.Brad does highlight a few keys points, including this:

David Dollar, Louis Kuijs and their colleagues have outdone themselves – and in the process provided a clear assessment of the sources of China’s current slowdown and the risks that lie ahead. I won’t try to summarize the entire report. Read it. The whole thing. No summary can do it justice.

The last thing anyone needs to worry about is fall in Chinese demand for US treasuries.Something to think about while eating your turkey!

...

The World Bank forecasts that China’s current account surplus will RISE not fall in 2009, going from an estimated $385 billion to $425 billion. How is that possible if real imports are forecast to grow faster than real exports? Easy – the terms of trade moved in China’s favor. The price of the raw materials China imports will fall faster than the value of China’s exports. China’s oil and iron bill will fall dramatically.

Happy Thanksgiving!

by Calculated Risk on 11/27/2008 12:52:00 AM

Happy Thanksgiving to all! Note: Tanta is with her family celebrating Thanksgiving.

|

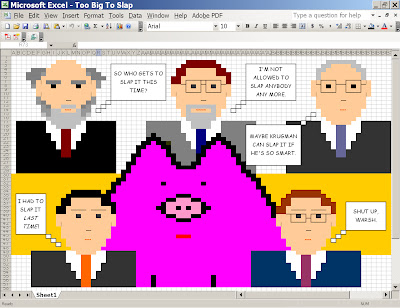

The Mortgage Pig™ is a Tanta creation. Here is her explanation of the origins of Excel Art and the Mortgage Pig™ (see here for Tanta's entire post including three Excel Art images):

|

| Click on the Mortgage Pig™ for a larger image in new window. |

I suppose this requires some explanation. Many years and versions of Excel ago, I was in some interminable conference call--I believe we were discussing general ledger interface mapping for HUD-1 line items regarding undisbursed escrow items on the FHA 203(k) in the servicing system upload, or perhaps we were watching paint dry--when I experienced one of those evolutionary breakthroughs for which the human race is justly famous. I stopped doodling on my legal pad and started defacing my spreadsheet. In a word, Excel Art was born.No wait! You can see for yourself ...

An entire running gag developed, centered on the character of Mortgage Pig and his Adventures. The Pig you see above is a newer version; the old Pig didn't wear lipstick (old pig was developed before we started selling loans to Wall Street). You can, of course, print these images, but outside of the context of viewing them in Excel, they simply become primitive, childlike doodles of no particular resonance. Viewing them as a spreadsheet, on the other hand, makes them profoundly amusing. Really. There's just nothing like sending someone a file named "GL Error Recon 071597" and having a pig pop up when the workbook is opened for a knee-slapping good time. If you're a hopeless Nerd with no particular aesthetic sensibilities.

Our own regular commenter bacon dreamz, who is also accomplished with Word Art, has (woe betide his employer) become adept at Excel Art as well, under my provocation, and has developed a way cool variation, Excel Movies. This involves creating a large number of worksheets with tediously copied and edited images that, when you ctrl-page down rapidly, create crude animation. It takes a very long series of conference calls to produce a really good Excel Movie, but it can be done. Unfortunately they're hard to display on a blog post. You'll have to take my word for it that they're hysterical.

Here is a Mortgage Pig™ exclusive: "Raindrops Keep Falling on My Pig" starring the Mortgage Pig™ by Tanta. This Excel Movie is from December 2007 - and remember to press ctrl-page down to animate the movie!

Raindrops Keep Falling on My Pig (Warning: this is a 2 MB Excel File).

And more Mortgage Pig™: Fed: Emergency Meeting Minutes, posted in Jan 2008:

|

For more Mortgage Pig Art see: Happy Valentine's Day and Mortgage Pig™ Fights Back

Happy Thanksgiving to all! CR

note: for those that don't know, my co-blogger Tanta is undergoing cancer treatment and has been unable to post.

Wednesday, November 26, 2008

UK: "Woolies" to Close after Christmas; 30,000 Jobs in Jeopardy

by Calculated Risk on 11/26/2008 10:40:00 PM

From The Times: Woolworths stores to close after Christmas

Woolworths went into administration last night, putting thousands of high street jobs at risk despite last-ditch government efforts to save it.Also on high street:

The retail chain, which opened its first British shop almost 100 years ago, has debts of £385 million. Its 800 outlets will open as usual today, but many are expected to shut for good after Christmas.

The decision to call in the administrators was taken despite the intervention of ministers anxious to save the jobs of almost 30,000 people who work for Woolworths.

MFI, the kitchens and furniture retailer, also called in administrators. The company has 100 stores and employs 1,000 people. Many other retailers are struggling to stay afloat, heavily discounting stock to entice consumers before Christmas. Price cuts of up to 40 per cent are widely available in many shops.

The Slowdown in China

by Calculated Risk on 11/26/2008 08:01:00 PM

More on the slowdown in China from Bloomberg: China Rate Cut Highlights Concern Over Slowdown, Unemployment

China’s biggest interest-rate cut in 11 years highlights government concerns that the country risks spiraling unemployment, social unrest and the deepest economic slowdown in almost two decades.China needs an annual GDP growth rate of something in the 6% to 8% range to provide jobs for all the people moving from the countryside to the cities. Anything less than 6% GDP growth will mean rising unemployment - and rising unrest. The rate cut yesterday was 108 basis points to 5.58% and follows the announcement of a $586 billion stimulus plan a few weeks ago.

...

“China’s trying to draw a line under unemployment and civil unrest,” said Glenn Maguire, chief Asia-Pacific economist at Societe Generale SA in Hong Kong.

...

Gross domestic product may grow 5.5 percent next year, the slowest since a 3.8 percent expansion in 1990 ...

But what happens to U.S. interest rates if China slows their investment in dollar denominated assets?

On Faltering Consumption

by Calculated Risk on 11/26/2008 06:24:00 PM

First, look at these three comments on consumer spending:

From the WSJ: Data Indicate Faltering Demand

Spending is declining in the consumer and capital sectors, as demand for expensive goods took its biggest spill in two years in October and consumption dropped at the sharpest rate in seven years.From Professor Roubini wrote:

Another batch of worse than awful news greeted today Americans getting ready for the Thanksgiving holiday: free falling consumption spending, collapsing new homes sales, falling consumer confidence, very high initial claims for unemployment benefits, collapsing orders for durable goods.And from Bloomberg: Consumer Spending in U.S. Falls 1%, Most in 7 Years

Spending by U.S. consumers dropped in October by the most since the 2001 contraction, signaling the economy is sinking into a deeper recession.emphasis added

...

The biggest consumer spending slump in three decades is likely to persist as home prices fall and job losses mount, threatening the holiday sales outlook ...

Sounds pretty bad, and the numbers from the BEA were definitely ugly - but the numbers were slightly better than I expected. The monthly data is pretty noisy and may be revised significantly, but the reported numbers showed a 3.9% annualized real decline in personal consumption expenditures (PCE) from July to October (the period that matters for GDP), and that was somewhat better than 4.5% to 5.0% decline I was expecting. This is just one month of 4th quarter data - and PCE could get revised or decline more in November and December - but this suggests the more dire predictions (worse than 5% annualized real GDP decline) for Q4 GDP might be excessive.

Hey, a 5% annualized decline in real GDP is bad enough!

Roubini: Policies will lead to "much higher real interest rates on public debt"

by Calculated Risk on 11/26/2008 03:52:00 PM

Another batch of worse than awful news greeted today Americans getting ready for the Thanksgiving holiday: free falling consumption spending, collapsing new homes sales, falling consumer confidence, very high initial claims for unemployment benefits, collapsing orders for durable goods. It is hard to get any worse than this but the next few months will serve even worse macro news. At this rate of contraction as revealed by the latest data it would not be surprising if fourth quarter GDP were to fall at an annualized rate of 5-6%.And Roubini concludes:

[T]he Fed, together with the Treasury, started to implement some of the “crazier” policy actions that we discussed last week: a) outright purchases of agency debt and MBS to the tune of a whopping $600 billion; b) another $200 billion of loans to backstop the consumer and small business credit markets (credit cards, auto loans, student loans, small business loans); c) an effective policy of aggressive quantitative easing as the balance sheet of the Fed – already grown from $800 billion to over $2 trillion – will be expanded further as most of the new bailout actions and new programs will be financed via injections of liquidity rather than issuance of public debt.To continue to attract massive inflows of capital, the U.S. might have to start paying higher interest rates on the public debt. This is one of the concerns that Volcker (previous post) expressed in early 2005.

Effectively the Fed Funds rate has been abandoned as a tool of monetary policy ... the Fed is now relying on massive quantitative easing and direct purchases of private sector short term and long term debts to try to aggressively push down short term and long term market rates.

...

Desperate times and desperate economic news require desperate policy actions ... The Treasury will be issuing in the next two years about $2 trillion of additional debt ... These policies – however partially necessary – will eventually leads to much higher real interest rates on the public debt and weaken the US dollar once this tsunami of implicit and explicit public liabilities and monetary debt driven by rising twin fiscal and current account deficits will hit a world where the global supply of savings is shrinking – as most countries moves to fiscal deficits thus reducing global savings – and foreign investors start to ponder the long term sustainability of the US domestic and external liabilities.

Video: Obama Appoints Volcker to Head New Economic Advisory Board

by Calculated Risk on 11/26/2008 02:51:00 PM

Obama appointed former Fed Chairman Paul Volcker to head a new economic advisory board. Way back in February 2005, Volcker gave a speech at the Stanford Institute for Economic Policy Research warning of the problems the economy is now facing. Here is a video of that speech and a few excerpts:

"Altogether, the circumstances seem as dangerous and intractable as I can remember."

"Boomers are spending like there is no tomorrow."

"Homeownership has become a vehicle for borrowing and leveraging as much as a source of financial security."

"I come now to the heart of the problem, as a Nation we are consuming and investing, that is spending, about 6% more than we are producing. What holds it all together? - High consumption - high leverage - government deficits - What holds it all together is a really massive and growing flow of capital from abroad. A flow of capital that today runs to more than $2 Billion per day."And it is this last point that is still concerning today. The U.S. will need to finance huge budget deficits over the next couple of years (due to a combination of the Bush structural budget deficit and a significant stimulus plan), and this will require more massive borrowing from abroad (or from investors at home).

Credit Crisis Indicators: Mostly Unchanged

by Calculated Risk on 11/26/2008 01:08:00 PM

The TED spread is stuck above 2.0, and still too high. The peak was 4.63 on Oct 10th. I'd like to see the spread move back down to 1.0 or lower. A normal spread is around 0.5.

The 10-Year Treasury Note yield is just below 3.0%. The rush to treasuries of all durations is still stunning!

The effective Fed Funds rate has risen slightly to 0.62% (target rate is 1.0%), so that is a small piece of positive news.

This is the spread between high and low quality 30 day nonfinancial commercial paper. If the credit crisis eases, I'd expect a significant decline in this spread - and the graph makes it clear this indicator is still in crisis.

The LIBOR, the TED spread, and the two-year swap have seen clear progress - but now appear mostly stuck with a long ways to go. For the A2P2 spread (and all treasury yields), the markets are still in crisis.

The exception is the mortgage market with rates falling sharply.