by Calculated Risk on 11/17/2008 03:38:00 PM

Monday, November 17, 2008

Forecast: 2009 Hotel Occupancy Rate to be Lowest Since 1971

From PricewaterhouseCoopers: PricewaterhouseCoopers Forecasts a Substantial Reduction in Hotel RevPAR in 2009

According to the PwC forecast, 2008 RevPAR will decrease by 0.8 percent, primarily due to a 3.7 percent decrease in occupancy, the highest annual decrease in occupancy since 2001. In 2009, demand is forecast to decrease by 2.0 percent, which, when coupled with a 1.6 percent increase in supply, is expected to further reduce occupancy to 58.6 percent, the lowest since 1971.Note: RevPAR is revenue per available room. The article also mentions ADR: average daily room rate.

...

"The deteriorating outlook for the economy is impacting travel habits and spending, and hotels are expected to experience reduced occupancy levels, and to a lesser degree, some room rate erosion through 2009," said Scott Berman, principal and U.S. Leader of PricewaterhouseCoopers' Hospitality and Leisure practice.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the annual occupancy rate for the last 50 years. The data is from PricewaterhouseCoopers LLP (1958 to 1986), and Smith Travel Research (1987 to 2007).

The PricewaterhouseCoopers forecast for 2008 and 2009 are in red. Note: The y-axis starts at 50% to better show the change.

Just more evidence of the coming slowdown in non-residential investment.

Report: Bush Administration will not seek remaining TARP Funds

by Calculated Risk on 11/17/2008 02:59:00 PM

From Bloomberg: Bush Administration Said to Not Seek Remaining Bailout Funds

The Bush administration will not seek the $350 billion remaining as part of the $700 billion financial-rescue package, leaving it to the [Obama] administration to request the funds ...

Walking Away from ... Boats

by Calculated Risk on 11/17/2008 11:56:00 AM

From the USAToday: In bad economy, boat owners abandon their vessels (hat tip FFIDC)

Boats have long been a barometer of consumer confidence, disposable income and the overall state of the economy. Now, marina and harbor officials are reporting a sudden increase in the past year in the number of deserted pleasure boats and working vessels.Talking about disposable income, I'm still waiting for my favorite restaurants to empty out a little ... although not too much because I want them to stay in business.

Credit Crisis Indicators: Unchanged

by Calculated Risk on 11/17/2008 10:20:00 AM

Another daily look at a few credit indicators ...

The London interbank offered rate, or Libor, that banks say they charge each other for such loans rose less than half a basis point to 2.24 percent today, British Bankers' Association data showed.The three-month LIBOR was 2.23% yesterday and the rate peaked at 4.81875% on Oct. 10. (unchanged)

With the effective Fed Funds rate at 0.35% (as of yesterday), this is probably somewhat in the right range. At some point, I'd like to see the effective Fed funds rate close to the target rate (currently 1.0%) and the 3 month yield within 25 bps of the target rate.

But for now, the Fed is engaged in quantitative easing.

The TED spread is above 2.0 again, and still too high. The peak was 4.63 on Oct 10th. I'd like to see the spread move back down to 1.0 or lower. A normal spread is around 0.5. From reader Kai using data back to 1986: "The average TED spread is 58bps, but the median TED spread is 42bps and the non-crisis (i.e. less than 100bps spread) median is 37.8bps."

The Federal Reserve assets increased $139 billion last week to $2.214 trillion.

Click on graph for larger image in new window.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

The Fed is buying higher quality commercial paper (CP) and this is pushing down the yield on this paper (0.50% yesterday!) - and increasing the spread between AA and A2/P2 CP. So this indicator has been a little misleading. Also the recession is creating concern for lower rated paper. Still, if the credit crisis eases, I'd expect a significant decline in this spread.

Another day with no improvement ... (except the A2/P2 spread).

Note: The Fed's balance sheet is interesting and I'll try to have more on how the Fed is funding their initiatives and quantitative easing. See Bernanke's paper from 2004: Conducting Monetary Policy at Very Low Short-Term Interest Rates One thing is clear - the target Fed funds rate is pretty much meaningless right now.

Citigroup: About 50,000 job cuts in "near-term"

by Calculated Risk on 11/17/2008 08:47:00 AM

From MarketWatch: Citi says it plans about 50,000 job cuts in the "near-term"

Citigroup said at the end of the September it employed 352,000 people, and that its near-term headcount target is about 300,000.This might include selling off some operations, but still ... Ouch!

Click on graph for larger image in new window.

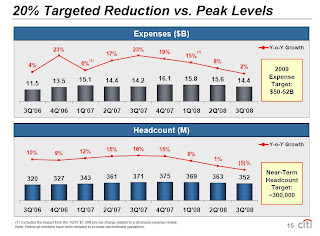

Click on graph for larger image in new window.Update: From the Citigroup Presentation this morning.

This shows expenses and headcount. Citi's goal is to reduce headount by about 20% from the peak, and substantially reduce expenses to about $12.5 to $13 billion per quarter.

Lowe's: "decline in sales trends" in November

by Calculated Risk on 11/17/2008 08:39:00 AM

"We expect continued, broad-based external pressures on our industry, as rising unemployment, falling home prices, tight credit and volatile equity markets continue to erode consumer confidence and impact sales," [Robert A. Niblock, Lowe's chairman and CEO said]. "While falling energy prices and initial signs of stabilization in housing turnover should aid the consumer, we saw a decline in sales trends in the last week of October that continued into November as the overall economic outlook deteriorated. In light of the difficult environment, we remain cautious in the near term and focused on providing great service to customers, increasing market share, controlling expenses, and appropriately managing capital expenditures to drive long-term returns for shareholders."

emphasis added

Spot the Bankruptcy Attorney

by Calculated Risk on 11/17/2008 12:43:00 AM

| Click on cartoon for larger image in new window. Another great cartoon from Eric G. Lewis, a freelance cartoonist living in Orange County, CA. |

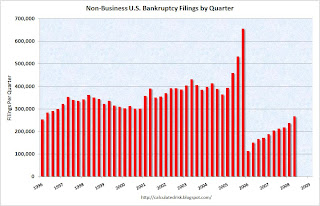

For anyone who missed it, on Saturday I posted the following graph of non-business bankruptcies by quarter (see NY Times: The Debt Trap)

This graph shows the non-business bankruptcy filings per quarter since the beginning of 1996 through Q2 2008 (Source: USCourts.gov).

This graph shows the non-business bankruptcy filings per quarter since the beginning of 1996 through Q2 2008 (Source: USCourts.gov).The spike in 2005 was because of people filing in advance of changes to the bankruptcy law.

According to the NY Times article "Downturn Drags More People Into Bankruptcy", filings were over 100 thousand in Oct 2008 and will probably be well over 300 thousand for Q4 2008 - so the graph is still trending up sharply.

Hence the smiling BK attorney ...

Sunday, November 16, 2008

Hotels: rapid deterioration "across the board"

by Calculated Risk on 11/16/2008 10:30:00 PM

From the WSJ: LaSalle Orders 20% Cut in Hotel Staffing

"At this time, we do not believe that we can provide a credible outlook for the remainder of the year as expected performance at our hotels continues to decline," [LaSalle Chief Financial Officer Hans Weger] said in statement ... noting the rapid deterioration was seen in more than just business cuts.The article also mentions the "AIG effect" of companies cancelling events because they "don't want to look like AIG".

"We've seen it across the board; it's across cities, consumers, groups and corporate."

However the more important story is the rapid deterioration in all hotel segments: "across cities, consumers, groups and corporate".

Europe, Japan Recessions Confirmed

by Calculated Risk on 11/16/2008 07:08:00 PM

From The Independent: It's official: eurozone collapses into its first recession

Europe's economy officially collapsed into recession for the first time since its inception during the third quarter ... The eurozone, made up of the 15 countries that use the euro as their primary currency, shrank by 0.2 percentage points between July and the end of September, having contracted by the same margin during the preceding three months as well. ...From Bloomberg: Japan's Economy Shrinks 0.4%, Confirming Recession

Germany and Italy, the continent's largest and fourth largest economies, dragged the eurozone down – both slipped into recession during the third quarter. Spain also suffered its first quarter of negative growth in 15 years. However, France just managed to maintain a positive growth rate.

Japan's economy, the world's second largest, contracted more than economists expected in the third quarter, confirming it entered its first recession since 2001 as companies cut back spending.The U.S. is already in a recession too, although the NBER still hasn't called the start date. From the NBER:

Gross domestic product fell an annualized 0.4 percent in the three months ended Sept. 30 ...

The committee places particular emphasis on two monthly measures of activity across the entire economy: (1) personal income less transfer payments, in real terms and (2) employment.It is close - and subject to revision - but based on these measures I think the NBER will decide the U.S. recession started in Dec '07 or Jan '08.

Iceland Closer to IMF Bailout

by Calculated Risk on 11/16/2008 04:12:00 PM

From the WSJ: Iceland Overcomes IMF Obstacle

Iceland has agreed that European regulations require it to guarantee accounts of hundreds of thousands of Britons and other foreigners frozen in the online arm of one of the nation's collapsed banks, the government said Sunday.The bailouts continue ...

Recognition of the legal principle ... is a significant step toward freeing up a $2.1 billion bailout package from the International Monetary Fund. ...

It isn't clear how the depositors would actually be paid. The European rules ... require Iceland to guarantee the first €20,000 ($26,000) of account holders' deposits. That sum could well run into the billions of euros, cash that Iceland's guarantee fund doesn't have.