by Calculated Risk on 11/14/2008 02:57:00 PM

Friday, November 14, 2008

Paulson: We have "humiliated ourselves as a nation"

From CNBC: Paulson: Worsening Crisis Forced Change in Strategy

"By the time the process with Congress was completed, it was clear that we were facing a much more severe situation than we had envisioned earlier on," Paulson said in a live interview. "We have this limited pool of resources—big, but limited, $700 billion—and how do we use that, and get the maximum impact, and it's by putting capital in (banks)."And from Reuters: US's Paulson-adding bank capital needed-CNBC

"We have in many ways humiliated ourselves as a nation with some of the problems that have taken place here," Paulson said in an interview with CNBC television.Speak for yourself Mr. Paulson.

Update: Looks like Kashkari had fun today (a 36 second video):

Credit Crisis Indicators: LIBOR Rises Again

by Calculated Risk on 11/14/2008 01:03:00 PM

Once again, as economic activity dives off a cliff, here is another daily look at a few credit indicators ...

The London interbank offered rate, or Libor, for three-month dollar loans edged above 2.23% from just below 2.15% Thursday, the British Bankers Association reported.The three-month LIBOR was 2.15% yesterday and the rate peaked at 4.81875% on Oct. 10. (slightly worse)

With the effective Fed Funds rate at 0.35% (as of yesterday), this is probably somewhat in the right range. At some point, I'd like to see the effective Fed funds rate close to the target rate (currently 1.0%) and the 3 month yield within 25 bps of the target rate.

The TED spread is back above 2.0 again, and still too high. The peak was 4.63 on Oct 10th. I'd like to see the spread move back down to 1.0 or lower. A normal spread is around 0.5. From reader Kai using data back to 1986: "The average TED spread is 58bps, but the median TED spread is 42bps and the non-crisis (i.e. less than 100bps spread) median is 37.8bps."

Here is a list of SFP sales. It has been a few days without an announcement from the Treasury... (no progress).

Click on graph for larger image in new window.

The Federal Reserve assets increased $139 billion this week to $2.214 trillion.

Note: the graph shows Total Factors Supplying Federal Reserve Funds and is an available series that is close to assets.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

The Fed is buying higher quality commercial paper (CP) and this is pushing down the yield on this paper (0.65% yesterday!) - and increasing the spread between AA and A2/P2 CP. So this indicator has been a little misleading. Also the recession is creating concern for lower rated paper. Still, if the credit crisis eases, I'd expect a significant decline in this spread.

If anything these indicators suggest a small step backwards ...

FDIC Loan Modification Proposal Estimated to Cost $24.4 Billion

by Calculated Risk on 11/14/2008 12:41:00 PM

From the FDIC: FDIC Loss Sharing Proposal to Promote Affordable Loan Modifications

Although foreclosures are costly to lenders, borrowers and communities, the pace of loan modifications continues to be extremely slow (around 4 percent of seriously delinquent loans each month). It is imperative to provide incentives to achieve a sufficient scale in loan modifications to stem the reductions in housing prices and rising foreclosures.There are more details in the press release, and the following table provides a summary:

Modifications should be provided using a systematic and sustainable process. The FDIC has initiated a systematic loan modification program at IndyMac Federal Bank to reduce first lien mortgage payments to as low as 31% of monthly income. Modifications are based on interest rate reductions, extension of term, and principal forbearance. A loss share guarantee on redefaults of modified mortgages can provide the necessary incentive to modify mortgages on a sufficient scale, while leveraging available government funds to affect more mortgages than outright purchases or specific incentives for every modification. The FDIC would be prepared to serve as contractor for Treasury and already has extensive experience in the IndyMac modification process.

Basic Structure and Scope of Proposal

This proposal is designed to promote wider adoption of such a systematic loan modification program:by paying servicers $1,000 to cover expenses for each loan modified according to the required standards; and sharing up to 50% of losses incurred if a modified loan should subsequently re-default

We envision that the program can be applied to the estimated 1.4 million non-GSE mortgage loans that were 60 days or more past due as of June 2008, plus an additional 3 million non-GSE loans that are projected to become delinquent by year-end 2009. Of this total of approximately 4.4 million problem loans, we expect that about half can be modified, resulting in some 2.2 million loan modifications under the plan.

Survey: Planned Holiday Spending Off Sharply

by Calculated Risk on 11/14/2008 11:54:00 AM

From American Research Group, Inc.: Shoppers Cut 2008 Christmas Spending Plans in Half from 2007

Shoppers around the country say they are planning to spend an average of $431 for gifts this holiday season, down from $859 last year according to the twenty-third annual survey on holiday spending from the American Research Group, Inc. The overall average planned spending is down almost 50% from 2007 and it is the lowest level of planned spending recorded by the American Research Group since 1991.

While planned spending increases as Christmas approaches, a majority of shoppers are beginning the holiday shopping season saying they plan to cut their gift spending in half from a year ago.

In telephone interviews with a random sample of 1,100 adults nationwide conducted November 10 through 13, 2008, the average planned spending of $431 for 2008 is down about 50% from planned spending in the 2007 survey.

| Year | Average Spending | Percent Change |

| 2008 | $431 | -50% |

| 2007 | $859 | -5% |

| 2006 | $907 | -4% |

| 2005 | $942 | -6% |

| 2004 | $1,004 | +3% |

| 2003 | $976 | -6% |

| 2002 | $1,037 | -1% |

| 2001 | $1,052 | + 9% |

| 2000 | $968 | + 3% |

| 1999 | $939 | + 1% |

| 1998 | $928 | + 34% |

This table from American Research Group shows the planned spending for each holiday season since 1998. Although actual spending changes (and spending will not be off 50% compared to 2007), this does show consumer pessimisim is very high.

Combined with the sharp plunge in October retail sales, this suggests a very weak fourth quarter for personal consumption expenditures (PCE) and suggests that forecasts for Q4 GDP might be too high.

Although the table only goes back to 1998, planned spending is a the lowest since the 1991 recession.

Freddie Mac Asks Government for $13.8 Billion

by Calculated Risk on 11/14/2008 10:13:00 AM

From Reuters: Record loss forces Freddie Mac to tap $100 bln fund

Freddie Mac reported a $25.3 billion quarterly loss on Friday as the housing slump worsened, forcing the second-largest provider of U.S. home loan funding to draw on a $100 billion Treasury Department lifeline.Remember Fannie and Freddie have much lower default rates than the loans packaged by Wall Street. If conditions worsened dramatically for Freddie and Fannie, imagine how bad it is for Wall Street MBS and loans held by lenders like Wachovia (Wells Fargo) and WaMu (JPMorgan Chase).

The company attributed much of the record loss to a write down of tax-related assets ...

Freddie Mac said ... [housing market] conditions worsened "dramatically" during July through September.

The companies' regulator has submitted a request for the Treasury Department to provide $13.8 billion for Freddie Mac to erase the shareholder equity deficit.

LA Ports in October: Export Traffic Below 2007

by Calculated Risk on 11/14/2008 09:20:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the combined loaded inbound and outbound traffic at the ports of Long Beach and Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported.

Inbound traffic has peaked for the year as retailers have already imported most of the goods for the holiday season. Inbound traffic is about 7% below last October.

This slowdown in exports (inbound traffic to the U.S.) is hitting countries like China hard, from the NY Times: Factories Shut, China Workers Are Suffering

[A]n export slowdown that began earlier this year and that has been magnified by the global financial crisis of recent months is contributing to the shutdown of tens of thousands of small and mid-size factories here and in other coastal regions, forcing laborers to scramble for other jobs or return home to the countryside.But even more concerning for the U.S. is that export traffic is declining. For the LA area ports, outbound traffic fell off a cliff in September, and was even lower in October. Outbound traffic was about 8% below the level of October 2007.

The key supports for the economy earlier this year - consumer spending, exports, and investment in non-residential structures - are all declining sharply now.

Retail Sales Collapse in October

by Calculated Risk on 11/14/2008 08:43:00 AM

The Census Bureau reports that retail sales collapsed in October:

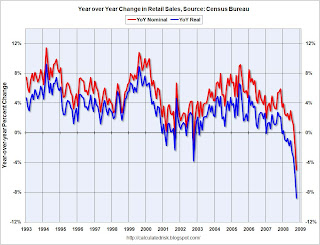

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for October, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $363.7 billion, a decrease of 2.8 percent from the previous month and 4.1 percent below October 2007. Total sales for the August through October 2008 period were down 1.3 percent from the same period a year ago.The following graph shows the year-over-year change in nominal and real retail sales since 1993.

Retail trade sales were down 3.1 percent from September 2008 and were 5.0 percent below last year.

Click on graph for larger image in new window.

Click on graph for larger image in new window.To calculate the real change, the monthly PCE price index from the BEA was used (October PCE prices were estimated based on the increases for the last 3 months).

Although the Census Bureau reported that nominal retail sales decreased 5.0% year-over-year (retail and food services decreased 4.1%), real retail sales declined by 8.8% (on a YoY basis). This is the largest YoY decline since the Census Bureau started keeping data.

Retail sales are a key portion of consumer spending and real retail sales have fallen off a cliff.

Krugman: Return of Depression Economics

by Calculated Risk on 11/14/2008 01:57:00 AM

From Professor Krugman: Depression Economics Returns. A few excerpts:

I don’t expect another Great Depression ... [but] We are ... well into the realm of what I call depression economics. By that I mean a state of affairs like that of the 1930s in which the usual tools of economic policy — above all, the Federal Reserve’s ability to pump up the economy by cutting interest rates — have lost all traction. When depression economics prevails, the usual rules of economic policy no longer apply: virtue becomes vice, caution is risky and prudence is folly.Krugman suggests a huge fiscal stimulus package on the order of $600 billion.

To see what I’m talking about, consider the implications of the latest piece of terrible economic news: Thursday’s report on new claims for unemployment insurance, which have now passed the half-million mark. Bad as this report was, viewed in isolation it might not seem catastrophic. After all, it was in the same ballpark as numbers reached during the 2001 recession and the 1990-1991 recession, both of which ended up being relatively mild by historical standards (although in each case it took a long time before the job market recovered).

But on both of these earlier occasions the standard policy response to a weak economy — a cut in the federal funds rate, the interest rate most directly affected by Fed policy — was still available. Today, it isn’t: the effective federal funds rate (as opposed to the official target, which for technical reasons has become meaningless) has averaged less than 0.3 percent in recent days. Basically, there’s nothing left to cut.

Thursday, November 13, 2008

Office Vacancy Rate Doubles in Bend, Oregon

by Calculated Risk on 11/13/2008 07:09:00 PM

This is a story that is playing out everywhere ...

Click on graph for larger image in new window.

Credit: Greg Cross, The Bulletin.

This graph from The Bulletin shows the office and industrial vacancy rates in Bend, Oregon. The office vacancy rate has doubled from last year and has almost tripled from the low in Q1 2007.

From Jeff McDonald at The Bulletin: More offices empty as demand goes soft

The vacancy rate in Bend’s office market more than doubled from third quarter 2007 to third quarter 2008, to 17.1 percent ... The vacancy rate is the highest in at least 15 years, said Darren Powderly, a Bend-based broker for Compass Commercial Real Estate Services ...This happened in many places across the country - demand for offices increased with the housing bubble, developers responded by building new office buildings (and industrial buildings, malls and hotels) and now demand is waning just as the new buildings are coming on line.

[T]he spike in demand for office space that occurred during the boom years between 2004 and 2006 resulted in a glut of new office buildings that appeared on the market this year — just as demand levels waned with the economic downturn ...

The good news is very little building is planned for 2009, so vacancy rates are expected to flatten in Redmond and Bend, Powderly said.

The "good news" in the article is that "little building is planned for 2009". That is also happening everywhere, and while less building might be good news for building owners, it also means a significant decline in non-residential investment in 2009.

Charlie Rose: A conversation with Bill Ackman

by Calculated Risk on 11/13/2008 05:25:00 PM

A half hour converstion with Bill Ackman of Pershing Square Capital Management: